Brazil Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033

Brazil Cryptocurrency Market Overview:

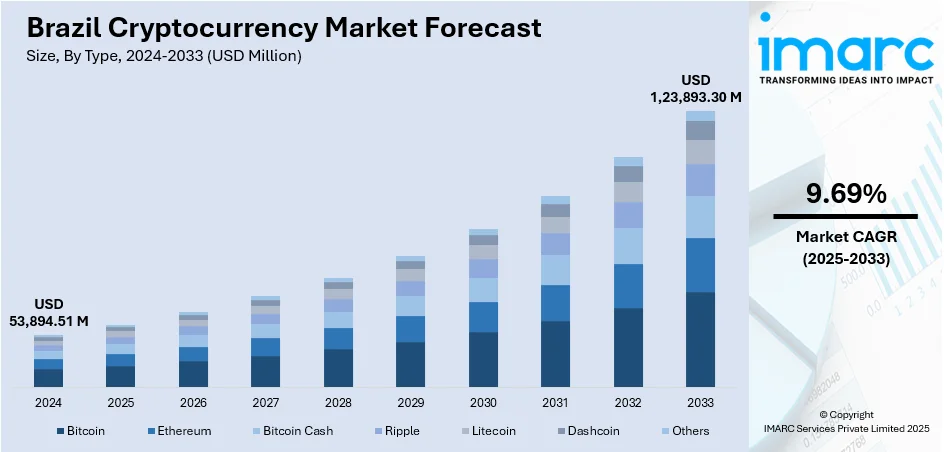

The Brazil cryptocurrency market size reached USD 53,894.51 Million in 2024. The market is projected to reach USD 1,23,893.30 Million by 2033, exhibiting a growth rate (CAGR) of 9.69% during 2025-2033. Increasing tourism activities in Brazil are boosting cryptocurrency utilization by promoting fast and secure payment options for travelers. Local businesses and tourist services are accepting digital currencies, encouraging broader adoption. Besides this, as interest in digital asset trading is rising, both usage and investment are growing, ultimately contributing to an increase in Brazil cryptocurrency market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 53,894.51 Million |

| Market Forecast in 2033 | USD 1,23,893.30 Million |

| Market Growth Rate 2025-2033 | 9.69% |

Brazil Cryptocurrency Market Trends:

Increasing interest in digital asset trading

The growing interest in digital asset trading is offering a favorable market outlook in Brazil. As traditional financial systems are facing limitations, many Brazilians are turning to cryptocurrencies for faster, decentralized, and more inclusive financial solutions. Digital asset trading offers accessibility, low entry barriers, and the potential for high returns, making it attractive to a wide range of investors, from individuals to institutions. The popularity of mobile banking and fintech apps has further enabled users to explore crypto trading with ease. Enhanced internet penetration, smartphone usage, and social media exposure are contributing to the growing curiosity and engagement with crypto markets. Educational content and peer influence also play an important role in bringing more people into the space. Local and international companies are launching digital trading services, providing user-friendly platforms that offer real-time data, secure transactions, and access to multiple digital assets. In June 2025, Webull Corporation collaborated with Coinbase to provide digital currency trading for users in Brazil. The service offered round-the-clock access to leading cryptocurrencies like Bitcoin, Ethereum, Solana, and Cardano. These platforms simplify the trading experience and offer value-added features like portfolio tracking and learning tools. As more people are participating, trading volumes are increasing, and the market ecosystem is maturing, leading to further innovations.

To get more information on this market, Request Sample

Rising tourism activities

Increasing tourism activities are impelling the Brazil cryptocurrency market growth. As per industry reports, Brazil welcomed 6.65 Million international tourists in 2024, marking a 12.6% rise compared to 2023. Tourists often face challenges with currency exchange rates and banking fees, and cryptocurrencies offer a seamless solution for transactions without the need for local currency. As Brazil is attracting more international visitors, especially in cities like Rio de Janeiro and Salvador, many local businesses, including hotels, restaurants, and travel services, are beginning to adopt digital currencies to cater to this expanding segment. This acceptance is encouraging both tourists and locals to become more familiar with cryptocurrency use in everyday transactions. The trend is also supporting the growth of crypto payment infrastructure, such as point-of-sale (POS) systems, in tourist hotspots. Additionally, tourism-focused platforms are integrating crypto-friendly booking and payment features, making travel planning easier and more inclusive. The increased visibility and functionality of digital assets in the tourism sector are fostering wider public interest and trust in cryptocurrencies. As a result, more people in Brazil are exploring crypto as both a spending and investment option, contributing to the overall expansion of the market through increased awareness, accessibility, and real-world utility.

Brazil Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transaction.

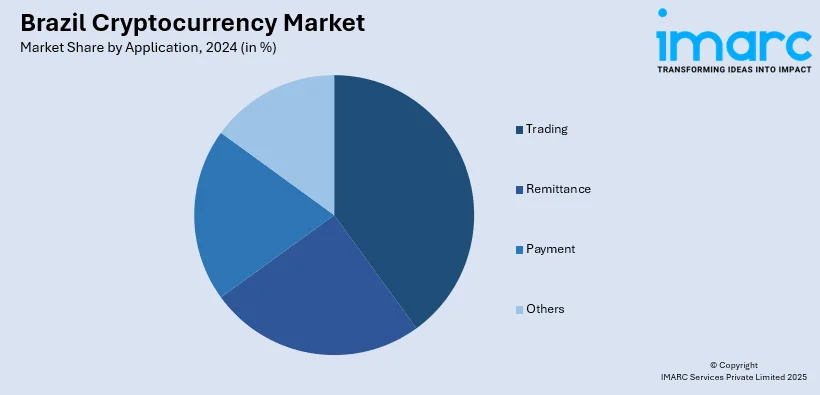

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Cryptocurrency Market News:

- In July 2025, Bybit, the prominent cryptocurrency exchange, established a strategic partnership with Tether to boost cryptocurrency adoption in Brazil through institutional collaborations, event sponsorships, and educational initiatives. Bybit planned to introduce a national educational initiative that included ‘Learn to Earn’ campaigns, rewarding users for finishing blockchain courses. The initiative featured in-person workshops, university gatherings, and seminars aimed at students, developers, and entrepreneurs.

- In July 2025, BitGo launched official office in Brazil to provide crypto custody and digital treasury solutions for financial institutions. With the new Brazilian operation, these services were provided through a genuinely localized method, considering Brazil’s economic, regulatory, and cultural landscape. BitGo was set to assist companies that considered cryptocurrencies a strategic option for cash diversification, asset safeguarding, and capital expansion.

Brazil Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil cryptocurrency market on the basis of type?

- What is the breakup of the Brazil cryptocurrency market on the basis of component?

- What is the breakup of the Brazil cryptocurrency market on the basis of process?

- What is the breakup of the Brazil cryptocurrency market on the basis of application?

- What is the breakup of the Brazil cryptocurrency market on the basis of region?

- What are the various stages in the value chain of the Brazil cryptocurrency market?

- What are the key driving factors and challenges in the Brazil cryptocurrency market?

- What is the structure of the Brazil cryptocurrency market and who are the key players?

- What is the degree of competition in the Brazil cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)