Brazil Energy Storage Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Brazil Energy Storage Market Summary:

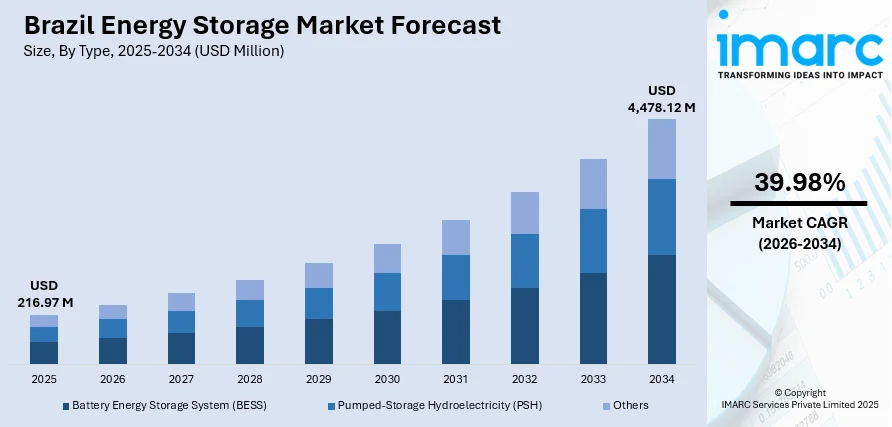

The Brazil energy storage market size was valued at USD 216.97 Million in 2025 and is projected to reach USD 4,478.12 Million by 2034, growing at a compound annual growth rate of 39.98% from 2026-2034.

The Brazil energy storage market is experiencing significant momentum as the country accelerates its renewable energy expansion and confronts growing grid management challenges. Increasing integration of solar and wind power generation, which now accounts for over one-third of the national electricity matrix, is driving demand for flexible storage solutions. Supportive regulatory developments, expanding domestic manufacturing capabilities, and innovative energy-as-a-service business models are removing barriers to adoption and advancing the Brazil energy storage market share.

Key Takeaways and Insights:

- By Type: Battery Energy Storage System (BESS) dominates the market with a share of 70% in 2025, driven by its modularity, rapid deployment capabilities, and declining lithium-ion battery costs enabling commercial viability across applications.

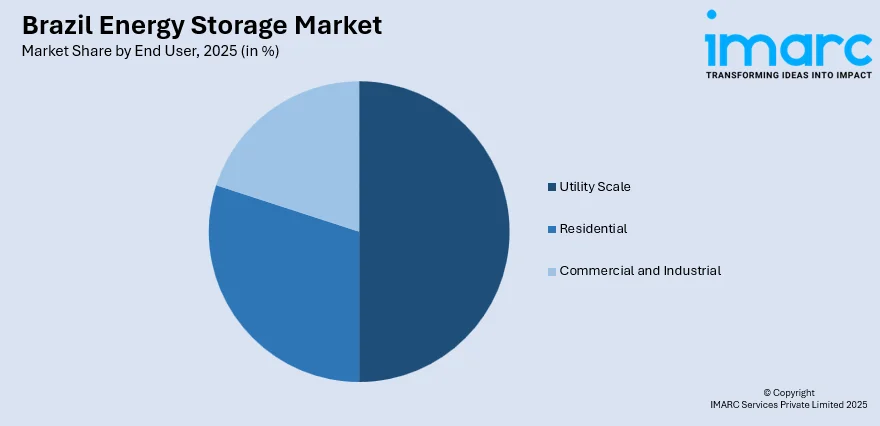

- By End User: Utility scale leads the market with a share of 50% in 2025, supported by government capacity auction initiatives and growing demand for grid-scale solutions to manage renewable energy intermittency.

- Key Players: The Brazil energy storage market exhibits a developing competitive landscape with international technology providers partnering with domestic energy companies. Competition is intensifying as global battery manufacturers establish market presence, while local firms develop energy-as-a-service offerings to capture emerging opportunities across residential, commercial, and utility segments.

To get more information on this market Request Sample

The Brazil energy storage market is positioned for transformative growth as the nation addresses critical infrastructure needs and renewable energy integration challenges. The country reached 685 MWh of cumulative storage capacity by the end of 2024, with 269 MWh added during the year alone, representing growth of 29% from the previous year. The upcoming capacity reserve auction scheduled for April 2026 represents a watershed moment, with approximately 18 GW of battery projects ready for registration according to the Brazilian Energy Storage Solutions Association. Matrix Energia has emerged as a pioneer in the energy storage-as-a-service model, securing a strategic partnership with Huawei to deploy 750 MWh of storage systems by 2027. These developments collectively signal Brazil's commitment to establishing a competitive, resilient energy storage ecosystem capable of supporting its ambitious renewable energy transition.

Brazil Energy Storage Market Trends:

Growing Integration with Renewable Sources

The Brazil energy storage market growth is strongly supported by the rapid integration of renewable energy sources into the national electricity grid. As solar capacity is projected to reach 88.2 GW by 2029, up from 51.7 GW in 2024, the need for efficient storage systems to stabilize intermittent power generation intensifies. Energy storage technologies are being deployed to improve grid reliability and ensure energy availability during peak demand periods. In August 2025, the Brazilian Photovoltaic Solar Energy Association reported that solar generators faced projected losses of BRL 1.7 Billion due to curtailment issues, underscoring the critical need for storage infrastructure to absorb excess renewable generation.

Policy Support and Regulatory Evolution

Regulatory progress and government involvement are key trends shaping Brazil's energy storage market as authorities develop frameworks recognizing storage as an independent asset within the power system. In November 2025, the Ministry of Mines and Energy opened a public consultation on guidelines for the 2026 LRCAP storage capacity auction, which will contract systems of at least 30 MW with four-hour daily discharge obligations under ten-year contracts. The Brazilian National Electric Energy Agency (ANEEL) has made significant progress through Public Consultation No. 39/2023, advancing crucial decisions including classification of storage operators as independent power producers with thirty-five-year concessions.

Technological Innovation and Local Manufacturing

Advancements in technology and rising interest in domestic production are shaping the future of Brazil's energy storage sector as manufacturers explore localized assembly to reduce import dependency and lower costs. In September 2024, Matrix Energia completed Brazil's first green debentures issuance worth BRL 100 Million (USD 17.9 Million) to build 224 MWh of battery storage capacity, marking the country's first green issuance specifically dedicated to a BESS project. Research institutions and universities are partnering with energy companies to develop prototypes for grid-scale storage and community microgrids, while digitalization and smart energy management platforms enable real-time monitoring and optimization of charge-discharge cycles.

Market Outlook 2026-2034:

The Brazil energy storage market outlook remains robust, with the country strategically positioning itself to become a regional leader in storage deployment by 2030. Key drivers include government capacity reserve auctions, federal rural electrification initiatives, and an increasing awareness among commercial and industrial players of the economic and operational benefits of energy storage. These factors are expected to stimulate significant investments across the sector. The market generated a revenue of USD 216.97 Million in 2025 and is projected to reach a revenue of USD 4,478.12 Million by 2034, growing at a compound annual growth rate of 39.98% from 2026-2034.

Brazil Energy Storage Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Battery Energy Storage System (BESS) | 70% |

| End User | Utility Scale | 50% |

Type Insights:

- Battery Energy Storage System (BESS)

- Pumped-Storage Hydroelectricity (PSH)

- Others

Battery Energy Storage System (BESS) dominates the Brazil energy storage market with a 70% share in 2025.

Battery energy storage systems have emerged as the preferred technology in Brazil due to their modularity, scalability, and ability to provide rapid response services essential for grid stability. The technology's declining costs, driven by global electric vehicle battery demand, have made BESS commercially viable for applications ranging from peak shaving to frequency regulation. The segment benefits from growing interest among commercial and industrial users seeking energy reliability and cost optimization. Companies are pioneering energy storage-as-a-service models that enable new projects for commercial clients without requiring substantial upfront capital investments. In June 2025, Matrix Energia announced an agreement with the city of São Paulo to supply storage for electric bus depots, deploying 4.5 MWh BESS modules integrated with ultra-fast chargers capable of serving at least 29 buses per unit, demonstrating the technology's versatility across transportation electrification applications.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial and Industrial

- Utility Scale

Utility scale leads the Brazil energy storage market with a 50% share in 2025.

Utility-scale is gaining prominence as Brazil addresses the challenges of integrating variable renewable generation into its national grid. The segment is driven by government initiatives, which aim to contract large-scale battery systems to enhance grid reliability. The utility-scale segment benefits from strategic investments by major power companies and transmission operators seeking to modernize grid infrastructure. ISA CTEEP, a prominent transmission system operator, has deployed grid-scale BESS projects as non-wires alternatives to traditional network reinforcement. The Ministry of Mines and Energy has actively courted international investment from Chinese companies during bilateral meetings in October 2025, with the goal of attracting technology partnerships and capital for utility-scale battery deployment across the National Interconnected System.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast is driven by concentrated industrial activity in São Paulo and Minas Gerais metropolitan areas, superior grid infrastructure enabling commercial and industrial storage adoption, presence of major energy service providers, and strong demand from manufacturing sectors seeking power reliability solutions.

South is a growing market segment, supported by established renewable energy infrastructure in Paraná and Rio Grande do Sul, increasing distributed generation penetration, agricultural sector interest in backup power solutions, and favorable state-level policies encouraging clean energy technology adoption.

Northeast is fueled by severe renewable curtailment challenges requiring storage solutions, high solar irradiance resources in Bahia and Ceará, expanding wind-solar hybrid project developments, and urgent need to address transmission bottlenecks limiting energy export to load centers.

North is supported by rural electrification programs serving isolated Amazon communities in Pará and Amazonas, government initiatives replacing diesel generation, highest regional electricity tariffs creating economic incentives, and social inclusion objectives requiring decentralized energy solutions.

Central-West is experiencing demand for reliable power replacing diesel generators, growing distributed solar installations in Mato Grosso, agricultural processing facilities seeking energy independence, and increasing awareness of storage benefits for remote farming operations.

Market Dynamics:

Growth Drivers:

Why is the Brazil Energy Storage Market Growing?

Accelerating Renewable Energy Expansion

Brazil's rapid expansion of renewable energy generation, particularly solar and wind power, is creating substantial demand for energy storage solutions to manage intermittency and grid stability. The share of photovoltaic power in Brazil's electricity matrix is projected to increase significantly by the end of the decade, according to the National System Operator's Energy Operation Plan. This growth trajectory, which will see installed solar capacity nearly double over the forecast period, necessitates flexible storage infrastructure to balance supply and demand. Brazil recently surpassed major cumulative solar capacity milestones, more than doubling its photovoltaic installations in recent years and demonstrating the urgent need for storage solutions to integrate this expanding generation base.

Government Capacity Auction Initiatives

The Brazilian government's decision to launch dedicated capacity reserve auctions for energy storage represents a transformative policy shift that is accelerating market development. The Ministry of Mines and Energy has scheduled Brazil's first battery storage auction, which will contract systems meeting minimum capacity thresholds with multi-hour daily discharge obligations under long-term contracts. The Brazilian Energy Storage Solutions Association reports that substantial battery project capacity is ready for registration, with anticipated contracting expected to unlock significant investments. This government-backed procurement mechanism provides revenue certainty for developers and signals long-term commitment to storage as a strategic infrastructure asset essential for grid modernization.

Grid Reliability and Curtailment Challenges

Growing concerns about grid reliability and escalating renewable energy curtailment are driving urgent demand for storage solutions across Brazil. Recent years have witnessed substantial increases in curtailed renewable generation, with solar experiencing proportionally higher curtailment rates than wind power. Frequent power outages in certain regions are leading consumers to seek reliable backup alternatives. Energy storage technologies are increasingly viewed as essential infrastructure to absorb excess solar generation during peak production hours and discharge stored power during evening demand periods, addressing both curtailment losses affecting solar generators and consumer reliability requirements throughout the country.

Market Restraints:

What Challenges the Brazil Energy Storage Market is Facing?

Regulatory Uncertainty and Framework Gaps

The absence of a comprehensive regulatory framework for energy storage creates significant uncertainty for investors and project developers. ANEEL's public consultation process addressing storage classification, tariffs, and remuneration models has experienced multiple delays, with crucial decisions on whether storage assets should be classified as generators or consumers remaining unresolved. This regulatory vacuum inhibits investment decisions and leaves Brazil behind other countries that have already established clear storage frameworks.

High Tax Burden and Capital Costs

Energy storage systems in Brazil face substantial fiscal burdens that impede market growth and project viability. Batteries are currently classified as luxury products, subjecting them to cumulative taxes representing a significant portion of total system costs. This high tax burden, combined with elevated upfront capital requirements for battery installations, creates financial barriers that limit adoption across residential, commercial, and utility-scale applications despite long-term operational savings.

Infrastructure and Grid Connection Constraints

Transmission capacity has not kept pace with the rapid expansion of renewable energy projects, creating bottlenecks that limit energy storage deployment potential. Grid access restrictions and connection delays affect both centralized and distributed generation sites, while outstanding regulatory questions about transmission and distribution network usage charges for storage systems create additional uncertainty. These infrastructure limitations constrain the ability of storage solutions to fully capture their value in supporting grid operations.

Competitive Landscape:

The Brazil energy storage market exhibits an emerging competitive landscape characterized by partnerships between international technology providers and domestic energy companies. Competition is intensifying as global battery manufacturers seek to establish market presence ahead of the government's capacity auction. Companies are focusing on diversifying technology offerings, developing localized manufacturing capabilities, and creating innovative business models such as energy storage-as-a-service to attract commercial and industrial clients. Strategic partnerships with Chinese technology providers are accelerating project development and technology transfer. Market players are continually refining their strategies to capture opportunities across utility-scale, commercial, and residential segments as regulatory clarity improves and auction mechanisms provide revenue certainty for long-term investments.

Brazil Energy Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Battery Energy Storage System (BESS), Pumped-Storage Hydroelectricity (PSH), Others |

| End Users Covered | Residential, Commercial and Industrial, Utility Scale |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil energy storage market size was valued at USD 216.97 Million in 2025.

The Brazil energy storage market is expected to grow at a compound annual growth rate of 39.98% from 2026-2034 to reach USD 4,478.12 Million by 2034.

Battery Energy Storage System (BESS), holding the largest share of 70% in 2025, dominates the Brazil energy storage market due to its modularity, declining costs, and rapid deployment capabilities enabling commercial viability across residential, commercial, and utility-scale applications.

Key factors driving the Brazil energy storage market include accelerating renewable energy expansion creating integration challenges, government capacity auction initiatives providing revenue certainty, growing grid reliability concerns and curtailment issues, declining battery technology costs, and increasing adoption of energy-as-a-service business models.

Major challenges include regulatory uncertainty with incomplete frameworks for storage classification and remuneration, high tax burdens reaching 55-79% on battery systems, transmission infrastructure constraints limiting grid connection capacity, and elevated upfront capital costs despite improving project economics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)