Brazil Mammography Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Brazil Mammography Market Summary:

The Brazil mammography market size was valued at USD 51.00 Million in 2025 and is projected to reach USD 108.40 Million by 2034, growing at a compound annual growth rate of 8.74% from 2026-2034.

The Brazil mammography market is experiencing significant expansion driven by heightened awareness of breast cancer screening and early diagnosis initiatives. Advanced imaging technologies, including digital systems and artificial intelligence-enabled analysis tools, are revolutionizing diagnostic capabilities across healthcare facilities. Government investments in medical infrastructure and expanding private healthcare networks are accelerating equipment deployment, while nationwide awareness campaigns encourage routine screening participation among the female population throughout the country.

Key Takeaways and Insights:

- By Product Type: Digital systems dominate the market with a share of 45% in 2025, owing to superior image quality, enhanced diagnostic accuracy, and seamless integration with hospital information systems. The transition from analog to digital platforms continues accelerating across public and private healthcare facilities nationwide.

- By End User: Hospitals lead the market with a share of 51% in 2025. This dominance is driven by comprehensive breast health programs, advanced imaging departments with multidisciplinary teams, and substantial capital investment capacity enabling procurement of state-of-the-art mammography equipment.

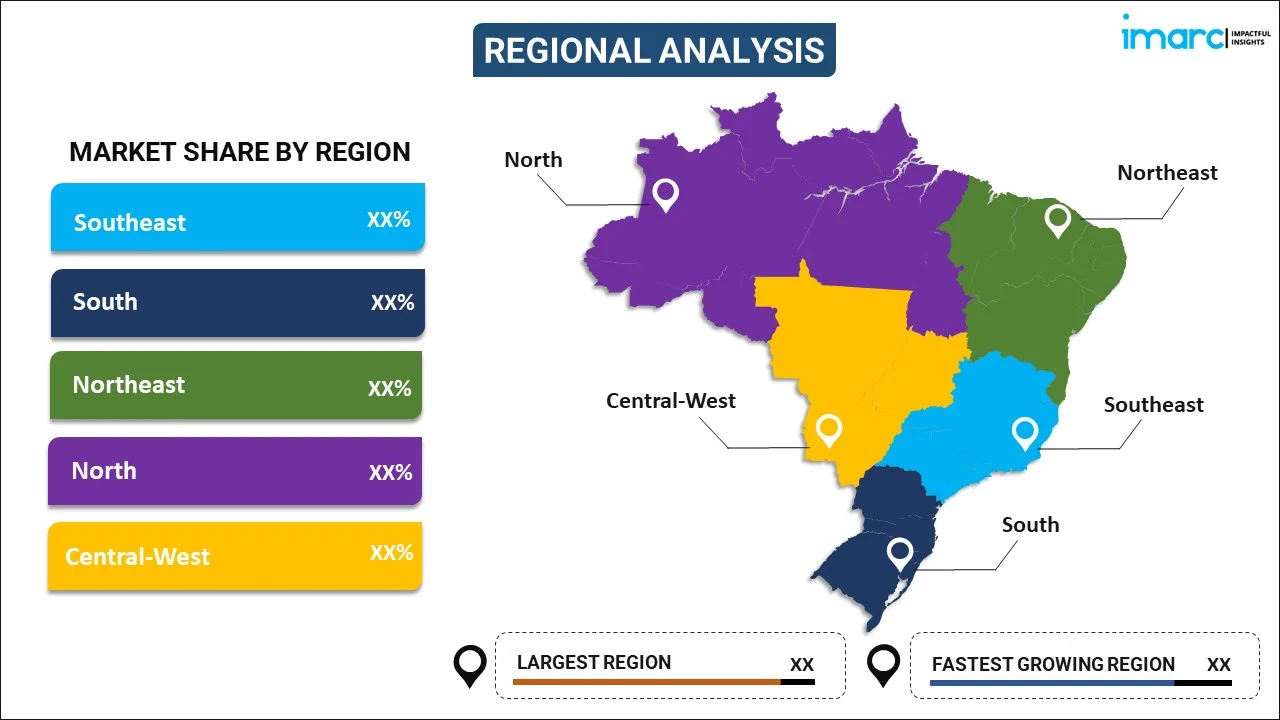

- By Region: Southeast represents the largest region with 40% share in 2025, driven by concentration of major metropolitan healthcare centers in São Paulo and Rio de Janeiro, higher disposable incomes enabling private healthcare access, and well-established diagnostic imaging infrastructure.

- Key Players: Key players drive the Brazil mammography market by expanding digital imaging portfolios, enhancing diagnostic accuracy through artificial intelligence integration, and strengthening nationwide service networks. Their investments in advanced tomosynthesis technology, regulatory approvals, and partnerships with healthcare institutions boost equipment accessibility, accelerate digital transformation, and ensure consistent availability of cutting-edge breast imaging solutions across diverse healthcare settings.

The Brazil mammography market demonstrates robust growth potential underpinned by escalating breast cancer incidence rates necessitating enhanced screening infrastructure across the country. Healthcare modernization initiatives prioritize diagnostic imaging equipment upgrades throughout public and private medical facilities, addressing longstanding capacity gaps. The market benefits from regulatory streamlining that accelerates equipment approvals while ensuring stringent safety standards compliance. Expanding awareness campaigns, including the nationally recognized Pink October initiative, encourage preventive healthcare adoption among women nationwide, driving sustained demand for mammographic examinations. Technological innovations incorporating artificial intelligence algorithms and three-dimensional tomosynthesis imaging enhance diagnostic precision while simultaneously reducing radiation exposure for patients. Collaborative efforts between governmental health agencies and private sector stakeholders strengthen diagnostic capacity development, particularly in underserved northern and northeastern regions requiring improved healthcare access and specialist workforce availability.

Brazil Mammography Market Trends:

Integration of Artificial Intelligence in Diagnostic Workflows

Healthcare facilities across Brazil are increasingly adopting artificial intelligence-powered computer-aided detection systems that enhance radiologist efficiency and diagnostic accuracy. These sophisticated algorithms analyze mammographic images to identify suspicious lesions, reduce false-positive rates, and prioritize cases requiring urgent attention. The integration streamlines workflow management while enabling healthcare providers to handle growing patient volumes without compromising diagnostic quality, particularly beneficial for facilities experiencing specialist shortages in remote regions. According to a large-scale prospective study published in Nature Medicine involving 463,094 women across 12 sites in Germany, AI-supported mammography screening increased breast cancer detection rates by 17.6% compared to standard screening without affecting recall rates.

Expansion of Mobile Mammography Services

Mobile mammography units are gaining prominence throughout Brazil as healthcare authorities address geographic barriers limiting screening access in remote and underserved communities. These portable facilities bring advanced digital imaging capabilities directly to populations residing far from established medical centers. The initiative supports national breast cancer screening objectives by eliminating travel burdens, reducing appointment wait times, and increasing examination compliance among women who previously lacked convenient access to preventive healthcare services. A study by the Harvey L. Neiman Health Policy Institute published in Clinical Breast Cancer found that women in rural areas are 210% more likely to utilize mobile mammography services than urban women, demonstrating the critical role of mobile units in expanding screening access to underserved populations.

Advancement of Three-Dimensional Tomosynthesis Technology

Digital breast tomosynthesis represents the next generation of mammographic imaging technology gaining adoption across Brazilian healthcare institutions. This three-dimensional imaging modality captures multiple breast images from different angles, creating detailed cross-sectional reconstructions that significantly improve lesion visibility, particularly in women with dense breast tissue where conventional screening often proves challenging. The technology demonstrates superior cancer detection capabilities compared to conventional two-dimensional systems, reducing unnecessary callback rates for additional imaging while simultaneously enhancing overall screening program effectiveness and diagnostic confidence among radiologists throughout the country.

Market Outlook 2026-2034:

The Brazil mammography market outlook remains favorable as healthcare infrastructure expansion continues throughout the forecast period. Government-led modernization programs prioritize diagnostic imaging equipment procurement to strengthen breast cancer screening capabilities nationwide. Rising breast cancer awareness among the female population drives sustained demand for routine mammographic examinations across urban and rural settings. Private healthcare sector investments complement public sector initiatives, expanding advanced imaging availability. International collaborations facilitate technology transfer and specialist training programs. Favorable regulatory developments streamline equipment approvals while maintaining safety standards. The market trajectory reflects sustained commitment to improving early breast cancer detection capabilities throughout the country. The market generated a revenue of USD 51.00 Million in 2025 and is projected to reach a revenue of USD 108.40 Million by 2034, growing at a compound annual growth rate of 8.74% from 2026-2034.

Brazil Mammography Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Digital Systems |

45% |

|

End User |

Hospitals |

51% |

|

Region |

Southeast |

40% |

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- Digital Systems

- Analog Systems

- Breast Tomosynthesis

- Others

Digital systems dominate with a market share of 45% of the total Brazil mammography market in 2025.

Digital mammography systems have transformed breast imaging capabilities throughout Brazil by offering superior image quality, enhanced contrast resolution, and efficient data storage solutions. These systems enable healthcare providers to manipulate and optimize images post-acquisition, improving diagnostic accuracy for challenging cases. The Brazilian National Health Regulatory Agency continues approving advanced digital platforms incorporating artificial intelligence algorithms that assist radiologists in identifying suspicious findings. Integration with picture archiving and communication systems facilitates seamless image sharing across healthcare networks.

The transition toward digital mammography accelerates as healthcare facilities recognize operational efficiencies and improved patient throughput compared to legacy analog systems. Digital platforms eliminate film processing requirements, reducing examination turnaround times while enabling remote consultation capabilities. Brazilian hospitals increasingly prioritize digital equipment procurement as part of comprehensive imaging department modernization initiatives supporting enhanced breast cancer detection programs. The segment benefits from declining equipment costs making advanced technology accessible to broader healthcare settings nationwide.

End User Insights:

- Hospitals

- Specialty Clinics

- Diagnostic Centers

Hospitals lead with a share of 51% of the total Brazil mammography market in 2025.

Hospitals maintain leadership in mammography equipment utilization through comprehensive breast health programs integrating screening, diagnostic, and interventional capabilities within single facilities. Major hospital networks deploy multiple mammography units to accommodate high patient volumes while minimizing appointment waiting periods. Brazilian public hospitals affiliated with the Unified Health System serve substantial screening populations, particularly benefiting women lacking private insurance coverage. Private hospital chains invest in premium imaging equipment to differentiate service offerings and attract health-conscious patients seeking advanced diagnostic capabilities.

Hospital-based mammography services benefit from multidisciplinary team availability enabling immediate follow-up consultations, biopsies, and treatment planning when abnormalities are detected. Academic medical centers additionally support radiologist training programs essential for expanding the specialized workforce required to operate advanced imaging equipment effectively. Hospital procurement decisions increasingly favor comprehensive imaging solutions incorporating digital mammography, tomosynthesis, and computer-aided detection within integrated platforms maximizing diagnostic versatility while optimizing capital investments across breast imaging departments.

Regional Insights:

To get detailed segment analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast exhibits a clear dominance with a 40% share of the total Brazil mammography market in 2025.

The Southeast commands market leadership driven by concentrated healthcare infrastructure across São Paulo and Rio de Janeiro metropolitan areas housing major hospital networks and diagnostic imaging centers. Higher regional per capita income levels support robust private healthcare demand, enabling substantial investments in advanced mammography equipment. The region benefits from established medical device distribution networks ensuring equipment availability and technical support services. Additionally, the Southeast hosts numerous medical education institutions training radiologists and imaging technicians essential for operating sophisticated breast imaging platforms effectively.

São Paulo state alone represents the largest concentration of mammography equipment installations, reflecting population density and healthcare spending patterns. Regional breast cancer screening programs demonstrate higher participation rates compared to national averages, generating consistent equipment utilization. Private healthcare providers routinely pilot advanced imaging technologies in Southeast facilities before broader national deployment. The International Atomic Energy Agency recently donated advanced digital mammography equipment to expand screening capacity in the Amazon region through the João de Barros Barreto University Hospital in Belém, demonstrating international commitment to addressing regional healthcare disparities.

Market Dynamics:

Growth Drivers:

Why is the Brazil Mammography Market Growing?

Rising Breast Cancer Incidence Necessitating Enhanced Screening Infrastructure

Brazil faces escalating breast cancer incidence rates positioning the disease as the most common malignancy among Brazilian women, excluding non-melanoma skin cancers. The growing disease burden creates urgent demand for expanded mammographic screening capacity to enable early detection when treatment outcomes remain most favorable. Healthcare authorities recognize mammography as the primary screening modality capable of identifying breast abnormalities before clinical symptoms manifest, potentially reducing mortality through timely intervention. The National Cancer Institute estimates substantial new case volumes annually throughout the current triennium, underscoring screening infrastructure expansion requirements. Demographic factors including population aging and lifestyle changes contribute to rising incidence patterns, particularly affecting women in major metropolitan areas. Public health campaigns emphasize screening importance, generating sustained equipment demand across healthcare facilities serving diverse populations. The epidemiological trajectory reinforces mammography equipment investment priorities within both public and private healthcare sectors committed to improving women's health outcomes nationwide. According to Brazil's National Cancer Institute (INCA), the country expects 73,610 new breast cancer cases annually during the 2023-2025 triennium, representing an incidence rate of 41.89 cases per 100,000 women and making breast cancer the most common cancer among Brazilian women.

Government Healthcare Investment Programs Accelerating Equipment Procurement

Brazilian federal government healthcare modernization initiatives allocate substantial resources toward medical equipment procurement, specifically targeting diagnostic imaging capacity enhancement throughout the public healthcare system. Strategic investment programs prioritize addressing equipment gaps in underserved regions lacking adequate mammography access, directing federal funding toward states demonstrating greatest need for screening infrastructure development. These coordinated efforts aim to reduce regional healthcare disparities by establishing diagnostic capabilities enabling timely breast cancer detection regardless of geographic location. Government procurement programs increasingly specify advanced digital mammography systems to maximize long-term value while ensuring compatibility with evolving technological standards. Public healthcare facility modernization complements broader objectives of strengthening primary care networks capable of conducting routine screening examinations at community level. Federal health authorities collaborate with state and municipal governments to ensure investment coordination optimizing equipment deployment impact. The sustained commitment to healthcare infrastructure development creates favorable conditions for market growth as procurement activities accelerate across public healthcare facilities nationwide. In July 2025, the Brazilian Federal Government announced R$ 6 Billion (approximately USD 1.1 Billion) for new health equipment through the Novo PAC Seleções program, with 11,904 proposals selected across 5,290 cities reaching 95% of Brazilian municipalities in all 26 states and the Federal District.

Breast Cancer Awareness Campaigns Driving Screening Participation

Annual breast cancer awareness initiatives, prominently featuring the Pink October campaign, generate substantial public attention toward mammographic screening importance throughout Brazil. These comprehensive outreach efforts mobilize healthcare institutions, civil society organizations, and government agencies in coordinated messaging emphasizing early detection benefits and screening accessibility. Campaign activities include educational events, free screening opportunities, and media coverage reaching millions of Brazilian women annually. Public awareness campaigns demonstrate measurable impact on mammography examination volumes, with participating healthcare facilities reporting increased appointment requests during campaign periods. Beyond immediate screening participation increases, awareness initiatives contribute to lasting behavioral changes as women incorporate routine mammographic examinations into preventive healthcare practices. Healthcare providers leverage campaign momentum to strengthen patient engagement and community outreach programs throughout the year. The sustained awareness environment supports consistent equipment utilization, encouraging healthcare facilities to invest in mammography capacity expansion meeting growing examination demand generated through successful public education efforts.

Market Restraints:

What Challenges the Brazil Mammography Market is Facing?

Geographic Barriers Limiting Healthcare Access in Remote Regions

Substantial portions of Brazil's population reside in remote and rural areas located considerable distances from established healthcare facilities offering mammographic screening services. Geographic isolation creates significant access barriers as women face lengthy travel requirements to reach diagnostic imaging centers, discouraging routine screening participation. Infrastructure limitations in distant regions complicate equipment installation and maintenance while challenging workforce recruitment efforts necessary to operate sophisticated imaging systems effectively.

Shortage of Specialized Radiologists and Imaging Technicians

Brazil experiences uneven distribution of breast imaging specialists, with qualified radiologists concentrated predominantly in major metropolitan areas while underserved regions struggle to attract and retain diagnostic expertise. Workforce shortages constrain screening capacity expansion as equipment procurement alone cannot address service delivery limitations without adequate personnel to perform and interpret examinations. Training program capacity limitations restrict new specialist supply, prolonging workforce imbalances affecting mammography service availability outside established healthcare centers.

High Equipment Costs Challenging Smaller Healthcare Facilities

Advanced digital mammography systems require substantial capital investments that smaller healthcare facilities and community clinics often cannot accommodate within constrained budgets. Equipment acquisition costs combine with ongoing maintenance expenses, software licensing fees, and facility modifications necessary to support sophisticated imaging platforms. Import dependencies expose Brazilian healthcare providers to exchange rate fluctuations affecting equipment affordability while extended procurement processes delay technology adoption cycles compared to more accessible markets.

Competitive Landscape:

The Brazil mammography market demonstrates moderate consolidation with established international medical device manufacturers commanding substantial market presence through comprehensive product portfolios and nationwide service networks. Leading industry participants compete through continuous innovation, introducing advanced digital systems incorporating artificial intelligence algorithms and three-dimensional tomosynthesis capabilities that enhance diagnostic precision. Market differentiation strategies emphasize clinical workflow integration, image quality improvements, and radiation dose reduction features addressing healthcare provider priorities. Regional distribution partnerships extend market reach while ensuring equipment installation and technical support capabilities throughout the country. Regulatory approval expertise enables efficient product launches following Brazilian National Health Surveillance Agency clearance processes. Competitive dynamics increasingly emphasize software solutions and connectivity features complementing hardware offerings, positioning participants to capture value throughout equipment lifecycle stages beyond initial sales transactions.

Recent Developments:

- In November 2025, the International Atomic Energy Agency donated a state-of-the-art digital mammography unit to the João de Barros Barreto University Hospital in Belém, Brazil, under the Rays of Hope initiative. The donation expands breast cancer screening access in the Amazon region, raising hospital capacity to perform examinations for over two thousand women annually. The equipment features advanced digital imaging technology enhancing diagnostic accuracy and speed.

- In March 2024, CureMetrix received ANVISA clearance for cmAngio, an artificial intelligence software as a medical device that flags breast arterial calcifications on full-field digital mammography and tomosynthesis images. The approval enables Brazilian healthcare providers to access advanced cardiovascular risk assessment capabilities integrated within existing breast imaging workflows.

Brazil Mammography Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Digital Systems, Analog Systems, Breast Tomosynthesis, Others |

| End Users Covered | Hospitals, Specialty Clinics, Diagnostic Centers |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil mammography market size was valued at USD 51.00 Million in 2025.

The Brazil mammography market is expected to grow at a compound annual growth rate of 8.74% from 2026-2034 to reach USD 108.40 Million by 2034.

Digital systems dominated the market with a share of 45%, driven by superior image quality, enhanced diagnostic accuracy, seamless integration with hospital information systems, and declining equipment costs enabling broader healthcare facility adoption.

Key factors driving the Brazil mammography market include rising breast cancer incidence rates, government healthcare investment programs, breast cancer awareness campaigns, technological advancements in digital imaging, and expanding private healthcare infrastructure.

Major challenges include geographic barriers limiting healthcare access in remote regions, shortage of specialized radiologists and imaging technicians, high equipment costs challenging smaller healthcare facilities, uneven specialist distribution, and extended procurement cycles affecting public healthcare modernization efforts.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)