Brazil Electrically Powered Hydraulic Steering Market Size, Share, Trends and Forecast by Component Type, Vehicle Type, and Region, 2026-2034

Brazil Electrically Powered Hydraulic Steering Market Summary:

The Brazil electrically powered hydraulic steering market size was valued at USD 806.86 Million in 2025 and is projected to reach USD 1,158.79 Million by 2034, growing at a compound annual growth rate of 4.10% from 2026-2034.

The Brazil electrically powered hydraulic steering market is experiencing robust expansion driven by the thriving automotive manufacturing sector and growing consumer preference for fuel-efficient vehicles. Rising urbanization across major metropolitan areas has heightened demand for vehicles equipped with advanced steering technologies that offer superior maneuverability in congested traffic conditions. Government initiatives promoting vehicle safety standards and environmental sustainability are further accelerating the adoption of EPHS systems that deliver enhanced driving control while reducing energy consumption, positioning Brazil as a key growth market for the Brazil electrically powered hydraulic steering market share.

Key Takeaways and Insights:

- By Component Type: Steering motor dominates the market with a share of 44% in 2025, owing to its critical role in providing precise electric assistance for steering control and enhanced responsiveness across varying driving conditions.

- By Region: Southeast leads the market with a share of 31% in 2025, driven by the concentration of automotive manufacturing facilities in São Paulo and the region's established industrial infrastructure supporting vehicle production.

- Key Players: The Brazil electrically powered hydraulic steering market exhibits moderate concentration, with leading global automotive component suppliers maintaining significant presence through established partnerships with original equipment manufacturers and investments in local manufacturing capabilities to serve the growing domestic automotive sector.

The Brazil electrically powered hydraulic steering (EPHS) market is gaining momentum, driven by a growing automotive production base and increasing vehicle ownership nationwide. EPHS technology integrates hydraulic assistance with electric motor control, offering improved fuel efficiency while maintaining precise steering response and driver comfort. Automakers are increasingly incorporating these systems to comply with stricter fuel economy and emissions standards set by Brazil’s PROCONVE L-8 regulations, which aim to enhance vehicle efficiency starting in 2025. Additionally, government initiatives such as the MOVER program, launched in 2024, provide substantial fiscal incentives for investments in sustainable mobility solutions. These measures are encouraging major vehicle manufacturers to make significant capital investments in EPHS integration across new model lineups.

Brazil Electrically Powered Hydraulic Steering Market Trends:

Integration of Advanced Sensor Technologies for Enhanced Steering Precision

The Brazil electrically powered hydraulic steering market is witnessing accelerated adoption of sophisticated sensor technologies that improve steering accuracy and driver feedback. Torque sensors and steering angle sensors are being integrated into EPHS systems to provide real-time data for adaptive steering assistance. These innovations enable dynamic adjustment of steering effort based on vehicle speed and road conditions, enhancing both safety and driving comfort. Leading sensor manufacturers have developed contactless inductive position sensor technologies that measure steering torque and angle with exceptional accuracy, supporting the next generation of steering control systems.

Rising Demand for Fuel-Efficient Steering Solutions in Commercial Vehicles

Commercial vehicle fleet operators in Brazil are increasingly prioritizing fuel efficiency to reduce operating costs, driving the adoption of EPHS systems that offer significant energy savings compared to conventional hydraulic steering. These systems can achieve fuel savings of approximately 0.2 liters per 100 kilometers compared to traditional hydraulic power steering, translating to meaningful cost benefits for high-mileage commercial fleets. The higher rack load capacity of EPHS systems also makes them particularly suitable for heavy-duty applications, where vehicles experience constant use and heavier loads than passenger cars.

Growing Focus on Lightweight Materials and Component Miniaturization

Automotive suppliers are investing in research and development to reduce the weight of steering system components while maintaining performance standards. The emphasis on lightweight materials including aluminum and advanced composites in steering components, aligns with broader industry efforts to improve vehicle fuel efficiency and reduce emissions. Component miniaturization is enabling more compact steering system designs that optimize vehicle packaging while delivering enhanced steering response and reliability.

Market Outlook 2026-2034:

The Brazil electrically powered hydraulic steering market is poised for sustained expansion through the forecast period, supported by robust automotive industry investments and favorable government policies promoting vehicle modernization. The country's position as the largest automotive market in South America and eighth largest globally creates substantial demand for advanced steering technologies. Brazil's vehicle sales reached a ten-year high of 2.63 million units in 2024, with production projected to reach 2.8 million units in 2025, signaling strong underlying demand. The market generated a revenue of USD 806.86 Million in 2025 and is projected to reach a revenue of USD 1,158.79 Million by 2034, growing at a compound annual growth rate of 4.10% from 2026-2034.

Brazil Electrically Powered Hydraulic Steering Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component Type | Steering Motor | 44% |

| Region | Southeast | 31% |

Component Type Insights:

To get detailed segment analysis of this market Request Sample

- Sensors

- Steering Motor

- Others

Steering motor dominates with a market share of 44% of the total Brazil electrically powered hydraulic steering market in 2025.

The steering motor segment holds the largest market share as it serves as the core component that provides electric assistance in EPHS systems, directly influencing steering responsiveness and vehicle handling characteristics. These motors adjust the level of hydraulic assistance based on driving conditions detected by integrated sensors, offering minimal steering effort at lower speeds during parking and maneuvering while providing appropriate resistance at highway speeds for stability. The segment benefits from ongoing innovations in brushless motor technology and motor control algorithms that enhance efficiency and durability.

Advanced steering motors are increasingly incorporating integrated inverters and sophisticated electronic control units that enable precise power delivery and seamless integration with vehicle stability systems. Major automotive suppliers are investing in rare-earth-free motor technologies to reduce material cost dependencies while maintaining performance standards. The commercial vehicle segment presents significant growth opportunities for high-torque steering motor designs capable of meeting the demanding requirements of heavy-duty applications.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

Passenger cars represent a substantial portion of EPHS demand in Brazil, driven by consumer expectations for comfortable and responsive steering in urban driving environments. The growing preference for vehicles equipped with advanced driver assistance features supports the integration of sophisticated steering systems that provide enhanced handling and safety benefits. Compact and mid-size vehicles popular in the Brazilian market particularly benefit from EPHS technology that balances steering precision with fuel economy improvements.

Commercial vehicles, including trucks and buses, are increasingly adopting EPHS systems due to the significant fuel savings and reduced maintenance requirements compared to conventional hydraulic steering. Fleet operators recognize the total cost of ownership benefits, particularly for vehicles operating in demanding conditions with high mileage and frequent starts and stops. The segment is expected to witness accelerated growth as manufacturers introduce commercial vehicle platforms optimized for EPHS integration.

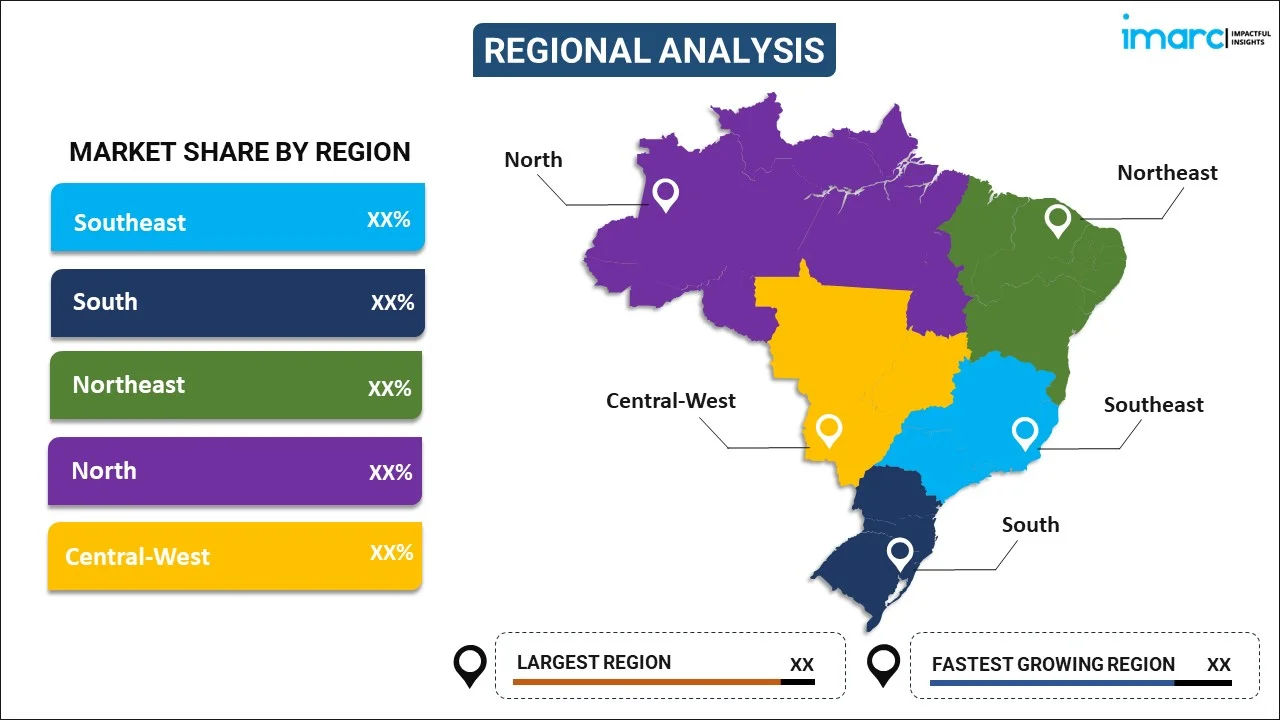

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast leads the market with a 31% share of the total Brazil electrically powered hydraulic steering market in 2025.

The Brazil electrically powered hydraulic steering (EPHS) market in the Southeast region is being driven by the growing production of passenger and commercial vehicles, supported by both domestic and foreign automakers. As manufacturers launch new models with hybrid and fully electric powertrains, there is increasing integration of advanced steering technologies like EPHS to improve vehicle efficiency and driving dynamics. The shift toward electrification encourages the adoption of energy-efficient steering systems that reduce engine load and enhance fuel economy, making EPHS a preferred choice for modern vehicle platforms in the region.

Government policies promoting vehicle efficiency and emissions reduction are further propelling EPHS adoption in Southeast Brazil. Safety and comfort standards increasingly favor electronically assisted steering systems over traditional hydraulic solutions, supporting regulatory compliance. Additionally, consumer demand for vehicles with enhanced handling, smoother steering response, and better maneuverability is influencing OEM decisions to integrate EPHS across multiple segments. Combined with rising investments in automotive manufacturing and modernization of local production facilities, these factors collectively sustain steady growth in the regional EPHS market.

Market Dynamics:

Growth Drivers:

Why is the Brazil Electrically Powered Hydraulic Steering Market Growing?

Expanding Automotive Production and Rising Vehicle Ownership

The thriving automotive industry in Brazil serves as a fundamental driver for the EPHS market, with vehicle production and sales demonstrating strong recovery and growth momentum. As car manufacturers increase their production in response to rising consumer demand, the need for advanced steering systems becomes essential to provide enhanced driving control and performance. Brazil's status as the largest automotive market in South America creates a substantial addressable market for steering technology suppliers. The country's vehicle sales reached a ten-year high in 2024, with projections indicating continued production growth through 2025 and beyond. Major automakers like Stellantis, Volkswagen, General Motors, Renault, Nissan, and Toyota have announced combined investments exceeding USD 22 billion for Brazil through 2030, supporting the launch of new vehicle platforms that incorporate modern steering technologies.

Government Initiatives Supporting Sustainable Mobility and Vehicle Modernization

The Brazilian federal government’s Mover program provides significant fiscal incentives to automakers investing in sustainable mobility technologies and vehicle innovation. These measures encourage manufacturers to integrate fuel-efficient systems, including advanced steering solutions that improve overall vehicle efficiency. In parallel, stricter emission standards are promoting the adoption of technologies that enhance fuel economy, with electrically powered hydraulic steering (EPHS) systems reducing energy losses compared to conventional hydraulic steering. Together, these initiatives are driving the broader uptake of EPHS and other efficiency-focused innovations across the Brazilian automotive market.

Growing Consumer Preference for Enhanced Driving Comfort and Safety

Brazilian consumers are increasingly prioritizing vehicles that offer superior driving comfort and safety features, propelling demand for advanced steering systems. EPHS technology provides precise steering control with minimal driver effort, particularly beneficial in urban environments where frequent parking maneuvers and stop-and-go traffic are common. The integration of EPHS with advanced driver assistance systems enables enhanced vehicle stability and control features that appeal to safety-conscious consumers. Rising income levels and expanding credit availability support consumer access to vehicles equipped with modern steering technologies, contributing to market expansion.

Market Restraints:

What Challenges the Brazil Electrically Powered Hydraulic Steering Market is Facing?

Economic Volatility Affecting Consumer Purchasing Power

Economic fluctuations, including inflation pressures and elevated interest rates, impact consumer purchasing decisions and vehicle affordability. High borrowing costs constrain access to vehicle financing, potentially limiting demand for new vehicles equipped with advanced steering systems. Currency depreciation affects the cost of imported components, creating pricing pressures for steering system manufacturers.

Competition from Pure Electric Power Steering Systems

The growing adoption of pure electric power steering systems presents competitive pressure for EPHS technology, as EPS offers greater simplicity and efficiency by eliminating hydraulic components entirely. Many vehicle manufacturers are transitioning toward EPS for new vehicle platforms, particularly in the passenger car segment, where steering load requirements can be adequately served by electric-only systems.

Supply Chain Dependencies and Component Sourcing Complexities

Reliance on imported components and materials creates supply chain vulnerabilities that can affect production continuity and cost structures. The automotive components sector faces challenges related to logistics costs and infrastructure limitations in certain regions. Semiconductor availability and specialized sensor component sourcing remain considerations for steering system manufacturers operating in the Brazilian market.

Competitive Landscape:

The Brazil electrically powered hydraulic steering market exhibits moderate concentration characterized by the presence of established global automotive component suppliers alongside regional manufacturers. Leading international players maintain competitive advantages through proprietary motor-control technologies, integrated electronics capabilities, and long-term supply agreements with major vehicle manufacturers operating in Brazil. Companies are investing in research and development to advance steering system efficiency, sensor integration, and compatibility with evolving vehicle architectures. Strategic partnerships between steering system suppliers and local automotive manufacturers facilitate market penetration and component localization efforts. The competitive landscape reflects ongoing technological evolution as suppliers balance EPHS product development with investments in next-generation electric and by-wire steering solutions.

Recent Developments:

- March 2024: Stellantis announced a record EUR 5.6 billion investment plan for South America through 2030, the largest in regional automotive history, supporting the launch of more than 40 new products including vehicles with advanced steering and powertrain technologies and development of Bio-Hybrid innovations.

- January 2024: General Motors announced USD 1.4 billion in manufacturing investments in Brazil to build a new generation of vehicles for the local market, including internal combustion engine vehicles and fully electric models requiring advanced steering system integration.

Brazil Electrically Powered Hydraulic Steering Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Sensors, Steering Motor, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil electrically powered hydraulic steering market size was valued at USD 806.86 Million in 2025.

The Brazil electrically powered hydraulic steering market is expected to grow at a compound annual growth rate of 4.10% from 2026-2034 to reach USD 1,158.79 Million by 2034.

Steering motor dominated the market with a 44% share in 2025, attributed to its essential role in providing electric assistance for steering control and its critical function in adjusting hydraulic assistance based on driving conditions.

Key factors driving the Brazil electrically powered hydraulic steering market include expanding automotive production, government incentives under the Mover program supporting sustainable mobility investments, rising consumer demand for fuel-efficient vehicles, and stringent emission regulations encouraging adoption of advanced steering technologies.

Major challenges include economic volatility affecting consumer purchasing power, competition from pure electric power steering systems gaining adoption in new vehicle platforms, supply chain dependencies on imported components, and high interest rates constraining vehicle financing accessibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)