Brazil Freight and Logistics Market Size, Share, Trends and Forecast by Logistics Function, End Use Industry, and Region, 2026-2034

Brazil Freight and Logistics Market Summary:

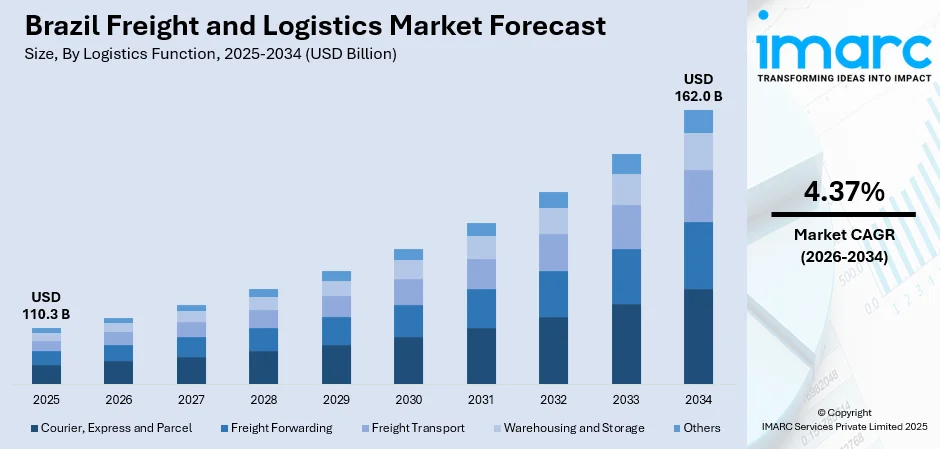

The Brazil freight and logistics market size was valued at USD 110.26 Billion in 2025 and is projected to reach USD 162.03 Billion by 2034, growing at a compound annual growth rate of 4.37% from 2026-2034.

The market is driven by accelerating e-commerce penetration driving the demand for efficient last-mile delivery networks, infrastructure modernization initiatives enhancing transportation connectivity across regions, and growing adoption of digital technologies including Internet of Things (IoT) and blockchain for real-time cargo visibility. Apart from this, manufacturing sector resurgence and agricultural export growth are creating sustained demand for integrated supply chain solutions, thereby expanding the Brazil freight and logistics market.

Key Takeaways and Insights:

- By Logistics Function: Freight transport dominates the market with a share of 30% in 2025, supported by extensive road network dependency and commercial vehicle fleet modernization.

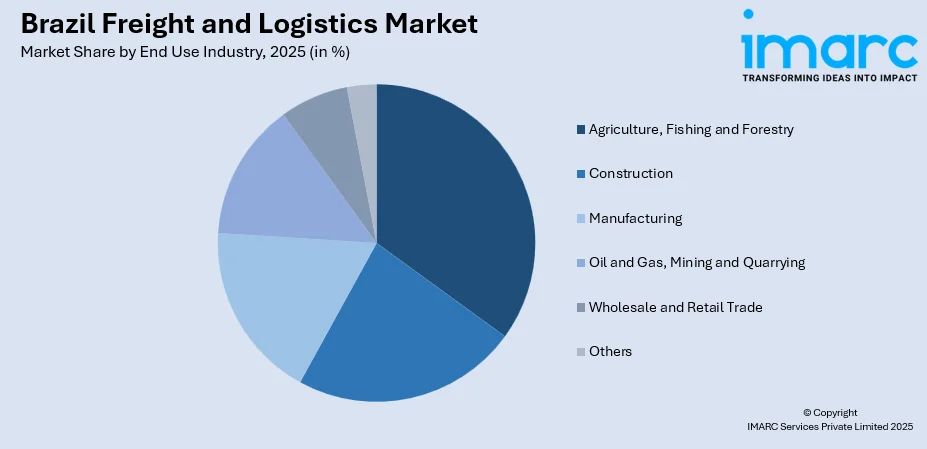

- By End Use Industry: Manufacturing leads the market with a share of 26% in 2025, driven by the automotive production expansion and food processing operations.

- Key Players: The Brazil freight and logistics sector exhibits moderate to high competitive intensity, with established multinational logistics corporations competing alongside regional operators across specialized service segments, while technology-driven startups are disrupting traditional business models through digital freight matching platforms.

To get more information on this market Request Sample

Brazil's freight and logistics sector is experiencing structural transformation as businesses navigate evolving supply chain requirements amid expanding trade volumes and heightened service expectations. The country's continental geography necessitates sophisticated multimodal transportation networks connecting agricultural production zones, manufacturing hubs, and urban consumption centers across five distinct regions. Infrastructure development initiatives are progressively reducing transportation bottlenecks, particularly through port capacity expansions and highway network improvements that facilitate smoother goods movement. The sector is witnessing accelerated technology adoption as companies deploy automation systems, predictive analytics tools, and digital tracking platforms to enhance operational visibility and responsiveness. This technological shift is particularly pronounced in warehousing operations where automated storage and retrieval systems are streamlining fulfilment processes for e-commerce distribution networks. In 2026, the Brazilian government is considering a temporary extension of the Central Atlantic Railway (FCA) concession for two years to guarantee the continuity of freight operations when the existing contract ends in August. The proposal arises while discussions persist regarding the complete early renewal of the concession owned by VLI Logistics.

Brazil Freight and Logistics Market Trends:

Electrification and Zero-Emission Logistics Infrastructure Development

Brazil is pioneering sustainable freight transportation through strategic investments in electric vehicle fleets and zero-emission corridors that demonstrate commercial viability of green logistics solutions. The transportation sector accounts for substantial greenhouse gas emissions, prompting collaborative initiatives between government entities, logistics operators, and vehicle manufacturers to accelerate electrification. In November 2025, the Traton Group and Volkswagen Truck & Bus launched the e-Dutra corridor connecting Rio de Janeiro and São Paulo as Brazil's first zero-emission freight route, establishing a framework for scaling battery-electric truck operations across critical trade corridors. This coalition-based approach coordinates fleet operators and infrastructure providers to reduce charging network investment risks while supporting commercial deployment of electric heavy-duty vehicles.

Digital Platform Integration for Supply Chain Visibility

Advanced digital technologies are fundamentally reshaping freight operations through enhanced transparency, predictive capabilities, and automated processes that optimize asset utilization and reduce operational delays. Logistics companies are deploying Internet of Things sensors, blockchain distributed ledgers, and artificial intelligence analytics to create interconnected supply chain networks with real-time cargo monitoring and documentation management. These technological investments enable proactive exception management, automated customs clearance processes, and dynamic route optimization that collectively improve delivery reliability while reducing manual intervention requirements. In April 2024, goFlux raised six million dollars in Series A funding led by Capria Ventures specifically to enhance its digital freight services platform across the Americas, developing artificial intelligence capabilities for freight prediction and operational automation.

E-commerce Acceleration Driving Last-Mile Delivery Innovation

Explosive e-commerce growth is compelling logistics providers to reconfigure delivery networks with emphasis on speed, flexibility, and urban density optimization through micro-fulfillment centers and alternative delivery models. Consumer expectations for same-day or next-day delivery in metropolitan areas are driving investments in compact distribution facilities located closer to end customers, reducing final delivery distances and enabling more frequent replenishment cycles. Companies are deploying automated sorting systems, artificial intelligence-based route planning algorithms, and real-time tracking interfaces that provide customers with delivery transparency while optimizing fleet utilization. The sector is witnessing proliferation of dark stores, micro-warehousing facilities, and hybrid locker-pickup models particularly in tier-two cities, where these innovations simultaneously reduce failed-delivery costs and improve asset turnover rates for logistics operators managing fragmented, high-frequency shipment patterns. IMARC Group predicts that the Brazil e-commerce market is projected to reach USD 1,501.8 Billion by 2034.

Market Outlook 2026-2034:

Brazil's freight and logistics sector is positioned for sustained expansion as infrastructure investments, technology adoption, and evolving trade patterns converge to enhance transportation efficiency and service capabilities. Port capacity expansions, highway network improvements, and rail connectivity enhancements are progressively reducing transit bottlenecks that historically constrained logistics performance, enabling more reliable delivery schedules and lower transportation costs. The market generated a revenue of USD 110.26 Billion in 2025 and is projected to reach a revenue of USD 162.03 Billion by 2034, growing at a compound annual growth rate of 4.37% from 2026-2034. Digital transformation initiatives are embedding real-time visibility, predictive analytics, and automated processes into supply chain operations, allowing logistics providers to respond more effectively to demand fluctuations and disruptions.

Brazil Freight and Logistics Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Logistics Function | Freight Transport | 30% |

| End Use Industry | Manufacturing | 26% |

Logistics Function Insights:

- Courier, Express and Parcel

- Destination Type

- Domestic

- International

- Destination Type

- Freight Forwarding

- Mode of Transport

- Air

- Sea and Inland Waterways

- Others

- Mode of Transport

- Freight Transport

- Mode of Transport

- Air

- Pipelines

- Rail

- Road

- Sea and Inland Waterways

- Mode of Transport

- Warehousing and Storage

- Temperature Control

- Non-Temperature Controlled

- Temperature Controlled

- Temperature Control

- Others

Freight transport dominates with a market share of 30% of the total Brazil freight and logistics market in 2025.

Freight transport functions as the backbone of Brazil's logistics infrastructure, facilitating movement of agricultural commodities, manufactured products, and consumer goods across the country's vast geographical expanse. Road transportation maintains dominance given Brazil's extensive highway network and limited railway coverage for most cargo categories, though modal shifts toward rail and waterways are gradually increasing for specific bulk commodities. The segment encompasses diverse transportation modes including trucking services for door-to-door delivery, maritime shipping for coastal and international trade, air freight for time-sensitive cargo, pipeline networks for petroleum products, and railway systems for heavy bulk materials. Commercial vehicle manufacturers are responding to logistics demand through significant capital investments.

The solid goods segment alone accounts for approximately 71 percent of Brazil's road freight transport market value, driven by substantial consumer and industrial products transportation across Brazil's manufacturing and retail distribution networks. Infrastructure development initiatives are progressively improving freight transport efficiency through targeted capacity expansions and connectivity enhancements. The joint venture announcement in 2024 between Rumo, Brazil's leading railway operator, and DP World to construct a specialized port terminal for grains and fertilizers at the Port of Santos exemplifies strategic infrastructure investments that integrate multiple transport modes to optimize cargo flow from agricultural production zones to export terminals.

End Use Industry Insights:

To get detailed segment analysis of this market Request Sample

- Agriculture, Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas, Mining and Quarrying

- Wholesale and Retail Trade

- Others

Manufacturing leads with a share of 26% of the total Brazil freight and logistics market in 2025.

Manufacturing operations dominate the end-use industry category, generating extensive logistics requirements spanning inbound raw material procurement, work-in-process inventory management, and finished goods distribution through complex supply networks connecting production facilities with domestic and international markets. The sector encompasses diverse industrial activities including automotive assembly, food and beverage processing, chemical production, electronics manufacturing, and textile operations, each presenting unique transportation, warehousing, and handling specifications that demand sophisticated logistics coordination. Brazil's manufacturing resurgence is creating sustained demand for advanced logistics solutions accommodating just-in-time delivery requirements, inventory optimization objectives, and quality preservation standards throughout distribution networks. The automotive industry represents a particularly significant logistics consumer, with the manufacturing and food processing sectors closely linked to Brazil's agribusiness operations necessitating extensive cold chain logistics infrastructure, specialized handling equipment, and coordinated multimodal transportation.

Manufacturing logistics complexity is accelerating adoption of warehouse management systems, automated material handling equipment, and predictive maintenance technologies that optimize operational efficiency and reduce distribution costs. These facilities exemplifies modern manufacturing distribution requirements where technology-enabled operations provide the agility, visibility, and responsiveness necessary to support complex production schedules and evolving customer delivery expectations. The manufacturing sector's logistics intensity, combined with ongoing industrial investments and expanding export activities, positions this segment as a critical driver of Brazil's freight and logistics market growth throughout the forecast period.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast region commands a major market position driven by São Paulo's status as Brazil's primary economic hub and Rio de Janeiro's strategic port infrastructure. The region concentrates substantial manufacturing capacity, financial services activity, and population density that collectively generate intensive logistics requirements across warehousing, transportation, and distribution functions. Major logistics providers maintain extensive operational footprints with multiple distribution centers, freight forwarding offices, and last-mile delivery networks servicing metropolitan areas and connecting to national transportation corridors.

South region exhibits strong logistics activity supported by diverse agricultural production, automotive manufacturing presence, and petrochemical industry operations that require specialized freight services. The region benefits from established port facilities, improving highway connectivity, and proximity to Mercosur trading partners. ucking, warehousing, and customs clearance capabilities.

Northeast region is experiencing logistics infrastructure development driven by agricultural exports, tourism industry requirements, and growing manufacturing investments attracted by government incentive programs and improving transportation connectivity to major consumption centers.

North region presents logistics expansion opportunities amid infrastructure constraints, with freight networks supporting extractive industries, agricultural development, and emerging commercial activities across the Amazon basin requiring specialized transportation solutions adapted to challenging geographical conditions.

Central-West region serves as critical agricultural production zone requiring substantial grain logistics capacity, fertilizer distribution networks, and livestock transportation services connecting farming operations to processing facilities and export terminals across multiple transportation modes.

Market Dynamics:

Growth Drivers:

Why is the Brazil Freight and Logistics Market Growing?

Infrastructure Modernization and Government Capital Investment Programs

Brazilian authorities are implementing substantial infrastructure investment initiatives aimed at reducing transportation bottlenecks, improving intermodal connectivity, and enhancing logistics efficiency across the country's extensive geographical reach. The government allocated R$ 100 billion (Brazilian reais) for infrastructure projects focusing on transportation networks and logistics hubs, with specific emphasis on road improvements, railway expansions, port facility upgrades, and airport modernizations that collectively facilitate smoother cargo movement and reduced transit times. These infrastructure enhancements directly translate into lower logistics costs, improved service reliability, and enhanced competitiveness for Brazilian exports in international markets. The National Logistics Plan mandates integrated planning for road, rail, port, and airport investments, with approximately one billion dollars allocated for coordinated infrastructure development over the next five years through public-private partnerships and regulatory streamlining measures. At the Infrastructure Forum that was hosted by Veja Magazine in São Paulo, the Port and Air Transport Minister Silvio Costa Filho reported that there would be approximately R$30 billion invested in Ports between 2023-2026 from all of the federal governments' leased ocean going vessels to private operators. All together there will be over 60 bids for Port and Air Travel combined with Public and Private Infrastructure Investments which will solidify Brazil as the primary investment location for both local and foreign investors.

Manufacturing Sector Resurgence and Agricultural Export Expansion

Brazil's manufacturing industries and agricultural sectors are experiencing renewed growth momentum, driving sustained demand for sophisticated logistics solutions spanning procurement, production support, and distribution operations across domestic and international markets. The manufacturing segment encompasses automotive assembly, food processing, chemical production, electronics fabrication, and consumer goods manufacturing, each generating complex supply chain requirements for inbound materials, work-in-process handling, and finished product distribution through multimodal transportation networks. Automotive manufacturers are committing substantial capital to Brazilian production capacity, as evidenced by Stellantis' announcement in March 2024 of a €5.6 billion investment between 2025 and 2030 planning over 40 new vehicle launches including hybrid-flex technology variants, collectively generating extensive logistics demand for component supply chains and vehicle distribution networks. The manufacturing resurgence creates sustained freight volumes, warehouse capacity requirements, and specialized logistics services spanning quality-controlled storage, just-in-time delivery capabilities, and integrated supply chain coordination that position logistics providers as essential enablers of industrial competitiveness and export capacity expansion.

Automation Technology Adoption and Warehouse Digitalization Initiatives

Logistics companies are aggressively deploying automation systems, artificial intelligence analytics, and digital management platforms to enhance operational efficiency, reduce manual processes, and improve service responsiveness amid intensifying competition and evolving customer expectations for transparency and speed. Technology investments encompass warehouse management systems integrating real-time inventory tracking, automated storage and retrieval equipment, robotic material handling solutions, predictive maintenance algorithms, and artificial intelligence-based route optimization tools that collectively transform traditional logistics operations into data-driven, highly responsive distribution networks. In February 2024, DHL Supply Chain and Adidas inaugurated a distribution center in Brazil featuring nearly 40,000 square meters of technologically advanced facilities incorporating automated sortation systems, real-time inventory visibility platforms, and sustainable practices designed to serve e-commerce channels, retail distribution, and company-owned stores through integrated, technology-enabled logistics operations. Digital transformation extends beyond warehouse automation to encompass freight matching platforms, blockchain-based documentation systems, and Internet of Things sensor networks providing real-time cargo condition monitoring, collectively enabling logistics providers to deliver superior transparency, reliability, and efficiency that differentiate service offerings in increasingly competitive markets where operational excellence and customer experience determine market positioning and growth trajectories.

Market Restraints:

What Challenges the Brazil Freight and Logistics Market is Facing?

Complex Regulatory Compliance and Administrative Burden

Brazilian logistics operations encounter significant challenges from an intricate regulatory framework encompassing distinct laws affecting transportation, warehousing, customs clearance, and documentation requirements across federal, state, and municipal jurisdictions. Compliance costs exceed R$ 5 billion annually for logistics companies navigating overlapping regulatory authorities, inconsistent enforcement practices, and frequently changing administrative procedures that create operational uncertainty and delay cargo movement. The complexity of Brazil's regulatory environment particularly impacts cross-border trade operations where customs documentation, import/export permits, and product certification requirements involve multiple government agencies with sometimes conflicting procedures. Small and medium-sized logistics providers face disproportionate compliance burdens relative to their operational scale, limiting their ability to compete effectively against larger organizations with dedicated regulatory affairs departments and established government relationships.

Infrastructure Gaps and Regional Connectivity Disparities

Despite ongoing investment initiatives, Brazil continues experiencing infrastructure deficiencies that constrain logistics efficiency, particularly in road network quality, railway capacity limitations, and uneven regional connectivity between production zones and consumption centers. Highway conditions in many regions suffer from inadequate maintenance, limited capacity for growing traffic volumes, and vulnerability to weather-related disruptions that increase transportation costs and delivery unpredictability. Railway infrastructure remains underdeveloped compared to road networks, limiting modal shift opportunities for bulk cargo transportation that could reduce freight costs and environmental impacts. Northern and Central-West regions face particular challenges with infrastructure gaps that increase logistics costs for agricultural products moving from production areas to export terminals, while last-mile delivery infrastructure in many secondary cities lacks the density and efficiency found in major metropolitan areas.

High Technology Implementation Costs and Workforce Capability Constraints

Advanced automation systems, digital platforms, and artificial intelligence tools require substantial capital investments that create adoption barriers particularly for small and medium-sized enterprises operating with limited financial resources and uncertain return timeframes. Technology implementation extends beyond initial equipment acquisition to encompass system integration complexities, ongoing maintenance requirements, cybersecurity infrastructure, and continuous software updates that collectively represent significant financial commitments. Workforce development challenges compound technology adoption difficulties as organizations require skilled personnel capable of operating sophisticated automation equipment, analyzing data analytics outputs, and managing digital platforms, necessitating substantial training investments and ongoing capability development. The rapid pace of technological change creates additional pressure as companies must continuously evaluate emerging solutions while ensuring existing systems deliver anticipated efficiency improvements and competitive advantages before committing to next-generation technologies.

Competitive Landscape:

Brazil's freight and logistics market exhibits dynamic competitive intensity characterized by established multinational corporations, regional logistics specialists, and technology-enabled new entrants competing across differentiated service segments spanning courier express parcel, freight forwarding, freight transport, and warehousing operations. Major international logistics providers leverage global networks, advanced technology platforms, and comprehensive service portfolios to serve multinational clients and complex supply chain requirements, while regional operators compete through specialized capabilities, local market knowledge, and relationship-based service delivery models. The competitive landscape is experiencing transformation as digital freight platforms disrupt traditional broker relationships, automation technologies reshape warehouse operations, and sustainability requirements influence fleet composition decisions and service design. Companies are pursuing growth strategies including geographic expansion through office openings and acquisition activities, infrastructure capacity investments in port terminals and distribution centers, technology platform development for enhanced visibility and efficiency, and strategic partnerships coordinating multiple stakeholders across end-to-end supply chains. Competitive differentiation increasingly depends on technology capabilities, service reliability, sustainability credentials, and integrated solution offerings rather than traditional price-based competition, as customers prioritize supply chain resilience, transparency, and responsiveness over purely cost-minimization approaches.

Recent Developments:

- In November 2025, CEVA Logistics, an international leader in third-party logistics, has entered into a new agreement with Iveco Group to manage a new 20,000-square-meter distribution facility in Pouso Alegre (Minas Gerais), Brazil. The new distribution center's construction started in June, with operations anticipated to launch in April 2026, taking over the existing facility in Sorocaba, São Paulo, because of capacity limitations. The new Parts Distribution Center will span 20,000 square meters and feature advanced technology, establishing a strategic center for Iveco to enhance connections between customers and suppliers while growing its logistics operations. CEVA Logistics will oversee the site, handling the logistics infrastructure, as well as the shipping and management of materials for the Iveco Group.

- In November 2025, Seventeen prominent companies, supported by local and national Brazilian government, have united in the Laneshift e-Dutra project and started deploying electric trucks and chargers along the Rio de Janeiro–São Paulo corridor, referred to as the Rodovia Presidente Dutra highway, aiming for 1,000 e-trucks in daily operation by 2030, with the possibility of acquiring thousands of trucks within.

- In October 2025, DP World has launched a new freight forwarding office in Porto Alegre, enhancing its network in Brazil and reinforcing its position as a comprehensive logistics provider throughout Latin America. Situated in the Mercosul Center Building on Avenida Carlos Gomes, the new office places DP World in the center of Southern Brazil’s industrial core. This region hosts significant export sectors such as food and drink, footwear, automotive, petrochemicals, and metal-mechanical production.

Brazil Freight and Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Logistics Functions Covered |

|

| End Use Industries Covered | Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil freight and logistics market size was valued at USD 110.26 Billion in 2025.

The Brazil freight and logistics market is expected to grow at a compound annual growth rate of 4.37% from 2026-2034 to reach USD 162.03 Billion by 2034.

Freight transport dominates the logistics function segment with a market share of 30% in 2025, driven by Brazil's extensive road network dependency, ongoing commercial vehicle fleet modernization, and infrastructure investments improving multimodal transportation connectivity across the country's vast geographical expanse.

Key factors driving the Brazil Freight and Logistics market include infrastructure modernization initiatives with government investments targeting transportation network enhancements, manufacturing sector resurgence alongside agricultural export expansion generating sustained freight volumes, automation technology adoption transforming warehouse operations through digital platforms and robotic systems, and e-commerce acceleration creating demand for sophisticated last-mile delivery solutions with same-day and next-day service capabilities.

Major challenges include complex regulatory compliance environments with laws governing logistics operations creating administrative burdens and compliance costs exceeding annually, persistent infrastructure gaps particularly in road network quality and railway capacity limiting modal shift opportunities, high technology implementation costs creating adoption barriers for small and medium-sized enterprises, workforce capability constraints requiring substantial training investments for operating advanced automation systems, and regional connectivity disparities between production zones and consumption centers increasing transportation costs and delivery unpredictability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)