Brazil Portable Power Station Market Size, Share, Trends and Forecast by Operation Type, Technology Type, Capacity Type, Application, and Region, 2026-2034

Brazil Portable Power Station Market Summary:

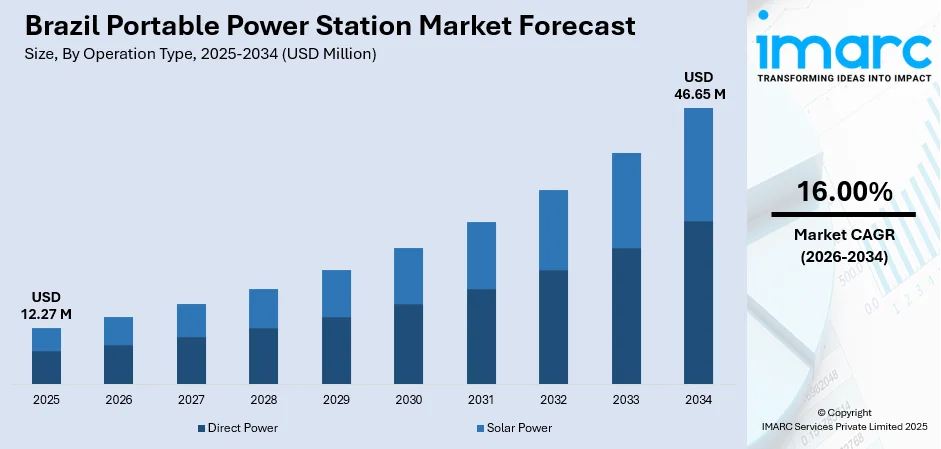

The Brazil portable power station market size was valued at USD 12.27 Million in 2025 and is projected to reach USD 46.65 Million by 2034, growing at a compound annual growth rate of 16.00% from 2026-2034.

The Brazil portable power station market is driven by increasing frequency of power outages across major metropolitan areas, growing consumer interest in outdoor recreational activities, and the expanding adoption of renewable energy solutions for backup power needs. Rising disposable incomes among Brazil's middle class, combined with heightened awareness of energy independence and grid reliability concerns, are encouraging households and businesses to invest in portable power solutions. The country's extensive natural landscapes and emerging eco-tourism sector further support demand for compact, rechargeable battery-based systems that enable off-grid power access.

Key Takeaways and Insights:

- By Operation Type: Direct power dominates the market with a share of 63% in 2025, driven by consumer preference for versatile charging options that allow immediate wall outlet or vehicle-based recharging, providing convenient backup power solutions without dependency on weather conditions or extended charging times.

- By Technology Type: Lithium-ion leads the market with a share of 87% in 2025, owing to superior energy density, longer cycle life, and declining battery costs that make these units lighter, more compact, and cost-effective compared to traditional sealed lead-acid alternatives.

- By Capacity Type: 500 WH to 999 WH comprises the largest segment with a market share of 36% in 2025, driven by optimal balance between portability and power output that suits both residential backup needs and outdoor recreation applications without excessive weight.

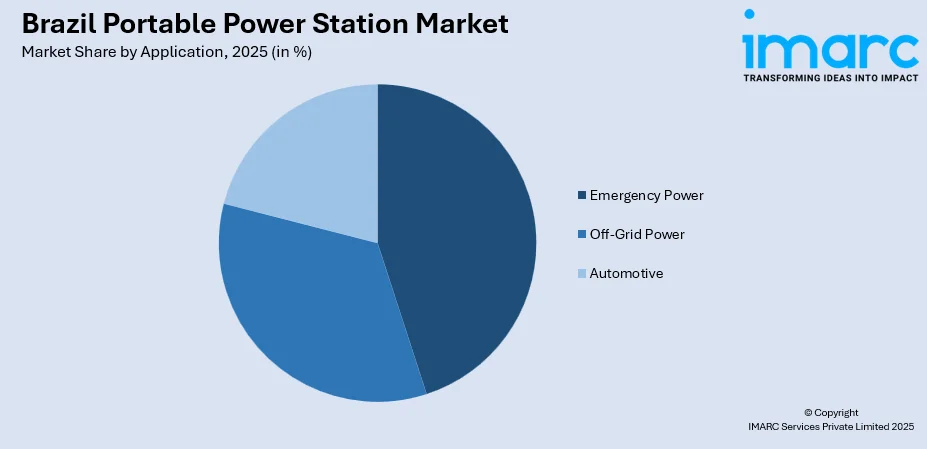

- By Application: Emergency power prevails the market with a share of 45% in 2025, attributable to recurring grid instability across major urban centers and increasing consumer awareness of backup power necessity for essential household appliances.

- By Region: Southeast represents the largest region with a market share of 33% in 2025, supported by concentration of Brazil's economic activity in São Paulo and Rio de Janeiro metropolitan areas, higher household incomes, and greater exposure to grid reliability challenges.

- Key Players: The Brazil portable power station market exhibits moderate competitive intensity, with international brands competing alongside regional distributors across various price segments and capacity ranges, focusing on product differentiation through battery technology, solar compatibility, and digital connectivity features.

To get more information on this market Request Sample

In Brazil, the portable power station market is experiencing substantial momentum as grid reliability challenges continue to affect millions of households. In October 2024, severe storms in São Paulo left over 1.4 Million households without electricity for multiple days, highlighting the critical need for backup power solutions. The growth of camping, travel, and remote work is also boosting the demand for lightweight and easy-to-use power devices. Technological improvements in battery efficiency and compact designs are making portable power stations more affordable and powerful. The increasing use of solar-compatible power stations further supports the market expansion by enabling clean, off-grid energy solutions. E-commerce growth and wider product availability are improving consumer access. As awareness about energy independence is rising, the demand is expected to remain strong. Overall, innovations, lifestyle changes, and sustainability interests will continue to drive steady growth of the market.

Brazil Portable Power Station Market Trends:

Rising Integration of Solar-Compatible Charging Systems

The Brazil portable power station market is witnessing accelerated adoption of solar-compatible units as distributed solar generation transforms the national energy landscape. Consumer demand for hybrid charging capabilities that combine wall outlet, vehicle, and photovoltaic panel inputs is reshaping product development priorities. Brazil is expected to attain 40 GW of distributed solar power capacity by 2025, creating favorable conditions for solar-integrated portable power systems that enable extended off-grid usage during camping expeditions and emergency situations.

Expansion of Smart Connectivity and Mobile Application Features

Digital integration is transforming portable power station functionality, with manufacturers embedding smartphone applications that enable remote monitoring, power management, and predictive maintenance alerts. As of November 2025, Brazil had around 217 Million internet users, with 175 Million of them being active smartphone users. These connectivity features allow users to track remaining capacity, optimize charging cycles, and receive notifications during power outages, enhancing user experience and product value proposition. Smart features particularly appeal to Brazil's tech-savvy urban consumers who prioritize convenience and real-time information access when selecting backup power equipment for residential and recreational applications.

Increasing tourism activities

Rising tourism activities are driving the market expansion in Brazil, as travelers are seeking reliable power for camping, beach trips, and eco-tourism. While participating in the Visit Brazil Summit, the World Travel & Tourism Council (WTTC) revealed an optimistic forecast for Brazil's Travel and Tourism industry in 2025, with an expected contribution of USD167.6 Billion to the nation’s GDP, accounting for 7.7% of the overall economy. Tourists use power stations to charge phones, cameras, and small appliances in remote areas. Adventure tourism increases demand for lightweight, solar-compatible devices. Hotels and tour operators also adopt portable power for outdoor services and events.

Market Outlook 2026-2034:

Market momentum will be sustained by continued grid infrastructure challenges, expanding outdoor recreation participation, and declining lithium-ion battery costs that enhance product affordability. The market generated a revenue of USD 12.27 Million in 2025 and is projected to reach a revenue of USD 46.65 Million by 2034, growing at a compound annual growth rate of 16.00% from 2026-2034. Government initiatives aimed at promoting renewable energy adoption and the growing consumer emphasis on energy independence will create favorable conditions for the market penetration across residential, commercial, and recreational segments, establishing portable power stations as essential components of Brazil's evolving energy landscape.

Brazil Portable Power Station Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Operation Type | Direct Power | 63% |

| Technology Type | Lithium‑Ion | 87% |

| Capacity Type | 500 WH To 999 WH | 36% |

| Application | Emergency Power | 45% |

| Region | Southeast | 33% |

Operation Type Insights:

- Direct Power

- Solar Power

Direct power dominates with a market share of 63% of the total Brazil portable power station market in 2025.

The direct power segment maintains market leadership through its versatility and accessibility, allowing consumers to recharge portable power stations via standard wall outlets, vehicle adapters, and generator connections without requiring additional equipment investments. This operational flexibility appeals to urban consumers seeking immediate backup power solutions for residential applications, where consistent grid access enables rapid recharging between usage cycles. Brazil's established electrical infrastructure across major metropolitan areas supports direct power adoption, with households valuing the convenience of overnight charging that ensures full capacity availability during unexpected outages.

The segment's dominance reflects practical consumer preferences for straightforward charging methods that integrate seamlessly with existing household electrical systems. Direct power units typically offer faster recharging times compared to solar alternatives, reaching full capacity within one to two hours under optimal conditions, which proves particularly valuable during emergency situations requiring rapid deployment. The operational simplicity reduces barriers to adoption among less technically oriented consumers while maintaining compatibility with solar panel accessories for users seeking hybrid functionality.

Technology Type Insights:

- Lithium-Ion

- Sealed Lead-Acid

Lithium-ion leads with a share of 87% of the total Brazil portable power station market in 2025.

Lithium-ion technology has established overwhelming market dominance through superior performance characteristics that include higher energy density, reduced weight, longer operational lifespan, and lower self-discharge rates compared to sealed lead-acid alternatives. These advantages enable manufacturers to design compact, portable units that deliver substantial power output while remaining manageable for individual transport. As per IMARC Group, the Brazil lithium-ion battery market size is valued at USD 1,295.94 Million in 2025 and is projected to reach USD 3,218.70 Million by 2034, growing at a compound annual growth rate of 10.64% from 2026-2034.

The technology segment benefits from continuous innovations in battery chemistry, with lithium iron phosphate variants gaining traction for their enhanced thermal stability and extended cycle life. This evolution addresses consumer concerns regarding battery longevity and safety, particularly for units stored in residential environments or transported during outdoor activities. Manufacturing investments across Latin America, including battery production facilities in Brazil, are strengthening regional supply chains and supporting competitive pricing that accelerates lithium-ion adoption across consumer segments.

Capacity Type Insights:

- Less Than 500 WH

- 500 WH To 999 WH

- 1000 WH To 1499 WH

- 1500 WH And Above

500 WH to 999 WH exhibits a clear dominance with a 36% share of the total Brazil portable power station market in 2025.

500 WH to 999 WH capacity type captures the largest market share by delivering optimal balance between power output and portability that addresses diverse consumer applications. Units within this capacity range typically weigh between 15 and 25 pounds, enabling individual transport while providing sufficient energy storage to power essential devices, including smartphones, laptops, small appliances, and medical equipment during extended outages. This versatility positions mid-capacity units as practical solutions for both residential backup and outdoor recreation scenarios.

Consumer preference for this capacity range reflects pragmatic assessment of actual power requirements versus investment cost and portability constraints. While higher-capacity units offer extended runtime, their increased weight and price points limit appeal among mainstream consumers who prioritize convenience alongside functionality. The 500 WH to 999 WH range effectively powers camping equipment, charges multiple devices simultaneously, and maintains essential household appliances during typical outage durations, delivering strong value proposition that drives segment leadership.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Emergency Power

- Off-Grid Power

- Automotive

Emergency power represents the leading segment with a 45% share of the total Brazil portable power station market in 2025.

Emergency power applications drive the market growth, as Brazilian consumers increasingly recognize backup power necessity following high-profile grid disruptions affecting major population centers. Recurring severe weather events that damage electrical infrastructure have elevated consumer awareness regarding household preparedness, with portable power stations emerging as preferred alternatives to traditional fuel-based generators. The segment benefits from urban population concentration where noise restrictions and emissions concerns limit generator viability, positioning battery-based solutions as practical residential backup options.

Portable stations are easy to store, quick to activate, and safe to use indoors compared to fuel-based generators. They power essential devices, such as lights, routers, and medical equipment, without noise or fumes. Rising ownership of electronic devices increases the need for backup solutions. By May 2024, there were 480 Million digital devices, including computers, laptops, tablets, and smartphones, in use for corporate or personal purposes in Brazil, averaging 2.2 devices per inhabitant, as reported in the 35th edition of the Annual Survey of the Brazilian IT Market and Corporate IT Use. In addition, offices, retail shops, and rural users adopt portable power to avoid operational disruptions. The ability to recharge through solar or wall outlets also adds convenience, making emergency power the most practical and widely adopted application segment in Brazil.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast dominates with a market share of 33% of the total Brazil portable power station market in 2025.

Southeast leads the portable power station market due to its high population density, strong urban infrastructure, and greater purchasing power. The region has more households and businesses investing in backup power solutions. High adoption of electronic devices and digital services also increases demand for reliable portable energy systems.

The Southeast also benefits from better distribution networks, strong e-commerce penetration, and a higher presence of electronics retailers, making portable power stations easily accessible to consumers. The Seade Foundation published findings on internet usage, indicating the strengthening of e-commerce in São Paulo, with 67% of residents buying online by 2025, of whom 56% had made purchases in May 2025, highlighting the routine nature of digital shopping. Growing outdoor culture, remote work trends, and emergency preparedness awareness further support sales. Commercial users, such as small offices, shops, and service providers, widely adopt portable power solutions to ensure operational continuity. In addition, higher awareness about clean energy devices and solar compatibility is encouraging buyers to choose battery-based power systems.

Market Dynamics:

Growth Drivers:

Why is the Brazil Portable Power Station Market Growing?

Increasing Frequency and Severity of Power Outages Across Urban Centers

Surging frequency and severity of power outages across urban centers are significantly driving the market expansion, as households and businesses seek reliable backup power solutions. In October 2025, a blaze at an energy substation operated by Brazilian company Eletrobras resulted in a power failure in various regions of Brazil, causing an overall shutdown of about 10,000 Megawatts (MW) of demand and impacting over 1 Million customers. City residents depend heavily on electricity for internet access, communication, food storage, and digital payments, making even short outages disruptive. Portable power stations provide a quick, clean, and easy alternative to fuel generators, allowing users to maintain daily activities during blackouts. Small businesses, clinics, and home offices increasingly invest in these systems to avoid operational losses and service interruptions. Urban apartment living also favors compact, battery-based solutions that are safe for indoor use and easy to store. As urban lifestyles are becoming more technology-driven, awareness about energy reliability is increasing. This growing need for uninterrupted power supply strengthens demand for portable power stations, supporting steady market expansion across Brazil’s major cities.

Expanding Outdoor Recreation and Adventure Tourism Participation

Expanding outdoor recreation and adventure tourism participation is driving the market expansion, as travelers increasingly require reliable electricity in remote locations. Campers, trekkers, and eco-tourists need power to charge smartphones, cameras, lights, and portable cooking equipment where grid access is unavailable. Portable power stations offer a convenient and safe solution compared to fuel generators, supporting quiet and eco-friendly travel. Growth in beach tourism, forest exploration, and rural stays boosts demand for lightweight, solar-compatible power devices. Tour operators and camp operators also use portable power to improve guest services in off-grid destinations. In addition, social media usage encourages tourists to stay connected, further increasing power needs. According to DataReportal, in January 2025, Brazil had 144 Million social media user accounts, representing 67.8% of the entire population. As experiential travel is becoming more popular, reliable off-grid electricity is viewed as a necessity rather than a luxury, supporting stronger and sustained growth for portable power stations in Brazil.

Declining Lithium-Ion Battery Costs Enhancing Product Affordability

Declining lithium-ion battery costs are significantly fueling the market expansion by making products more affordable to a wider customer base. As battery prices fall, manufacturers can offer higher-capacity power stations at lower price points, attracting households, small businesses, and outdoor users. Improved affordability encourages first-time buyers and supports faster replacement cycles for older models. Lower battery costs also allow companies to invest in better features, such as faster charging, longer battery life, and compact designs, without raising prices. This improves overall product value and customer satisfaction. Retailers can introduce more models across different price ranges, expanding market reach beyond premium customers. In addition, finance schemes and online sales further support accessibility. As cost barriers decline, adoption increases across urban and rural areas, strengthening overall market growth in Brazil.

Market Restraints:

What Challenges the Brazil Portable Power Station Market is Facing?

Limited Power Capacity Compared to Traditional Generator Alternatives

Portable power stations face inherent capacity limitations that restrict their utility for heavy-duty applications requiring sustained high-wattage output over extended periods. While units provide convenient backup for essential electronics and small appliances, they cannot match fuel-based generators' ability to power air conditioning systems, electric heating, or multiple high-draw devices simultaneously for prolonged durations.

High Initial Purchase Costs Limiting Mass Market Penetration

Premium portable power stations with adequate capacity for comprehensive household backup require significant upfront investment that exceeds budget constraints for many Brazilian consumers. Entry-level units with limited capacity offer lower price points but may not satisfy essential backup requirements, creating purchase decision complexity that delays adoption among cost-sensitive market segments.

Import Dependency and Supply Chain Vulnerability

Import dependency and supply chain vulnerability slow the growth of the market by increasing costs and causing product shortages. Reliance on imported batteries and electronics exposes the market to currency fluctuations and shipping delays. Disruptions lead to longer delivery times and unstable pricing, reducing consumer confidence. Limited local manufacturing also restricts innovations and customization for local needs.

Competitive Landscape:

The Brazil portable power station market features diverse competitive dynamics with international brands establishing market presence alongside regional distributors and emerging domestic players. Competition centers on product differentiation through battery technology specifications, charging speed capabilities, solar compatibility features, and smart connectivity functions that enhance user experience. Market participants pursue varied positioning strategies spanning premium segments emphasizing advanced features and extended warranties to value-oriented offerings targeting price-sensitive consumers seeking basic backup functionality. Distribution channel development represents key competitive battleground, as manufacturers balance direct-to-consumer (D2C) e-commerce approaches against traditional retail partnerships that provide product demonstration opportunities and after-sales support capabilities. Strategic partnerships with outdoor recreation retailers, electronics distributors, and solar installation companies enable market access expansion while brand awareness investments through digital marketing and influencer collaborations support consumer education regarding product categories and applications.

Brazil Portable Power Station Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Operation Types Covered | Direct Power, Solar Power |

| Technology Types Covered | Lithium-Ion, Sealed Lead-Acid |

| Capacity Types Covered | Less Than 500 WH, 500 WH To 999 WH, 1000 WH To 1499 WH, 1500 WH And Above |

|

Applications Covered |

Emergency Power, Off-Grid Power, Automotive |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil portable power station market size was valued at USD 12.27 Million in 2025.

The Brazil portable power station market is expected to grow at a compound annual growth rate of 16.00% from 2026-2034 to reach USD 46.65 Million by 2034.

Direct power dominates the market with a share of 63%, as users prefer immediate, reliable electricity for home backup, outdoor activities, and worksites. It supports multiple devices simultaneously without depending on sunlight or charging conditions, ensuring consistent performance anytime.

Key factors driving the Brazil portable power station market include increasing frequency of power outages across major metropolitan areas, expanding outdoor recreation and adventure tourism participation, declining lithium-ion battery costs enhancing product affordability, growing consumer awareness about energy independence benefits, and rising adoption of renewable energy solutions for backup power needs.

Major challenges include limited power capacity compared to traditional generators restricting heavy-duty applications, high initial purchase costs limiting mass market penetration, import dependency creating supply chain vulnerability, consumer education requirements regarding product capabilities and limitations, and competition from alternative backup power solutions in commercial segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)