Brazil Home Decor Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Brazil Home Decor Market Overview:

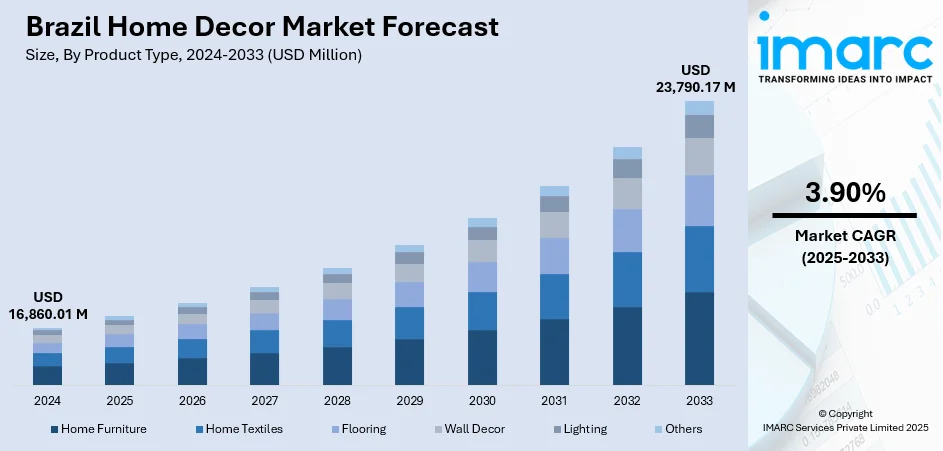

The Brazil home decor market size reached USD 16,860.01 Million in 2024. The market is projected to reach USD 23,790.17 Million by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is driven by urbanization, rising disposable income, and increasing consumer demand for personalized interiors. E-commerce and digital tools enhance accessibility, while growing eco-consciousness fosters demand for sustainable products. Brazil home decor market share is expanding due to its blend of cultural heritage and modern trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16,860.01 Million |

| Market Forecast in 2033 | USD 23,790.17 Million |

| Market Growth Rate 2025-2033 | 3.90% |

Brazil Home Decor Market Trends:

Digitalization and Online Retail Growth

Brazil's home décor market has evolved as a result of digitalization, making it easier for customers to purchase goods online. Customers may see furniture and décor pieces in their surroundings before making a purchase thanks to virtual showrooms, augmented reality (AR) technologies, and 3D visualization apps, which boosts confidence and lowers refunds. With simple delivery alternatives, e-commerce platforms have spread across the country, reaching even isolated locations. Social media sites, particularly Instagram and Pinterest, are setting trends by displaying carefully chosen interior design ideas that affect consumer choices. Online awareness has been further enhanced through collaborations with influencers and blogs on home décor. Additionally, online marketplaces are offering easy customization options, from fabric choices to finishes. This tech-driven approach is accelerating Brazil home decor market growth and expanding its customer base across various demographics. For instance, in July 2025, Brazilian e‑commerce furniture leader Mobly completed its acquisition of Tok&Stok, a major home décor and furniture retail chain, in a deal valued at R$ 112.3 million. The move reflects Mobly’s ambition to deepen its influence in Brazil’s furniture and décor market by combining digital reach with physical retail assets

To get more information on this market, Request Sample

Fusion of Heritage and Modern Design

Brazilian home decor is gaining global attention for its blend of traditional craftsmanship and modern aesthetics. Artisans incorporate indigenous motifs, vibrant colors, and handcrafted materials into contemporary designs, creating unique decor products. This fusion resonates with consumers seeking authenticity and cultural connection in their homes. Handmade items such as woven textiles, artisanal ceramics, and wooden furniture reflect Brazil’s cultural identity while appealing to international markets. Collaborations between local artisans and modern designers are further fueling creativity and product innovation. These cultural elements not only preserve heritage but also differentiate Brazilian decor from mass-produced alternatives. By combining heritage techniques with modern design trends, this fusion significantly contributes to Brazil home decor market growth and export potential. For instance, Brazil Furniture Group expanded its product line at the April 2024 High Point Market, introducing the Forest Lane collection and 10 standalone bedroom sets. The 30-piece Forest Lane line features handcrafted solid wood furniture, showcasing Brazil’s traditional woodworking skills while presenting modern designs like live-edge tables and minimalist bedroom sets. Displayed in a newly renovated 12,000-square-foot showroom, the collection highlights the company’s vertically integrated operations, with wood sourced from 15,000 acres of managed forests.

Brazil Home Decor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Home Furniture

- Home Textiles

- Flooring

- Wall Decor

- Lighting

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes home furniture, home textiles, flooring, wall decor, lighting, and others.

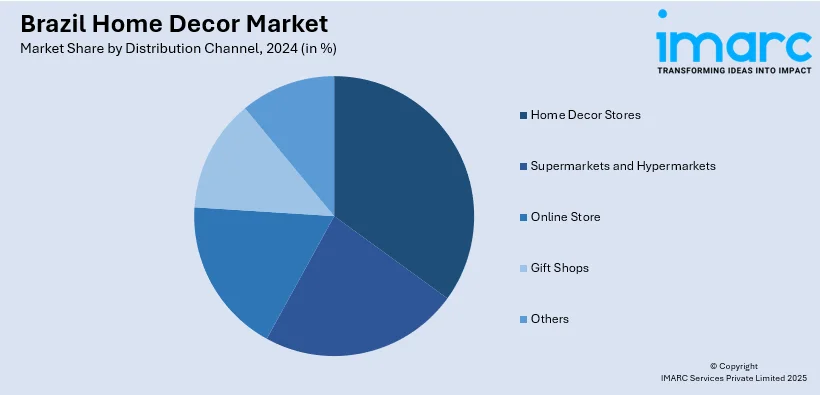

Distribution Channel Insights:

- Home Decor Stores

- Supermarkets and Hypermarkets

- Online Store

- Gift Shops

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes home decor stores, supermarkets and hypermarkets, online store, gift shops, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Home Decor Market News:

- In February 2025, Ornare, the upscale Brazilian furniture company, expanded globally with its new flagship showroom on Via Manzoni in Milan. Known for luxury kitchens, closets, and home solutions, the brand plans further openings in Lisbon, Washington, D.C., and Boston by late 2025. With 11 U.S. showrooms and a strong presence in Dubai, Ornare is focusing on bespoke millwork, hospitality projects, and AI integration to enhance design and operations. Despite Brazil’s economic challenges, the company reports steady growth, with international sales projected to rise 20–30% in 2025, positioning it as a competitive global design brand.

- In March 2024, Brazilian homeware brand Tramontina entered the Indian market, targeting the mid-premium segment with high-quality cookware and kitchen tools. The brand will adopt an omni-channel approach, selling via general trade, modern retail, e-commerce platforms, and its own D2C site.

Brazil Home Decor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, Others |

| Distribution Channels Covered | Home Decor Stores, Supermarkets and Hypermarkets, Online Store, Gift Shops, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil home decor market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil home decor market on the basis of product type?

- What is the breakup of the Brazil home decor market on the basis of distribution channel?

- What is the breakup of the Brazil home decor market on the basis of region?

- What are the various stages in the value chain of the Brazil home decor market?

- What are the key driving factors and challenges in the Brazil home decor market?

- What is the structure of the Brazil home decor market and who are the key players?

- What is the degree of competition in the Brazil home decor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil home decor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil home decor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil home decor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)