Brazil Foodservice Market Report by Foodservice Type (Cafes and Bars, Cloud Kitchen, Full Service Restaurants, Quick Service Restaurants), Outlet (Chained Outlets, Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, Travel), and Region 2026-2034

Market Overview:

Brazil foodservice market size reached USD 55.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 94.8 Billion by 2034, exhibiting a growth rate (CAGR) of 6.10% during 2026-2034. Brazil's highly urbanized population (around 88%) fuels a significant demand for prepared meals and convenience in the foodservice market. This on-the-go lifestyle makes digital ordering crucial for market growth. With 55 million active delivery-app users, services like iFood are an integral part of daily life for many Brazilians.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 55.6 Billion |

|

Market Forecast in 2034

|

USD 94.8 Billion |

| Market Growth Rate 2026-2034 | 6.10% |

Foodservice is a vital sector comprising a wide range of establishments that provide meals and beverages to customers, both on-site and for takeout. It includes restaurants, cafes, fast-food outlets, and catering services. It plays a crucial role in meeting the dining needs and preferences of a dynamic and culturally rich population. It offers convenient dining solutions to individuals, families, tourists, and corporate clients. It provides a diverse array of culinary experiences, from traditional cuisine to international flavors. It is especially valued for its speed in delivering meals, which makes it a preferred option for those with busy schedules. It caters to various dietary preferences and restrictions, such as vegetarian, vegan, gluten-free, and allergen-free options. It aids in providing hygienic and safe food products to maintain customer trust and satisfaction. Besides this, it assists in the development of new dishes, cooking techniques, and food presentation styles. As it allows consumers to explore different culinary experiences and flavors, the demand for foodservice is rising in Brazil.

Brazil Foodservice Market Trends:

Changing Consumer Lifestyles and Dining Preferences

As Brazilians adopt better lives, their eating tastes move to more convenient, healthy options. The fast-paced nature of modern living is driving this shift, resulting in a growth in demand for grocery delivery services and pre-packaged meal solutions that appeal to both health-conscious and time-crunched consumers. With an increasing emphasis on wellbeing, Brazilians are opting toward plant-based, organic, and locally produced foods, forcing eateries to adjust their menus appropriately. This shift is reflected in the growing popularity of home-cooked meal kits and ready-to-eat choices. The shift in customer behavior is a major driver for the growth of food service in Brazil, as firms adapt to suit new needs for convenience, sustainability, and health.

Rising Disposable Income and Increased Spending on Dining Out

With growing disposable income, Brazilians are more likely to spend on eating out, creating demand throughout the foodservice sector. Consumers, most notably in urban areas, are looking for good quality eating experiences, including upscale restaurants, fine dining, and high-end casual restaurants. This buying behavior is not limited to high-end restaurants; middle-income households are also seeking eating experiences that offer value and quality as well. The food service market in Brazil 2024 grew significantly as more people make eating out a part of their regular lives. In addition, middle-class households are investing more in mid-range restaurants and casual dining, presenting potential for Brazilian restaurants to innovate their menu options, service styles, and atmosphere.

Cultural Diversity and Culinary Innovation

Brazil's vast cultural variety is creating a distinct and dynamic foodservice business. The combination of Indigenous, African, European, and Asian culinary traditions is resulting in an explosion of novel flavors, cooking techniques, and eating ideas. Brazilian restaurants are reinventing classic meals with modern twists, resulting in creative gastronomic experiences. As global culinary trends spread throughout the country, there is a rising hunger for various cuisines, which contributes to the cultural mosaic. This cultural diversity affects not just what is offered on the plate, but also how foodservice firms evolve. Restaurant supply firms play an important part in this, providing a varied selection of ingredients that allow chefs to experiment and produce new, innovative recipes that appeal to an increasingly diversified client base.

Digital Transformation and Delivery Services

Digital transformation is reshaping the Brazilian foodservice sector, with technology playing a crucial role in enhancing both customer experience and operational efficiency. The rise of online grocery delivery and food delivery apps has forced restaurants to adopt innovative tech solutions to meet consumer demand for convenience and speed. Many establishments are leveraging mobile apps, online ordering systems, and digital payment platforms to streamline their services. In addition to improving customer satisfaction, these digital tools help businesses optimize their operations, manage delivery logistics, and maintain high levels of service. The shift towards a more digital foodservice experience is an essential factor in the food service market in Brazil, driving competition and providing new avenues for growth in the industry.

Tourism and Events Boosting the Market

Tourism and events have a big influence on Brazil's foodservice business, driving its expansion. Major international events like as Carnival, World Cup games, and worldwide conferences bring millions of tourists to the country, many of whom are eager to sample Brazil's diverse gastronomic options. Restaurants and food sellers cater to both local and foreign tastes, providing unique dining experiences that reflect Brazil's rich culinary culture. With rising tourism, there is a growing demand for both traditional Brazilian meals and international cuisine, resulting in a boom in new restaurants and foodservice establishments. This spike in demand is a fundamental driver of the Brazil foodservices market, with firms capitalizing on tourism-related possibilities to broaden their reach and provide new eating experiences targeted to a global audience.

Brazil Foodservice Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on foodservice type, outlet, and location.

Foodservice Type Insights:

To get more information on this market, Request Sample

- Cafes and Bars

- Bars & Pubs

- Cafes

- Juice/Smoothie/Desserts Bars

- Specialist Coffee and Tea Shops

- Cloud Kitchen

- Full Service Restaurants

- Asian

- European

- Latin American

- Middle Eastern

- North American

- Others

- Quick Service Restaurants

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

The report has provided a detailed breakup and analysis of the market based on the foodservice type. This includes cafes and bars (bars & pubs, cafes, juice/smoothie/desserts bars, and specialist coffee and tea shops), cloud kitchen, full service restaurants (Asian, European, Latin American, Middle Eastern, North American, and Others), and quick service restaurants (bakeries, burger, ice cream, meat-based cuisines, pizza, and others).

Outlet Insights:

- Chained Outlets

- Independent Outlets

A detailed breakup and analysis of the market based on the outlet have also been provided in the report. This includes chained outlets and independent outlets.

Location Insights:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

The report has provided a detailed breakup and analysis of the market based on the location. This includes leisure, lodging, retail, standalone, and travel.

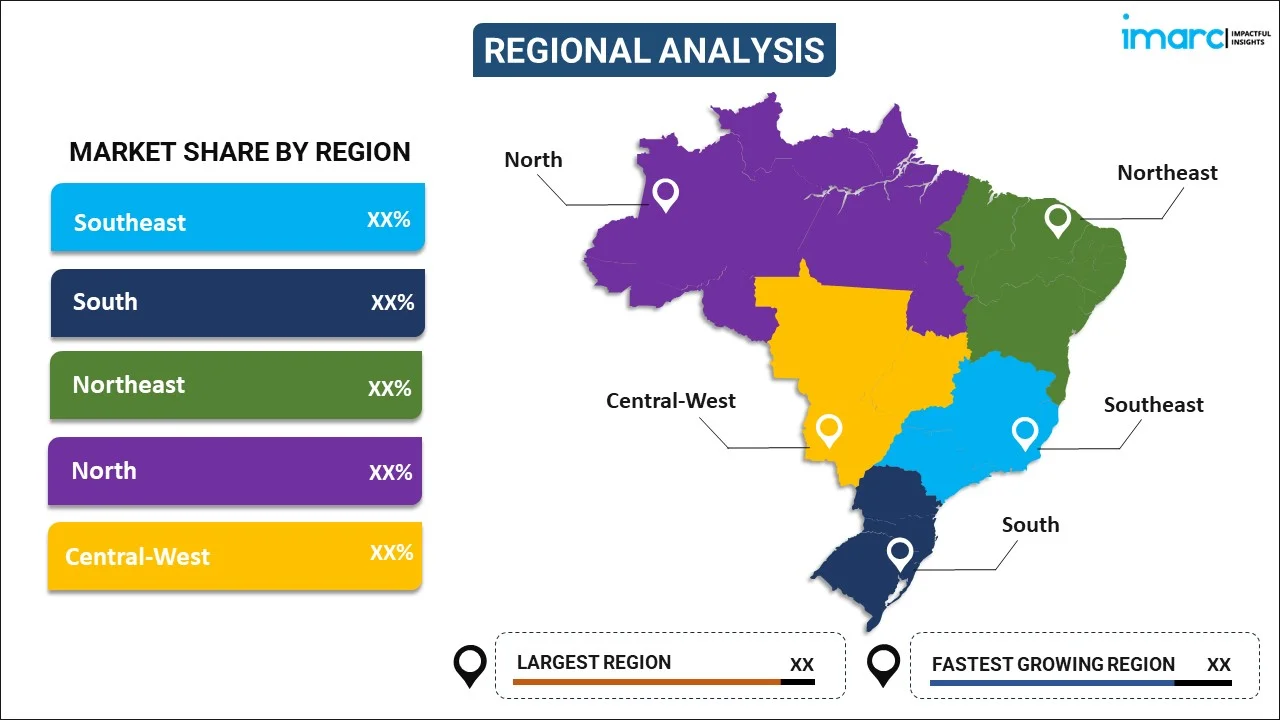

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Brazil Foodservice Companies:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Arcos Dorados Holdings Inc.

- CHQ Companhia de Franchising

- Domino's Pizza Brasil

- Grupo Madero

- Halipar

- International Meal Company Alimentacao SA

- Oggi Sorvetes

- Restaurant Brands International Inc.

- SouthRock

- The Wendy's Company

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Brazil Foodservice Market News:

- In July 2025, Solina Foods, a French supplier, has bought Brazil's New Max Industrial Ltda, marking its first foray into South America. New Max, located in Americana, São Paulo, specializes in savory solutions, flavoring systems, and natural colorants. With 30 years of expertise, it services both the domestic food industry and global meat players in Brazil, therefore increasing the country's position in the foodservice sector.

- In March 2025, Krispy Kreme opened its first location in São Paulo, Brazil, at Avenida Juscelino Kubitschek neighborhood. The brand entered the market through a joint venture with AmPm, which leveraged its 1,500 retail outlets across the country. This agreement, announced in February 2024, brought Krispy Kreme's Original Glazed doughnuts to Brazilian customers.

- In February 2025, Tanmiah Food Company, a top Middle Eastern supplier of fresh chicken, processed proteins, and animal feed, signed a memorandum of understanding (MoU) with Vibra Agroindustrial S.A, one of Brazil's major poultry producers and exporters. The event was held in the Ministry of Environment, Water, and Agriculture (MEWA). This agreement increases Brazil's position in the worldwide halal poultry market and expands export potential, notably in the Middle East and North Africa (MENA) region.

Brazil Foodservice Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Foodservice Types Covered |

|

| Outlets Covered | Chained Outlets, Independent Outlets |

| Locations Covered | Leisure, Lodging, Retail, Standalone, Travel |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Companies Covered | Arcos Dorados Holdings Inc., CHQ Companhia de Franchising, Domino's Pizza Brasil, Grupo Madero, Halipar, International Meal Company Alimentacao SA, Oggi Sorvetes, Restaurant Brands International Inc., SouthRock, The Wendy's Company etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil foodservice market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil foodservice market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil foodservice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The foodservice market in Brazil was valued at USD 55.6 Billion in 2025.

The Brazil foodservice market is projected to exhibit a CAGR of 6.10% during 2026-2034, reaching a value of USD 94.8 Billion by 2034.

The Brazil foodservice market is expanding due to urbanization, rising disposable incomes, and a growing middle class. Consumers are increasingly seeking convenience, health-conscious options, and diverse dining experiences. The proliferation of digital platforms and delivery services further drives market growth.

Some of the major players in the Brazil foodservice market include Arcos Dorados Holdings Inc., CHQ Companhia de Franchising, Domino's Pizza Brasil, Grupo Madero, Halipar, International Meal Company Alimentacao SA, Oggi Sorvetes, Restaurant Brands International Inc., SouthRock, The Wendy's Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)