Brazil Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2026-2034

Brazil Gaming Market Summary:

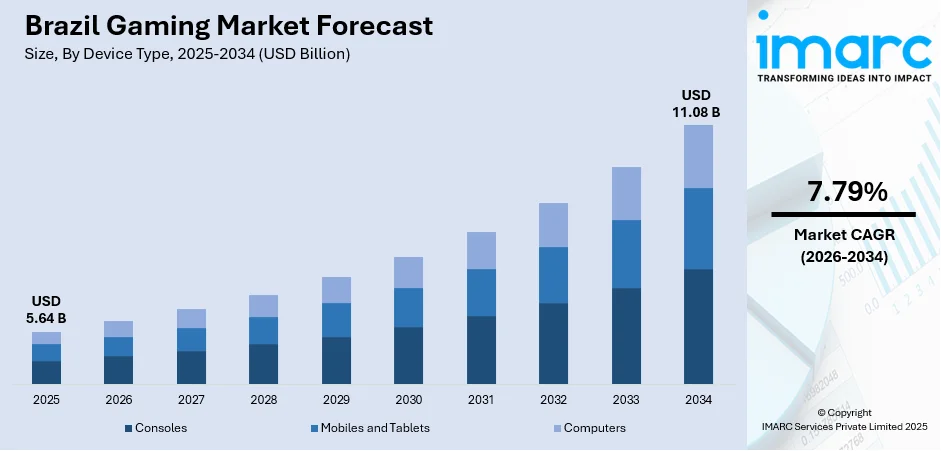

The Brazil gaming market size was valued at USD 5.64 Billion in 2025 and is projected to reach USD 11.08 Billion by 2034, growing at a compound annual growth rate of 7.79% from 2026-2034.

The Brazil gaming market is experiencing robust expansion driven by widespread smartphone adoption, increasing internet connectivity across urban and rural areas, and a young digitally engaged population. The growing popularity of mobile gaming platforms, coupled with rising disposable incomes among the middle class, continues to fuel consumer spending on gaming content and accessories. Additionally, the expansion of eSports culture and competitive gaming tournaments has cultivated vibrant gaming communities that sustain long-term engagement and boost the Brazil gaming market share.

Key Takeaways and Insights:

- By Device Type: Mobiles and Tablets dominated the market with approximately 52.8% revenue share in 2025, driven by the widespread availability of affordable smartphones, improved mobile internet infrastructure, and the convenience of gaming on portable devices across diverse demographics.

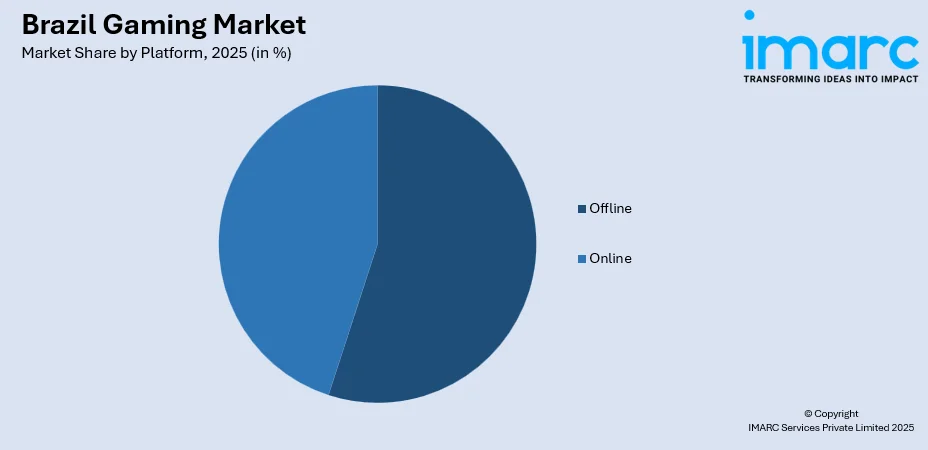

- By Platform: Offline platform leads the market with a share of 54.9% in 2025, owing to the preference for downloadable games that offer seamless gameplay without connectivity requirements, particularly in regions with inconsistent internet access.

- By Revenue Type: In-Game Purchase represents the largest segment with a market share of 64.3% in 2025, attributed to the prevalence of free-to-play gaming models that monetize through virtual goods, cosmetic items, and premium content purchases.

- By Type: Adventure/Role Playing Games dominates with a share of 40.6% in 2025, reflecting Brazilian gamers' strong preference for immersive storytelling experiences and character-driven narratives that offer extended gameplay engagement.

- By Age Group: Adult segment holds the largest share of 76.7% in 2025, driven by higher purchasing power and the continued gaming engagement of millennials and Generation Z who grew up with video game culture.

- By Region: Southeast region accounts for the largest revenue share of 43.7% in 2025, attributed to the concentration of Brazil's population and economic activity in major metropolitan areas including São Paulo and Rio de Janeiro.

- Key Players: The Brazil gaming market exhibits a dynamic competitive landscape characterized by the presence of international gaming publishers alongside emerging domestic studios that are gaining recognition for culturally relevant content development.

To get more information on this market Request Sample

The Brazilian gaming industry has emerged as Latin America's largest and most dynamic market, representing one of the world's most engaged gaming populations. The country's gaming ecosystem benefits from increasing digital payment adoption, particularly through instant payment systems, which has simplified in-game transactions. In a significant boost to the local development scene, Google Play recently announced the 2025 recipients of its Google Play Indie Games Fund, awarding equity-free funding to several Brazilian studios, a move that underscores growing support for homegrown developers. The domestic game development sector has experienced significant growth, demonstrating substantial industry expansion over the past decade. Brazil's hosting of major gaming events underscores the nation's commitment to fostering a vibrant gaming ecosystem while attracting international investment and partnerships that further strengthen market positioning.

Brazil Gaming Market Trends:

Mobile-First Gaming Ecosystem Development

The Brazilian gaming landscape is witnessing a fundamental shift toward mobile platforms as the primary gaming medium. Rising smartphone affordability combined with expanding network coverage enables broader market penetration across socioeconomic segments. In fact, a recent 2025 survey by Pesquisa Game Brasil (PGB) found that more than 82.8% of Brazilians now regularly play digital games, and smartphones, not PC or console, have become the dominant gaming device in the country. Players increasingly favor mobile gaming due to its accessibility and convenience, while developers are prioritizing mobile-first strategies to capture this growing audience. The trend encompasses both casual gaming experiences and competitive mobile eSports titles that attract dedicated player communities.

Rise of Free-to-Play and Hybrid Monetization Models

Brazilian gaming consumers demonstrate strong engagement with free-to-play models: a 2025 survey of mobile-game developers found that roughly 73% of Brazilian mobile games rely on in-app advertising, while 38% also integrate in-app purchases, showing that hybrid monetization combining ads and IAPs is now the norm. Developers are increasingly adopting hybrid monetization approaches combining in-app purchases with advertising revenue streams to maximize profitability. This evolution reflects changing consumer preferences and economic considerations, enabling wider market participation while maintaining sustainable business models for publishers and developers alike.

Growth of Local Game Development and Cultural Content

The domestic game development sector is experiencing remarkable expansion with studios increasingly incorporating Brazilian cultural elements into their productions. Local developers are gaining international recognition by creating content that resonates with regional audiences while appealing to global markets. In support of this growth, the Brazilian government passed the Legal Framework for the Electronic Games Industry (Law No. 14,852) in 2024, providing tax incentives and formal recognition for game production as a cultural industry, which helps nurture home-grown development. Government initiatives supporting the creative industries and specialized gaming education programs are nurturing local talent development, contributing to a more diverse and culturally representative gaming ecosystem.

Market Outlook 2026-2034:

The Brazil gaming market demonstrates strong growth potential driven by continuous infrastructure improvements, rising digital payment adoption, and an expanding young population with increasing purchasing power. Cloud gaming expansion and eSports professionalization are expected to create additional growth avenues while government support for the digital entertainment sector continues strengthening the industry foundation. The market generated a revenue of USD 5.64 Billion in 2025 and is projected to reach a revenue of USD 11.08 Billion by 2034, growing at a compound annual growth rate of 7.79% from 2026-2034.

Brazil Gaming Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Device Type | Mobiles and Tablets | 52.8% |

| Platform | Offline | 54.9% |

| Revenue Type | In-Game Purchase | 64.3% |

| Type | Adventure/Role Playing Games | 40.6% |

| Age Group | Adult | 76.7% |

| Region | Southeast | 43.7% |

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The mobiles and tablets dominate with a market share of 52.8% of the total Brazil gaming market in 2025.

Mobile gaming has emerged as the primary gaming platform in Brazil due to the widespread adoption of affordable smartphones and expanding mobile network coverage that reaches both urban centers and rural communities. According to a 2023 survey by Pesquisa Game Brasil (PGB), 51.7% of Brazilian gamers now primarily play on smartphones, surpassing consoles and PCs in popularity. The segment benefits from lower hardware costs compared to consoles and personal computers, making gaming accessible to broader demographic segments. Brazilian gamers demonstrate strong engagement with mobile titles spanning casual puzzle games to competitive multiplayer experiences, establishing Brazil as a key market for mobile gaming publishers seeking regional expansion opportunities.

The mobile gaming ecosystem continues expanding as developers optimize their offerings for the Brazilian market through Portuguese localization and culturally relevant content. The integration of local payment methods has streamlined in-game purchases and reduced friction in monetization. Mobile eSports tournaments are gaining popularity across the country, attracting both players and sponsors while contributing to the professionalization of competitive mobile gaming in the region.

Platform Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The offline leads with a share of 54.9% of the total Brazil gaming market in 2025.

Offline gaming maintains dominance in Brazil due to the preference for downloadable content that ensures uninterrupted gameplay experiences regardless of internet connectivity quality. According to reports, here are more than 1,042 game‑development studios operating in Brazil in 2023, underscoring a rapidly expanding domestic industry that supports both online and offline game production. Many Brazilian consumers prefer purchasing games for local installation to avoid potential latency issues and bandwidth limitations that can affect online gaming performance. The segment encompasses both premium title purchases for consoles and computers as well as mobile games with substantial offline functionality that appeal to players in regions with inconsistent network coverage.

The offline gaming segment continues benefiting from the release of major console titles and the popularity of single-player narrative experiences that Brazilian gamers appreciate. Despite growing internet penetration, many players maintain libraries of offline games alongside their online gaming activities. Publishers recognize this preference and ensure robust offline modes in their Brazilian releases while the domestic development sector creates games optimized for offline enjoyment.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The in-game purchase dominates with a market share of 64.3% of the total Brazil gaming market in 2025.

The in-game purchase segment reflects the strong adoption of free-to-play gaming models across Brazil, where players access games without upfront costs while spending on virtual goods, character customization options, and gameplay advantages. This monetization approach aligns with Brazilian consumer preferences for accessible entry points combined with optional premium content. Mobile games particularly leverage this model effectively, with titles offering extensive cosmetic items and season passes that generate sustained revenue from engaged player bases.

Brazilian gamers demonstrate willingness to invest in in-game purchases despite economic fluctuations, indicating strong entertainment value perception. The segment benefits from improved digital payment infrastructure that simplifies transactions and builds consumer trust in online purchases. Publishers continue refining their monetization strategies to balance player satisfaction with revenue generation, offering compelling content that encourages voluntary spending without creating pay-to-win perceptions.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

The adventure/role playing games leads with a share of 40.6% of the total Brazil gaming market in 2025.

Adventure and role-playing games resonate strongly with Brazilian gamers who appreciate immersive storytelling, character development systems, and expansive game worlds that offer extended entertainment value. A 2024 survey found that approximately 62.8% of respondents selected “Adventure” and around 51.2% chose “RPG/MMORPG” as their favorite game genres, showing that these types of games enjoy broad appeal within the Brazilian gaming community. The genre encompasses both Western and Japanese role-playing traditions, with releases from established franchises consistently achieving strong reception in the Brazilian market. Mobile adaptations of popular role-playing series have successfully captured the attention of players seeking substantive gaming experiences on portable devices.

The popularity of adventure and role-playing games reflects broader cultural preferences for narrative-driven entertainment and the desire for escapist experiences that transport players to fantastical settings. Brazilian localization of major titles, including Portuguese voice acting and text translation, enhances accessibility and emotional connection with game content. The genre's emphasis on progression systems and achievement unlocking aligns with player motivations for sustained engagement and personal investment in gaming experiences.

Age Group Insights:

- Adults

- Children

The adults dominate with a market share of 76.7% of the total Brazil gaming market in 2025.

Adult gamers constitute the dominant demographic in Brazil's gaming market, representing individuals with established purchasing power and long-term engagement with gaming culture. This segment includes millennials and Generation Z consumers who grew up with video games and continue participating in gaming activities as primary entertainment. The predominant gaming age group consists of young professionals with disposable income for gaming expenditures, reflecting sustained interest across working-age populations.

The adult demographic demonstrates diverse gaming preferences spanning mobile casual games to premium console titles and competitive eSports participation. This segment drives significant in-game purchase revenue as adults possess financial resources for optional gaming content investments. Marketing strategies increasingly target adult audiences with mature themes and sophisticated gameplay mechanics while maintaining appropriate content considerations for broader market appeal.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The southeast exhibits a clear dominance with a 43.7% share of the total Brazil gaming market in 2025.

The Southeast region dominates Brazil's gaming market owing to its concentration of population, economic activity, and digital infrastructure development. Major metropolitan areas including São Paulo and Rio de Janeiro host the largest gaming communities with established retail channels, eSports venues, and gaming events that drive market engagement. The region benefits from superior internet connectivity and higher average incomes that support premium gaming hardware purchases and sustained spending on gaming content.

Gaming industry infrastructure concentrates heavily in the Southeast, with domestic game development studios predominantly located in São Paulo and surrounding areas. The region hosts major gaming conferences and eSports tournaments that attract national and international attention while fostering community development. Marketing activities and retail partnerships prioritize the Southeast market due to its economic significance and consumer responsiveness to gaming products and services.

Market Dynamics:

Growth Drivers:

Why Is the Brazil Gaming Market Growing?

Rising Smartphone Penetration and Mobile Internet Expansion

The proliferation of affordable smartphones across Brazil has fundamentally transformed gaming accessibility, enabling millions of consumers to participate in mobile gaming activities. Network operators continue expanding coverage while improving connection speeds that support seamless gaming experiences even in previously underserved areas. Recently, the Projeto Expansão de Redes, launched by the Ministério das Comunicações (MCom), committed R$ 1.4 billion to expand broadband and telecom infrastructure, targeting 767,000 households across 17 states and improving fiber‑optic, 4G/5G, and fixed‑broadband coverage nationwide. The availability of budget-friendly devices from various manufacturers provides entry points for diverse socioeconomic segments interested in gaming entertainment. This infrastructure development creates sustainable foundations for continued mobile gaming market expansion as connectivity reaches broader populations throughout urban and rural communities.

Growing eSports Ecosystem and Competitive Gaming Culture

Brazil has emerged as a significant eSports market with passionate competitive gaming communities and professional tournament infrastructure development. According to a 2024 report, Brazil now ranks as the third‑largest eSports audience globally, with over 30 million fans, underlining the scale and maturity of its competitive gaming community. Major international eSports events increasingly include Brazilian venues, demonstrating the country's importance in the global competitive gaming circuit. The competitive gaming scene cultivates player engagement beyond casual gaming while attracting sponsor investments and media attention that elevate industry visibility. Streaming platforms have established strong Brazilian audiences that follow competitive players and content creators, fostering community growth and sustained market engagement.

Government Support and Regulatory Framework Development

Brazilian government initiatives supporting the digital entertainment sector have created favorable conditions for gaming industry expansion. In May 2024, the government passed Law 14,852/2024, the Legal Framework for the Electronic Games Industry, which formally recognizes electronic games as part of the country’s cultural and audiovisual industries, making them eligible for cultural-sector incentives and public funding previously reserved for film, music, and other media. Legislative measures supporting local video game development benefit creators working across console, mobile, web, and virtual reality platforms. The government has officially recognized gaming as a distinct industry with dedicated job categories, enabling targeted support programs and workforce development initiatives. Additionally, policy adjustments have addressed import costs for gaming hardware, encouraging major publishers to expand their Brazilian market presence and demonstrating long-term governmental commitment to nurturing a vibrant domestic gaming ecosystem.

Market Restraints:

What Challenges the Brazil Gaming Market is Facing?

High Hardware Import Costs and Taxation

Despite recent improvements, gaming hardware remains relatively expensive in Brazil due to import duties and taxation policies that inflate retail prices above international averages. Console and gaming computer costs create barriers for consumers interested in premium gaming experiences, potentially limiting market expansion into price-sensitive segments.

Limited Investment in Domestic Game Development

Brazilian game development studios face challenges securing adequate funding for ambitious projects, with limited venture capital and publishing partnerships available domestically. Many studios rely on internal resources or modest grants, constraining their ability to compete with internationally funded productions.

Infrastructure Disparities Across Regions

Significant variations in internet connectivity quality and digital infrastructure between urban and rural areas create uneven gaming experiences across Brazil. Players in less developed regions may encounter latency issues and connectivity limitations that diminish online gaming satisfaction and restrict market development potential.

Competitive Landscape:

The Brazil gaming market demonstrates a dynamic competitive environment featuring established international publishers alongside emerging domestic studios that increasingly capture market attention. Major global gaming entities maintain significant Brazilian presence through localized content offerings, dedicated marketing initiatives, and partnerships with local distributors. The domestic development sector has experienced considerable growth with numerous studios creating games for various platforms, though many focus on outsourcing services rather than original intellectual property development. Competition intensifies as studios seek differentiation through cultural authenticity, innovative gameplay mechanics, and effective monetization strategies tailored to Brazilian consumer preferences.

Recent Developments:

- In September 2024, Flutter Entertainment announced it would acquire a 56% stake in Brazil’s NSX Group, which operates the Betnacional gaming platform, for USD 350 million. The deal strengthens Flutter’s push into Brazil’s rapidly expanding online betting market and signals rising international investor interest following the country’s evolving regulatory landscape for sports betting and iGaming.

Brazil Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, Others |

| Age Groups Covered | Adults, Children |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil gaming market size was valued at USD 5.64 Billion in 2025.

The Brazil gaming market is expected to grow at a compound annual growth rate of 7.79% from 2026-2034 to reach USD 11.08 Billion by 2034.

Mobiles and Tablets dominated the Brazil gaming market with approximately 52.8% revenue share, driven by widespread smartphone adoption and affordable mobile internet access enabling gaming participation across diverse demographics.

Key factors driving the Brazil gaming market include rising smartphone penetration, expanding mobile internet infrastructure, growing eSports ecosystem development, government support for the gaming industry, and increasing disposable incomes among young consumers.

Major challenges include high hardware import costs due to taxation, limited domestic investment funding for game development studios, regional infrastructure disparities affecting connectivity, and competition from established international publishers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)