Brazil Home Appliances Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region 2026-2034

Brazil Home Appliances Market Overview:

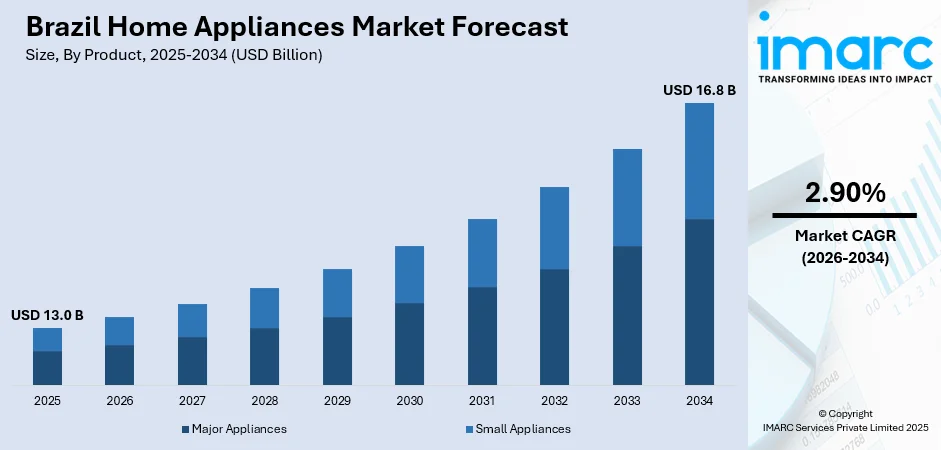

The Brazil home appliances market size was valued at USD 13.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 16.8 Billion by 2034, exhibiting a CAGR of 2.90% during 2026-2034. Southeast currently dominates the market share in 2025. The market is fueled by increasing urbanization, an emerging middle class, and growing consumer interest in convenience and energy-saving products. Technological innovations and new product features are prompting households to replace older equipment. Growth in e-commerce and easy availability of financing have also made high-end appliances affordable, especially in large urban areas. Infrastructure development in regions and extensive retail networks further drive the growth and competition within the industry, making the overall Brazil home appliances market share stronger.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 13.0 Billion |

|

Market Forecast in 2034

|

USD 16.8 Billion |

| Market Growth Rate 2026-2034 | 2.90% |

Among the major drivers of the Brazil home appliances market is the fast urbanization of the country and changing consumer attitudes, especially in major cities like São Paulo, Rio de Janeiro, and Belo Horizonte. With increasing numbers of individuals moving to cities in search of improved jobs and living conditions, demand for home appliances facilitating effective, modern living increases. Urban lifestyles tend to demand space-saving, multi-functional, and energy-efficient appliances to accommodate small apartments and busy lifestyles. Appliances such as front-loading washing machines, microwave ovens, and inverter refrigerators are becoming increasingly popular among urban residents who value convenience and dependability. Urban Brazilian consumers are also increasingly driven by digital media and global lifestyle trends, which are creating a demand for design-conscious and technologically sophisticated home appliances. Increased use of dual-income households again increases demand for time- and effort-saving appliances. These changes in urban lifestyle and consumer behavior are directly influencing product preferences and driving consistent growth for the market.

To get more information on this market, Request Sample

Retail infrastructure and access to credit are key drivers of growth for the Brazil home appliances market. National retail networks and specialty stores like Magazine Luiza, Casas Bahia, and Ponto offer widespread access to appliances even in small cities and rural towns. They offer localized service, delivery, and financing options that are extremely attractive to Brazilian consumers. Among the interesting aspects of the retail culture in Brazil is the prevalence of installment payments (parcelamento), which enable shoppers to purchase mid- to high-end appliances without immediate financial burden. This culture of credit is longstanding in Brazil's retail environment and remains the force behind consumers' spending habits. Additionally, retailers' digital transformation has widened their reach via e-commerce sites, mobile applications, and regional distribution networks to make home appliances available to customers outside conventional storefronts. Consequently, the convergence of physical and internet retail channels, along with flexible credit, is driving appliance buying across dissimilar income levels and geographies.

Brazil Home Appliances Market Trends:

Income Growth and Urban Living Fueling Demand

Higher household earnings and steady urban migration keep the Brazil household appliances market on an upward path. CEIC reported that Brazil's household disposable income reached BRL 8.54 Trillion in February 2025, marking an increase from BRL 8.47 Trillion in January 2025. With more families moving into cities, there’s a push for modern conveniences that make daily routines easier. What once counted as luxury, like multi-functional kitchen gadgets or advanced washing machines, is now normal for an expanding middle class. Brands keep an eye on these urban pockets, launching appliances that match busy city lifestyles and smaller living spaces. Better income levels mean people look for appliances that combine good looks with practical features. Retailers respond with bigger showrooms, new financing schemes, and better after-sales help. Rising urban density shapes everything from where stores open to how they deliver. Brazil has 203.1 million people, of whom 177.5 million (87.4%) live in cities and 25.6 million (12.6%) live in rural regions, according to the 2022 Population Census. As households upgrade their living standards, they expect their appliances to keep up, which keeps the replacement cycle rolling and opens space for new brands to win trust.

Smart Tech Taking Over the Home

According to recent Brazil home appliances market trends, technology is transforming the everyday household, and smart appliances are no longer a niche idea. From smart fridges that track groceries to washing machines that one can operate from a phone, homes are getting more connected. Voice control, AI learning, and integration with other devices make these products more practical and appealing to busy families. Local brands and global giants are in a race to add the smartest features at competitive prices. With faster broadband and affordable data plans, more households can actually use these functions fully. New tech helps people save time and energy, which adds to its appeal. Brands that offer seamless apps, real-time updates, and good support build loyal fan bases fast. Smart upgrades also mean shorter replacement cycles, so buyers who once kept an appliance for a decade are now willing to upgrade every few years to stay up to date.

Online Shopping Driving Appliance Sales

As per the Brazil home appliances market forecast, ordering a fridge or microwave online is now routine for millions, pushing e-commerce home appliances forward at full speed. It has been reported that Brazil's e-commerce generated nearly BRL 186 Billion (USD 33.4 Billion) in 2023, reflecting a 9.5% increase from 2022, indicating continued strong market growth. Major online retailers and homegrown platforms have made buying large household goods simple, secure, and competitive. Price checks, product reviews, and flexible payment plans encourage shoppers to skip the store visit altogether. Fast delivery, easy returns, and extended warranties have built trust even for high-value appliances. Digital-only discounts and flash deals pull in young buyers who prefer shopping on their phones. Brands benefit too, reaching small towns and remote buyers without needing a store in every corner. The surge in online shopping also helps collect real-time data on buyer habits. This lets companies launch targeted ads, personalized deals, and better loyalty programs. As digital payments get smoother and faster, online sales will keep climbing, reshaping how people buy everyday household essentials.

Policy Support Keeping Market Busy

Public policy has a quiet but strong hand in shaping the Brazilian home appliances market. Tax perks and rebates for energy-efficient products give shoppers a reason to upgrade old appliances. Regulations that favor local assembly help international brands set up plants, create jobs, and offer competitive pricing. Certification rules push makers to raise quality standards and cut energy use, which benefits household budgets. Infrastructure projects that expand reliable electricity to new regions unlock fresh demand for basics like refrigerators and washing machines. Trade pacts influence which global brands enter and how they price their goods, which keeps competition healthy. Some state programs help low-income families buy or replace appliances through subsidies or credit support. Better recycling rules push companies to handle old machines responsibly, closing the loop from production to disposal. These moves make sure innovation and sustainability stay part of everyday purchases.

Youthful Buyers Powering Fresh Growth

A large, young generation is shaping how the Brazil household appliances market evolves. Many are setting up their first homes, upgrading rentals, or buying bigger spaces for growing families. This group loves trendy, practical appliances that balance cost with smart features. They’re also fast adopters of new styles and digital upgrades. They want appliances that connect to apps, save power, and look good in small urban kitchens or open-plan living spaces. Social media and online reviews strongly shape what they pick, so brands invest in influencer tie-ups and digital campaigns. Young adults also lean toward brands that match their values, like sustainability and fair pricing. This crowd would not hesitate to switch brands if they spot better designs or offers. For retailers and manufacturers, staying relevant means listening to these buyers closely and rolling out models that meet both budget and taste.

Easier Financing Boosting Purchases

Better access to credit has changed how families shop for big-ticket items. More banks and digital lenders are offering flexible plans that make washing machines, fridges, or air conditioners affordable for a wider income range. Monthly installments, zero-interest deals, and fast approvals turn a big upfront spend into an easy routine payment. Retailers and banks often team up to pitch special festival offers or bundle deals to push volumes. Many households choose to upgrade older appliances sooner, thanks to these payment options. Digital wallets and fintech tools make borrowing quick and less intimidating, drawing in first-time buyers who might have waited years otherwise. Flexible credit terms have helped the Brazil household appliances market stay active even during slower economic periods. Companies that handle financing smoothly, with transparent terms and good service, often see repeat customers and higher loyalty, which also contribute to the Brazil home appliances market growth.

Efficiency Becoming a Top Priority

Running costs matter as much as purchase price now, which keeps demand strong for eco-friendly designs in the Brazil household appliances market. Households look for appliances with better energy ratings to shrink electricity bills over the long term. Newer models come with sensors that adjust settings automatically, inverter motors that cut power use, and displays that track consumption. Brands highlight these features in ads, knowing buyers compare energy labels before committing. Government standards and rebates also push the market in this direction. Replacing older, inefficient appliances is becoming common as more people see savings on power bills as worth the upfront cost. Retailers spotlight energy efficiency in promotions to tap into this cost-conscious buyer mood. As climate concerns grow, families feel good about buying appliances that save power and reduce waste, and hence brands keep refining designs to stay ahead of this shift.

Brazil Home Appliances Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Brazil home appliances market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product and distribution channel.

Analysis by Product:

- Major Appliances

- Refrigerators

- Freezers

- Dishwashing Machines

- Washing Machines

- Ovens

- Air Conditioners

- Others

- Small Appliances

- Coffee/Tea Makers

- Food Processors

- Grills and Roasters

- Vacuum Cleaners

- Others

Major appliances stand as the largest component in 2025, holding around 72.3% of the market. Major appliances such as refrigerators, air conditioners, washing machines, dishwashers, and cooking ranges, are the leading product segment in Brazil's home appliance market, with the largest revenue share and volume. Such leadership is mainly attributed to increasing urbanization, a growing middle class, and increasing household formations throughout Brazil, particularly in the Southeast. Buyers are increasingly spending money on energy-efficient, technologically superior major appliances that provide long-term value and cost savings. Access to local production and availability of credit through arrangements like installment plans encourages purchases of more expensive, durable items. Larger "white goods" are also commonly considered necessary household items in Brazilian houses—particularly considering cultural patterns of meal preparation, laundry routines, and heating/cooling in tropical climates. Many consumers replace or upgrade the big appliances as focal points of home renovation phases or in home mobility. Mirroring this, major appliances continue to influence consumer behavior and retailing strategies, solidifying their role as the dominant home appliance segment in Brazil. Specialty appliance stores—those dealing with electronics, white goods, and consumer durables—constitute the dominant distribution channel in Brazil's home appliances market, accounting for the largest share of revenue.

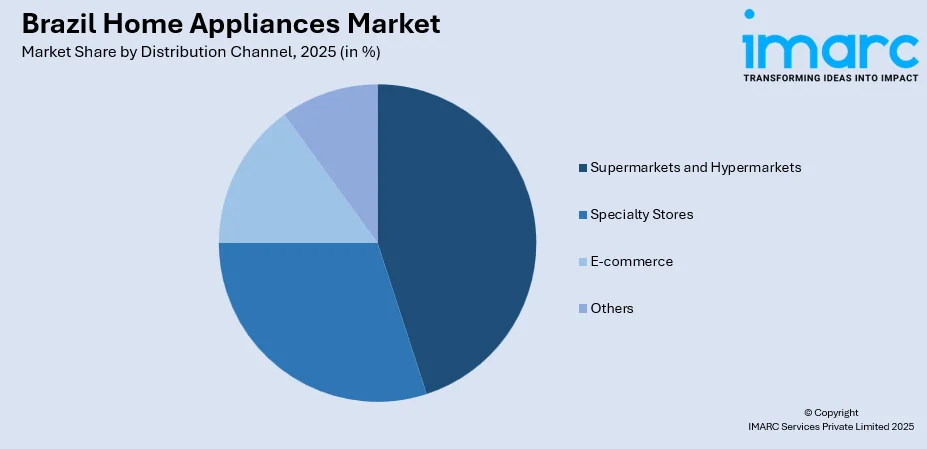

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- E-commerce

- Others

Specialty stores lead the market share in 2025. These stores, such as popular chains like Casas Bahia, Ponto Frio, and Magazine Luiza, have national footprints that cover both major metro and interior cities. According to the Brazil home appliances market analysis, their advantage is the ability to present broad assortments of major appliances, all in one place, enabling the customer to compare products in store, get expert advice, and use flexible installment payment plans to make pricier items more affordable. They also offer in-store demonstrations, strong after-sales support, and same-day or next-day delivery through combined logistics. Countrywide networks of retailers allow these stores to reach underserved interior and rural markets through smaller-format showrooms supported by catalog sales and affiliated e‑commerce offerings. This model successfully converges convenience, confidence, and accessibility—positioning specialty retailers as the first choice for Brazilians who are upgrading or replacing core household appliances and cementing their market leadership. In terms of both volume and value, the Southeast area of Brazil - which includes Rio de Janeiro, São Paulo, Espírito Santo, and Minas Gerais, is the market leader for household appliances.

Regional Analysis:

- Southeast

- South

- Northeast

- North

- Central-West

In 2025, Southeast accounted for the largest market share. This region enjoys the country's most concentrated population, key economic hubs, and extensive middle‑class consumer base with purchasing power. São Paulo alone generates huge appliance demand, which acts as a hub for manufacturing, sales, and logistics. Robust retail infrastructure in the form of national appliance chains, specialty retailers, and contemporary shopping malls facilitates extensive product distribution and promotional coverage. The area's well-established delivery networks and geography close to the appliance manufacturing units in nearby states ensure quick fulfillment and easy after-sales servicing. Moreover, Southeastern consumers are more inclined to use energy-efficient and intelligent appliances due to urban lifestyles, climatic changes necessitating air conditioning and refrigeration, and rising per capita incomes. Urban expansion, income, and retail density in the Southeast make it a place where major appliance sales happen with greater frequency. Due to these factors, the Southeast continues to be the most powerful and productive regional market contributing significantly to the Brazil home appliances market demand.

Competitive Landscape:

Major players in the Brazil home appliances industry are aggressively pursuing a series of strategic initiatives to enhance their market footing and generate consumer demand. Electrolux, Whirlpool, Brastemp, and Consul, among other companies, are pumping large amounts of money into research and development for new products that are energy-efficient, incorporate smart technologies, and have stylish designs that are compatible with contemporary Brazilian homes. These brands are increasing their product ranges to encompass smaller, more functional, and convenient appliances that reflect the changing demands of city consumers. Domestic manufacturing bases are being streamlined to save costs and deliver products faster, enabling brands to compete price-wise and in terms of speed of delivery. In addition to that, collaborations with large retail chains and online platforms have become necessary for extending customer reach, especially in outlying or underserved regions. Brands are also resorting to data-based marketing, improving customer care, and green initiatives—such as recycling initiatives and environmentally friendly product lines—to have closer ties with consumers. Sponsorships, influencer marketing, and attendance at regional trade shows help maximize visibility and brand loyalty. By coordinating their strategies with local consumer tastes, socio-economic conditions, and online retail trends, these market leaders are consolidating their positions in the market and positively influencing the development direction of Brazil home appliance market outlook.

The report provides a comprehensive analysis of the competitive landscape in the Brazil home appliances market with detailed profiles of all major companies, including:

Latest News and Developments:

- March 2025: Brazil's Vivo acquired accessories specialist Samauma for BRL 80 Million to expand its consumer product range. The purchase enhances Vivo's mobile accessory portfolio with Samauma's i2GO brand, offering products in over 20,000 retail points. The deal complements Vivo's growing electronics, fintech, and entertainment businesses.

- December 2024: Midea opened its third factory in Brazil, investing $96.1 million in Pouso Alegre. The facility, producing energy-efficient refrigerators and washing machines, aims to become a lighthouse factory. Midea’s local approach has boosted its market share, particularly in Brazil's refrigerator and washing machine segments.

- November 2024: Panasonic Brazil launched the "MAGIC" campaign, aiming to position the brand as the most desired by 2030. The campaign includes new product launches, such as the Nanocare Hair Dryer and BB65 refrigerators, and features actress Mariana Ximenes as the brand ambassador, strengthening connections with Japanese culture.

- November 2024: Messe Frankfurt announced the launch of Interior Lifestyle South America, a new consumer goods fare in Brazil, scheduled for June 2025. Organized by Grupo Eletrolar, the event will showcase products across various categories and is expected to attract 1,500 exhibitors and over 40,000 visitors.

- October 2024: Samsung launched the Bespoke AI Washer and Dryer in Brazil, featuring AI Wash, AI Dry, and a heat pump that reduces energy consumption by up to 70%. The model integrates with SmartThings and includes a 7-inch screen. The top-loading models are also available, with pricing starting at BRL 3,999.

- August 2024: Midea launched five new household appliances, including refrigerators and washing machines, produced in Brazil. The goal of this development is to increase its market share in Brazil. A new facility in Pouso Alegre is planned to produce 600,000 washing machines and 700,000 refrigerators a year.

Brazil Home Appliances Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, E-commerce, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil home appliances market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Brazil home appliances market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the home appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home appliances market in Brazil was valued at USD 13.0 Billion in 2025.

The Brazil home appliances market is projected to exhibit a CAGR of 2.90% during 2026-2034, reaching a value of USD 16.8 Billion by 2034.

The Brazil home appliances market is driven by urbanization, rising disposable income, and increasing demand for energy-efficient and time-saving appliances. Expanding retail networks, access to consumer credit, and digital transformation in sales channels also contribute to growth, making home appliances more accessible across diverse regions and income groups in Brazil.

The Southeast region leads Brazil home appliances market, driven by its high urban population, strong economic activity, and dense retail infrastructure. Cities like São Paulo and Rio de Janeiro drive demand through rising incomes, modern housing, and consumer preference for advanced appliances, making the region central to market growth and innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)