Brazil Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End-Use Industry, and Region, 2025-2033

Brazil Cyber Insurance Market Overview:

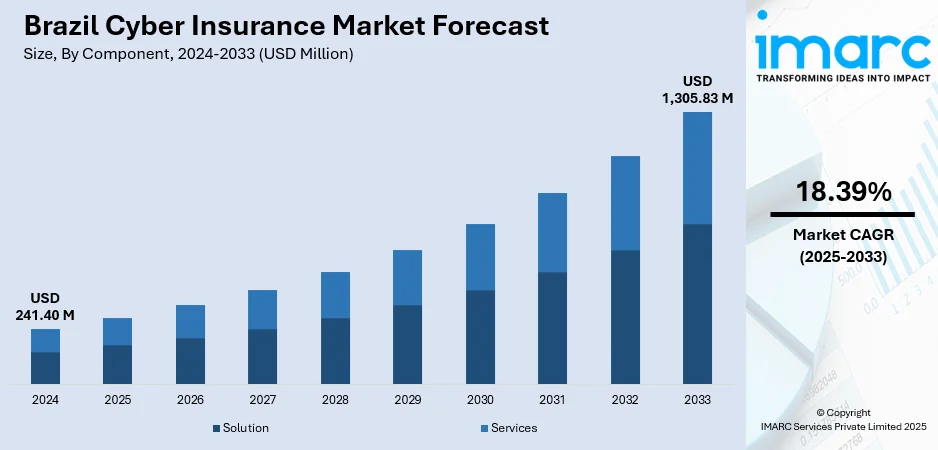

The Brazil cyber insurance market size reached USD 241.40 Million in 2024. The market is projected to reach USD 1,305.83 Million by 2033, exhibiting a growth rate (CAGR) of 18.39% during 2025-2033. The market is expanding, driven by the rising risk of cyberattacks and digital transformation. Increasing demand for tailored protection against data breaches and ransomware is boosting the Brazil cyber insurance market share, particularly in sectors like BFSI, healthcare, and IT.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 241.40 Million |

| Market Forecast in 2033 | USD 1,305.83 Million |

| Market Growth Rate 2025-2033 | 18.39% |

Brazil Cyber Insurance Market Trends:

Growing Demand for Cyber Coverage in Brazil

The Brazil cyber insurance market growth is experiencing a notable surge as businesses become more aware of the increasing frequency of cyberattacks. Companies are giving more emphasis to cybersecurity due to the increase in ransomware attacks and high-profile data breaches. Companies are now more vulnerable to a variety of cyberattacks, including virus attacks and phishing attacks, due to their greater dependence on online platforms. Consequently, as companies seek risk management and financial safeguards, cyber insurance demand has risen. Many companies, such as retail, healthcare, and finance, that deal with sensitive information that can be a target for malicious actors have embraced the market in tremendous numbers. Companies are coming under pressure from this heightened awareness to eliminate any monetary loss as well as to secure their systems. Besides, expansions of e-commerce and digital services in Brazil have added to the need for holistic cybersecurity measures and therefore cyber insurance is no longer an afterthought but a critical piece of modern business strategies.

To get more information on this market, Request Sample

Regulatory Protection Driving Cyber Insurance

The launch of more stringent data protection laws in Brazil, like the General Data Protection Law (LGPD), has also been instrumental in fueling the cyber insurance industry. The laws require organizations to provide security and privacy to individual data, with heavy penalties if not complied with. As companies in Brazil work to comply with these new legal mandates, cyber insurance has become a necessary tool for safeguarding against the financial losses due to data breaches and regulatory failure. Insurance companies are becoming more specialized in their policies to satisfy these regulatory demands, including coverage for data breaches, cyber extortion, and business interruption due to cyber-attacks. The threat of reputational loss, and imposing significant fines for non-adherence, has incentivized many firms to take out cyber insurance. This regulatory environment not only fuels market expansion but also stimulates organizations to take a proactive approach in handling cybersecurity threats, making them better equipped to deal with and limit the impact of potential cyber-attacks.

Brazil Cyber Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on component, insurance type, organization size, and end-use industry.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Insurance Type Insights:

- Packaged

- Stand-alone

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes packaged and stand-alone.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

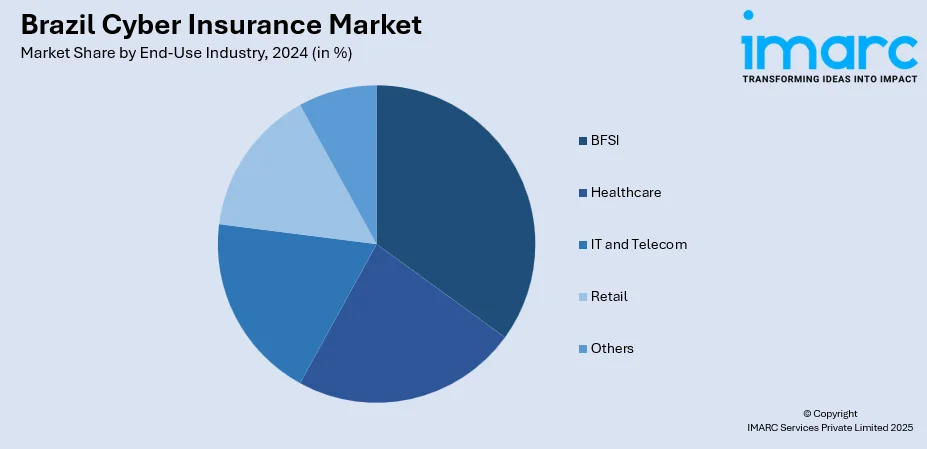

End-Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes BFSI, healthcare, IT and telecom, retail, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Cyber Insurance Market News:

- July 2025: Resecurity expanded its operations in Brazil to accelerate LGPD compliance, enhancing cyber resilience. Their cybersecurity and compliance solutions, including AI-driven threat intelligence, support businesses in mitigating cyber risks, thus driving growth in the Brazil cyber insurance market by addressing increasing data protection demands.

- November 2024: Tokio Marine reported strong underwriting results in North America and Brazil, despite a cautious approach to expanding its cyber insurance portfolio. The company introduced new cyber event cancellation coverage and highlighted a softening cycle, impacting growth in the cyber insurance market.

Brazil Cyber Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End-Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil cyber insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil cyber insurance market on the basis of component?

- What is the breakup of the Brazil cyber insurance market on the basis of insurance type?

- What is the breakup of the Brazil cyber insurance market on the basis of organization size?

- What is the breakup of the Brazil cyber insurance market on the basis of end-use industry?

- What is the breakup of the Brazil cyber insurance market on the basis of region?

- What are the various stages in the value chain of the Brazil cyber insurance market?

- What are the key driving factors and challenges in the Brazil cyber insurance market?

- What is the structure of the Brazil cyber insurance market and who are the key players?

- What is the degree of competition in the Brazil cyber insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil cyber insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil cyber insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil cyber insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)