Brazil Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

Brazil Drones Market Overview:

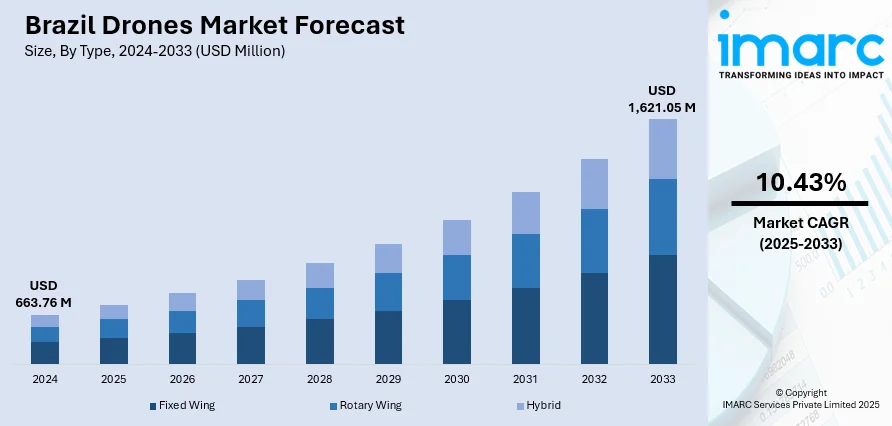

The Brazil drones market size reached USD 663.76 Million in 2024. Looking forward, the market is expected to reach USD 1,621.05 Million by 2033, exhibiting a growth rate (CAGR) of 10.43% during 2025-2033. The market is fueled by growing applications in agriculture, environmental observation, and city security. Commercial-scale farm operations gain from drone precision agriculture, with increased productivity and sustainability. Government initiatives to curb deforestation and illicit mining drive the use of drones in forest monitoring. The nation's varied geography and economic dependence on agriculture and natural resources also drive demand for drone technology, further contributing to Brazil drones market share in both public and private industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 663.76 Million |

| Market Forecast in 2033 | USD 1,621.05 Million |

| Market Growth Rate 2025-2033 | 10.43% |

Brazil Drones Market Trends:

Agricultural Integration and Precision Farming

An exceptionally strong trend in the market of drones in Brazil is its extensive integration with agriculture, a mainstay of the national economy. Brazil's extensive agricultural lands, covering soybean, sugarcane, and coffee crops, offer a special chance for precision farming with the help of drones. Drones are being widely utilized for crop monitoring, pest management, irrigation planning, and yield prediction. The region's uniqueness with this trend lies in the magnitude, as big plantations and out-of-the-way agricultural areas greatly optimize using aerial intelligence and automation. In addition, numerous Brazilian farms are embracing drones to lower labor dependency and increase sustainability, particularly in regions with drought or deforestation risks. The regulatory framework is slowly changing to accommodate commercial drone deployment within the agricultural sector, further inspiring small and large farms alike to incorporate UAVs. As climate stress and international food demand increase, Brazil's use of drones in agriculture is set to become more profound, particularly as indigenous companies start producing low-cost, agriculture-targeted drone models, which will also contribute to the Brazil drones market growth.

To get more information on this market, Request Sample

Monitoring Forests and Environmental Conservation

Brazil's drone industry is also intricately tied to environmental surveillance, particularly in the Amazon Rainforest and other eco-sensitive areas. With illegal deforestation, mining, and logging constituting ongoing dangers, drones represent a non-invasive and efficient means of monitoring extensive and frequently inaccessible territories. Government departments and green NGOs are using UAVs ever more for real-time mapping, detecting fires, and border surveillance of protected areas. The capacity of drones to collect reliable information without disrupting animals is especially vital in nature reserves. In addition to this, the drones assist in identifying environmental offenses that would otherwise remain undetected because these areas are remote. This increased use of UAVs is an evolutionary step in technology and is also a demonstration of Brazil's pressing environmental demands. The drones are increasingly becoming part of an overall national policy to enforce conservation policy, track biodiversity, and regulate natural resources in a manner that equalizes ecological conservation with economic growth.

Urban Applications and Security Innovation

Cities in Brazil are increasingly using drones for a variety of urban and public security purposes. With congested cities like São Paulo and Rio de Janeiro struggling with traffic management, surveillance, and emergency response, drones represent a viable solution. Police forces utilize UAVs for crowd surveillance in major events, crime mapping of high-risk areas, and real-time situational awareness in natural disasters or public disturbances. Moreover, smart city projects are now starting to incorporate drones for infrastructure inspections, mapping, and maintenance of utilities with decreased cost and risk to human life. Exclusive to Brazil is applying drones for monitoring favelas, where conventional methods of surveillance have been restricted by the issues of accessibility and safety. As people increasingly accept drone technology, Brazilian cities are funding pilot initiatives and collaborations with local drone technology startups. This application of UAVs in urban administration heralds a change toward intelligent, responsive city leadership.

Brazil Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 Kilograms, 25-170 Kilograms, and >170 Kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

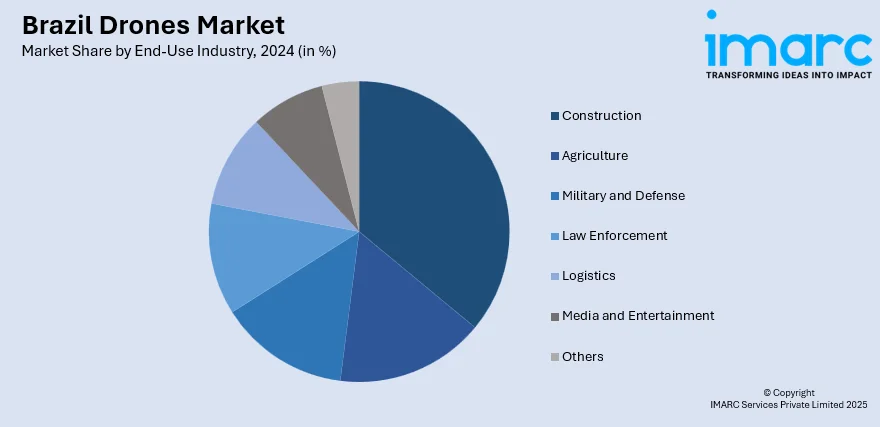

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which includes Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Drones Market News:

- In July 2025, to enhance its air defense abilities against new aerial threats, the Brazilian Navy has commenced training A-4 Skyhawk jets to intercept and eliminate drones. Remotely Operated Vehicles present a growing danger in various operational settings- below the water, above the surface, and in the skies over critical regions. Due to their diminutive size and sluggish speeds, they are hard to spot, recognize, and counter.

- In May 2025, XAG introduced a new series of high-efficiency farming drones, the P150 and P60, in partnership with CNH for the Brazilian market. These models were presented at Agrishow 2025, the biggest agricultural trade fair in Latin America, representing a major advancement in providing comprehensive smart farming solutions with improved efficiency. The XAG P150 Agricultural Drone caught interest on-site with its 70-liter liquid capacity and integrated features for spraying, seeding, and fertilizing. With a maximum payload of 70 kilograms, the P150 offers unrivaled efficiency in robust tasks across extensive agricultural land. With a high spray flow rate reaching 30 liters per minute and RTK centimeter-level positioning, it ensures accurate and efficient crop protection while reducing chemical waste and water usage.

- On March 26, 2025, the Brazilian Post Office conducted its inaugural drone delivery. The initial package carried by the state-owned firm using a drone across Brazil was sent to the Mayor of Curitiba, Eduardo Pimentel. The delivery is a component of an initiative to establish aerial routes for drone shipments. Atech conducted a beyond visual line of sight (BVLOS) flight in Curitiba to perform practical tests of the software it is creating for the safe aerial control of drone flights in urban areas, including flights over people. In adherence to the standards set by the National Civil Aviation Agency (ANAC), the delivery took place on a path that circumvented pedestrian traffic, departing from Praça Afonso Botelho and soaring above the Ligga Arena.

Brazil Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil drones market on the basis of type?

- What is the breakup of the Brazil drones market on the basis of component?

- What is the breakup of the Brazil drones market on the basis of payload?

- What is the breakup of the Brazil drones market on the basis of point of sale?

- What is the breakup of the Brazil drones market on the basis of end-use industry?

- What is the breakup of the Brazil drones market on the basis of region?

- What are the various stages in the value chain of the Brazil drones market?

- What are the key driving factors and challenges in the Brazil drones market?

- What is the structure of the Brazil drones market and who are the key players?

- What is the degree of competition in the Brazil drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)