Brazil Off The Road Tire Market Size, Share, Trends and Forecast by Vehicle Type, Tire Type, End Use, Distribution Channel, Rim Size, and Region, 2026-2034

Brazil Off The Road Tire Market Overview:

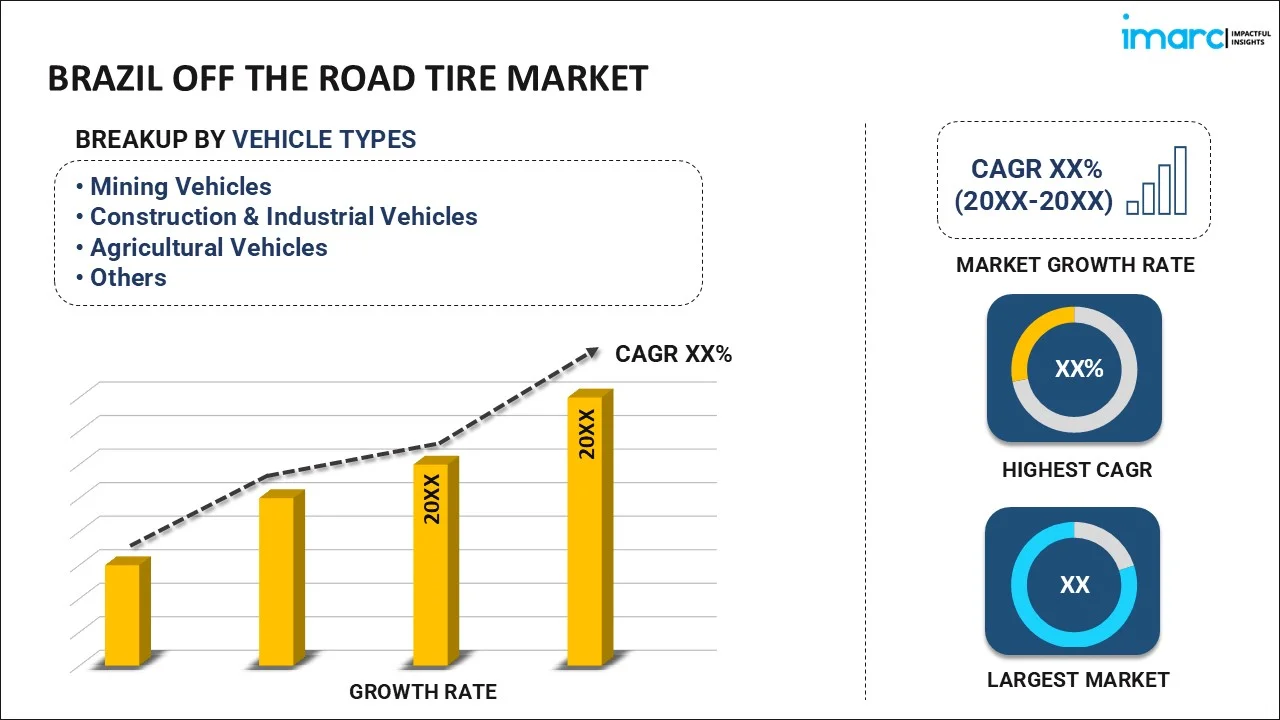

The Brazil off the road tire market size reached USD 601.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 809.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.35% during 2026-2034. The increasing agricultural activities, rising infrastructure development, growing mining operations, the rise in heavy machinery usage, growing focus on efficient and durable tires, increasing investment in renewable energy projects, and a rise in construction activities are some of the major factors driving the growth of the market across Brazil.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 601.5 Million |

| Market Forecast in 2034 | USD 809.1 Million |

| Market Growth Rate (2026-2034) | 3.35% |

Brazil Off The Road Tire Market Trends:

Agricultural Expansion

Brazil's vast agricultural sector is a significant driver for the off-the-road tire market growth. As the demand for food increases, farmers are investing in advanced machinery, which requires specialized tires for optimal performance in diverse terrains. Enhanced agricultural practices and the adoption of mechanized equipment improve efficiency, prompting farmers to seek durable, high-performance tires. The rise in precision farming and sustainable agricultural techniques further emphasizes the need for reliable tires that can withstand challenging conditions and contribute to higher productivity. For example, in July 2024, Trelleborg Tires and John Deere, two leaders within the agriculture industry, announced their collaboration in the distribution of Trelleborg tires through John Deere dealerships in Brazil. Trelleborg designs and manufactures agricultural tires with patented technologies designed to deliver high stability, self-cleaning, greater traction power, and very high flexion (VF) construction.

Technological Advancements

Innovations in tire technology, such as enhanced durability, fuel efficiency, and eco-friendly designs, are driving growth in the Brazil’s OTR tire market. The introduction of radial and tubeless tire designs, along with the use of sustainable materials, improves performance and lifespan. For instance, in April 2024, Trelleborg, engineered and manufactured the TM1 ECO POWER, its most sustainable tire. This tire was launched in Brazil demonstrating Trelleborg Tires’ commitment to sustainable farming in response to the call for sustainable innovation in agriculture. Trelleborg also mentioned a new size in the TM150 tire range intended for use on modern sprayers since such application would further ground protection and fuel savings even for high-powered machines with heavy-capacity loads. These developments express the industry's needs and imply that tires are made to respond to the increasing demands in terms of heavy-duty, arduous applications.

Brazil Off The Road Tire Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on vehicle type, tire type, end use, distribution channel, and rim size.

Vehicle Type Insights:

- Mining Vehicles

- Construction & Industrial Vehicles

- Agricultural Vehicles

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes mining vehicles, construction & industrial vehicles, agricultural vehicles, and others.

Tire Type Insights:

- Radial Tire

- Bias Tire

A detailed breakup and analysis of the market based on the tire type have also been provided in the report. This includes radial tire and bias tire.

End Use Insights:

- OEM

- Replacement

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes OEM and replacement.

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Rim Size Insights:

- Below 24 Inches

- 24-30 Inches

- 31-35 Inches

- 36-39 Inches

- 40-50 Inches

- 51- 55 Inches

- Above 56 Inches

A detailed breakup and analysis of the market based on the rim size have also been provided in the report. This includes below 24 inches, 24-30 inches, 31-35 inches, 36-39 inches, 40-50 inches, 51- 55 inches, and above 56 inches.

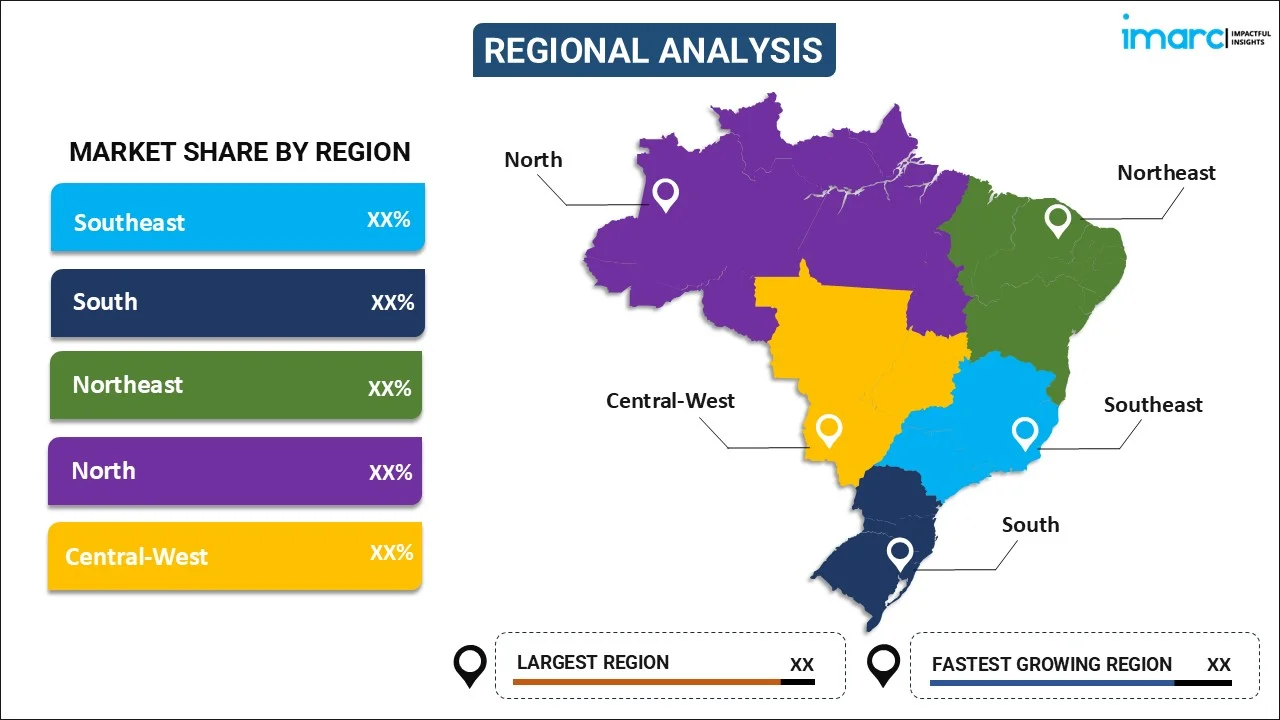

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Off The Road Tire Market News:

- In July 2023, Goodyear, one of the largest tire manufacturers in the world, launched the new Armor Max MSA GEN2 tire, which is part of the second generation of its flagship premium product line, the Max Series, thinking about the needs of large and medium-sized fleets operating in the on- and off-road cargo transportation segment. The mixed service, the focus of the launch, is significant for transport in Brazil as it is directly connected to agricultural production, which is an important part of the Brazilian economy and is projected to grow.

- In May 2023, CEAT Specialty, a foremost manufacturer of tires for off-highway applications, showcased a number of agricultural tires during Agrishow 2023-the largest agricultural trade show in Brazil. CEAT Specialty also displayed VF tires-Torquemax for tractors and Spraymax for sprayers. Whereas, in the combination, yield-max tires were for harvesters. The complete range of tires is designed for traction, stability, and durability.

Brazil Off The Road Tire Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | mining vehicles, construction & industrial vehicles, agricultural vehicles, Others |

| Tire Types Covered | Radial Tire, Bias Tire |

| End Uses Covered | Organic, Conventional |

| Distribution Channels Covered | Offline, Online |

| Rim Sizes Covered | Below 24 Inches, 24-30 Inches, 31-35 Inches, 36-39 Inches, 40-50 Inches, 51- 55 Inches , Above 56 Inches |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil off the road tire market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil off the road tire market on the basis of vehicle type?

- What is the breakup of the Brazil off the road tire market on the basis of tire type?

- What is the breakup of the Brazil off the road tire market on the basis of end use?

- What is the breakup of the Brazil off the road tire market on the basis of distribution channel?

- What is the breakup of the Brazil off the road tire market on the basis of rim size?

- What is the breakup of the Brazil off the road tire market on the basis of region?

- What are the various stages in the value chain of the Brazil off the road tire market?

- What are the key driving factors and challenges in the Brazil off the road tire?

- What is the structure of the Brazil off the road tire market and who are the key players?

- What is the degree of competition in the Brazil off the road tire market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil off the road tire market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil off the road tire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil off the road tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)