Brazil Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Brazil Insurtech Market Overview:

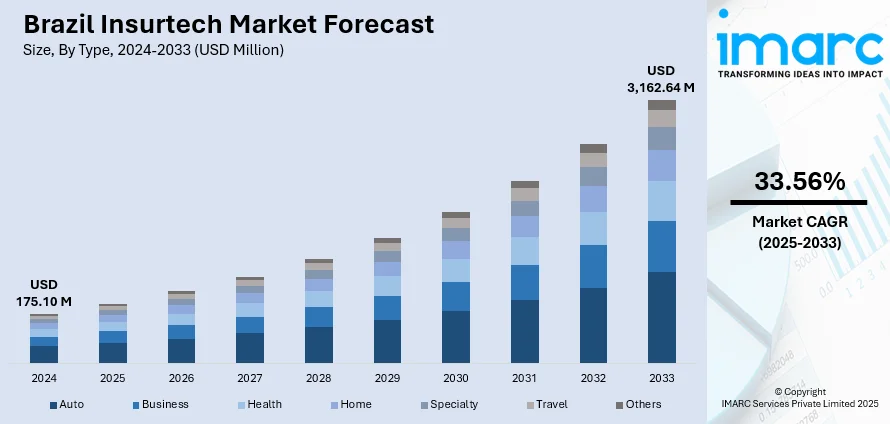

The Brazil Insurtech market size reached USD 175.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,162.64 Million by 2033, exhibiting a growth rate (CAGR) of 33.56% during 2025-2033. In Brazil, partnerships between Insurtech startups and traditional insurers are driving innovation and efficiency, leading to the development of more effective, tech-driven products. Additionally, the growing health and wellness sector is driving the demand for insurance solutions focused on preventive care, wearable tech, and telemedicine, thus expanding the Brazil Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 175.10 Million |

| Market Forecast in 2033 | USD 3,162.64 Million |

| Market Growth Rate 2025-2033 | 33.56% |

Brazil Insurtech Market Trends:

Strategic Partnerships and Collaborations

Collaborative alliances between Insurtech startups and traditional insurance firms are crucial for integrating innovation, improving efficiency, and accelerating product development in the industry. Conventional insurers are progressively partnering with Insurtech companies to integrate cutting-edge technologies into their processes, enabling them to present new, more effective products while enhancing overall operational effectiveness. These collaborations allow traditional insurers to utilize the agility, speed, and technological proficiency of startups, whereas Insurtech firms gain access to insurers' client networks, regulatory insights, and financial security. A significant instance of this partnership occurred in 2024, when InsureMO collaborated with Brazil's Noorden Group to advance digital transformation in the nation’s insurance industry. The partnership sought to integrate InsureMO’s technology with Noorden’s local knowledge to enhance efficiency, accelerate market entry, and assist both insurers and Insurtech companies in introducing innovative products more swiftly. The collaboration between established companies and startups results in the joint development of technology-based solutions, enhancing client interaction and enhancing service delivery. These collaborations enable both sides to remain competitive in a fast-changing market, encourage innovation, lower operational expenses, and enhance user experiences. Insurers and Insurtech companies are working together to transform Brazil's insurance sector, addressing the growing needs of contemporary individuals while remaining competitive in a rapidly evolving, tech-oriented marketplace.

To get more information on this market, Request Sample

Evolution of Health and Wellness Sector

The health and wellness industry in significantly contributing to the Brazil Insurtech market growth, as increased health consciousness and a greater emphasis on wellness are reshaping individual expectations. With the Brazil health and wellness market projected to reach USD 82.3 Billion in 2024, as per the IMARC Group, people are seeking insurance solutions that extend beyond traditional health coverage. Insurtech companies are addressing this need by launching policies centered on wellness, frequently incorporating health monitoring tools, fitness incentives, and preventive care offerings. These solutions are often augmented with wearable devices, enabling users to track their health and receive rewards, discounts, or premium reductions depending on their actions and lifestyle decisions. The convergence of health technology and insurance offers new avenues for Insurtech firms to address the growing user demand for proactive and tailored health management. Moreover, the rise in telemedicine and remote health consultations are broadening the range of insurance options, enabling Insurtech companies to deliver more adaptable, accessible, and thorough health insurance. Through the incorporation of cutting-edge technologies, like virtual consultations and remote monitoring, Insurtech firms are changing the way individuals engage with their health insurance. As a result, this trend not only enhances user engagement but also responds to the growing demand for insurance products that promote healthier lifestyles while offering greater convenience and support.

Brazil Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

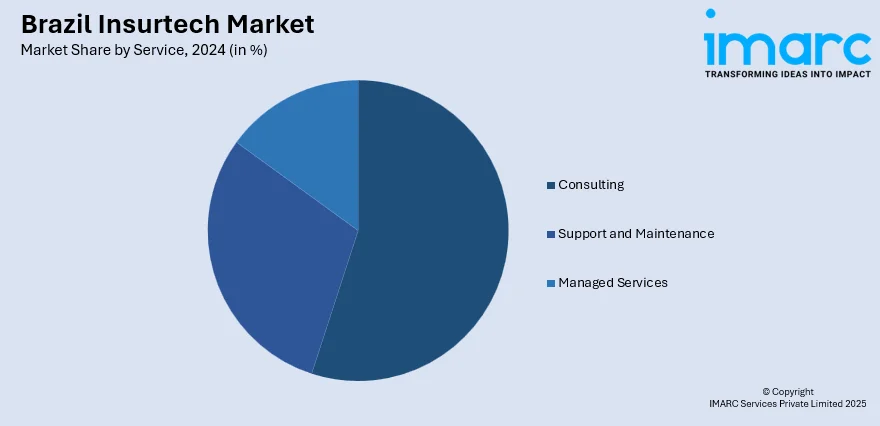

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Insurtech Market News:

- In December 2024, Insurtech firm discovermarket announced its expansion into Latin America, starting with the launch of a legal entity in Brazil. The company aimed to revolutionize embedded insurance in the region by partnering with brands across industries. This move targeted making digital, affordable, and accessible protection widely available.

- In October 2024, Prudential Financial announced a strategic partnership with 123Seguro, a leading Latin American Insurtech, to expand access to digital life, accident, and health insurance in Brazil and Mexico. The collaboration leveraged Prudential’s insurance expertise and 123Seguro’s digital platform to reach underserved mass markets.

Brazil Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil Insurtech market on the basis of type?

- What is the breakup of the Brazil Insurtech market on the basis of service?

- What is the breakup of the Brazil Insurtech market on the basis of technology?

- What is the breakup of the Brazil Insurtech market on the basis of region?

- What are the various stages in the value chain of the Brazil Insurtech market?

- What are the key driving factors and challenges in the Brazil Insurtech market?

- What is the structure of the Brazil Insurtech market and who are the key players?

- What is the degree of competition in the Brazil Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)