Brazil Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

Brazil Electric Two-Wheeler Market Overview:

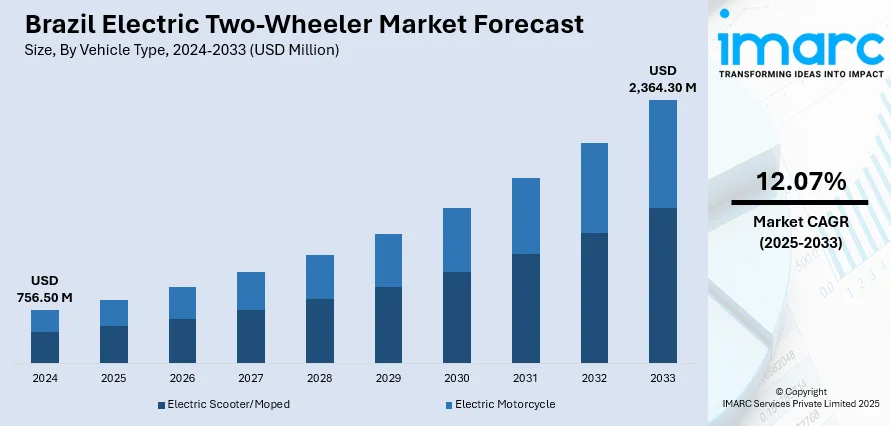

The Brazil electric two-wheeler market size reached USD 756.50 Million in 2024. The market is projected to reach USD 2,364.30 Million by 2033, exhibiting a growth rate (CAGR) of 12.07% during 2025-2033. The market is driven by increasing environmental awareness, government incentives promoting clean energy, and rising fuel prices boosting demand for cost-effective transportation. Urbanization and traffic congestion encourage consumers to adopt compact, efficient electric bikes and scooters. Advances in battery technology improving range and affordability also support growth. Additionally, growing investments in charging infrastructure and a youthful population favoring sustainable mobility contribute significantly to Brazil electric two-wheeler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 756.50 Million |

| Market Forecast in 2033 | USD 2,364.30 Million |

| Market Growth Rate 2025-2033 | 12.07% |

Brazil Electric Two-Wheeler Market Trends:

Urbanization and Traffic Congestion Challenges

One of the key Brazil electric two-wheeler market trends is increasing demand for electric two-wheelers. São Paulo and Rio de Janeiro, the major cities in Brazil, are plagued by heavy traffic congestion, which makes commuters look for efficient, lightweight, and agile means of transport. Electric scooters and electric bikes provide the perfect solution in congested streets and cutting down on the travel time, particularly in densely populated urban areas. The two-wheelers' compact size and simplicity of maneuverability enable riders to circumvent gridlocks and parking hassles. Additionally, city dwellers are more eco-friendly and look for green mobility options in harmony with electric two-wheelers' zero-emission functionality. Improvements in urban infrastructure, such as exclusive bike lanes and charging points, also fosters this trend. As Brazil urbanizes further, the convenience and eco-friendliness of electric two-wheelers will continue to be important in solving urban transport problems.

To get more information on this market, Request Sample

Environmental Awareness and Government Initiatives

Environmental concerns are a key driver of Brazil’s electric two-wheeler market growth. Increasing awareness about pollution, climate change, and greenhouse gas emissions motivates consumers and policymakers to adopt sustainable transport solutions. In 2024, Brazil’s motorcycle production exceeded 1.748 million units, with sales rising 18.6% year-on-year to 1.876 million units, highlighting strong market potential. The government supports this shift through initiatives like subsidies, tax reductions, and relaxed regulations, lowering costs and making electric two-wheelers more appealing compared to gasoline-powered bikes. Brazil’s commitment to international climate agreements further reinforces eco-friendly transportation policies. This combination of regulatory incentives and public environmental awareness drives demand for electric scooters and bikes as cleaner alternatives, helping reduce urban air pollution and fossil fuel dependence, ultimately fueling significant Brazil’s electric two-wheeler market growth.

Rising Fuel Prices and Cost Efficiency

The consistent increase in fuel prices in Brazil plays a major role in consumer preference for electric two-wheelers. With gas and diesel prices fluctuating, conventional petrol-run motorcycles and scooters turn out to be more costly to run. Electric two-wheelers provide an affordable option with substantially lower operating costs, as electricity is relatively cheaper than petrol and maintenance expenses are lower with fewer parts to replace. This economic benefit attracts frugal buyers, particularly in cities where daily commuting is prevalent. Furthermore, with inflation impacting disposable incomes, consumers are on the lookout for affordable mobility choices, placing additional momentum behind electric two-wheeler uptake. The economic attractiveness of electric vehicles, backed by government subsidies and expanded financing schemes, bolsters the argument for electrification as a long-term solution against increasing fuel costs.

Brazil Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

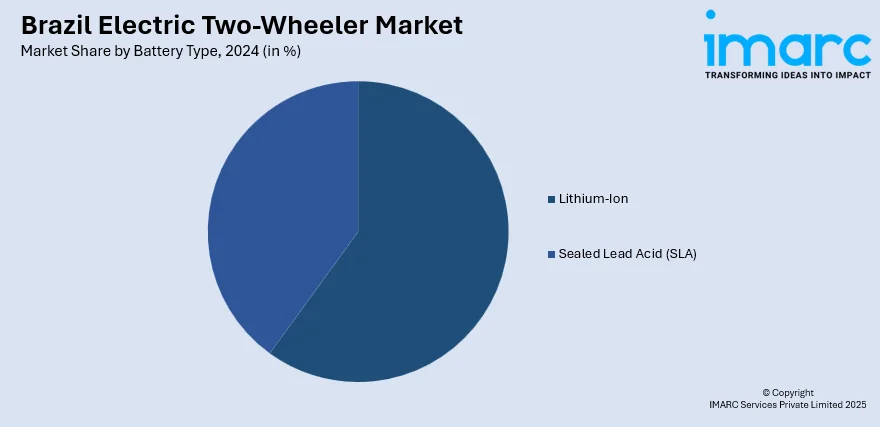

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Brazil electric two-wheeler market on the basis of battery type?

- What is the breakup of the Brazil electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Brazil electric two-wheeler market on the basis of peak power?

- What is the breakup of the Brazil electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Brazil electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Brazil electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Brazil electric two-wheeler market?

- What are the key driving factors and challenges in the Brazil electric two-wheeler market?

- What is the structure of the Brazil electric two-wheeler market and who are the key players?

- What is the degree of competition in the Brazil electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)