Brazil Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2026-2034

Brazil Meat Market Summary:

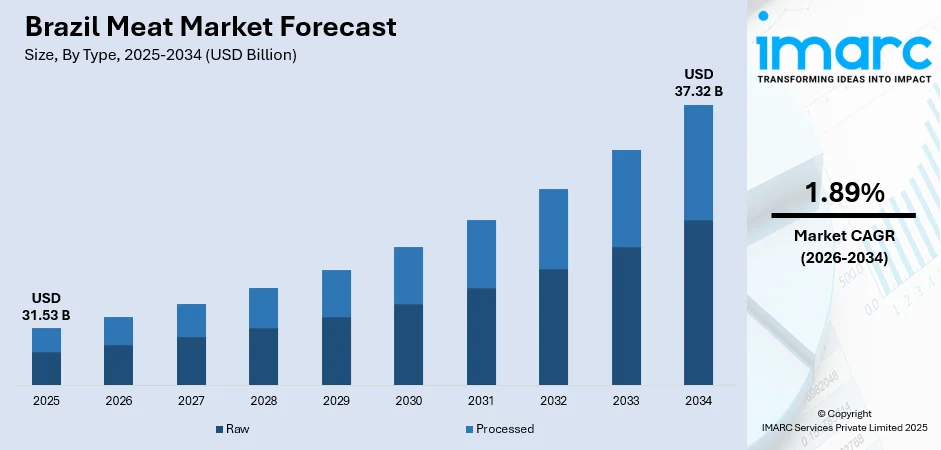

The Brazil meat market size was valued at USD 31.53 Billion in 2025 and is projected to reach USD 37.32 Billion by 2034, growing at a compound annual growth rate of 1.89% from 2026-2034.

Brazil's position as the world's largest beef exporter and second-largest chicken meat producer underpins robust market dynamics driven by strong global demand, particularly from China and Asian markets. The country's competitive production advantages, including vast pastureland, favorable climate conditions, and access to low-cost feed ingredients from its substantial corn and soybean production, support sustained domestic consumption and export growth. Cultural preferences deeply embedded in Brazilian cuisine, combined with improving household incomes and expanding retail infrastructure, continue to strengthen Brazil meat market share.

Key Takeaways and Insights:

-

By Type: Raw meat dominates the market with a share of 78.5% in 2025, driven by traditional consumption patterns and strong churrasco culture across Brazilian households.

-

By Product: Chicken leads the market with a share of 34.8% in 2025, supported by affordability advantages and high protein accessibility for price-conscious consumers.

-

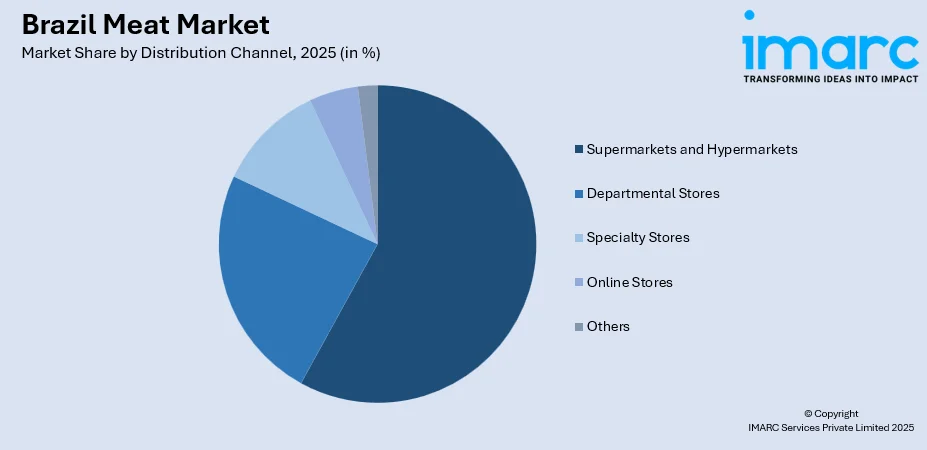

By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 58.9% in 2025, owing to extensive product assortment and integrated cold chain infrastructure.

-

By Region: Southeast dominates with a 38.8% share in 2025, anchored by São Paulo and Rio de Janeiro metropolitan areas with concentrated population and purchasing power.

-

Key Players: The Brazil meat market exhibits significant consolidation with major domestic processors competing alongside integrated multinational operations across beef, poultry, and pork value chains.

To get more information on this market Request Sample

Brazil's meat sector continues to benefit from its integrated supply chain infrastructure connecting extensive cattle ranches and poultry operations to modern processing facilities and diversified distribution networks. The country's favorable sanitary status, having remained free from Highly Pathogenic Avian Influenza in commercial plants, strengthens its export credentials and market access negotiations with key trading partners across Asia, the Middle East, and emerging African markets. The recent approval of the Marfrig-BRF merger by Brazil's antitrust regulator CADE created MBRF Global Foods, demonstrating ongoing industry consolidation that enhances competitive positioning in global protein markets and establishes a formidable competitor among the world's largest protein producers.

Brazil Meat Market Trends:

Sustainability and Supply Chain Traceability Enhancement

Brazil's meat industry is undergoing significant transformation toward enhanced traceability and sustainability certification to meet evolving international market requirements. The Beef on Track Monitoring Protocol 2.0 came into effect in January 2025, strengthening criteria for deforestation-free sourcing and human rights. Agriculture Minister Carlos Fávaro announced plans for individual cattle tracing from birth to slaughter, targeting full traceability by 2032 to address European Union Deforestation Regulation requirements and maintain premium market access.

Export Market Diversification and Geographic Expansion

Brazilian meat producers are actively pursuing market diversification beyond traditional destinations to reduce dependency on single markets and capture emerging demand. In 2025 alone, Brazil opened 25 new markets for poultry products, including day-old chicks to South Korea and Benin, duck and turkey meat to China, and chicken meat to Malaysia's Sarawak region. This strategic diversification reduces vulnerability to trade disruptions while positioning Brazilian processors to capitalize on growing protein demand across Africa, Central America, and Southeast Asia.

Premium and Value-Added Product Development

Consumer preferences are shifting toward processed and value-added meat products, driving investment in product innovation and manufacturing capacity expansion. In October 2023, JBS inaugurated two value-added food production facilities in Rolândia, Paraná, employing 4,500 workers to expand the Seara brand's breaded chicken products and sausage offerings. This trend reflects growing urban consumer demand for convenience while enabling processors to capture higher margins through product differentiation.

Market Outlook 2026-2034:

Brazil's meat market is positioned for sustained growth over the forecast period, supported by strong export fundamentals and gradual domestic consumption recovery. The market generated a revenue of USD 31.53 Billion in 2025 and is projected to reach a revenue of USD 37.32 Billion by 2034, growing at a compound annual growth rate of 1.89% from 2026-2034. Industry consolidation through strategic mergers enhances operational efficiencies and export competitiveness, while ongoing infrastructure investments in processing capacity and cold chain logistics strengthen supply chain resilience. Regulatory alignment with international sustainability standards positions Brazilian producers for continued premium market access.

Brazil Meat Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Raw |

78.5% |

|

Product |

Chicken |

34.8% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

58.9% |

|

Region |

Southeast |

38.8% |

Type Insights:

- Raw

- Processed

Raw meat dominates the Brazil meat market with a 78.5% share in 2025.

Brazil's cultural affinity for fresh meat preparation, particularly through churrasco traditions and home cooking practices, sustains strong demand for raw meat products across all protein categories. Brazilian consumers demonstrate preference for selecting fresh cuts at retail locations, enabling visual quality assessment and customized portion selection that processed alternatives cannot replicate. The extensive network of butcher counters within supermarkets and dedicated açougues reinforces this purchasing behavior. Raw meat's dominance reflects established infrastructure supporting fresh product distribution, including integrated cold chain networks connecting processing facilities to retail endpoints throughout major metropolitan areas. Continued processor investments in slaughtering capacity expansion demonstrate ongoing commitment to meeting domestic fresh meat demand.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

Chicken leads the Brazil meat market with a 34.8% share in 2025.

Chicken meat's market leadership reflects its positioning as the most affordable animal protein option for Brazilian households, particularly during periods of economic pressure when consumers trade down from higher-priced beef alternatives. The protein's versatility in traditional Brazilian cuisine, from everyday meals to celebratory gatherings, reinforces consistent household demand across income segments. Brazil's position as one of the world's largest chicken meat producers supports robust domestic availability at competitive prices. The country's favorable sanitary status in commercial poultry operations provides competitive advantages over global competitors facing disease-related supply disruptions, ensuring reliable production continuity and export market access throughout the year.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets hold the largest share with 58.9% of the Brazil meat market in 2025.

Supermarkets and hypermarkets dominate meat distribution through their comprehensive product assortment, integrated cold chain infrastructure, and consumer trust established through consistent quality standards. These retail formats serve as primary destinations for household meat purchases, with dedicated butcher counters and refrigerated sections offering extensive selection across protein categories. Established supplier relationships with major meat processors enable consistent product availability and competitive pricing through volume procurement advantages. The expansion of cash-and-carry formats demonstrates retail evolution meeting diverse consumer shopping preferences while maintaining cold chain integrity. Modern store layouts featuring specialized meat departments enhance the shopping experience and reinforce channel preference among Brazilian consumers.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region dominates with a 38.8% share of the Brazil meat market in 2025.

The Southeast region's market leadership stems from its concentration of Brazil's largest population centers and highest household income levels, with São Paulo state alone representing approximately 30% of national GDP. The metropolitan areas of São Paulo and Rio de Janeiro contain dense consumer markets with sophisticated retail infrastructure and established cold chain networks supporting high-volume meat distribution across diverse retail formats.

The region's economic concentration attracts significant processor investment in distribution facilities and retail partnerships, ensuring product availability across premium supermarket chains and neighborhood retail outlets. Strong employment rates and wage growth in service sectors support consistent meat consumption patterns, while cultural preferences for churrasco and traditional Brazilian cuisine maintain demand across all protein categories throughout the year.

Market Dynamics:

Growth Drivers:

Why is the Brazil Meat Market Growing?

Strong Global Export Demand and Market Access Expansion

Brazil’s meat market benefits significantly from strong international demand, with the country maintaining a leading position in global beef and chicken exports. Continued efforts to expand and diversify export markets support sustained growth, while international partnerships and trade relationships help strengthen Brazil’s role in supplying meat products worldwide. Ongoing focus on market development and strategic engagement ensures that the sector remains competitive, resilient, and capable of meeting global demand for high-quality protein. In 2025, Brazil opened 25 new markets for poultry products, demonstrating government commitment to expanding trade relationships and reducing market concentration risks.

Competitive Production Cost Advantages

Brazil's integrated agricultural ecosystem provides significant cost advantages in meat production through access to domestically produced feed ingredients at competitive prices. As the world's largest soybean producer and third-largest corn producer, Brazil offers feed cost structures substantially below global competitors, enabling processors to maintain price competitiveness in international markets. The devalued Brazilian Real further enhances export competitiveness, with currency depreciation making Brazilian meat products more attractive to foreign buyers. These structural advantages support sustained production growth and export expansion across all protein categories.

Expanding Domestic Retail Infrastructure

Continued investment in modern retail formats and distribution infrastructure supports meat market growth through improved product accessibility and consumer convenience. The Brazilian supermarket sector represents a significant contributor to national economic activity, with extensive store networks serving millions of customers daily across urban and rural communities. Expansion of cash-and-carry formats and neighborhood supermarkets extends cold chain coverage into underserved communities, while e-commerce growth enables new consumption occasions and purchasing patterns. Strategic investments in refrigeration technology and logistics networks strengthen product freshness and availability, reinforcing consumer confidence in retail meat purchases throughout the country.

Market Restraints:

What Challenges the Brazil Meat Market is Facing?

Price Volatility and Consumer Affordability Pressures

Rising meat prices create consumption barriers for price-sensitive Brazilian households, as inflationary pressures on food products continue to outpace general consumer price increases. Beef prices experienced significant seasonal surges during late 2024, driven by strong export demand and currency depreciation that prioritize international sales over domestic supply. These price pressures force consumer trade-downs to lower-cost proteins or reduced purchase frequency.

Regulatory Compliance and Sustainability Requirements

International market access increasingly requires demonstrated compliance with deforestation-free sourcing and traceability standards, necessitating significant investment in monitoring systems and supply chain documentation. The European Union Deforestation Regulation creates compliance burdens for Brazilian exporters, requiring proof that commodities do not contribute to recent deforestation. Meeting these requirements demands substantial processor investment in individual animal traceability and supplier verification protocols.

Disease Outbreak and Biosecurity Vulnerabilities

Brazil's extensive livestock operations face ongoing risks from disease outbreaks that can disrupt production and trigger trade restrictions. The July 2024 Newcastle disease outbreak in a commercial poultry plant in Rio Grande do Sul resulted in temporary export suspensions from multiple trading partners, demonstrating market vulnerability to biosecurity incidents. Continued HPAI monitoring and strengthened biosafety protocols require ongoing investment and operational vigilance.

Competitive Landscape:

The Brazil meat market exhibits significant consolidation characterized by large integrated processors competing across multiple protein categories and geographic markets. Major domestic companies maintain vertically integrated operations spanning breeding, processing, and distribution, enabling operational efficiencies and quality control throughout the value chain. Strategic investments in processing capacity expansion, product innovation, and export market development differentiate leading players while ongoing consolidation reshapes competitive dynamics. Market participants leverage established supplier networks with cattle ranchers and poultry farmers to secure consistent raw material supply, while advanced processing technologies and stringent quality certifications strengthen competitive positioning in premium export markets across Asia, the Middle East, and Europe.

Brazil Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil meat market size was valued at USD 31.53 Billion in 2025.

The Brazil meat market is expected to grow at a compound annual growth rate of 1.89% from 2026-2034 to reach USD 37.32 Billion by 2034.

Raw meat dominated the Brazil meat market with a share of 78.5% in 2025, driven by traditional consumption patterns emphasizing fresh meat preparation through churrasco culture and home cooking practices prevalent across Brazilian households.

Key factors driving the Brazil Meat market include strong global export demand particularly from China and Asian markets, competitive production cost advantages from domestic feed ingredient availability, and expanding modern retail infrastructure improving product accessibility nationwide.

Major challenges include price volatility and consumer affordability pressures from rising meat inflation, regulatory compliance requirements for international sustainability standards, disease outbreak risks requiring ongoing biosecurity investments, and infrastructure constraints in remote distribution areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)