Brazil Pre-cooked Flour Market Size, Share, Trends and Forecast by Nature, Source, End Use, Distribution Channel, and Region, 2026-2034

Brazil Pre-cooked Flour Market Summary:

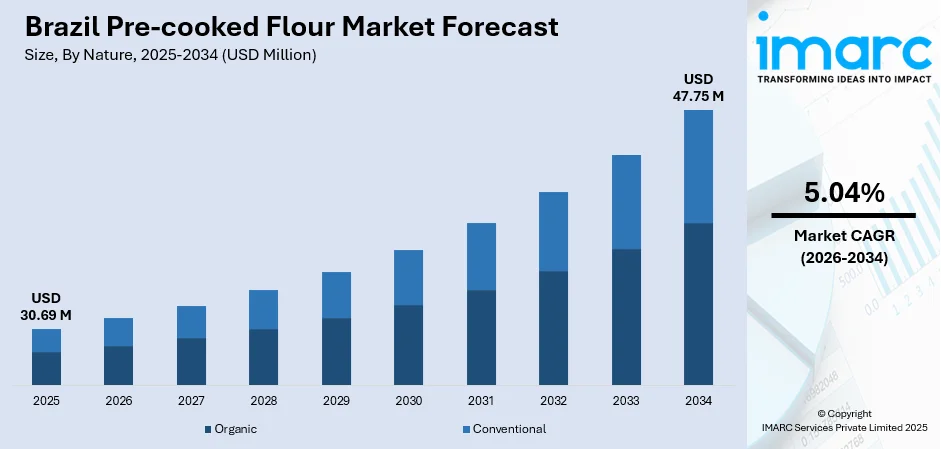

The Brazil pre-cooked flour market size was valued at USD 30.69 Million in 2025 and is projected to reach USD 47.75 Million by 2034, growing at a compound annual growth rate of 5.04% from 2026-2034.

The market is experiencing steady expansion, driven by changing consumer lifestyles that prioritize convenience and reduced meal preparation time. The growing urbanization across major Brazilian metropolitan areas is increasing the demand for ready-to-use food ingredients that deliver consistent quality in bakery, pasta, and snack applications. The expanding food and beverage processing sector continues to adopt pre-cooked flour formulations for efficient large-scale manufacturing, while rising health consciousness among Brazilian consumers is generating interest in nutrient-enriched and gluten-free variants that cater to dietary preferences and medical requirements.

Key Takeaways and Insights:

-

By Nature: Conventional comprises the largest segment with a market share of 65% in 2025, as it is affordable, widely available, and trusted for daily cooking. Strong distribution, familiar taste, and suitability for mass consumption make it the preferred choice for households, food vendors, and bakeries across different income groups.

-

By Source: Wheat dominates the market with a share of 42% in 2025, driven by its extensive applications across bakery products, pasta manufacturing, and its established role in traditional Brazilian cuisine, including bread and confectionery production.

-

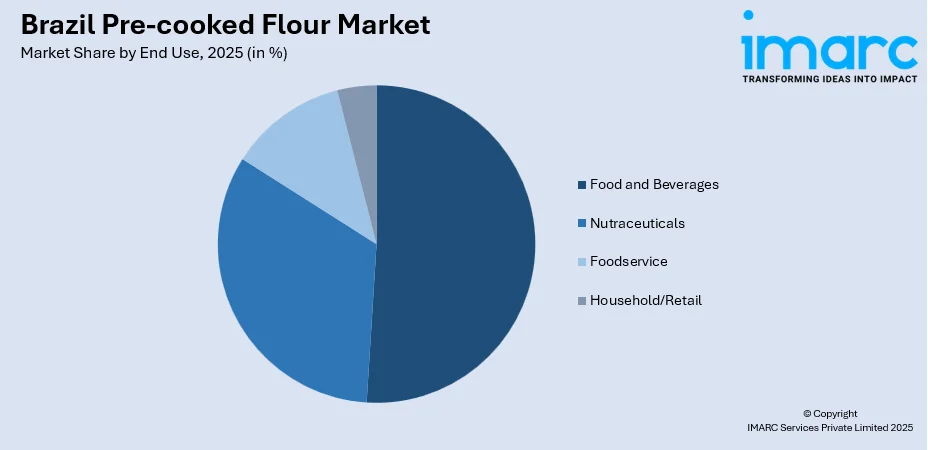

By End Use: Food and beverages lead the market with a share of 51% in 2025, owing to the sector's significant demand for convenience ingredients that reduce processing time while maintaining consistent texture and taste profiles across manufactured products.

-

By Distribution Channel: Business to business prevails the market with a share of 59% in 2025. This dominance is driven by bulk procurement practices of food processing companies, institutional buyers, and foodservice operators who require consistent supply for large-scale production requirements.

-

By Region: Southeast represents the largest region with a market share of 45% in 2025, supported by the concentration of food processing industries in São Paulo and the presence of major population centers, driving consumption volumes across retail and industrial segments.

-

Key Players: Key players are investing in product innovations, improving packaging, expanding distribution networks, and educating consumers about usage benefits. Strategic pricing, branding, and partnerships with retailers help increase visibility, availability, and trust, accelerating adoption across urban and rural markets alike.

To get more information on this market Request Sample

The Brazil pre-cooked flour market shows a strong positive outlook, driven by changing lifestyles, increasing demand for convenience foods, and the growing preference for easy-to-prepare meal solutions. Urbanization and busy work schedules are encouraging households to choose quick cooking ingredients without sacrificing taste or quality. Manufacturers are introducing improved textures, blended flours, and fortified options to meet diverse consumer needs. Food service outlets and bakeries are also increasing the use of pre-cooked flour for consistency and efficiency in production. Innovations in packaging, longer shelf life, and better branding are enhancing consumer trust and repeat purchases. Moreover, rising wheat production is improving raw material availability and stabilizing supply chains for manufacturers. In 2024, Brazil saw a 3% increase in wheat flour output, surpassing 13.19 Million Tons, as reported by the Brazilian Wheat Industry Association (Abitrigo).

Brazil Pre-cooked Flour Market Trends:

Rising Demand for Convenience-Oriented Food Products

Brazilian consumers increasingly seek quick and easy meal solutions that require minimal preparation without compromising on taste and nutrition. The accelerating pace of urban lifestyles is driving household and commercial adoption of pre-cooked flour products that significantly reduce cooking time. The food delivery industry in Brazil is experiencing substantial growth, with revenue reaching USD 1.5 Billion in 2025, reflecting changing dining habits. This convenience-seeking behavior extends to ingredient selection, where pre-cooked flour products enable faster preparation of traditional dishes and snacks across residential and commercial kitchens.

Broadening of E-commerce Portals

The expansion of e-commerce portals is driving the market growth in Brazil by improving product accessibility, especially in areas with limited physical retail options. As per the International Trade Administration (ITA), Brazil is witnessing rapid growth in e-commerce demand, and the industry is set to achieve USD 36.3B in revenue by 2025. Online platforms allow consumers to explore multiple brands, compare prices, read reviews, and choose products based on preferences such as grain type or packaging size. Home delivery services add convenience, encouraging repeat purchases and bulk buying. Digital promotions, subscription models, and discount offers also attract price-sensitive customers. For manufacturers, e-commerce reduces dependence on traditional distribution channels and helps reach a wider audience at lower cost.

Technological Innovations in Processing Methods

Advanced processing technologies are enhancing the functional properties and shelf stability of pre-cooked flour products across the Brazilian market. Thermoplastic extrusion technology enables full utilization of whole grains without separating husks, resulting in products with improved nutritional retention and extended shelf life. Research institutions are exploring novel grain combinations and processing parameters to optimize texture, taste, and nutritional characteristics of pre-cooked flour variants. These technological advancements support product differentiation strategies while addressing manufacturer requirements for consistent quality in large-scale food production applications.

Market Outlook 2026-2034:

The Brazil pre-cooked flour market is anticipated to witness sustained revenue growth during the forecast period, driven by structural shifts in consumer behavior and food manufacturing practices. The market generated a revenue of USD 30.69 Million in 2025 and is projected to reach a revenue of USD 47.75 Million by 2034, growing at a compound annual growth rate of 5.04% from 2026-2034. The market is supported by continued urbanization and the proliferation of convenience-focused food products across retail and foodservice channels. Ongoing investments in food processing infrastructure and ingredient innovation are expected to generate new application opportunities, while growing export potential for value-added flour products may provide additional revenue streams for market participants.

Brazil Pre-cooked Flour Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Nature | Conventional | 65% |

| Source | Wheat | 42% |

| End Use | Food and Beverages | 51% |

| Distribution Channel | Business to Business | 59% |

| Region | Southeast | 45% |

Nature Insights:

- Organic

- Conventional

Conventional comprises the largest segment with a market share of 65% of the total Brazil pre-cooked flour market in 2025.

Conventional pre-cooked flour leads the market mainly because it is more affordable and widely available than organic alternatives. Most households prefer budget friendly staples for daily cooking, and conventional flour fits easily into regular meal planning. Its consistent supply supports stable pricing, making it the first choice for large families, restaurants, and small food businesses.

From the supply side, conventional production benefits from large scale farming and established distribution channels. Manufacturers can produce in higher volumes, maintain uniform quality, and serve both urban and rural markets efficiently. Retailers stock conventional flour more heavily due to faster turnover and stronger demand. Greater brand presence, frequent promotional offers, and bulk packaging options further strengthen its position. These factors keep conventional pre-cooked flour the dominant segment across diverse consumer groups in Brazil.

Source Insights:

- Wheat

- Corn

- Rice

- Barley

- Legumes

Wheat dominates with a market share of 42% of the total Brazil pre-cooked flour market in 2025.

Wheat leads the market because it fits easily into everyday eating habits across households and foodservice outlets. Safras & Mercado predicts Brazil's wheat output will hit 9.125 Million Tons in 2025, marking a 17.4% rise compared to 2024. Its neutral flavor and flexible consistency allow it to be used in a wide range of recipes, from flatbreads to snacks and baked foods.

Consumers also associate wheat with familiarity and comfort foods, which supports higher purchase frequency compared to alternative sources like maize or rice. From a production viewpoint, wheat offers stable processing characteristics and uniform texture, making it ideal for pre-cooking and packaging at scale. Manufacturers can standardize quality, extend shelf life, and maintain taste consistency across batches. Wheat flour also adapts well to fortification and blending, enabling product variety. Strong retail presence, established supply chains, and ease of storage further strengthen wheat’s dominance in the Brazil pre-cooked flour market.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Nutraceuticals

- Foodservice

- Household/Retail

Food and beverages lead with a share of 51% of the total Brazil pre-cooked flour market in 2025.

The food and beverages sector represents the primary consumption channel for pre-cooked flour products, driven by large-scale manufacturing requirements for consistent ingredient quality. Biscuit, pasta, and industrialized bread categories collectively represent substantial consumer spending, creating sustained demand for pre-cooked flour ingredients that optimize production efficiency. The sector's emphasis on clean-label formulations and reduced preparation complexity aligns with pre-cooked flour functional advantages.

Food manufacturers increasingly prioritize ingredients that reduce processing time while maintaining product consistency across production batches. Pre-cooked flour products enable manufacturers to achieve desired texture and taste profiles with reduced cooking cycles, supporting operational efficiency improvements. The growing popularity of convenience-oriented packaged foods, including instant meal preparations and ready-to-cook products, generates expanding opportunities for pre-cooked flour integration. Major food processing companies continue to evaluate ingredient innovations that address consumer preferences for nutritional enhancement while maintaining familiar taste characteristics.

Distribution Channel Insights:

- Business to Business

- Business to Consumer

Business to business exhibits a clear dominance with a 59% share of the total Brazil pre-cooked flour market in 2025.

The business to business distribution channel dominates market revenues through bulk procurement arrangements between pre-cooked flour manufacturers and food processing companies. Industrial buyers prioritize consistent quality specifications, reliable supply schedules, and competitive pricing structures that bulk purchasing enables.

Major food manufacturers maintain long-term supplier relationships that ensure ingredient availability during peak production periods. Distribution infrastructure supporting business to business transactions encompasses specialized logistics networks, warehousing facilities, and quality assurance protocols tailored to industrial requirements. Food processing clusters concentrated in São Paulo and surrounding regions benefit from proximity to major pre-cooked flour production facilities, reducing transportation costs and lead times. Technical support services provided by business to business suppliers assist manufacturers in optimizing ingredient utilization and adapting formulations to specific product requirements. The channel's dominance reflects the structural characteristics of the Brazilian food industry where large-scale processors drive ingredient consumption patterns.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast represents the leading segment with a 45% share of the total Brazil pre-cooked flour market in 2025.

Southeast leads the pre-cooked flour market due to rising population, higher incomes, and time constrained lifestyles that favor quick meals. As per World Population Review, the projected population of Sao Paulo for 2025 is 22,990,000. Large cities generate steady demand for packaged staples used in homes, bakeries, and foodservice outlets. Strong retail penetration ensures availability across neighborhoods, while promotions and private labels stimulate frequent purchases.

Consumers show greater openness to new formats, flavored mixes, and premium variants backed by loyalty programs. Food manufacturing clusters and milling capacity concentrate in the Southeast, shortening supply chains and lowering logistics costs. Ports, highways, and warehousing improve inbound grain flows and outbound distribution across Brazil. Marketing agencies and distributors collaborate closely, accelerating launches and shelf placement. With skilled labor and financing access, producers maintain quality, faster replenishment, and broader assortments that reinforce regional leadership consistently to meet demand spikes during seasons nationwide.

Market Dynamics:

Growth Drivers:

Why is the Brazil Pre-cooked Flour Market Growing?

Expanding Food Processing Industry and Industrial Demand

Brazil's food processing sector continues to demonstrate robust growth that directly stimulates pre-cooked flour consumption across manufacturing applications. The Brazilian Food Processors' Association announced that revenue for the Brazilian food processing sector in 2024 reached USD 233 Billion, reflecting a 9.9% increase from 2023. This expansion reflects ongoing investments in production capacity, technology modernization, and product development initiatives that require consistent ingredient supply. Pre-cooked flour products offer food manufacturers significant advantages in production efficiency, enabling reduced processing time while maintaining quality standards. The sector's continued growth trajectory creates sustained demand for ingredients that support large-scale manufacturing requirements across bakery, confectionery, pasta, and snack categories.

Urbanization and Changing Consumer Lifestyles

Accelerating urbanization across Brazilian metropolitan areas is fundamentally reshaping food consumption patterns and ingredient preferences. As per macrotrends, the urban population of Brazil in 2023 stood at 185,356,223. Brazil's highly urbanized population increasingly relies on prepared meals and convenience-oriented food solutions that align with time-constrained lifestyles. This demographic shift generates demand for pre-cooked flour products that enable faster meal preparation without sacrificing taste or nutritional quality. Urban consumers demonstrate willingness to adopt innovative food products that simplify cooking processes while delivering familiar flavor profiles. The proliferation of quick-service restaurants (QSRs), cafeterias, and institutional food services in urban centers creates additional demand channels for pre-cooked flour ingredients across commercial applications.

Rising Health Awareness and Functional Food Demand

The growing health and wellness consciousness among Brazilian consumers is propelling the market growth. As per IMARC Group, the Brazil health and wellness market size reached USD 91.3 Billion in 2025. Consumer interest in functional foods, clean-label products, and dietary-specific options is accelerating market development for specialized pre-cooked flour formulations. The combination of protein-enriched and fiber-enhanced pre-cooked flour variants addresses evolving consumer preferences for products supporting health and wellness objectives. This trend supports premium product development and market segmentation strategies that generate additional revenue opportunities. Families and working professionals also prefer nutritious options that reduce cooking time without compromising food quality. This shift in eating habits is encouraging brands to innovate with better formulations, clearer labeling, and healthier alternatives. As food becomes more closely linked with personal well-being, pre-cooked flour continues to gain popularity across households in Brazil.

Market Restraints:

What Challenges the Brazil Pre-cooked Flour Market is Facing?

Raw Material Price Volatility and Import Dependency

Brazil's significant dependence on imported wheat creates exposure to international price fluctuations and currency exchange variations that impact pre-cooked flour production costs. Domestic wheat production remains insufficient to meet total consumption requirements, necessitating substantial imports that introduce supply chain complexity and cost uncertainty.

Competition from Alternative Convenience Ingredients

Pre-cooked flour products face competitive pressure from other convenience-oriented food ingredients and ready-to-use preparations that address similar consumer needs. Alternative starch sources, ready-mix products, and frozen convenience foods compete for consumer attention and manufacturer adoption across similar application categories.

Infrastructure and Distribution Challenges

Logistics infrastructure limitations in certain Brazilian regions constrain pre-cooked flour distribution efficiency and market accessibility. Transportation costs and storage requirements for maintaining product quality represent ongoing operational challenges, particularly for serving remote or less-developed market areas where distribution networks remain underdeveloped.

Competitive Landscape:

The Brazil pre-cooked flour market features a moderately fragmented competitive environment, characterized by the presence of established domestic food companies alongside regional specialty manufacturers. Market participants employ diverse competitive strategies, including product innovations, quality differentiation, and distribution network expansion, to strengthen market positions. Leading companies leverage vertical integration advantages through grain sourcing and milling operations that ensure ingredient supply consistency. Strategic partnerships between pre-cooked flour producers and food manufacturers facilitate product development initiatives addressing specific application requirements. Market competition emphasizes technical capabilities, supply reliability, and pricing competitiveness as key differentiating factors. Recent market activity reflects continued investments in production capacity expansion and technological upgrading to meet evolving customer specifications and quality standards.

Brazil Pre-cooked Flour Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Organic, Conventional |

| Sources Covered | Wheat, Corn, Rice, Barley, Legumes |

| End Uses Covered | Food and Beverages, Nutraceuticals, Foodservice, Household/Retail |

| Distribution Channels Covered | Business to Business, Business to Consumer |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil pre-cooked flour market size was valued at USD 30.69 Million in 2025.

The Brazil pre-cooked flour market is expected to grow at a compound annual growth rate of 5.04% from 2026-2034 to reach USD 47.75 Million by 2034.

Wheat dominates the market with a 42% share, driven by its extensive application across bakery products, pasta manufacturing, and established consumer preferences.

Key factors driving the Brazil pre-cooked flour market include expanding food processing industry demand, rising urbanization and changing consumer lifestyles favoring convenience products, and the growing health awareness, which is driving the demand for functional and nutritionally enhanced flour variants.

Major challenges include raw material price volatility and import dependency for wheat supplies, competition from alternative convenience ingredients and ready-mix products, infrastructure and distribution limitations affecting market accessibility in certain regions, and maintaining consistent quality standards across production batches.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)