Brazil Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

Brazil Private Equity Market Overview:

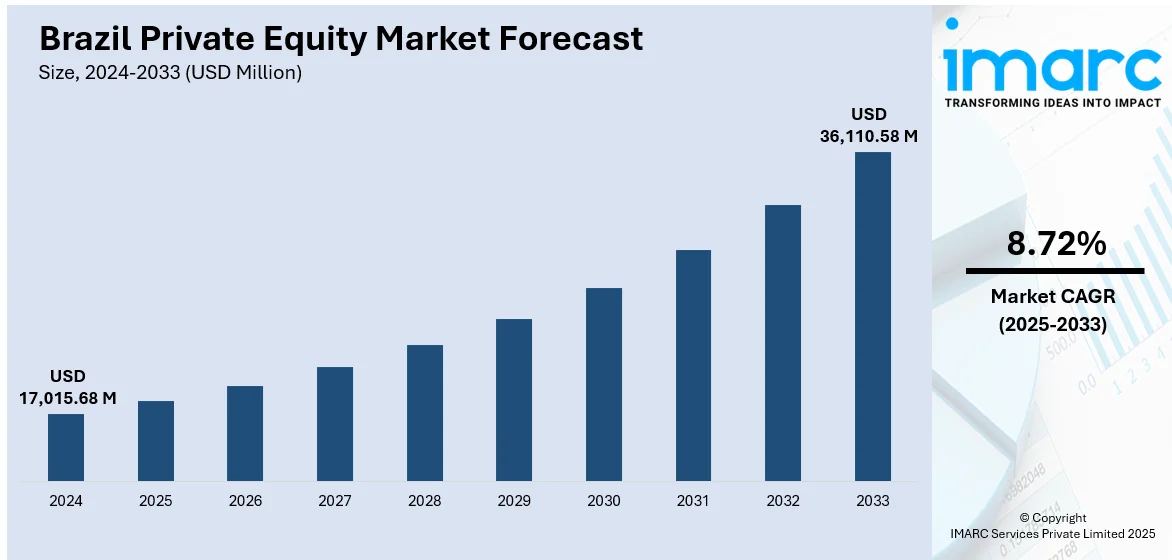

The Brazil private equity market size reached USD 17,015.68 Million in 2024. The market is projected to reach USD 36,110.58 Million by 2033, exhibiting a growth rate (CAGR) of 8.72% during 2025-2033. The market is energized by state-backed climate finance initiatives, ESG alignment, institutional investor partnerships, and infrastructure expansion. Government-led platforms and green development funds attract global capital, thereby accelerating the Brazil private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17,015.68 Million |

| Market Forecast in 2033 | USD 36,110.58 Million |

| Market Growth Rate 2025-2033 | 8.72% |

Brazil Private Equity Market Trends:

Increased Investment in Digital Transformation

Brazil remains the most active private equity (PE) market in Latin America, with 2,849 private companies backed by PE/VC, about 3.39% penetration of its private sector, top in the region. Despite a 44% drop in PE investment to USD 2.2 Billion in 2024, the market is evolving, with investor strategies shifting toward early‑stage tech, infrastructure, special‑situations, and ESG‑linked deals. Investments in digital transformation are on the rise in Brazil's private equity market, especially in industries like software, e-commerce, and fintech. Private equity firms are profiting from the rising demand for digital solutions, particularly in the financial services and retail sectors, as the nation continues to adopt new technologies. This tendency was accelerated by the pandemic, and private equity investors are increasingly concentrating on helping traditional businesses adjust to the digital age, increasing operational efficiency, and growing tech-driven startups. Brazil is a desirable location for private equity firms wishing to participate in the nation's digital transformation because of its sizable consumer base and rising internet penetration, which present substantial development prospects.

To get more information on this market, Request Sample

Expansion and Global Integration of the Market

Brazil private equity market growth is primarily being driven by increasing investment in sectors with high growth or restructuring potential. The market is profiting from an increase in foreign investment as a result of investors' high faith in Brazil's economic prospects. Efforts to improve market access and update rules are driving this rise. In order to promote innovation, aid in the creation of jobs, and increase Brazil's competitive advantage internationally, private equity funds are becoming more and more important. At the same time, Brazil's position as a major participant in the global private equity market is being strengthened by smart international relationships, especially with European countries, which are opening doors to new capital flows and investment opportunities. For instance, in May 2025, ANBIMA participated in the Luxembourg Private Equity Seminar in Lisbon, discussing Brazil's regulatory modernization, growth in private equity, and international cooperation opportunities with Portugal and Luxembourg. Tatiana Itikawa highlighted Brazil's progress with Resolution 175, which aligns the country with global investment standards, and announced plans to expand retail investor access to private equity funds. The industry now manages 9% of total assets in Brazil, with foreign investors contributing significantly.

Brazil Private Equity Market Segmentation:

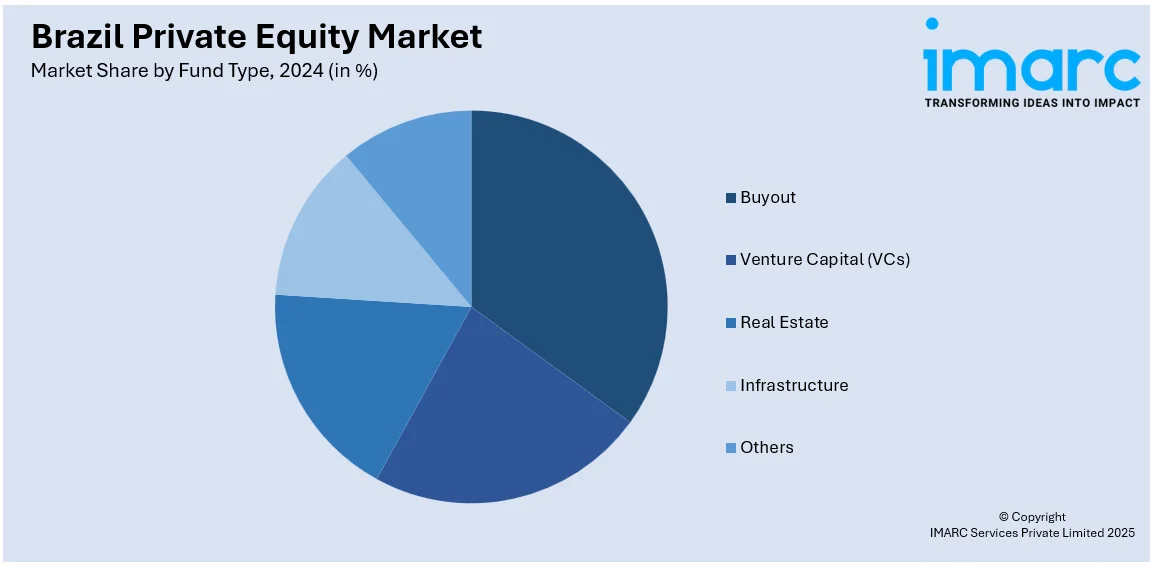

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on fund type.

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Private Equity Market News:

- In June 2025, Brazil's Securities and Exchange Commission (CVM) announced plans to open private equity funds (FIPs) to retail investors. This move is part of efforts to modernize capital markets under Resolution 175. The CVM aims to increase accessibility to private equity with appropriate safeguards, enabling broader participation in the sector.

- In April 2025, Vista Capital, a Brazilian hedge fund, achieved a 37% return, marking its strongest monthly gain since inception. This performance, driven by tactical positioning in a volatile macro environment, led Bloomberg’s index tracking Brazilian hedge funds to a record high. Vista’s strategy included bearish bets on oil and energy equities, particularly Petrobras.

Brazil Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil private equity market on the basis of fund type?

- What is the breakup of the Brazil private equity market on the basis of region?

- What are the various stages in the value chain of the Brazil private equity market?

- What are the key driving factors and challenges in the Brazil private equity market?

- What is the structure of the Brazil private equity market and who are the key players?

- What is the degree of competition in the Brazil private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil private equity market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)