Brazil Prefilled Syringes Market Size, Share, Trends and Forecast by Design, Material, Closing System, Application, End User, and Region, 2026-2034

Brazil Prefilled Syringes Market Summary:

The Brazil prefilled syringes market size was valued at USD 187.79 Million in 2025 and is projected to reach USD 307.28 Million by 2034, growing at a compound annual growth rate of 5.62% from 2026-2034.

The Brazil prefilled syringes market is witnessing significant growth, fueled by the rising prevalence of chronic diseases, expanding healthcare infrastructure, and increasing adoption of self-administered treatments. Demand for biologics and biosimilars requiring accurate drug delivery, along with a focus on patient safety and medication precision, is driving market expansion. Healthcare providers are shifting toward prefilled syringes to reduce errors, minimize contamination risks, and enhance treatment adherence for conditions like diabetes and autoimmune disorders.

Key Takeaways and Insights:

- By Design: Single-chamber prefilled syringes dominate the market with a share of 54% in 2025, driven by versatility of use in various therapeutic classes and the availability of manufacturing facilities for mass production.

- By Material: Glass prefilled syringes leads the market with a share of 60% in 2025, owing to superior chemical inertness, drug stability preservation, and compatibility with sensitive biological formulations.

- By Closing System: Staked needle system dominates the market with a share of 45% in 2025, attributed to its improved safety standards, lower incidence of needle stick injuries, and simplified drug administration procedures.

- By Application: Diabetes leads the market with a share of 33% in 2025, fueled by the high diabetes prevalence in Brazil and increasing adoption of injectable therapies for glycemic management.

- By End User: Hospitals represent the largest segment with a market share of 49% in 2025, driven by concentrated healthcare delivery infrastructure and high-volume parenteral drug administration requirements.

- Key Players: The Brazil prefilled syringes market exhibits a moderately competitive landscape characterized by the presence of established multinational medical device manufacturers alongside regional players. Market participants are focusing on strategic partnerships, technology licensing arrangements, and capacity expansions to strengthen their market positioning.

The Brazil prefilled syringes market is witnessing transformative growth propelled by the convergence of demographic shifts and evolving healthcare delivery paradigms. The expanding geriatric population requiring long-term medication management and the rising incidence of lifestyle-related chronic conditions are fundamentally reshaping drug delivery preferences. In 2025, Brazil’s health regulator ANVISA announced structural reforms to optimize approval queues for medicines and medical devices, including advanced delivery systems like prefilled syringes, aimed at reducing regulatory backlogs and expediting product access. Pharmaceutical companies are increasingly collaborating with prefilled syringe manufacturers to package biologics in ready-to-use formats, enhancing product differentiation and extending drug shelf life. Furthermore, the growing emphasis on home healthcare services and telemedicine platforms is accelerating prefilled syringe adoption as patients seek convenient self-administration options that reduce hospital visits while maintaining therapeutic efficacy.

Brazil Prefilled Syringes Market Trends:

Rising Adoption of Biologics and Biosimilars

The expanding biologics and biosimilars segment is fundamentally transforming the Brazil prefilled syringes market landscape. Biologic drugs used for treating complex conditions including cancer, rheumatoid arthritis, and autoimmune disorders require precise and sterile delivery mechanisms. Prefilled syringes offer the ideal packaging solution for these sensitive formulations, ensuring drug stability and accurate dosing. In January 2026, Blau Farmacêutica fully developed a pembrolizumab biosimilar with ANVISA GMP approval, marking Brazil’s first end-to-end high-complexity immunotherapy development and highlighting the government’s push for local biologics production.

Expansion of Home Healthcare and Self-Administration Practices

The healthcare delivery model in Brazil is progressively shifting toward decentralized care settings, with home healthcare services gaining significant traction. In March 2025, ANVISA approved Novo Nordisk’s weekly insulin (Awiqli), enabling adults with type 1 and type 2 diabetes to manage glycemic control with a single weekly injection rather than daily shots, expanding convenient self-administration options. Patients managing chronic conditions are increasingly preferring self-administered injectable treatments that offer convenience and independence from frequent hospital visits. Prefilled syringes address this emerging need by providing user-friendly, pre-measured medication doses that simplify the injection process.

Technological Advancements in Safety Features and Materials

Continuous innovation in prefilled syringe technology is reshaping product development strategies across the Brazilian market. Manufacturers are incorporating advanced safety mechanisms including passive needle shielding, tamper-evident closures, and integrated needle protection systems to minimize needle-stick injuries and medication handling risks. In August 2025, ANVISA approved Enable Injections’ wearable enFuse on‑body delivery system, validating advanced subcutaneous drug delivery that enhances patient convenience and safety in Brazil. Additionally, the emergence of polymer-based prefilled syringes offering enhanced durability, break resistance, and compatibility with sensitive drug formulations is creating new market opportunities.

Market Outlook 2026-2034:

The Brazil prefilled syringes market is positioned for sustained expansion throughout the forecast period, supported by favorable demographic trends and healthcare infrastructure development. The convergence of an aging population, increasing chronic disease burden, and government initiatives promoting healthcare accessibility will continue driving market momentum. Strategic investments in local manufacturing capabilities, coupled with technology transfer partnerships between international pharmaceutical companies and Brazilian entities, are expected to strengthen domestic production capacity. The regulatory environment under ANVISA oversight remains conducive to innovation adoption, facilitating the introduction of next-generation prefilled delivery systems. The market generated a revenue of USD 187.79 Million in 2025 and is projected to reach a revenue of USD 307.28 Million by 2034, growing at a compound annual growth rate of 5.62% from 2026-2034.

Brazil Prefilled Syringes Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Design |

Single-Chamber Prefilled Syringes |

54% |

|

Material |

Glass Prefilled Syringes |

60% |

|

Closing System |

Staked Needle System |

45% |

|

Application |

Diabetes |

33% |

|

End User |

Hospitals |

49% |

Design Insights:

To get Detailed segment analysis of this market, Request Sample

- Single-Chamber Prefilled Syringes

- Dual-Chamber Prefilled Syringes

- Customized Prefilled Syringes

The single-chamber prefilled syringes dominate with a market share of 54% of the total Brazil prefilled syringes market in 2025.

Single-chamber prefilled syringes maintain their dominant market position due to their widespread applicability across diverse therapeutic categories and well-established manufacturing processes. In April 2025, OneSource Specialty Pharma’s injectable facility received ANVISA approval for GMP compliance, enabling supply of drug-device combinations and injectable products to Brazil, including future syringe-based therapies. These devices are particularly well-suited for stable drug formulations that do not require reconstitution prior to administration, making them the preferred choice for routine injectable medications including vaccines, anticoagulants, and hormone therapies.

The cost-effectiveness of single-chamber prefilled glass syringes over more complex alternatives makes them a market leader in Brazil. The healthcare system benefits from faster medication preparation and easier storage, and patients benefit from easier medication administration, which improves medication compliance. The pharmaceutical industry prefers prefilled glass syringes for established drug lines because of familiarity with compatibility and validation procedures, ensuring that demand remains strong in both healthcare and retail sectors serving a wide range of patients.

Material Insights:

- Glass Prefilled Syringes

- Plastic Prefilled Syringes

The glass prefilled syringes lead with a share of 60% of the total Brazil prefilled syringes market in 2025.

Glass prefilled syringes continue to dominate the Brazilian market owing to their superior chemical inertness and exceptional barrier properties that ensure drug stability over extended storage periods. Borosilicate glass, the predominant material used in these syringes, offers minimal extractables and leachables, making it particularly suitable for sensitive biologic formulations and preservative-free medications. The established track record of glass syringes in maintaining drug integrity provides healthcare providers and pharmaceutical manufacturers with confidence in therapeutic outcomes and product quality.

The clarity of glass syringes makes it possible to check the contents of medications, which helps with verification of quality before administration by healthcare professionals. This feature is particularly important for parenteral medications where particulate matter visibility is essential for patient safety. The market leadership of glass prefilled syringes is ensured by familiarity with validation procedures in the pharmaceutical industry and established global supply chains with long-term stability data to support regulatory approvals across all therapeutic classes.

Closing System Insights:

- Staked Needle System

- Luer Cone System

- Luer Lock Form System

The staked needle system dominates with a market share of 45% of the total Brazil prefilled syringes market in 2025.

Staked needle system have achieved market leadership by offering superior convenience and safety features that address critical healthcare delivery requirements across Brazilian medical facilities. In July 2025, ANVISA began requiring high‑risk medical devices, including many injectable delivery systems, to carry a Unique Device Identification (UDI) code on their labels, enhancing traceability and patient safety. Moreover, these systems integrate the needle directly into the syringe during manufacturing, eliminating the need for separate needle attachment and significantly reducing the risk of contamination during preparation.

The safety benefits of staked needle systems extend to substantially reduced needle-stick injury risks, as many modern designs incorporate passive safety mechanisms that automatically shield the needle after injection completion. This feature aligns with occupational health guidelines and institutional safety protocols implemented across Brazilian healthcare facilities. The fixed needle configuration also ensures consistent needle gauge selection appropriate for specific drug viscosities, optimizing patient comfort and injection performance while supporting standardized administration procedures across diverse therapeutic applications and treatment settings.

Application Insights:

- Diabetes

- Anaphylaxis

- Rheumatoid Arthritis

- Oncology

- Others

The diabetes leads with a share of 33% of the total Brazil prefilled syringes market in 2025.

The diabetes maintains its leading position driven by the substantial and growing diabetic population across Brazil and the critical role of injectable therapies in effective glycemic management. In 2025, Brazil resumed domestic insulin production through a national PDP program, boosting local supply and health system autonomy to benefit roughly 350,000 diabetes patients nationwide. The country faces a significant diabetes burden, with millions of individuals requiring regular insulin administration and other injectable antidiabetic medications for disease control.

The convenience factor of prefilled insulin syringes supports improved treatment adherence among diabetes patients who must administer multiple daily injections to maintain stable blood glucose levels. The discrete and portable nature of these devices enables medication administration across various settings, aligning with the active lifestyles of many patients managing their condition. Healthcare providers increasingly recommend prefilled formats to simplify disease management education and empower patients with greater independence in their daily treatment routines and long-term self-care practices.

End User Insights:

- Hospitals

- Clinics

- Others

The hospitals dominate with a market share of 49% of the total Brazil prefilled syringes market in 2025.

Hospitals represent the largest end-user segment due to the concentration of acute care services, complex therapeutic interventions, and high-volume parenteral drug administration occurring within these facilities throughout Brazil. As per sources, in 2025, the Brazilian government announced a R$ 2.4 billion health equipment procurement initiative with priority for nationally manufactured products, reinforcing institutional purchasing power for hospitals and care networks. Brazilian hospitals serve as primary access points for specialized treatments including oncology protocols, emergency interventions, and surgical procedures requiring injectable medications delivered through precise drug delivery systems.

The preference for prefilled syringes in hospital settings reflects operational efficiency considerations and patient safety priorities that align with modern healthcare delivery standards. These devices significantly reduce medication preparation time, minimize contamination risks in sterile compounding areas, and standardize dosing accuracy across nursing shifts and clinical departments. Hospital pharmacy departments increasingly specify prefilled formats in formulary decisions to streamline workflow processes and support medication error reduction initiatives aligned with accreditation standards and institutional quality improvement programs.

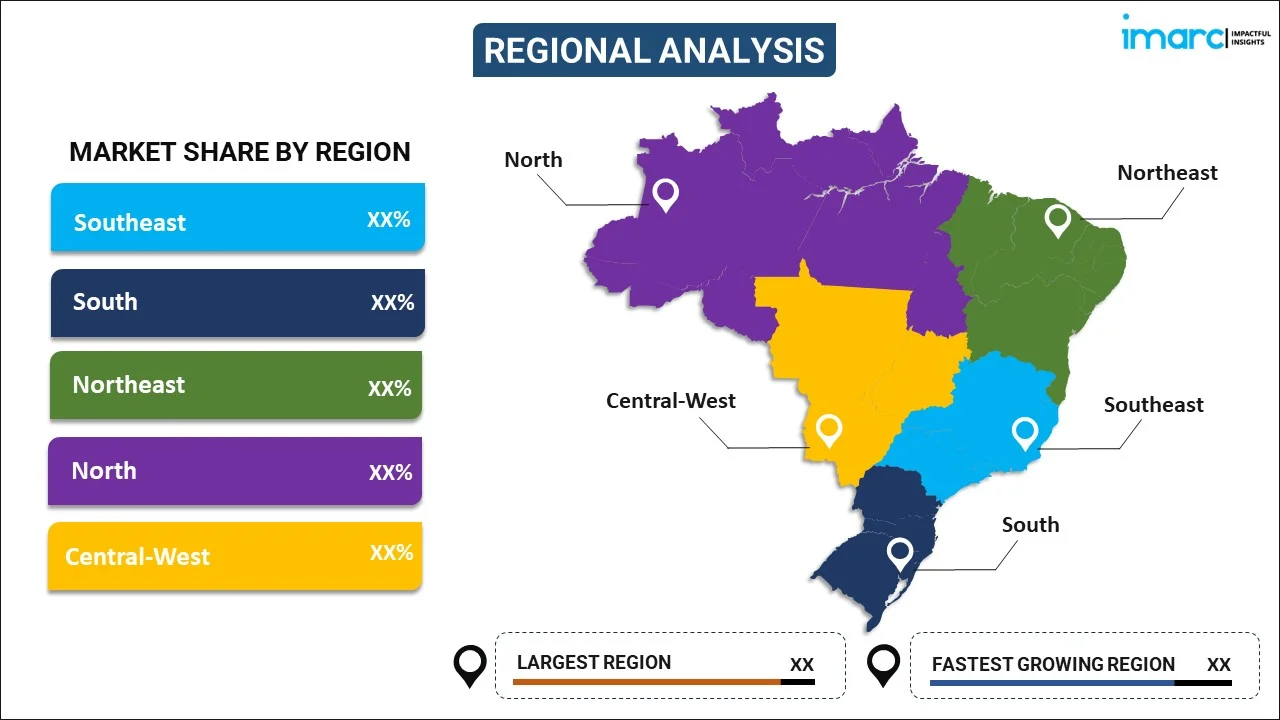

Regional Insights:

To get Detailed regional analysis of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast dominates the Brazil prefilled syringes market, driven by the concentration of major hospitals, pharmaceutical distribution centers, and healthcare facilities in São Paulo and Rio de Janeiro metropolitan areas. The region benefits from advanced healthcare infrastructure, higher disposable incomes enabling premium medical device adoption, and the presence of leading research institutions driving innovation in drug delivery technologies.

South represents a significant market for prefilled syringes, supported by well-developed healthcare systems and higher healthcare expenditure per capita. The region's aging population and elevated chronic disease prevalence drive consistent demand for injectable therapies. Strong pharmaceutical retail networks and established clinic infrastructure facilitate widespread prefilled syringe distribution across urban and semi-urban areas throughout the region.

Northeast is experiencing accelerating prefilled syringe adoption as healthcare infrastructure expansion initiatives gain momentum. Government investments in public health facilities and increasing private hospital development are enhancing access to advanced drug delivery systems. The growing diabetes burden across the region's population centers is particularly driving demand for insulin delivery solutions and self-administration devices.

North presents emerging opportunities for prefilled syringe market expansion as healthcare accessibility improvements progress across remote communities. Vaccination programs and chronic disease management initiatives are driving initial market penetration. The region's healthcare development priorities include establishing reliable cold chain logistics and expanding clinic networks to support broader adoption of prefilled injectable medications.

Central-West demonstrates steady prefilled syringe market growth supported by agricultural economic prosperity and expanding urban healthcare facilities. Brasília's concentration of government healthcare institutions and growing private hospital investments in emerging cities are driving demand. The region's demographic growth and increasing healthcare awareness are creating sustained opportunities for prefilled drug delivery solutions.

Market Dynamics:

Growth Drivers:

Why is the Brazil Prefilled Syringes Market Growing?

Increasing Prevalence of Chronic Diseases

The rising burden of chronic diseases across Brazil represents a fundamental driver of prefilled syringe market expansion. Conditions including diabetes mellitus, cardiovascular disorders, autoimmune diseases, and cancer require ongoing medication management that increasingly relies on injectable therapies. The epidemiological transition occurring in Brazil, characterized by lifestyle changes and population aging, is accelerating chronic disease incidence rates. Prefilled syringes address the growing demand for convenient, accurate, and safe drug delivery solutions suitable for long-term treatment regimens. Healthcare systems are adapting to manage larger chronic disease patient populations, necessitating efficient medication administration tools that reduce clinical workload while maintaining therapeutic precision.

Expansion of Healthcare Infrastructure and Access

Continued investment in healthcare infrastructure development across Brazil is creating expanded market opportunities for prefilled syringe manufacturers. According to reports, the Brazilian government launched a R$20 billion Social Infrastructure Investment Fund to finance construction, renovation, and modernization of health units, prioritizing underserved regions and equipment acquisition. The Brazilian government and private sector are collaborating to extend healthcare access to underserved populations through new hospital construction, clinic establishment, and pharmacy network expansion. Regional healthcare facilities are increasingly incorporating advanced drug delivery systems including prefilled syringes into their standard medication administration protocols.

Growing Adoption of Biologic Therapies

The therapeutic landscape in Brazil is undergoing significant transformation with the increasing adoption of biologic drugs for treating complex medical conditions. In June 2025, ANVISA granted marketing authorization to Ranivisio® (FYB201), the first biosimilar to Lucentis (ranibizumab), in partnership with Brazilian pharma Biomm, expanding local access to advanced biologic therapies. Biologics represent the fastest-growing pharmaceutical category and require specialized packaging solutions that preserve drug stability and ensure accurate administration. Prefilled syringes offer the optimal delivery mechanism for these sensitive large-molecule drugs, supporting precise dosing and minimizing exposure to environmental contaminants.

Market Restraints:

What Challenges the Brazil Prefilled Syringes Market is Facing?

Higher Production Costs Compared to Conventional Syringes

Prefilled syringes require more complex manufacturing processes, specialized materials, and advanced filling technologies that result in significantly higher production costs compared to traditional vial-and-syringe combinations. These elevated costs translate to premium pricing structures that may limit adoption in price-sensitive market segments and constrain procurement budgets of resource-limited healthcare facilities. Cost considerations particularly impact smaller clinics and public health programs operating under tight financial constraints.

Stringent Regulatory Requirements and Compliance Burden

The comprehensive regulatory framework governing prefilled syringes in Brazil imposes substantial compliance requirements on manufacturers seeking market authorization. Companies must navigate extensive testing protocols, stability studies, biocompatibility assessments, and documentation requirements to secure ANVISA approval, creating significant barriers to market entry. These demanding regulatory processes extend product development timelines and increase costs for introducing new prefilled syringe offerings into the Brazilian market.

Cold Chain and Storage Considerations

Many medications packaged in prefilled syringes require controlled temperature storage throughout the entire distribution chain to maintain drug stability and therapeutic efficacy. The cold chain infrastructure in certain Brazilian regions, particularly remote and rural areas, remains underdeveloped and inconsistent. This limitation potentially restricts the geographic reach of temperature-sensitive prefilled products and increases distribution costs for manufacturers and healthcare providers serving underserved populations.

Competitive Landscape:

The Brazil prefilled syringes market features a competitive environment characterized by the presence of established multinational medical device manufacturers alongside emerging regional players. Market leaders leverage global manufacturing expertise, extensive product portfolios, and established distribution networks to maintain competitive positioning. Strategic initiatives including technology licensing agreements, local production partnerships, and capacity expansions represent common approaches for strengthening market presence. Companies are differentiating through innovation in safety features, material technologies, and customized solutions addressing specific therapeutic requirements. The regulatory landscape under ANVISA oversight creates structured market entry conditions that favor companies with robust quality management systems and comprehensive dossier preparation capabilities.

Recent Developments:

- In February 2025, Caplin Steriles announced the qualification of its Pre-Filled Syringes production line and plans to file multiple prefilled syringe products in Latin American markets, including Brazil. The company targets commercial launches through FY2026, signaling expanded regional presence in sterile injectables and drug-delivery systems.

Brazil Prefilled Syringes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Designs Covered | Single-Chamber Prefilled Syringes, Dual-Chamber Prefilled Syringes, Customized Prefilled Syringes |

| Materials Covered | Glass Prefilled Syringes, Plastic Prefilled Syringes |

| Closing Systems Covered | Staked Needle System, Luer Cone System, Luer Lock Form System |

| Applications Covered | Diabetes, Anaphylaxis, Rheumatoid Arthritis, Oncology, Others |

| End Users Covered | Hospitals, Clinics, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil prefilled syringes market size was valued at USD 187.79 Million in 2025.

The Brazil prefilled syringes market is expected to grow at a compound annual growth rate of 5.62% from 2026-2034 to reach USD 307.28 Million by 2034.

Single-chamber prefilled syringes held the largest Brazil prefilled syringes market share, driven by widespread therapeutic applicability across diverse clinical settings, well-established manufacturing processes ensuring consistent production quality, and significant cost-effectiveness compared to more complex multi-chamber alternatives requiring specialized handling and reconstitution procedures.

Key factors driving the Brazil prefilled syringes market include rising chronic disease prevalence, expanding healthcare infrastructure, growing adoption of biologic therapies, increasing preference for self-administration, and favorable regulatory developments facilitating market entry.

Major challenges include higher production costs compared to conventional syringes, stringent regulatory compliance requirements, cold chain infrastructure limitations in remote and underserved regions, competition from alternative drug delivery formats, and limited adoption awareness among smaller healthcare facilities and clinics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)