Brazil Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

Brazil Foreign Exchange Market Overview:

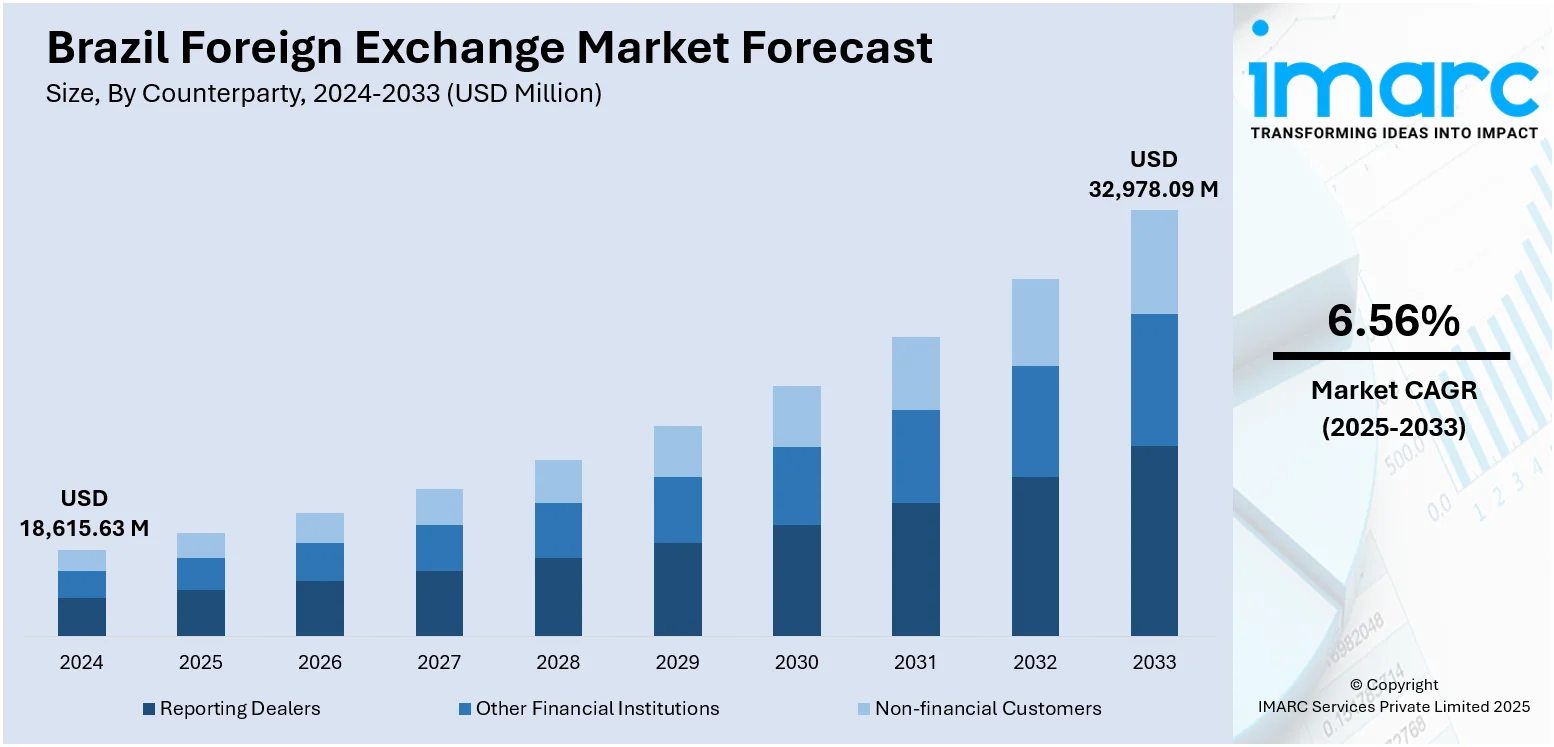

The Brazil foreign exchange market size reached USD 18,615.63 Million in 2024. The market is projected to reach USD 32,978.09 Million by 2033, exhibiting a growth rate (CAGR) of 6.56% during 2025-2033. The market is fueled by the country's strong commodity export performance, which generates substantial foreign currency inflows. Besides that, interest rate differentials continue to attract global investors seeking yield, which is supporting capital inflows into the country. Apart from that, robust remittance volumes and government efforts to stabilize inflation and fiscal performance have contributed to improving investor confidence, thereby expanding the Brazil foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18,615.63 Million |

| Market Forecast in 2033 | USD 32,978.09 Million |

| Market Growth Rate 2025-2033 | 6.56% |

Brazil Foreign Exchange Market Trends:

Remittance Inflows and Diaspora Engagement

Remittance flows contribute increasingly to the market, fueled by the global dispersal of the Brazilian diaspora, especially in the United States, Europe, and Japan. The flows serve as a reliable source of foreign exchange, most particularly during an economic recession or domestic market uncertainty. Unlike trade or portfolio-related flows, remittances are usually countercyclical, frequently rises during domestic economic hardship, thus offering support to the BRL. In addition to this, financial institutions and the Brazilian government have introduced fintech-driven remittance solutions that lower transactional costs and facilitate greater access, leading to increased volumes of formal remittances. Furthermore, exchange centers and digital banking products have incorporated real-time FX conversion functionalities, driving transactional efficiency and transparency. In line with this, holiday and beginning-of-school-year peaks in remittance activity create periodic surges in supply and demand for forex. With increasing global mobility and cross-border employment, the market will further be exposed to diversification in currency sources as remittances become a stable and durable stream of inflows.

To get more information on this market, Request Sample

Technological Integration and Digital FX Platforms

Technological advancement is propelling the Brazil foreign exchange market growth by increasing transparency, speed, and accessibility for participants. The rise of digital FX platforms, electronic trading systems, and mobile banking has democratized access to foreign currency transactions, enabling retail investors and SMEs to participate more actively in the market. Apart from that, the Central Bank’s implementation of the PIX instant payment system has further contributed to faster domestic and cross-border currency settlements. Furthermore, FX trading is increasingly being conducted through algorithmic and AI-assisted systems, reducing manual errors and improving execution efficiency. Fintech startups and neobanks in Brazil are offering multi-currency wallets and hedging solutions that were traditionally limited to institutional players, thereby broadening the base of market participants. Additionally, the use of blockchain and smart contracts for international settlements is gaining traction, with pilot projects underway in collaboration with global financial networks. These technological shifts are not only increasing the transaction volumes but also improving compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations through automation and data analytics.

Influence of Political and Fiscal Developments on Currency Volatility

Political stability and fiscal governance in Brazil significantly impact the market, often translating into pronounced currency volatility. Investor perceptions of government commitment to fiscal discipline, particularly public spending control, pension reform, and tax overhaul, play a pivotal role in shaping BRL performance. In line with this, announcements regarding budget deficits or changes in fiscal targets tend to trigger immediate market reactions, as they influence Brazil’s creditworthiness and economic outlook. Political events, such as elections, cabinet reshuffles, and shifts in legislative support for economic reforms, contribute to short-term currency fluctuations due to increased uncertainty. Besides this, the interplay between executive decisions and congressional dynamics can either foster investor optimism or raise concerns about policy continuity. Additionally, Brazil’s adherence to inflation-targeting frameworks and fiscal responsibility laws is closely monitored by credit rating agencies and institutional investors. Also, any signs of populist spending or deviation from reform agendas are swiftly priced into the FX market. Consequently, political and fiscal narratives are deeply embedded in daily exchange rate movements and long-term investor positioning.

Brazil Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

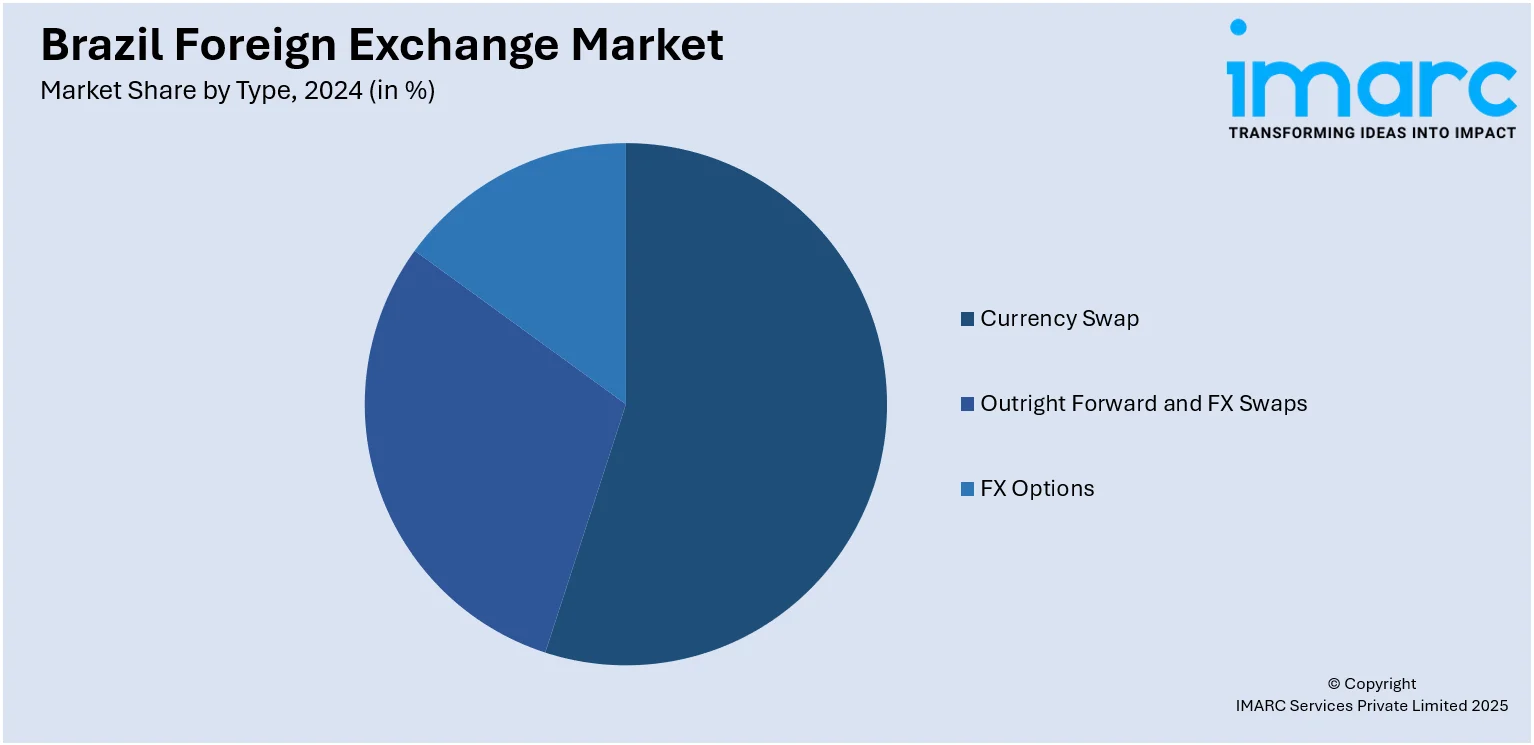

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Foreign Exchange Market News:

- June 2025: Conduit, a stablecoin-powered cross‑border payments platform, announced a partnership with Brazil’s Braza Group to enable real‑time FX swaps between Brazilian reais and U.S. dollars or euros using stablecoins. The collaboration integrates Braza Group’s BBRL stablecoin, pegged 1:1 to the Brazilian real and issued on the XRP Ledger, into Conduit’s global payment infrastructure, allowing minting of BBRL in Brazil and instant swaps into USD‑ or EUR‑denominated digital currency for rapid outbound settlements.

- February 2025: Brazil’s foreign exchange bank, Braza, launched BBRL, a Brazilian Real–pegged stablecoin issued on the XRP Ledger, initially targeting institutional clients with plans for retail rollout through its “Braza On” wallet. The launch leverages Braza’s strong FX market presence to offer efficient, low-cost, and stable digital payment solutions.

Brazil Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil foreign exchange market on the basis of counterparty?

- What is the breakup of the Brazil foreign exchange market on the basis of type?

- What is the breakup of the Brazil foreign exchange market on the basis of region?

- What are the various stages in the value chain of the Brazil foreign exchange market?

- What are the key driving factors and challenges in the Brazil foreign exchange market?

- What is the structure of the Brazil foreign exchange market and who are the key players?

- What is the degree of competition in the Brazil foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)