Brazil Diagnostic Imaging Equipment Market Size, Share, Trends and Forecast by Product Type, Application, End User, and Region, 2026-2034

Brazil Diagnostic Imaging Equipment Market Overview:

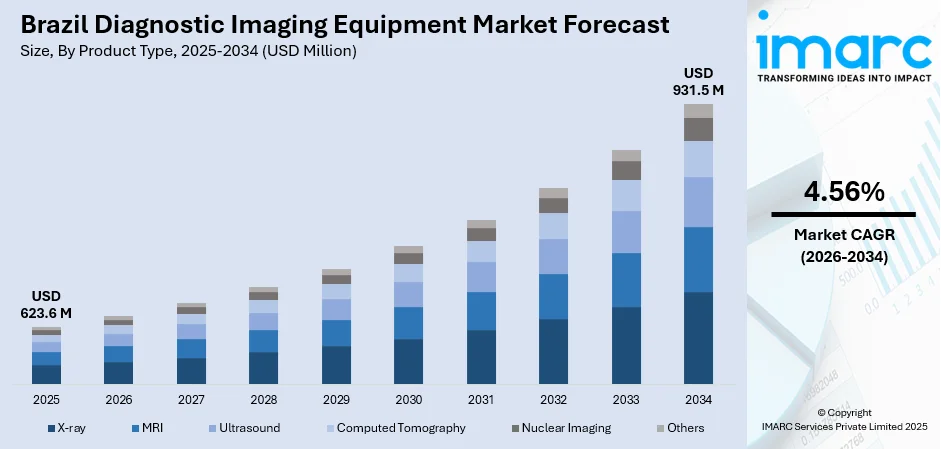

The Brazil diagnostic imaging equipment market size reached USD 623.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 931.5 Million by 2034, exhibiting a growth rate (CAGR) of 4.56% during 2026-2034. Brazil’s diagnostic imaging equipment market is experiencing significant growth, driven by artificial intelligence (AI) integration, expanding public healthcare investments, and rising demand for portable imaging devices. Increasing government support, technological advancements, and private-sector collaborations are enhancing accessibility, efficiency, and diagnostic accuracy across hospitals, clinics, and remote healthcare services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 623.6 Million |

| Market Forecast in 2034 | USD 931.5 Million |

| Market Growth Rate 2026-2034 | 4.56% |

Brazil Diagnostic Imaging Equipment Market Trends:

Growing Demand for AI-Integrated Imaging Equipment

The diagnostic imaging market in Brazil is also experiencing growing acceptance of AI-based imaging technologies in hospitals and diagnostic centers. Artificial intelligence (AI) based X-ray, magnetic resonance imaging (MRI), and computed tomography (CT) scan machines improve image evaluation, auto reporting, and diagnostic accuracy, and speed up disease detection with more accuracy. Integration of AI also minimizes errors, streamlines efficiency in workflow, and allows faster patient turnaround times. For instance, in May 2023, Mindray launched its Smart Hospital solutions at Hospitalar in São Paulo, Brazil. The solutions, powered by the M-Connect IT platform, integrate IoT, 5G, and Big Data to enhance diagnostic accuracy and streamline hospital workflows. Moreover, with Brazil developing in digital medicine, makers of medical devices are also investing in AI-driven imaging solutions specific to the local market. Cloud-based storage and image analysis platforms also facilitate this change, enabling remote consultation and second opinions. Predictive analytics powered by AI also identify patterns of diseases, enhancing early diagnosis and treatment planning. Government programs that encourage healthcare innovation are driving the adoption of AI, and partnerships between public entities and private enterprises are driving research in AI-based diagnostics. Consequently, AI-enhanced imaging machines are becoming an integral component of Brazil's transforming healthcare system.

To get more information on this market, Request Sample

Expanding Public Healthcare Investments in Imaging Infrastructure

Brazil's public health sector is investing heavily in advanced diagnostic imaging technology to boost access to healthcare and enhance the quality of medical care. Brazil's Unified Health System (SUS) is investing heavily in outfitting public clinics and hospitals with advanced imaging technologies, such as digital X-ray, ultrasound, and CT scanners. These initiatives focus on lowering patient waiting times, improving early detection of diseases, and countering the nation's increasing incidence of chronic conditions such as cancer and cardiovascular conditions. Public-private alliances are streamlining procurement and upkeep of sophisticated imaging equipment so diagnostic services are more accessible throughout Brazil. In addition, government-sponsored telemedicine programs are integrating imaging technologies to facilitate remote consultations, especially in underserved areas. With ongoing public investment, the need for high-quality, low-cost diagnostic imaging solutions is accelerating, providing opportunities for manufacturers and suppliers to assist Brazil's changing healthcare infrastructure. For example, In April 2024, AGFA HealthCare and Konimagem launched groundbreaking radiology innovations, unveiling the latest advancements to their Enterprise Imaging Platform to enhance clinical efficiency.

Rising Demand for Portable and Point-of-Care Imaging Devices

Brazil is experiencing increased demand for handheld and point-of-care imaging technologies as healthcare practitioners look for more affordable and more flexible diagnostic systems. Handheld ultrasound, point-of-care X-ray, and mobile CT scans are becoming indispensable pieces of equipment in emergency care, rural healthcare operations, and at-home diagnostics. These technologies support quicker and better diagnosis, especially in remote areas where access to large imaging facilities is restricted. Private healthcare facilities and diagnostic chains are adding portable imaging equipment to maximize patient convenience and maximize operational effectiveness. Advances in miniaturized imaging technology are enhancing image quality at affordable costs, making them more appealing to healthcare facilities of varying sizes. Moreover, physicians prefer AI-supported portable imaging devices that offer real-time analysis with less need for follow-up scans. As affordability and accessibility continue to influence Brazil's diagnostic imaging industry, portable imaging solutions are projected to be at the center of healthcare delivery.

Brazil Diagnostic Imaging Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, application, and end user.

Product Type Insights:

- X-ray

- MRI

- Ultrasound

- Computed Tomography

- Nuclear Imaging

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes X-ray, MRI, ultrasound, computed tomography, nuclear imaging, and others.

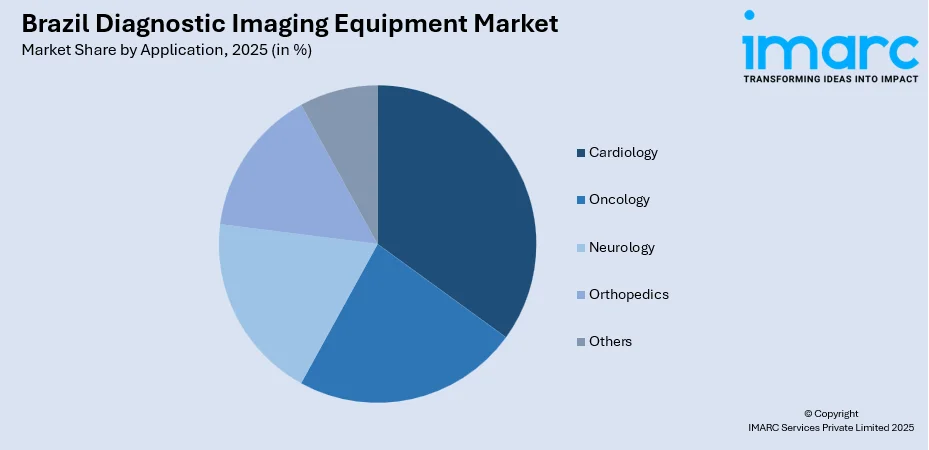

Application Insights:

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cardiology, oncology, neurology, orthopedics, and others.

End user Insights:

- Hospitals

- Diagnostic Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, diagnostic centers, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Diagnostic Imaging Equipment Market News:

- In May 2024, Claritas HealthTech expanded its global reach by establishing a headquarters in São Paulo, Brazil, to meet the growing demand for nuclear medicine imaging solutions. The company will focus on its iPET™ platform, offering advanced, accurate, and affordable imaging solutions for patients, clinicians, and hospitals.

- In February 2025, CARPL.ai, a San Francisco-based enterprise imaging AI platform, announced a partnership with Philips to enhance radiology capabilities in Brazil. The collaboration, revealed at the 54th Jornada Paulista de Radiologia, integrates AI with Philips' Vue PACS system, streamlining workflows and improving diagnostic efficiency, particularly in chest X-ray analysis.

Brazil Diagnostic Imaging Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | X-ray, MRI, Ultrasound, Computed Tomography, Nuclear Imaging, Others |

| Applications Covered | Cardiology, Oncology, Neurology, Orthopedics, Others |

| End User Covered | Hospitals, Diagnostic Centers, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil diagnostic imaging equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil diagnostic imaging equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil diagnostic imaging equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diagnostic imaging equipment market in Brazil was valued at USD 623.6 Million in 2025.

The Brazil diagnostic imaging equipment market is projected to exhibit a CAGR of 4.56% during 2026-2034, reaching a value of USD 931.5 Million by 2034.

The Brazil diagnostic imaging equipment market is driven by rising healthcare investments, an aging population, and increasing incidence of chronic diseases. Technological advancements, expanding hospital infrastructure, and growing demand for early and accurate diagnosis are also key factors supporting the adoption of advanced imaging systems across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)