Brazil Food Emulsifiers Market Size, Share, Trends and Forecast by Application, and Region, 2026-2034

Brazil Food Emulsifiers Market Summary:

The Brazil food emulsifiers market size was valued at USD 210.08 Million in 2025 and is projected to reach USD 311.93 Million by 2034, growing at a compound annual growth rate of 4.49% from 2026-2034.

Brazil’s food emulsifiers market is experiencing sustained expansion, driven by the country’s robust processed food manufacturing sector and evolving consumer preferences toward convenience-oriented products. The market benefits from Brazil’s position as South America’s largest economy, with a sophisticated food processing industry that relies extensively on emulsifiers to enhance product stability, texture, and shelf life across diverse applications, including meat processing, bakery formulations, dairy products, and beverage manufacturing.

Key Takeaways and Insights:

- By Application: Meat and poultry dominate the market with a share of 34% in 2025, driven by Brazil’s position as the world’s leading poultry exporter and third-largest producer, with processing facilities requiring emulsifiers for product uniformity, fat distribution, and texture enhancement in processed meat formulations.

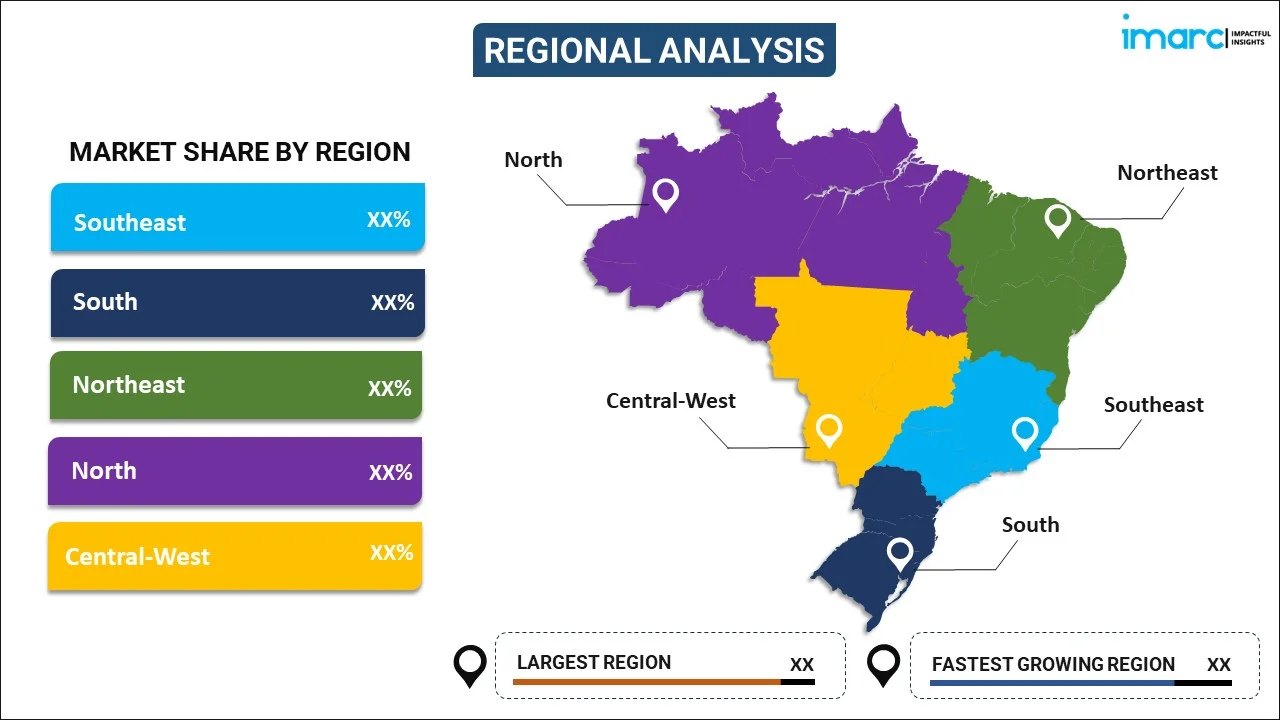

- By Region: Southeast leads the market with a share of 36% in 2025, attributed to the concentration of major food processing facilities, higher disposable incomes, and urban population density in states including Sao Paulo and Rio de Janeiro, which serve as the industrial hub for the country’s food manufacturing sector.

- Key Players: The Brazil food emulsifiers market exhibits moderate competitive intensity, characterized by the presence of multinational ingredient suppliers competing alongside regional manufacturers. Leading players maintain market positions through extensive distribution networks, technical support capabilities, and ongoing investments in natural and clean-label emulsifier development to address evolving consumer preferences.

The Brazil food emulsifiers market is underpinned by the country’s substantial food processing industry, which generated revenues exceeding USD 233 billion in 2024, according to the Brazilian Food Processors Association. Food emulsifiers serve as essential functional ingredients that enable the stable blending of otherwise immiscible components such as oil and water, while providing critical benefits including improved texture, extended shelf life, and enhanced product consistency. The market encompasses a diverse range of emulsifier types, including lecithin derived from soybeans and sunflower seeds, mono- and diglycerides widely utilized in bakery applications, and specialty emulsifiers such as polysorbates and sorbitan esters that ensure consistent textures across various food categories. Brazil’s favorable agricultural landscape as a major soybean producer provides competitive advantages in lecithin production, supporting domestic supply capabilities while meeting the growing demand from food manufacturers seeking cost-effective and functional emulsification solutions.

Brazil Food Emulsifiers Market Trends:

Rising Demand for Clean-Label and Natural Emulsifiers

Brazilian consumers are increasingly prioritizing products with recognizable and natural ingredient lists, prompting food manufacturers to reformulate products using emulsifiers derived from plant-based sources. Lecithin from sunflower and soybean origins is gaining significant traction as manufacturers respond to consumer demand for transparency and healthier formulations without compromising product performance or sensory attributes. For instance, in October 2025, Palsgaard increased its manufacturing footprint in Brazil by scaling up production of Emulpals powdered cake emulsifiers, a portfolio of plant-based, clean-label solutions designed for bakery premix applications. This expansion is intended to support rising demand for whipping agents across both regional and international markets, reflecting growing interest in naturally sourced emulsifiers within the bakery sector.

Expansion of Convenience Food and Ready-to-Eat Segments

Brazil’s rapidly urbanizing population, which accounts for 88.02% of the total population, is significantly boosting demand for convenience-focused food products. Urban lifestyles and time constraints are accelerating consumption of ready-to-eat meals, processed snacks, and frozen foods. These product categories depend heavily on emulsifiers to ensure texture, consistency, and stability during prolonged storage and transportation. As distribution networks expand and shelf-life requirements increase, food manufacturers are adopting advanced emulsification solutions to preserve product quality and performance across extended and complex supply chains.

Sustainability Focus in Ingredient Sourcing and Production

Environmental sustainability is playing a growing role in emulsifier sourcing decisions among Brazilian food manufacturers. Companies are increasingly prioritizing suppliers that demonstrate environmentally responsible production methods, sustainable raw material sourcing, and lower carbon footprints. These efforts are aligned with wider corporate sustainability goals, including waste reduction and energy efficiency initiatives. In parallel, evolving environmental regulations and stakeholder expectations are encouraging manufacturers to integrate sustainability criteria into procurement strategies, making eco-conscious emulsifier solutions an important factor in long-term supplier selection and brand positioning.

Market Outlook 2026-2034:

Brazil’s food emulsifiers market shows strong growth potential, driven by the continued expansion of the processed food industry and rising adoption of functional ingredients across a wide range of food products. Demand is supported by changing consumer preferences, urbanization, and innovation in convenience and packaged foods. In parallel, the regulatory landscape overseen by ANVISA is becoming more structured, with revised food additive regulations increasingly aligned with global standards. These developments offer greater regulatory transparency and compliance guidance for manufacturers using approved emulsifiers. The market generated a revenue of USD 210.08 Million in 2025 and is projected to reach a revenue of USD 311.93 Million by 2034, growing at a compound annual growth rate of 4.49% from 2026-2034.

Brazil Food Emulsifiers Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Application | Meat and Poultry | 34% |

| Region | Southeast | 36% |

Application Insights:

To get detailed segment analysis of this market Request Sample

- Meat and Poultry

- Dairy

- Beverages

- Bakery and Confectionery

- Others

Meat and poultry dominates with a market share of 34% of the total Brazil food emulsifiers market in 2025.

Brazil’s meat and poultry sector represents the primary consumption base for food emulsifiers, driven by the country’s substantial position as a global protein producer and exporter. The nation produced approximately fifteen million metric tons of poultry meat and over eleven million metric tons of beef in recent years, with processed meat products requiring emulsifiers for optimal fat binding, moisture retention, and texture consistency. Major meat processing facilities utilize emulsifiers extensively to ensure uniform product quality across their manufacturing operations.

The bakery and confectionery segment demonstrates significant emulsifier consumption, with the Brazil bakery products market size reached USD 9.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 12.2 Billion by 2034, exhibiting a growth rate (CAGR) of 3.33% during 2026-2034. Emulsifiers in this segment improve dough stability, enhance crumb structure, and extend product shelf life. The growing preference for premium and artisanal bakery products further supports demand for specialized emulsification solutions that deliver superior texture and mouthfeel characteristics.

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits clear dominance with a 36% share of the total Brazil food emulsifiers market in 2025.

The Southeast region, encompassing São Paulo, Rio de Janeiro, Minas Gerais, and Espírito Santo, serves as Brazil’s industrial heartland with the highest concentration of food processing facilities and consumer populations. This region benefits from superior logistics infrastructure, access to port facilities for ingredient imports, and proximity to the country’s most affluent consumer base, which drives demand for processed and premium food products requiring emulsification solutions.

The South region represents a significant market for food emulsifiers, supported by strong poultry and meat processing industries concentrated in states including Paraná, Santa Catarina, and Rio Grande do Sul. Parana alone accounts for a substantial portion of Brazil’s poultry exports, with cooperatives and processing facilities requiring a consistent emulsifier supply for their manufacturing operations.

Market Dynamics:

Growth Drivers:

Why is the Brazil Food Emulsifiers Market Growing?

Expanding Processed Food Manufacturing Sector

Brazil’s food processing industry continues to demonstrate robust expansion, with the sector processing approximately sixty-two percent of the country’s agricultural output and generating substantial employment across direct and indirect roles. This industrial growth creates sustained demand for functional ingredients including emulsifiers, which are essential for achieving desired product characteristics in manufactured food items. The sector’s investments in facility modernization, automation technologies, and expanded production capacities further support ingredient consumption volumes, as manufacturers seek to improve operational efficiencies while maintaining consistent product quality standards across their portfolios. For instance, in November 2025, McCain Foods, a global leader in prepared potato products, announced a major expansion of its production facility in Araxá, Minas Gerais. The project involves an estimated investment of R$ 1.8 billion (approximately USD 334 million), marking the company’s largest-ever investment in the region and reinforcing its long-term commitment to expanding manufacturing capacity in Brazil.

Growing Consumer Preference for Convenience Foods

Urbanization trends and changing lifestyle patterns among Brazilian consumers are driving increased consumption of convenience-oriented food products that rely extensively on emulsifiers for functional performance. The country’s highly urbanized population increasingly prioritizes time-saving meal solutions, ready-to-eat options, and processed food products that maintain quality during extended storage and distribution. This behavioral shift necessitates sophisticated emulsification technologies that ensure product stability, consistent texture, and optimal sensory attributes throughout the product lifecycle from manufacturing to consumption.

Strong Export Orientation of Protein Industries

Brazil’s position as a leading global exporter of meat products, including poultry and beef, drives substantial emulsifier demand across processing facilities focused on international markets. Export-oriented production requires stringent quality standards and consistent product characteristics that meet diverse international specifications, necessitating reliable emulsification solutions. The expansion into new export markets across Asia, the Middle East, and Africa further amplifies production volumes and corresponding ingredient requirements, as processors scale operations to capture growing global protein demand.

Market Restraints:

What Challenges the Brazil Food Emulsifiers Market is Facing?

Volatility in Raw Material Pricing and Supply Chains

Price volatility of key emulsifier raw materials such as soybeans and vegetable oils places sustained cost pressure on manufacturers and downstream food processors. Disruptions in supply chains, foreign exchange fluctuations, and seasonal shifts in agricultural output can further affect raw material availability and price stability. These uncertainties complicate sourcing strategies, budgeting, and long-term procurement planning for companies operating in the food processing sector.

Regulatory Complexity and Compliance Requirements

Brazil’s evolving food additive regulations under ANVISA require manufacturers to make continuous investments in compliance and regulatory monitoring. Updates to regulatory frameworks often demand changes in product formulations, labeling, and technical documentation. These requirements can increase administrative burden, extend approval timelines, and raise operational costs, particularly for companies seeking authorization for new emulsifier applications or reformulated products.

Competitive Pressure from International Suppliers

The Brazilian food emulsifiers market is highly competitive, with domestic players facing strong competition from international ingredient suppliers. Manufacturers from China and Europe offer a wide range of emulsifier products at competitive prices, intensifying price sensitivity among local food processors. This environment puts pressure on margins and encourages suppliers to differentiate through value-added services, technical expertise, customization, and continuous product innovation.

Competitive Landscape:

The Brazil food emulsifiers market can be described as moderately competitive, where the existing multinational ingredient corporations retain large market shares together with regional producers. The dominant players are using massive distribution systems, technical support applications, and building relationships with key food processing firms to hold onto the market share. Product quality, reliability in supply, and differentiation in customer service are the key elements of the competitive environment, whose attention to natural and clean-label emulsifier portfolios is getting more and more significant and meets the requirements of changing customer preferences. The players in the market are also making investments in research and development projects to diversify the product range and are also seeking strategic alliances as well as capacity building to enhance their competitive stance in the Brazilian market.

Recent Developments:

- In February 2025, ANVISA approved a new regulatory framework to streamline the evaluation of food-related petitions by accepting supporting documentation from equivalent foreign regulatory authorities, facilitating market access for ingredient suppliers.

- In August 2024, Bunge announced the expansion of its North American lecithin portfolio with new deoiled soybean lecithin products in powdered and granulated formats, complementing its existing range of specialty lecithins from soybean, sunflower, and rapeseed sources.

- In September 2024, Grupo Bimbo signed an agreement for the strategic acquisition of Wickbold, a Brazil-based bakery specializing in specialty breads, expanding its manufacturing footprint and portfolio in the Brazilian market.

Brazil Food Emulsifiers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Meat and Poultry, Dairy, Beverages, Bakery and Confectionery, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil food emulsifiers market size was valued at USD 210.08 Million in 2025.

The Brazil food emulsifiers market is expected to grow at a compound annual growth rate of 4.49% from 2026-2034 to reach USD 311.93 Million by 2034.

Meat and poultry dominated the market with a share of 34% in 2025, driven by Brazil’s position as a leading global protein producer and exporter, with processing facilities requiring emulsifiers for product stability, texture enhancement, and fat distribution in processed meat formulations.

Key factors driving the Brazil food emulsifiers market include expanding processed food manufacturing sector generating over USD 233 billion in revenues, growing consumer preference for convenience foods amid urbanization trends, strong export orientation of protein industries, and increasing demand for clean-label and natural ingredients.

Major challenges include volatility in raw material pricing and supply chains affecting cost stability, evolving regulatory requirements under ANVISA’s updated frameworks, competitive pressure from international suppliers, and the need for continuous investment in natural and clean-label product development to meet changing consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)