Brazil Food Acidulants Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Brazil Food Acidulants Market Summary:

The Brazil food acidulants market size was valued at USD 280.63 Million in 2025 and is projected to reach USD 487.16 Million by 2034, growing at a compound annual growth rate of 6.32% from 2026-2034.

The Brazil food acidulants market is experiencing robust expansion, driven by the growing preference for processed and convenience food products among consumers. Rising health consciousness is encouraging manufacturers to adopt natural preservatives and flavor enhancers in food formulations. The expanding beverage industry and increasing demand for shelf-stable products are further propelling market growth, alongside evolving consumer preferences for clean-label ingredients in the food and beverage (F&B) sector.

Key Takeaways and Insights:

- By Type: Citric acid dominates the market with a share of 45% in 2025, owing to its widespread application as a natural flavoring agent and preservative across multiple food categories. Its affordability, compatibility with various food matrices, and regulatory approval for use in beverages, confectionery, and processed foods are driving adoption.

- By Application: Beverages lead the market with a share of 32% in 2025. This dominance is driven by the extensive use of acidulants for pH regulation, flavor enhancement, and preservation in carbonated drinks, juices, and functional beverages. Rising consumer demand for ready-to-drink (RTD) products supports segment expansion.

- Key Players: Key players drive the Brazil food acidulants market by expanding production capacities, investing in sustainable sourcing practices, and developing innovative acidulant formulations. Their focus on distribution network enhancement, strategic partnerships with food manufacturers, and commitment to meeting clean-label demands accelerate market penetration and ensure consistent product availability across diverse industrial applications.

The Brazil food acidulants market is witnessing sustained growth, fueled by transformative shifts in consumer behavior and industrial practices. The expanding food processing sector is creating substantial demand for acidulants that enhance product quality and extend shelf life. Growing urbanization and changing lifestyles are driving preferences for convenience foods and RTD beverages, where acidulants serve critical functions in flavor optimization and preservation. In 2024, the urban population, as a percentage of the total population in Brazil, was recorded at 88.02%, as per the World Bank collection of development indicators. The rising emphasis on clean-label products is encouraging manufacturers to incorporate naturally derived acidulants that meet consumer expectations for transparency and health-conscious formulations. Additionally, the flourishing hospitality and foodservice industry across major Brazilian cities is amplifying demand for processed ingredients that maintain consistency and safety standards. Regulatory frameworks promoting food safety compliance are further incentivizing the adoption of approved acidulants. The convergence of health awareness, industrial modernization, and evolving dietary patterns positions the Brazil food acidulants market share for continued expansion throughout the forecast period.

Brazil Food Acidulants Market Trends:

Rising Preferences for Natural and Clean-Label Acidulants

Brazilian consumers are increasingly gravitating towards food products, featuring recognizable and naturally derived ingredients, prompting manufacturers to reformulate offerings with clean-label acidulants. This shift reflects heightened health and wellness consciousness and demand for transparency in food labeling. As per IMARC Group, the Brazil health and wellness market size reached USD 91.3 Billion in 2025. Citric acid derived from citrus sources and lactic acid from fermentation processes are gaining traction as preferred alternatives to synthetic additives. Food producers are responding by developing formulations that align with consumer expectations for minimal processing while maintaining desired taste profiles and preservation efficacy.

Expanding Application in Functional and Fortified Beverages

The functional beverage segment in Brazil is experiencing remarkable growth as health-oriented consumers seek drinks offering nutritional benefits beyond basic hydration. Acidulants play essential roles in these formulations by enabling optimal pH environments for nutrient stability and bioavailability enhancement. Energy drinks, vitamin-enriched waters, and probiotic beverages increasingly incorporate specialized acidulant blends to achieve desired taste balance and product stability. This trend is driving innovations in acidulant combinations that support both functionality and sensory appeal in emerging beverage categories.

Adoption of Sustainable Production and Sourcing Practices

Sustainability considerations are reshaping acidulant production and procurement strategies within the Brazilian market. Manufacturers are prioritizing bio-based production methods utilizing renewable feedstocks and implementing environmentally responsible manufacturing processes. The emphasis on reducing carbon footprints and minimizing environmental impact is driving investments in fermentation-based technologies that offer ecological advantages over traditional chemical synthesis. This sustainability focus aligns with broader industry commitments to responsible sourcing and supports market positioning among environmentally conscious food manufacturers and consumers.

Market Outlook 2026-2034:

The Brazil food acidulants market outlook remains favorable, underpinned by robust industrial demand and evolving consumer preferences towards processed and convenience food products. Regulatory support for food safety standards continues to drive adoption of approved acidulants across the manufacturing sector. The market generated a revenue of USD 280.63 Million in 2025 and is projected to reach a revenue of USD 487.16 Million by 2034, growing at a compound annual growth rate of 6.32% from 2026-2034. Innovations in product formulations, expansion of distribution networks, and strategic investments in production capacity enhancement are expected to sustain growth momentum. The convergence of health-conscious consumption patterns, clean-label demands, and food processing industry expansion positions the market for continued advancement throughout the forecast period.

Brazil Food Acidulants Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Citric Acid |

45% |

|

Application |

Beverages |

32% |

Type Insights:

To get detailed segment analysis of this market Request Sample

- Citric Acid

- Phosphoric Acid

- Lactic Acid

- Others

Citric acid dominates with a market share of 45% of the total Brazil food acidulants market in 2025.

Citric acid holds a dominant position in the Brazil food acidulants market due to its exceptional versatility and functional efficiency across diverse F&B applications. It acts simultaneously as a flavor enhancer, preservative, and pH regulator, allowing manufacturers to simplify formulations while maintaining product quality. Its compatibility with beverages, confectionery, dairy, and processed foods, combined with cost-effectiveness and a strong safety profile, makes it an industry-standard choice. Additionally, its natural origin supports clean-label positioning, aligning with rising consumer preference for recognizable and naturally derived ingredients.

Another key factor is the reliability of supply and regulatory clarity surrounding citric acid usage in food processing. Established production capabilities and access to agricultural raw materials ensure consistent availability for manufacturers. Clear food safety regulations reduce formulation risks and accelerate product development cycles. Moreover, citric acid’s stability, ease of handling, and proven performance across multiple processing conditions make it attractive for both large-scale producers and smaller food companies, reinforcing its sustained dominance in the Brazil food acidulants market.

Application Insights:

- Beverages

- Dairy and Frozen Products

- Bakery

- Meat Industry

- Confectionery

- Others

Beverages leads with a share of 32% of the total Brazil food acidulants market in 2025.

Beverages maintain their leadership in the Brazil food acidulants market, driven by the extensive application of acidulants in carbonated drinks, juices, energy beverages, and functional formulations. As per IMARC Group, the Brazil energy drink market size was valued at USD 3.3 Billion in 2025 and is projected to reach USD 4.8 Billion by 2034. High urbanization levels and changing consumer lifestyles are supporting sustained demand for RTD beverages across Brazil. Strong distribution networks and aggressive product launches by beverage manufacturers further reinforce segment growth.

The growing emphasis on sugar reduction initiatives is amplifying acidulant usage as manufacturers seek to balance sweetness profiles in reformulated beverages. Acidulants enable flavor optimization in low-sugar and zero-sugar products where taste modulation becomes critical for consumer acceptance. The expanding functional beverage segment, including energy drinks, vitamin-enriched waters, and probiotic formulations, is creating additional demand for specialized acidulant blends that support both nutritional stability and sensory appeal in innovative product categories targeting health-conscious Brazilian consumers.

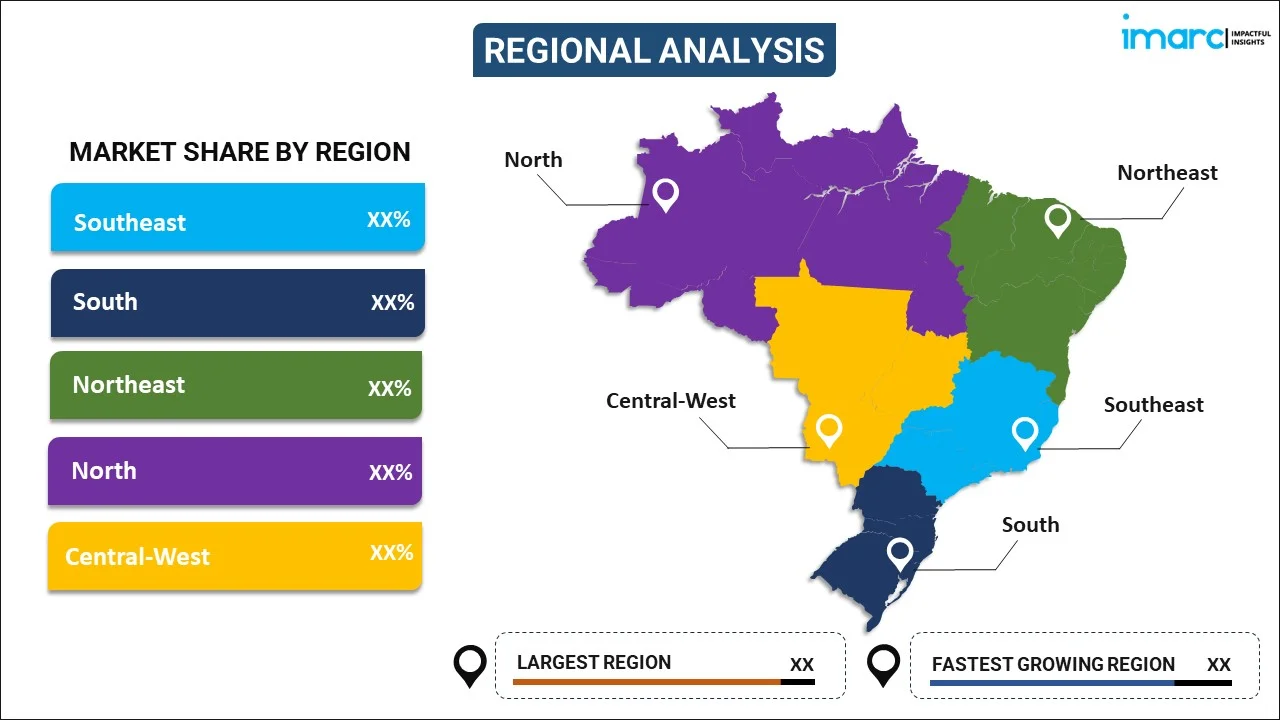

Regional Insights:

To get detailed segment analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast holds significant position in the market due to its highly concentrated F&B manufacturing base and strong consumer demand. States, such as São Paulo, Rio de Janeiro, and Minas Gerais, host large-scale processing facilities for beverages, dairy, confectionery, and bakery products that extensively use acidulants for flavor balance and preservation.

South represents a significant share of the Brazil food acidulants market, supported by its robust agro-processing and food export activities. Strong dairy, meat processing, and fruit-based product industries drive consistent acidulant consumption for preservation and taste enhancement. The region’s emphasis on quality standards and food safety encourages the use of standardized acidulant formulations.

In Northeast, the food acidulants market is expanding steadily, driven by rising urbanization and increasing consumption of packaged foods and beverages. Regional food industries focusing on fruit juices, carbonated drinks, sauces, and processed snacks utilize acidulants to enhance flavor and shelf life. The region’s warm climate increases the need for preservation solutions, supporting consistent demand.

In North, the market is positively influenced by gradual development of food processing infrastructure. Demand is primarily driven by local beverage production, fruit-based products, and regional specialties requiring acidity regulation and preservation. Investments in cold storage, transportation, and food safety are improving market penetration.

In Central-West, the food acidulants market is supported by its strong agricultural base and expanding food processing activities. Large-scale production of grains, fruits, and livestock creates opportunities for value-added food manufacturing requiring acidulants. Growth in meat processing, sauces, and beverage production contributes to rising demand. Improving infrastructure and connectivity are enabling better access to domestic markets.

Market Dynamics:

Growth Drivers:

Why is the Brazil Food Acidulants Market Growing?

Expanding Processed F&B Industry

The rapid expansion of Brazil's processed F&B industry represents a primary catalyst for food acidulants market growth. Urbanization and evolving lifestyle patterns are driving consumer preferences toward convenience foods that offer extended shelf life, consistent quality, and ready-to-consume formats. Food processors increasingly rely on acidulants to achieve desired taste profiles, preserve product freshness, and maintain safety standards throughout distribution channels. The growing middle-class population with rising disposable incomes is fueling demand for premium packaged products where acidulants deliver essential functional benefits. The share of middle class population in Brazil is set to climb to 54.8% by 2034, according to a study by Tendências Consultoria. Manufacturing investments across the country are creating additional capacity for processed food production, consequently amplifying acidulant consumption. The hospitality sector expansion, including hotels, restaurants, and cafes, is generating substantial demand for processed ingredients that meet stringent quality and safety requirements while delivering consistent performance in commercial food preparation applications.

Growing Consumer Preference for Clean-Label Products

Heightened consumer awareness regarding food ingredients and their health implications is propelling demand for clean-label acidulants derived from natural sources. Brazilian consumers are increasingly scrutinizing product labels and seeking formulations that feature recognizable, minimally processed ingredients without artificial additives. This behavioral shift is encouraging food manufacturers to reformulate existing products and develop new offerings that incorporate naturally derived acidulants meeting clean-label criteria. Citric acid, lactic acid, and other organic acidulants are gaining prominence as preferred alternatives to synthetic compounds. The transparency movement is reshaping procurement strategies as brands prioritize ingredients that resonate with health-conscious consumers. Regulatory developments promoting clearer food labeling are reinforcing this trend by enhancing consumer understanding of product compositions. Manufacturers investing in clean-label reformulations are capturing market share among discerning consumers willing to pay premium prices for products aligned with their health and wellness priorities.

Stringent Food Safety Regulations and Quality Standards

Evolving regulatory frameworks governing food safety and quality standards are driving adoption of approved acidulants across manufacturing operations. Brazilian regulatory bodies are implementing comprehensive guidelines that specify permitted additives, usage levels, and labeling requirements for food products. These regulations create structured environments where manufacturers must incorporate compliant acidulants to achieve market authorization and maintain product registrations. The emphasis on food safety is particularly pronounced in export-oriented production where international quality standards govern market access. Acidulants serve critical preservation and safety functions that enable compliance with microbial contamination limits and shelf-life specifications mandated by regulations. Manufacturers are investing in formulation expertise and quality assurance systems to ensure consistent adherence to regulatory requirements. The regulatory landscape continues to evolve with updates to additive specifications and harmonization with international food safety frameworks, reinforcing the essential role of approved acidulants in commercial food production.

Market Restraints:

What Challenges is the Brazil Food Acidulants Market Facing?

Raw Material Price Volatility and Supply Chain Constraints

Fluctuations in raw material prices for acidulant production create cost pressures that impact manufacturing economics and product pricing strategies. Brazil's reliance on imported feedstocks for certain acidulant categories exposes the market to currency exchange volatility and international supply disruptions. Agricultural input costs, energy expenses, and logistics challenges contribute to pricing instability that affects profit margins across the value chain. These constraints complicate long-term planning and investment decisions for market participants.

Competition from Alternative Preservation Methods

Emerging preservation technologies and alternative additives present competitive challenges to traditional acidulant applications. Advancements in packaging technologies, including modified atmosphere packaging and active packaging systems, offer preservation solutions that may reduce acidulant requirements in certain product categories. Natural antimicrobials, enzyme-based preservatives, and fermentation-derived compounds are gaining attention as potential substitutes that meet clean-label demands while delivering comparable functional benefits in specific applications.

Regulatory Complexity and Compliance Burden

The evolving regulatory landscape creates compliance challenges that require continuous monitoring and adaptation by market participants. Approval processes for new acidulant applications can be time-consuming and resource-intensive, potentially delaying product launches and market entry. Manufacturers must navigate complex documentation requirements, testing protocols, and registration procedures while maintaining compliance with existing authorizations. These administrative burdens disproportionately impact smaller enterprises with limited regulatory affairs capabilities.

Competitive Landscape:

The Brazil food acidulants market exhibits a fragmented competitive structure, characterized by the presence of multinational corporations and regional producers operating across diverse market segments. Competition centers on product quality, pricing strategies, technical support capabilities, and distribution network strength. Leading market participants are investing in production capacity expansion, research and development (R&D) initiatives, and sustainable manufacturing practices to strengthen competitive positioning. Strategic partnerships between ingredient suppliers and food manufacturers facilitate customized solution development and market penetration. Innovations in acidulant formulations, including specialized blends for specific applications and clean-label variants, represent a key differentiation strategy.

Brazil Food Acidulants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Citric Acid, Phosphoric Acid, Lactic Acid, Others |

| Applications Covered | Beverages, Dairy and Frozen Products, Bakery, Meat Industry, Confectionery, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil food acidulants market size was valued at USD 280.63 Million in 2025.

The Brazil food acidulants market is expected to grow at a compound annual growth rate of 6.32% from 2026-2034 to reach USD 487.16 Million by 2034.

Citric acid dominated the market with a share of 45%, driven by its versatility as a natural preservative, flavor enhancer, and pH regulator across beverages, confectionery, and processed food applications.

Key factors driving the Brazil food acidulants market include expanding processed F&B industry, growing consumer preference for clean-label products, and stringent food safety regulations promoting adoption of approved acidulants.

Major challenges include raw material price volatility affecting production costs, competition from alternative preservation technologies, regulatory complexity requiring continuous compliance monitoring, and supply chain constraints impacting feedstock availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)