Brazil Online Gaming Market Size, Share, Trends and Forecast by Device Type, Gaming Type, Age Group, Gender Demographic, Model, and Region, 2026-2034

Brazil Online Gaming Market Summary:

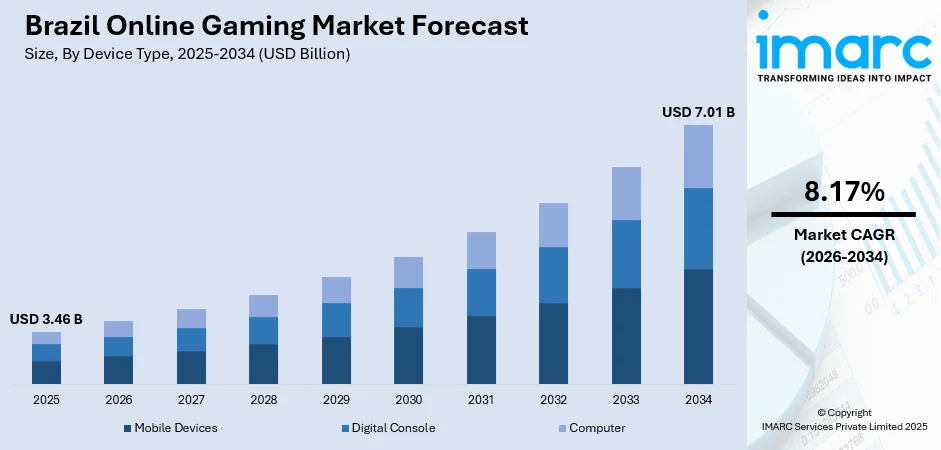

The Brazil online gaming market size was valued at USD 3.46 Billion in 2025 and is projected to reach USD 7.01 Billion by 2034, growing at a compound annual growth rate of 8.17% from 2026-2034.

The Brazil online gaming market is experiencing robust expansion driven by widespread smartphone adoption, enhanced internet connectivity, and a thriving digital entertainment culture. The country's large and digitally engaged population, combined with supportive government initiatives and expanding 5G infrastructure, creates favorable conditions for market growth. Rising esports popularity, increasing disposable incomes among urban consumers, and the accessibility of free-to-play gaming models are reshaping engagement patterns and strengthening the Brazil online gaming market share.

Key Takeaways and Insights:

- By Device Type: Mobile devices dominate the market with approximately 60.8% revenue share in 2025, driven by widespread smartphone adoption, affordable device availability, and enhanced mobile network connectivity enabling gaming access across both urban centers and remote regions.

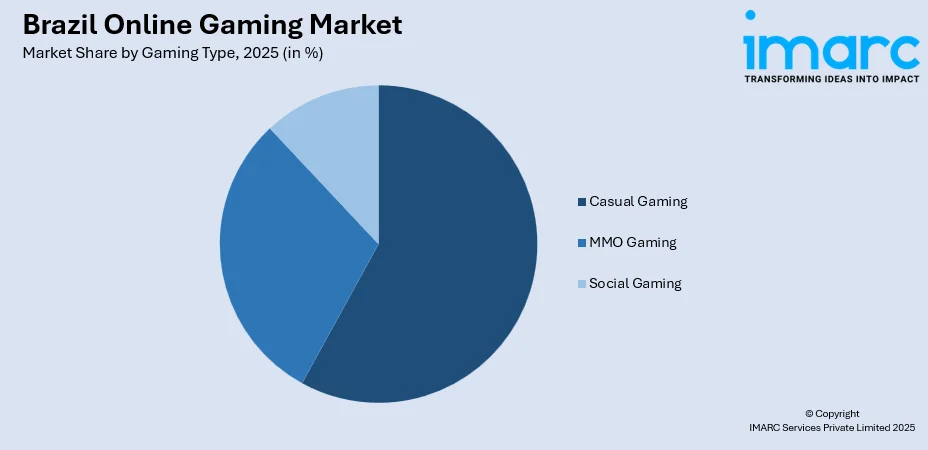

- By Gaming Type: Casual gaming leads the market with 58.7% share in 2025, reflecting Brazilian consumers' preference for accessible, easy-to-play games that accommodate busy lifestyles while offering quick entertainment sessions and social engagement opportunities.

- By Age Group: The 26-35 years demographic holds the largest share at 32.2% in 2025, representing digitally native professionals with discretionary spending power who balance gaming as a primary entertainment activity alongside work commitments.

- By Gender Demographic: Male players account for 57.5% of the market in 2025, though female participation continues expanding as mobile gaming accessibility attracts increasingly diverse player demographics across gaming genres and platforms.

- By Model: Free-to-play games dominate with 78.9% market share in 2025, reflecting the monetization model's effectiveness in attracting price-sensitive Brazilian consumers while generating revenue through optional in-app purchases and advertising.

- By Region: Southeast region holds the largest market share at 46.8% in 2025, driven by the concentration of Brazil's population, economic activity, and digital infrastructure in major metropolitan areas including São Paulo and Rio de Janeiro.

- Key Players: The Brazil online gaming market exhibits a competitive landscape with both international gaming corporations and regional developers expanding their presence through strategic partnerships, localized content development, platform investments, and esports sponsorships.

To get more information on this market Request Sample

The Brazil online gaming market is advancing rapidly as digital entertainment becomes increasingly integral to Brazilian culture. The country ranks among the world's top ten gaming markets with over 103 Million online gamers, reflecting deep consumer engagement with digital gaming platforms. Mobile gaming leads market expansion, particularly through accessible free-to-play titles that resonate with price-conscious consumers. For instance, in October 2024, Rio de Janeiro hosted the Intel Extreme Masters Counter-Strike 2 tournament at the Farmasi Arena, attracting 16 international teams and demonstrating Brazil's growing significance in the global esports ecosystem. Government initiatives supporting digital inclusion and the gaming industry's legal recognition through Law No. 14,852/2024 provide regulatory clarity and investment incentives that strengthen market fundamentals and encourage domestic game development.

Brazil Online Gaming Market Trends:

Accelerating Shift Toward Mobile-First Gaming Experiences

The Brazilian gaming landscape is witnessing a pronounced migration toward mobile platforms as smartphone accessibility expands across demographic segments. Affordable devices and competitive data plans enable gaming access for populations previously excluded from digital entertainment. Brazilian consumers increasingly favor mobile gaming for its convenience, allowing entertainment during commutes, breaks, and daily routines. The platform eliminates traditional barriers associated with console and PC gaming, including upfront hardware costs and dedicated gaming spaces. This accessibility transformation positions mobile gaming as the primary growth driver for Brazil online gaming market growth, with developers prioritizing mobile-optimized titles to capture expanding audiences across urban and emerging regional markets.

Cloud Gaming Emergence Through 5G Network Expansion

The deployment of fifth-generation wireless networks across major Brazilian metropolitan areas is unlocking cloud gaming capabilities that were previously inaccessible. High-speed, low-latency connections enable streaming of graphics-intensive games without requiring expensive hardware investments. Major telecommunications operators are integrating gaming services into their offerings, developing cloud gaming propositions that leverage advanced network infrastructure. Enterprise adoption of private networks demonstrates broader infrastructure investments supporting enhanced digital entertainment delivery. This technological advancement democratizes access to premium gaming experiences across income segments, enabling consumers with basic devices to enjoy content previously restricted to those with high-specification hardware, fundamentally reshaping market accessibility dynamics.

Professionalization of Esports and Competitive Gaming

Brazil's esports ecosystem is maturing rapidly with significant investments in professional infrastructure, league organization, and talent development programs. Major international tournaments are increasingly selecting Brazilian venues, elevating the country's profile within global competitive gaming. In May 2023, Team Liquid opened a multi-million dollar esports facility in São Paulo spanning 3,092 square meters, featuring 13 stories with offices, bootcamps, content studios, and event spaces. This investment reflects growing confidence in Brazil's competitive gaming potential and creates professional pathways for aspiring players while stimulating spectator engagement through live streaming platforms.

Market Outlook 2026-2034:

The Brazil online gaming market is positioned for sustained revenue expansion as digital entertainment consumption patterns continue evolving. The market generated a revenue of USD 3.46 Billion in 2025 and is projected to reach a revenue of USD 7.01 Billion by 2034, growing at a compound annual growth rate of 8.17% from 2026-2034, driven by expanding mobile gaming adoption, 5G network proliferation, and increasing engagement with free-to-play monetization models. Government support through the Legal Framework for Games and ongoing investments in digital infrastructure create favorable conditions for both domestic developers and international publishers. The professionalization of esports, rising disposable incomes among younger demographics, and the cultural integration of gaming as mainstream entertainment position Brazil as Latin America's leading online gaming market through the forecast period.

Brazil Online Gaming Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Device Type | Mobile Devices | 60.8% |

| Gaming Type | Casual Gaming | 58.7% |

| Age Group | 26-35 Years | 32.2% |

| Gender Demographic | Male | 57.5% |

| Model | Free-to-play Games | 78.9% |

| Region | Southeast | 46.8% |

Device Type Insights:

- Mobile Devices

- Digital Console

- Computer

Mobile devices lead the market with approximately 60.8% share in 2025, establishing dominance across Brazil's online gaming landscape.

Mobile devices have emerged as the primary gateway to digital gaming in Brazil, driven by widespread smartphone penetration and affordable device availability that extends gaming access across socioeconomic segments. The platform's accessibility eliminates traditional barriers associated with console and PC gaming, including upfront hardware costs and dedicated gaming spaces. Brazilian consumers increasingly rely on mobile devices for entertainment during commutes, breaks, and leisure time, integrating gaming seamlessly into daily routines. In 2024, operators added more than 40 Million smartphones in Brazil, while devices priced below USD 200 made up 41% of total shipments, reflecting accessibility improvements that expand the addressable gamer population across both urban centers and emerging regional markets.

Gaming Type Insights:

Access the comprehensive market breakdown Request Sample

- Casual Gaming

- MMO Gaming

- Social Gaming

Casual gaming dominates the market with 58.7% revenue share in 2025, reflecting Brazilian consumer preferences for accessible entertainment.

Casual gaming's market leadership reflects the accessibility preferences of Brazil's expanding gamer demographic, which increasingly includes first-time players attracted by low barriers to entry and intuitive gameplay mechanics. The segment thrives on short-session formats that accommodate busy schedules while delivering engaging entertainment experiences. Free-to-play casual titles particularly resonate with price-conscious Brazilian consumers, generating revenue through optional purchases while maintaining inclusive accessibility. Titles such as Candy Crush Saga, Coin Master, and Subway Surfers consistently rank among Brazil's most-played games, demonstrating sustained consumer appetite for straightforward, rewarding gaming experiences that deliver entertainment without demanding extended time commitments.

Age Group Insights:

- Below 18 Years

- 19-25 Years

- 26-35 Years

- 36-45 Years

- Over 46 Years

The 26-35 years segment holds the largest market share at 32.2% in 2025, representing the core consumer demographic.

The 26-35 years age group represents Brazil's most commercially significant gaming demographic, combining digital fluency with discretionary spending capacity that supports both free-to-play monetization and premium content purchases. This segment grew up with gaming as a primary entertainment form, maintaining engagement patterns established during childhood and adolescence. Professionals within this age range increasingly view gaming as their preferred leisure activity, dedicating evening and weekend hours to multiplayer experiences and competitive titles.

Gender Demographic Insights:

- Male

- Female

Male players account for 57.5% of the market in 2025, maintaining traditional demographic leadership.

Male consumers continue representing the majority of Brazil's gaming market, reflecting historical engagement patterns and preference concentration within action, sports, and competitive gaming genres. Marketing and content development have traditionally targeted male audiences, though this dynamic is evolving as mobile gaming attracts increasingly diverse demographics. Male players demonstrate higher engagement with esports content and competitive multiplayer experiences, contributing to their revenue share leadership through both time spent gaming and in-game purchase behavior. The demographic gap is narrowing as casual and social gaming categories attract female players, with industry surveys indicating women have become the majority among Brazilian gaming audiences when including all gaming formats.

Model Insights:

- Free-to-play Games

- Pay-to-Play Games

Free-to-play games dominate the market with 78.9% share in 2025, reflecting the prevailing monetization model.

The free-to-play model's overwhelming market dominance reflects its alignment with Brazilian consumer preferences for accessible entertainment that eliminates upfront cost barriers. This monetization approach enables publishers to build massive player bases through unrestricted access while generating revenue from optional cosmetic purchases, gameplay enhancements, and advertising. Brazilian gamers demonstrate strong engagement with free-to-play titles. Popular titles including Free Fire, Roblox, and Brawl Stars exemplify the model's effectiveness, maintaining large active player populations while generating substantial revenue through microtransaction ecosystems that reward engaged players without requiring mandatory spending.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region dominates the market with 46.8% share in 2025, driven by population concentration and infrastructure development.

The Southeast region's market leadership reflects Brazil's demographic and economic geography, with São Paulo and Rio de Janeiro metropolitan areas concentrating the country's population, economic activity, and digital infrastructure. The region hosts Brazil's most advanced telecommunications networks, with comprehensive 5G coverage enabling cloud gaming and low-latency multiplayer experiences. This ecosystem density creates favorable conditions for gaming culture development, with major esports events, gaming cafes, and professional facilities concentrated in Southeast metropolitan areas. Higher disposable incomes and urban lifestyles supporting digital entertainment consumption further strengthen regional market leadership.

Market Dynamics:

Growth Drivers:

Why is the Brazil Online Gaming Market Growing?

Expanding Smartphone Penetration and Affordable Device Availability

The democratization of smartphone access across Brazilian income segments fundamentally reshapes gaming market dynamics by eliminating traditional hardware barriers that previously restricted participation. Mobile devices serve as the primary computing platform for millions of Brazilians, enabling gaming access without dedicated console or PC investments. The combination of affordable entry-level smartphones and competitive mobile data plans creates accessible pathways to digital entertainment for populations previously excluded from gaming ecosystems.

Government Support and Regulatory Clarity Through Legal Framework

Brazil's establishment of comprehensive gaming industry legislation creates favorable conditions for market investment, domestic development, and international publisher engagement. Investments in electronic games are now recognized as contributing to research, development, innovation, and culture, creating tax advantages for companies investing in game production. This regulatory evolution represents the most significant government support since Brazil's gaming sector was officially recognized in 2003, creating what industry leaders describe as a transformative opportunity for domestic studio growth and international investment.

High-Speed Internet Expansion and 5G Network Deployment

The progressive deployment of advanced telecommunications infrastructure across Brazil enables gaming experiences that were previously inaccessible due to bandwidth and latency limitations. Fifth-generation wireless networks provide the speed and responsiveness required for cloud gaming, real-time multiplayer experiences, and content streaming without local hardware dependencies. Major metropolitan areas including São Paulo, Rio de Janeiro, Curitiba, and Porto Alegre have achieved full 5G rollout, enabling advanced gaming applications in densely populated zones. This infrastructure transformation supports market expansion by reducing barriers associated with expensive gaming hardware while enabling new gaming formats including augmented reality and cloud-based experiences.

Market Restraints:

What Challenges the Brazil Online Gaming Market is Facing?

Hardware Accessibility Limitations and Device Constraints

Despite improvements in smartphone affordability, the prevalence of entry-level devices with limited processing capabilities restricts engagement with graphics-intensive gaming experiences. Many affordable smartphones lack the advanced graphics processing units required for premium mobile titles, limiting the addressable market for high-fidelity games. Console and PC gaming remain constrained by import costs and pricing that exceeds purchasing power for significant population segments, limiting hardware-based gaming adoption.

Rural and Semi-Urban Connectivity Gaps

Geographic disparities in telecommunications infrastructure create uneven gaming accessibility across Brazilian territory. Rural and semi-urban areas frequently experience insufficient network coverage, inconsistent connection speeds, and limited access to the high-speed connectivity required for competitive multiplayer and cloud gaming experiences. These infrastructure gaps prevent substantial population segments from fully participating in online gaming ecosystems and delay market expansion into emerging regional areas.

Complex Taxation and Import Cost Structure

Brazil's taxation framework continues imposing significant cost burdens on gaming hardware, software, and development equipment that elevate consumer prices and restrict industry competitiveness. Protectionist measures increase import costs for consoles, peripherals, and development tools, limiting both consumer access and domestic studio capabilities. The complexity of Brazil's tax system presents challenges for gaming companies seeking to optimize operations while remaining compliant with regulatory requirements.

Competitive Landscape:

The Brazil online gaming market features a dynamic competitive environment with international gaming corporations, regional developers, and digital distribution platforms competing for consumer engagement. Major publishers have intensified their focus on Brazilian market localization, adapting content and marketing strategies to resonate with local cultural preferences and Portuguese language requirements. Strategic partnerships between global technology companies and domestic operators are accelerating market development, with recent collaborations focusing on content localization, payment integration, and esports infrastructure. The free-to-play segment demonstrates particularly intense competition, with publishers differentiating through game quality, monetization fairness, and community engagement approaches. Brazilian indie studios are gaining international recognition, leveraging government support programs and the Brazil Games export initiative to expand into global markets while contributing to domestic gaming culture development.

Recent Developments:

- In September 2025, Games Global partnered with Spin Gaming to launch Brazil's first fully localized live casino studio, operating from a state-of-the-art facility in São Paulo. The partnership established the country's first specialized academy for training live casino dealers and game presenters, creating hundreds of jobs for local talent while positioning Brazil as a content producer rather than solely a consumer in the digital gaming landscape.

Brazil Online Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Mobile Devices, Digital Consoles, Computer |

| Gaming Types Covered | Casual Gaming, MMO Gaming, Social Gaming |

| Age Groups Covered | Below 18 Years, 19-25 Years, 26-35 Years, 36-45 Years, over 46 Years |

| Gender Demographics Covered | Male, Female |

| Models Covered | Free-to-play Games, Pay-to-Play Games |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil online gaming market size was valued at USD 3.46 Billion in 2025.

The Brazil online gaming market is expected to grow at a compound annual growth rate of 8.17% from 2026-2034 to reach USD 7.01 Billion by 2034.

Mobile devices held the largest revenue share at approximately 60.8% in 2025, driven by widespread smartphone adoption, affordable device availability, enhanced mobile network connectivity, and consumer preference for accessible gaming experiences during daily activities.

Key factors driving the Brazil online gaming market include expanding smartphone penetration and affordable device availability, government support through the Legal Framework for Games, expansion of high-speed internet and 5G infrastructure, rising popularity of esports and competitive gaming, and growing consumer spending on digital entertainment.

Major challenges include hardware accessibility limitations with entry-level devices lacking advanced graphics capabilities, rural and semi-urban connectivity gaps affecting streaming and multiplayer experiences, complex taxation and import cost structures elevating consumer prices, and infrastructure disparities across geographic regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)