Brazil Lithium-ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Region, 2026-2034

Brazil Lithium-ion Battery Market Overview:

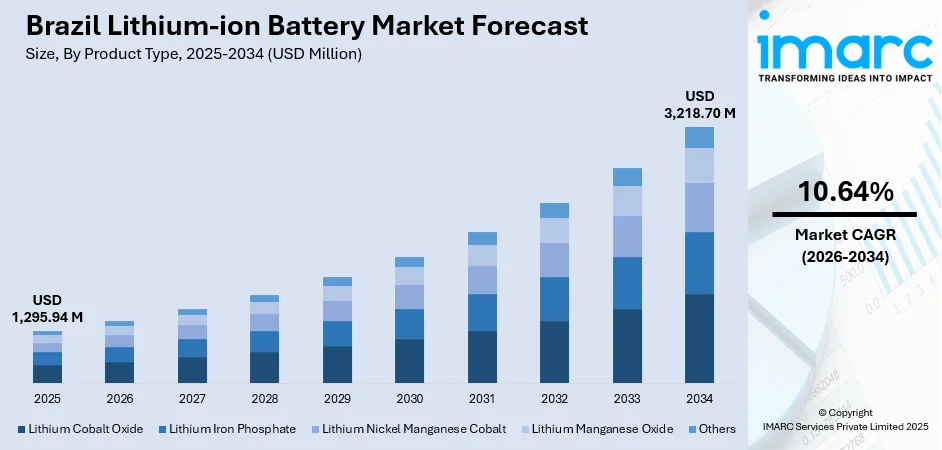

The Brazil lithium-ion battery market size was valued at USD 1,295.94 Million in 2025 and is projected to reach USD 3,218.70 Million by 2034, growing at a compound annual growth rate of 10.64% from 2026-2034.

Brazil's lithium-ion battery market is experiencing robust growth driven by accelerating electric vehicle adoption, expanding renewable energy storage infrastructure, and surging consumer electronics demand. The country's strategic position as Latin America's largest economy, combined with favorable government policies promoting clean energy transition and substantial foreign investments from leading manufacturers, is propelling market expansion. Rising environmental awareness and the need for reliable backup power solutions amid grid instability are further boosting demand across residential, commercial, and industrial segments, strengthening Brazil's lithium-ion battery market share.

Key Takeaways and Insights:

- By Product Type: Lithium iron phosphate (LFP) dominates the market with a share of 30% in 2025, driven by superior thermal stability, longer cycle life, and growing preference for safer battery chemistries in electric vehicles and energy storage applications.

- By Power Capacity: The 0 to 3000mAh segment leads the market with a share of 40% in 2025, fueled by widespread adoption in smartphones, tablets, wearables, and other portable consumer electronics across Brazil.

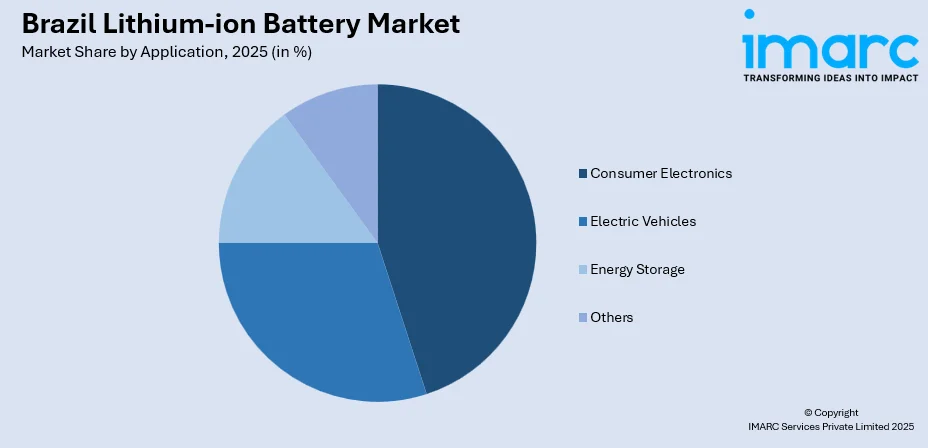

- By Application: Consumer electronics represents the largest segment with a market share of 35% in 2025, supported by Brazil's position as one of the world's largest smartphone markets with near-universal smartphone ownership rates.

- Key Players: The Brazil lithium-ion battery market is shaped by a dynamic competitive environment, with leading international and domestic manufacturers strengthening their foothold through capacity expansion, technology upgrades, and strategic partnerships. These companies are increasingly investing in advanced battery chemistries, localized production, and supply chain integration to capture rising demand across automotive, energy storage, and industrial applications.

To get more information on this market, Request Sample

Brazil's lithium-ion battery market is undergoing a transformative phase characterized by rapid electrification across multiple sectors. The country registered approximately 177,000 electric vehicles in 2024, representing a year-on-year surge that has positioned Brazil among the fastest-growing EV markets globally. This electric mobility revolution is supported by the expansion of charging infrastructure, which tripled to over 12,000 stations in 2024. The battery energy storage system segment is emerging as a significant growth driver, with installed capacity reaching 685 MWh by end of 2024 and investments projected to exceed USD 4.33 billion by 2030. Brazil's abundant renewable energy resources, particularly solar generation expected to reach 32.9% of the electricity matrix by 2029, are creating substantial opportunities for grid-scale battery storage deployment. For instance, BYD inaugurated its largest manufacturing facility outside Asia in Camaçari, Bahia in October 2025, with capacity to produce 150,000 vehicles annually, signaling strong confidence in Brazil's market potential.

Brazil Lithium-ion Battery Market Trends:

Rising Electric Vehicle Adoption Accelerating Battery Demand

Brazil's electric vehicle market has entered an unprecedented growth trajectory, with EV sales surging 89% year-on-year in 2024 to reach 177,538 units. Chinese automakers, especially BYD and Great Wall Motors, are driving this shift by setting up domestic manufacturing operations and rolling out competitively priced electric vehicles. Industry groups anticipate strong momentum in the coming years, with BYD maintaining a dominant role in the fully electric category. This accelerating transition toward EVs is boosting the need for lithium-ion batteries, particularly LFP types valued for their reliability, safety, and affordability. For instance, in October 2025, Renault has rolled out the Kwid E-Tech electric vehicle in Brazil, presenting it as the most budget-friendly electric hatchback in the market. This electric variant of the well-known Kwid reflects the company’s broader plan to accelerate its electrification efforts across Latin America.

Expanding Renewable Energy Storage Infrastructure

Brazil's solar energy expansion is driving substantial growth in battery energy storage systems. According to the national grid operator’s 2025–29 Energy Operation Plan, Brazil is projected to significantly expand its solar infrastructure, with total installed capacity anticipated to grow from its 2024 level to reach a much higher threshold by 2029. This planned increase underscores the country’s accelerating commitment to solar power as a key component of its long-term energy strategy. This renewable surge is creating urgent need for grid stabilization solutions, with the battery energy storage market. The Ministry of Mines and Energy's proposed battery storage auction model offers 10-year contracts, catalyzing utility-scale investments. Consultancy Greener reported 89% growth in BESS component demand during 2024, highlighting accelerating market momentum.

Domestic Manufacturing Expansion and Supply Chain Development

International manufacturers are establishing local production capabilities to serve Brazil's growing market while circumventing import tariffs. BYD's Camaçari facility represents a USD 1 billion investment creating 20,000 direct and indirect jobs. UCB Power has emerged as Brazil's first domestic manufacturer of LFP technology, producing over 72,000 lithium batteries annually. Additionally, a national initiative backed by 30 companies including Petrobras, Stellantis, and Volkswagen aims to establish domestic lithium-ion battery cell manufacturing, leveraging Brazil's low-carbon aluminum production advantage to create environmentally differentiated products.

Market Outlook 2026-2034:

The Brazil lithium-ion battery market outlook remains highly favorable, underpinned by structural demand drivers across electric mobility, renewable energy storage, and consumer electronics sectors. Government policies promoting clean energy transition, including tax incentives for EVs and proposed battery storage auctions, are creating conducive conditions for sustained market expansion. The convergence of declining battery costs, improving energy density, and expanding charging infrastructure is expected to accelerate mainstream EV adoption. Furthermore, Brazil's strategic lithium reserves in the Jequitinhonha Valley and Minas Gerais regions present opportunities for upstream supply chain integration. The market generated a revenue of USD 1,295.94 Million in 2025 and is projected to reach a revenue of USD 3,218.70 Million by 2034, growing at a compound annual growth rate of 10.64% from 2026-2034.

Brazil Lithium-ion Battery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Lithium Iron Phosphate |

30% |

| Power Capacity | 0 to 3000mAh |

40% |

| Application | Consumer Electronics |

35% |

Product Type Insights:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

Lithium iron phosphate dominates the Brazil lithium-ion battery market with a 30% share in 2025.

The lithium iron phosphate (LFP) segment has emerged as the dominant choice in Brazil’s battery industry, owing to its strong safety performance, durable lifespan, and cost-effectiveness resulting from its cobalt-free composition. Its reliability and lower production expenses make it the preferred option for a wide range of energy storage and electric mobility applications across the country. According to IEA data, LFP battery penetration in Brazil's EV market is expected to exceed 50% in 2025, primarily through imports from Chinese manufacturers led by BYD. The segment benefits from growing domestic manufacturing capabilities, with UCB Power emerging as Brazil's first LFP battery manufacturer producing over 72,000 units annually for industrial and energy storage applications.

LFP batteries are increasingly preferred for energy storage systems due to their thermal stability and fire safety characteristics, making them ideal for Brazil's expanding residential and commercial backup power market. The technology's suitability for high-temperature operation aligns well with Brazil's tropical climate conditions. Major automakers including BYD and Tesla are deploying LFP batteries in their Brazilian EV offerings, while energy storage providers favor LFP chemistry for grid-scale installations that require thousands of charge-discharge cycles over decades of operation.

Power Capacity Insights:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

The 0 to 3000mAh segment leads the market with a 40% share in 2025.

The 0 to 3000mAh power capacity segment holds the largest market share, reflecting Brazil's massive consumer electronics ecosystem. Brazil’s widespread smartphone usage continues to fuel strong demand for portable device batteries, making this segment one of the most dynamic areas within the consumer electronics ecosystem. The need for reliable, compact lithium-ion cells remains high as consumers prioritize longer battery life, fast charging, and improved device performance. This momentum extends across related categories such as wearables, tablets, and power banks, all of which rely heavily on efficient battery technology.

The segment's dominance is reinforced by Brazil's growing wearables market, expanding tablet adoption, and increasing use of portable power banks. Major consumer electronics manufacturers including Samsung, Apple, Motorola, and emerging Chinese brands are continuously introducing new devices requiring batteries in this capacity segment. The entry of OPPO, HONOR, and vivo into Brazil's smartphone market in 2024-2025 is further intensifying competition and stimulating demand for high-quality compact batteries.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

Consumer electronics holds the largest share at 35% of the total Brazil lithium-ion battery market in 2025.

The consumer electronics application segment maintains market leadership driven by Brazil's position as Latin America's largest consumer technology market. The segment encompasses smartphones, laptops, tablets, wearables, and other portable electronic devices that require rechargeable lithium-ion batteries. A 2024 survey revealed that 94% of Brazilian respondents use smartphones, while 73% own laptops or desktop computers. This high device penetration rate, combined with regular upgrade cycles, ensures sustained battery demand.

Emerging trends including AI integration in consumer devices, growing smart home adoption, and expanding e-commerce platforms are creating additional demand vectors. Brazil’s expanding middle-class population is playing a key role in boosting demand for higher-end consumer electronics, as more households gain the purchasing power to upgrade to premium devices. At the same time, the steady shift toward online retail is making these products easier to access, allowing consumers from diverse regions and income groups to explore a wider range of options. The growing influence of e-commerce platforms is streamlining product discovery, comparison, and delivery, ultimately accelerating the adoption of modern electronic devices across the country.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region benefits from high urbanization and strong industrialization, with growing EV adoption, expanding consumer electronics demand, and robust renewable energy initiatives. Presence of major automotive hubs and technology clusters further drives lithium-ion battery consumption for mobility and energy storage applications.

In the Northeast, expanding solar and wind energy projects are the primary growth drivers. Increasing rural electrification and off-grid renewable energy adoption, combined with growing demand for affordable energy storage solutions, are creating new opportunities for lithium-ion batteries in residential and commercial applications.

The North region’s growth is driven by hydropower and emerging renewable energy installations. Mining activities, particularly lithium and other battery metals, and infrastructure development are fueling demand for portable and large-scale energy storage solutions.

In the Central-West, agricultural modernization, off-grid renewable energy projects, and increasing EV adoption in urban centers are key factors. The region’s logistics and transport developments also support rising lithium-ion battery deployment for mobility and industrial applications.

Market Dynamics:

Growth Drivers:

Why is the Brazil Lithium-Ion Battery Market Growing?

Accelerating Electric Vehicle Adoption and Local Manufacturing

Brazil's electric vehicle market is experiencing exponential growth, with sales surging 89% year-on-year to reach 177,538 units in 2024, positioning the country among the world's fastest-growing EV markets. This transformation is led by Chinese manufacturers establishing local production capabilities, with BYD inaugurating its largest facility outside Asia in Camaçari, representing a USD 1 billion investment with 150,000 annual vehicle capacity. Government policies including EV tax exemptions and reduced import duties on electric vehicles are making clean mobility increasingly accessible. The Brazilian Association of Electric Vehicles forecasts continued strong growth, with projections indicating 300,000 EVs by 2029 and 500,000 by 2034, creating substantial long-term demand for automotive-grade lithium-ion batteries.

Renewable Energy Integration and Grid Storage Requirements

Brazil’s rapid shift toward renewable power is significantly accelerating the need for battery energy storage solutions. As solar generation becomes a major part of the national energy mix, the grid increasingly depends on storage systems to balance fluctuating output and ensure stable electricity supply. Government initiatives, including dedicated storage-focused policies and long-term contracting mechanisms, are encouraging large-scale investments in utility-level battery projects. At the consumer level, frequent power interruptions in several regions are prompting households and businesses to adopt backup battery systems to maintain energy reliability. Growing interest in self-generation and resilience is further expanding the market for distributed storage. Industry analysts anticipate strong momentum in both centralized and decentralized applications, driven by supportive regulations, rising renewable integration, and a broader push for energy security across the country.

Consumer Electronics Market Expansion and Digital Transformation

Brazil's consumer electronics market continues robust expansion, projected to reach USD 47.9 Billion by 2034 at 6.18% CAGR. With approximately 99% smartphone ownership and over 37 million smartphones sold annually, the country represents one of the world's largest mobile device markets. The entry of new smartphone vendors including OPPO, HONOR, and vivo in 2024-2025 is intensifying market competition and stimulating demand. The increasing household purchasing power, widening online retail access, and the continued expansion of Brazil’s middle-income population are fueling stronger demand for higher-end electronic devices. At the same time, government-led digital inclusion programs aimed at improving connectivity in underserved communities are expected to broaden the consumer base for affordable gadgets that rely on lithium-ion batteries.

Market Restraints:

What Challenges the Brazil Lithium-Ion Battery Market is Facing?

High Import Dependency and Limited Domestic Cell Production

Brazil’s lithium-ion battery industry continues to rely heavily on foreign suppliers for cells and critical components, as local capabilities remain largely focused on assembling battery packs rather than manufacturing core materials. This dependence increases exposure to global supply disruptions, currency instability, and geopolitical uncertainties, all of which can affect product availability and pricing across the domestic market.

High Tax Burden and Capital Costs

Brazil’s intricate tax system places a substantial financial load on battery energy storage solutions, making them considerably more expensive to deploy. In addition, elevated financing costs and stringent lending conditions create barriers for large-scale investments. Recent policy changes affecting renewable energy equipment have further raised project expenses, potentially slowing the rollout of solar-plus-storage developments.

Regulatory Gaps and Infrastructure Limitations

Regulatory frameworks for energy storage remain underdeveloped, creating uncertainty for investors and project developers. The charging infrastructure network, while tripling in 2024, remains concentrated in southern regions, limiting EV adoption in other areas. Additionally, concerns about battery recycling infrastructure and end-of-life management are emerging as the market scales, requiring regulatory attention.

Competitive Landscape:

The Brazil lithium-ion battery market features a competitive landscape dominated by global battery manufacturers while domestic companies focus on assembly and integration activities. BYD has positioned itself as a dominant force in the electric vehicle sector, strengthening its presence through extensive local production capabilities at its Camaçari facility. The company’s expanding footprint and strong product portfolio have enabled it to play a leading role in shaping Brazil’s rapidly evolving EV market. CATL supplies batteries to various automakers operating in Brazil and maintains dominant global market share exceeding 35%. Domestic players including Moura Group have entered the lithium segment through partnerships with international manufacturers, primarily assembling battery packs for buses and urban transport using imported cells. WEG and Unicoba represent emerging domestic assemblers serving industrial and telecommunications segments. UCB Power has distinguished itself as Brazil's first domestic LFP battery manufacturer. Strategic partnerships between global technology leaders and local companies are reshaping the competitive dynamics as the market matures.

Recent Developments:

- August 2025: Representatives from CATL met with Brazil's Minister of Mines and Energy in Brasília to reinforce partnership discussions aimed at boosting domestic battery production for electric vehicles, signaling high-level corporate commitment to local manufacturing capacity.

- July 2025: BYD rolled off the first Dolphin Mini manufactured in Brazil from its Camaçari plant, marking a historic milestone as the first locally-produced 100% electric vehicle and signaling the beginning of a new era for Latin America's EV industry.

Brazil Lithium-ion Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil lithium-ion battery market size was valued at USD 1,295.94 Million in 2025.

The Brazil lithium-ion battery market is expected to grow at a compound annual growth rate of 10.64% from 2026-2034 to reach USD 3,218.70 Million by 2034.

Lithium iron phosphate (LFP) dominates with a 30% market share in 2025, driven by superior safety profile, longer cycle life, and cost advantages from cobalt-free chemistry preferred in EVs and energy storage applications.

Key factors driving the Brazil lithium-ion battery market include accelerating electric vehicle adoption with 89% year-on-year growth, expanding renewable energy storage infrastructure, and robust consumer electronics demand with near-universal smartphone ownership.

The market struggles with heavy reliance on imported cells due to limited domestic manufacturing. High tax burdens and financing costs, combined with regulatory gaps and uneven charging infrastructure distribution, further hinder scalable growth and investment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)