Brazil Frozen Lamb Market Size, Share, Trends and Forecast by Type, Distribution channel, and Region, 2026-2034

Brazil Frozen Lamb Market Summary:

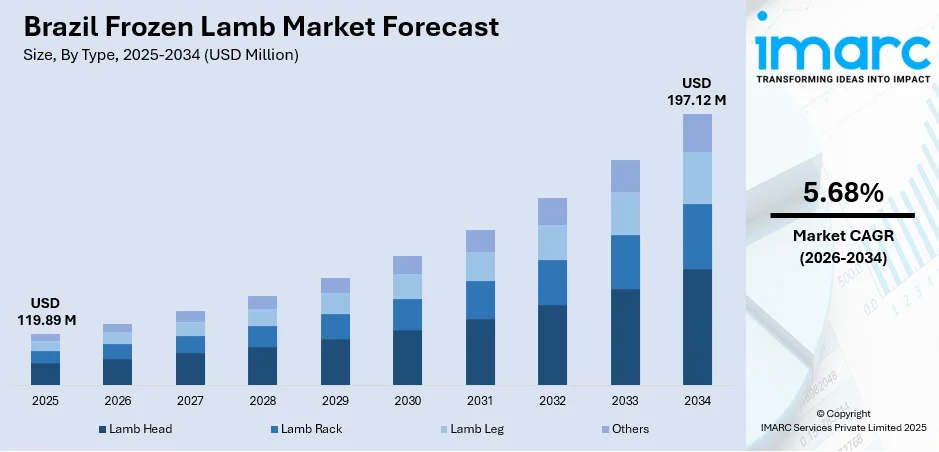

The Brazil frozen lamb market size was valued at USD 119.89 Million in 2025 and is projected to reach USD 197.12 Million by 2034, growing at a compound annual growth rate of 5.68% from 2026-2034.

The frozen lamb market growth is primarily driven by Brazil's evolving consumer preferences toward diverse protein sources, with increasing health consciousness prompting greater incorporation of lamb into dietary choices. The convergence of expanding modern retail infrastructure, significant cold chain logistics improvements, and the growing demand from premium foodservice establishments is fundamentally reshaping the competitive landscape. Additionally, the Northeast region's dominant sheep farming sector, combined with rising export activities to international markets and increasing halal certification requirements, creates substantial opportunities for market participants seeking to expand their market reach.

Key Takeaways and Insights:

- By Type: Lamb leg dominates the market with a share of 37.3% in 2025, owing to its popularity in traditional Brazilian churrascarias, premium restaurant establishments, and consumer preference for versatile cuts suitable for roasting, grilling, and slow-cooking preparations.

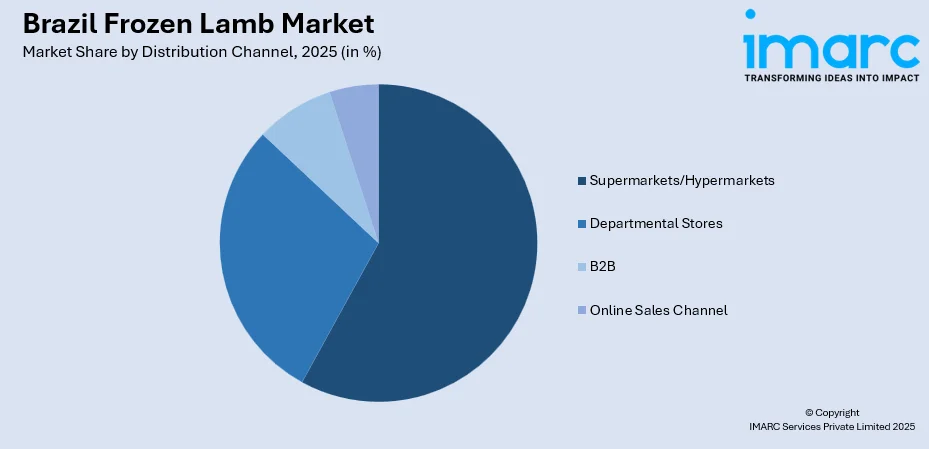

- By Distribution Channel: Supermarkets/Hypermarkets the market with a share of 58.2% in 2025, driven by expanding modern retail infrastructure, improved cold storage facilities within stores, and consumer preference for exploring products before purchasing.

- By Region: Northeast represents the largest segment with a market share of 45.7% in 2025, due to the concentration of Brazil's sheep farming activities in Bahia and Pernambuco states, established processing infrastructure, and proximity to major consumption centers that facilitate efficient distribution networks.

- Key Players: The Brazil frozen lamb market exhibits moderate competitive intensity, with major meat processing corporations competing alongside regional producers across price segments. Market dynamics reflect strategic positioning ranging from premium offerings targeting gourmet establishments to value-oriented products serving price-conscious consumers.

To get more information on this market Request Sample

The Brazil frozen lamb market is propelled by rising domestic demand for diversified protein sources, expanding export opportunities, and continual improvements in production efficiency supported by modernized farming practices and advanced processing technologies. Strengthened cold chain logistics further ensure consistent supply and enhanced product quality. In 2025, the e-Dutra project introduced Brazil’s first zero-emissions freight corridor between Rio de Janeiro and São Paulo, developed in partnership with the Traton Group, Volkswagen, and local stakeholders, marking a significant step toward freight decarbonization and signaling long-term logistical modernization. In addition to these advances, consumer preferences for convenient, premium, and traceable meat products, along with supportive regulatory frameworks and sustainability-focused livestock management, reinforce sectoral competitiveness. Moreover, economic stability and the growing role of digital retail channels continue to expand accessibility and market reach. Collectively, these factors create a resilient and dynamic environment that supports sustained long-term growth in Brazil’s frozen lamb sector.

Brazil Frozen Lamb Market Trends:

Rising Domestic Consumption of Red Meat

Brazil’s domestic demand for red meat, including lamb, is steadily growing, influenced by shifting dietary preferences and an expanding middle class that increasingly values protein-rich diets. According to the IBGE’s 2024 Continuous National Household Sample Survey (Continuous PNAD), per capita household earnings in Brazil averaged R$2,069, ranging from R$1,077 in Maranhão to R$3,444 in the Federal District, highlighting the considerable income variation across regions. This rising purchasing power, combined with urbanization and evolving lifestyles, is catalyzing the demand for convenient, high-quality frozen meat products. Retailers are responding with diversified offerings, encouraging producers to scale production, optimize supply chains, and ensure consistent availability to meet consumer expectations.

Advancements in Cold Chain Infrastructure

The development and modernization of cold storage and logistics infrastructure play a pivotal role in the frozen lamb market, ensuring product quality and safety throughout the supply chain. In 2025, Bem Brasil enhanced its logistics capabilities with two automated warehouses, increasing storage capacity for 500,000 tons of frozen food annually and employing technologies such as the Automated Pallet Shuttle and Easy WMS, which improved production by 10% and revenue by 30%. Such advancements in refrigerated transport, storage, and handling reduce post-harvest losses, extend shelf life, and strengthen supply chain efficiency, ultimately boosting consumer confidence and enabling producers to meet both domestic and international demand.

Integration of Digital Sales Channels

The adoption of e-commerce, online grocery platforms, and digital marketplaces is reshaping the distribution and accessibility of frozen lamb, particularly in urban areas where consumers increasingly prefer home-delivered purchases. Brazil’s e-commerce sector is projected to generate USD 36.3 billion in revenue in 2025, with an estimated 94 million Brazilians making online purchases, up 3 million from 2024, according to Associação Brasileira de Comércio Eletrônico (ABCOMM). This rapid growth illustrates the rising consumer reliance on digital channels, which allow producers and retailers to expand market reach, optimize inventory management, and implement subscription or bulk-order models. By connecting producers directly with end consumers, e-commerce strengthens brand visibility and contributes to the overall market growth.

Market Outlook 2026-2034:

The Brazil frozen lamb market is positioned for notable growth, driven by broader retail availability, rising consumer interest in diverse protein sources, and increased adoption of convenient frozen meat products. Improvements in cold chain logistics and stronger distribution networks further support the market accessibility. The market generated a revenue of USD 119.89 Million in 2025 and is projected to reach a revenue of USD 197.12 Million by 2034, growing at a compound annual growth rate of 5.68% from 2026-2034.

Brazil Frozen Lamb Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Lamb Leg | 37.3% |

| Distribution Channel | Supermarkets/Hypermarkets | 58.2% |

| Region | Northeast | 45.7% |

Type Insights:

- Lamb Head

- Lamb Rack

- Lamb Leg

- Others

Lamb leg dominates with a market share of 37.3% of the total Brazil frozen lamb market in 2025.

Lamb leg holds the biggest market share, as consumers value its versatility, tender texture, and suitability for a wide range of cooking methods. Its larger portion size also appeals to households and foodservice operators seeking cost-efficient cuts for shared meals.

Its strong position is further supported by consistent demand from retailers and restaurants that prioritize cuts offering high yield and predictable quality. As frozen formats improve shelf life and availability, lamb leg continues to outperform other categories in both volume and preference.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Departmental Stores

- B2B

- Online Sales Channel

Supermarkets/Hypermarkets lead with a market share of 58.2% of the total Brazil frozen lamb market in 2025.

Supermarkets and hypermarkets represent the largest segment owing to their ability to offer wide product selections, consistent availability, and reliable cold-chain conditions. The established retail presence of supermarkets and hypermarkets, which allows consumers to access diverse cuts and trusted quality, is underpinned by the sector's immense size, with the Brazilian Supermarket Association (ABRAS) reporting supermarket sales at USD 197 billion in 2024 across 424,120 stores serving 30 million consumers daily.

Their dominance is further supported by strong promotional activity and convenient shopping formats that attract high foot traffic. With better storage infrastructure and greater brand variety than smaller outlets, supermarkets and hypermarkets remain the primary channel for frozen lamb purchases across urban and suburban regions.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The Northeast exhibits a clear dominance with a 45.7% share of the total Brazil frozen lamb market in 2025.

The Northeast leads the market due to its large population base, expanding retail networks, and rising consumption of diverse protein options. The growing number of urban centers in the region support stronger demand for convenient frozen meat products, including lamb.

Cultural food practices and increasing household purchasing power also contribute to higher frozen lamb adoption. As supermarkets and hypermarkets expand their presence and improve cold-chain logistics, accessibility and availability rise, reinforcing the Northeast’s leading position in the market.

Market Dynamics:

Growth Drivers:

Why is the Brazil Frozen Lamb Market Growing?

Export Market Expansion

The Brazil frozen lamb market growth is increasingly driven by expanding international demand, as markets in the Middle East, Europe, and Asia seek high-quality, traceable meat products. In 2024, Brazil secured new export authorizations from Singapore for lamb and related products, marking the country’s 11th export market expansion that year and strengthening its presence in global trade. Such approvals not only enhance revenue streams and stabilize domestic prices but also incentivize producers to scale operations. By adhering to stringent sanitary and quality standards, Brazil consolidates its reputation as a reliable supplier, making export growth a key factor in long-term sectoral development.

Government Policies and Regulatory Support

Government policies and regulatory frameworks play a critical role in shaping the frozen lamb industry by promoting food safety, traceability, and quality standards that enhance international credibility. In 2025, the Ministry of Agriculture launched the National Plan for Individual Identification of Cattle and Buffaloes (PNIB), improving livestock traceability from birth to consumption, thereby strengthening food safety, transparency, and global market access. Coupled with fiscal incentives, such as tax breaks and subsidies for livestock producers, and strategic initiatives supporting exports, these measures encourage production expansion, modernization, and compliance with sanitary requirements. Collectively, such policies create a secure and predictable environment, fostering investment and long-term growth in the sector.

Strengthened Regional Development Initiatives

Market growth is driven by targeted regional development programs that enhance the structure and efficiency of sheep farming. In 2024, the Brazilian Association of Sheep Breeders (Arco) discussed strengthening the Lamb and Milk Route in Rio Grande do Sul, signaling a coordinated effort to elevate production standards and market integration. Consultant Daniel Benitez’s visits to Bagé and Sant'Ana do Livramento aimed to assess local capabilities and identify practical strategies for expanding the industry. The scheduled meetings in November to evaluate progress and extend the route to encompass all components of sheep farming reflect a strategic, long-term commitment to productivity, integration, and value chain development. These coordinated actions strengthen producer capabilities, encourage investment, and create a more competitive environment, collectively supporting the market growth.

Market Restraints:

What Challenges the Brazil Frozen Lamb Market is Facing?

Competition from Lower-Cost Protein Alternatives

Brazil’s strong consumer preference for beef, poultry, and pork significantly limits growth opportunities for frozen lamb, as these proteins are more affordable and culturally ingrained in daily diets. Their lower price points and broad availability create a competitive environment in which lamb struggles to gain widespread acceptance. This forces suppliers to focus on differentiation through superior quality, specialized cuts, premium packaging, and targeted marketing strategies. Despite these efforts, substitution remains limited, making it challenging for frozen lamb to expand its share within mainstream retail markets.

Regulatory Compliance and Food Safety Requirements

Frozen lamb suppliers in Brazil must comply with rigorous food safety, hygiene, and quality regulations, which include strict inspection protocols, traceability documentation, and temperature-control standards throughout the supply chain. Meeting these regulatory requirements increases operational complexity and imposes higher compliance costs on producers and distributors. Non-compliance risks delays, penalties, or product recalls, which can erode profitability. Ensuring consistent adherence across transport, storage, and retail environments remains a persistent challenge, impacting overall market efficiency and slowing growth efforts.

Supply Chain Limitations in Cold Storage and Transport

The frozen lamb market is hindered by gaps in Brazil’s cold-chain infrastructure, particularly in regions with limited refrigerated storage and transport capabilities. Inconsistent temperature maintenance during distribution raises the risk of spoilage and impacts product quality, leading to higher wastage and increased operational costs. These logistics constraints restrict the reliable nationwide availability of frozen lamb and reduce its competitiveness relative to more accessible proteins. Strengthening cold-chain networks is essential to support stable supply, expand retail penetration, and sustain long-term market growth across both household and foodservice sectors.

Competitive Landscape:

The Brazil frozen lamb market exhibits moderate competitive intensity characterized by the presence of major meat processing corporations alongside regional producers competing across price segments and distribution channels. Market dynamics reflect strategic positioning ranging from premium, innovation-driven offerings emphasizing superior quality and specialized cuts to value-oriented products targeting cost-conscious consumers and institutional buyers. The competitive landscape is increasingly shaped by cold chain capabilities, retail relationships, and brand marketing effectiveness in enhancing consumer awareness. Consolidation activities among major meat processors are reshaping market structure, while regional producers leverage local supply chain advantages and traditional farming relationships. Sustainability initiatives and halal certification capabilities are emerging as competitive differentiators for companies targeting export markets and diverse consumer segments.

Brazil Frozen Lamb Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lamb Head, Lamb Rack, Lamb Leg, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Departmental Stores, B2B, Online Sales Channel |

| Regions Covered | Southeast, South, Northeast, North, and Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil frozen lamb market size was valued at USD 119.89 Million in 2025.

The Brazil frozen lamb market is expected to grow at a compound annual growth rate of 5.68% from 2026-2034 to reach USD 197.12 Million by 2034.

The Northeast region dominates the Brazil frozen lamb market with a share of 45.7% in 2025, driven by concentrated sheep farming activities in Bahia and Pernambuco states, established processing infrastructure, and proximity to major consumption centers.

Key factors driving the Brazil frozen lamb market include the growing popularity of e-commerce channels, which are improving distribution as urban consumers increasingly choose home delivery. Brazil’s online market is expected to reach USD 36.3 billion in 2025, with 94 million shoppers, which is 3 million more than in 2024, highlighting the growing digital reliance that expands market reach and efficiency.

Brazil’s frozen lamb market faces pressure from cheaper protein alternatives, strict regulatory demands, and weaknesses in cold-chain infrastructure. These challenges raise operational costs, limit nationwide availability, and constrain consumer adoption, ultimately slowing the market’s ability to grow within a highly competitive and cost-sensitive environment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)