Brazil Rail Freight Transport Market Size, Share, Trends and Forecast by Cargo Type, Service Type, and Region, 2026-2034

Brazil Rail Freight Transport Market Summary:

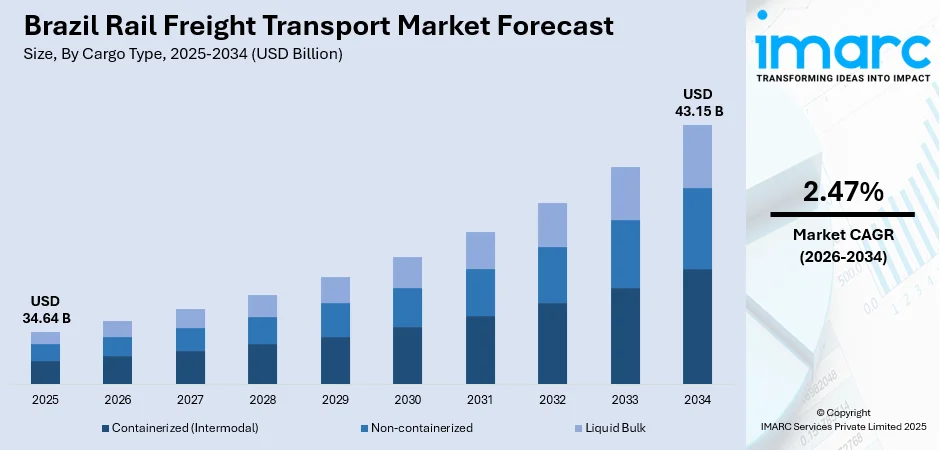

The Brazil rail freight transport market size was valued at USD 34.64 Billion in 2025 and is projected to reach USD 43.15 Billion by 2034, growing at a compound annual growth rate of 2.47% from 2026-2034.

The market is driven by the strategic need to efficiently transport bulk commodities across Brazil's vast territory, supported by increasing government investments in railway infrastructure modernization. Growing agricultural exports and mineral extraction activities continue to fuel demand for rail logistics solutions. Port connectivity enhancements and private sector participation in railway concessions further strengthen the sector's expansion, with operators focusing on sustainability initiatives and fleet upgrades to boost operational efficiency, enabling the market to capture a significant Brazil rail freight transport market share.

Key Takeaways and Insights:

- By Cargo Type: Non-containerized dominates the market with a share of 73.7% in 2025, driven by the transportation of bulk commodities including iron ore, agricultural grains, and mineral products that require high-volume movement capabilities, positioning rail as the most cost-effective mode for heavy freight across long distances.

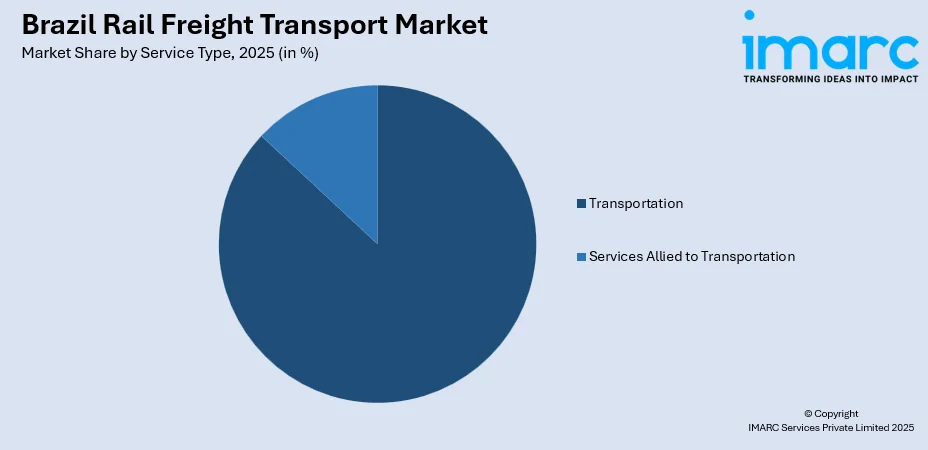

- By Service Type: Transportation leads the market with a share of 86.5% in 2025, owing to the essential role of core freight movement operations in connecting agricultural production zones in the interior with coastal export terminals, ensuring seamless commodity flow throughout the supply chain.

- By Region: Southeast dominates the market with a share of 46.5% in 2025, driven by the concentration of major port infrastructure including the Port of Santos, established railway networks connecting industrial centers, and significant economic activity across São Paulo, Rio de Janeiro, and Minas Gerais states.

- Key Players: The market exhibits a moderately consolidated competitive structure, with established private railway concessionaires competing across distinct geographic corridors. Market participants differentiate through infrastructure investments, fleet modernization programs, and integrated logistics offerings connecting interior production regions with coastal export terminals.

To get more information on this market Request Sample

The Brazil rail freight transport market continues to experience robust expansion driven by the nation's position as a leading global exporter of agricultural commodities and mineral resources. The inherent advantages of rail transportation for moving high-volume, low-value goods across extensive distances make it indispensable for Brazil's export-oriented economy. Government prioritization of railway infrastructure development under national logistics plans has attracted substantial private investment in track upgrades, rolling stock modernization, and terminal expansions. According to sources, in 2025, Cofco International invested BRL 1.2 billion to purchase 979 railcars and 23 locomotives, expanding logistics via Rumo’s network to transport grains and sugar to the Port of Santos. Moreover, the growing emphasis on multimodal transportation networks connecting interior production zones with strategic port facilities further accelerates market development. Additionally, sustainability considerations favoring lower carbon emissions compared to road transportation increasingly influence logistics decision-making among major commodity producers and exporters.

Brazil Rail Freight Transport Market Trends:

Expansion of Multimodal Integration Networks

The Brazil rail freight transport market is witnessing accelerated development of multimodal integration strategies connecting railways with port terminals and inland distribution centers. In April 2024, DP World and Rumo announced a $500 million project to build a new multimodal terminal at Brazil’s Port of Santos, designed to handle 12.5 million tonnes annually. Furthermore, logistics providers increasingly invest in intermodal facilities that enable seamless cargo transfers between rail and maritime transportation modes. This integration enhances supply chain efficiency by optimizing the strengths of each transportation mode. New port terminal constructions specifically designed to accommodate rail connections demonstrate the sector's commitment to comprehensive logistics solutions. The focus on reducing overall freight costs through coordinated multimodal operations continues to reshape infrastructure planning priorities across the nation.

Digital Transformation and Operational Efficiency

Railway operators across Brazil are embracing digital technologies to enhance operational performance and service reliability throughout their networks. Advanced satellite communication systems enable real-time train monitoring, improving safety protocols and operational coordination across extensive rail corridors. In October 2025, Rumo equipped 400 locomotives with Starlink connectivity, enabling real-time communication, remote diagnostics, and 97% signal availability across major Brazilian freight corridors. Additionally, implementation of predictive analytics and artificial intelligence supports optimized scheduling, reduced terminal dwell times, and enhanced asset utilization. Digital freight matching platforms facilitate improved coordination between shippers and rail operators, streamlining booking processes and capacity management. These technological advancements position rail freight as an increasingly competitive alternative for time-sensitive commodity movements.

Sustainability-Driven Fleet Modernization

Environmental sustainability has emerged as a central driver of investment decisions within the Brazil rail freight transport sector. Railway concessionaires are allocating substantial capital toward acquiring modern locomotives and wagons that deliver superior fuel efficiency and reduced emissions. In 2023, Rumo introduced two hybrid EMD GT38H locomotives developed by Progress Rail, featuring diesel-electric systems and battery packs that deliver up to 45% greater fuel efficiency and significantly lower emissions. Moreover, fleet renewal programs prioritize equipment designed for enhanced productivity while minimizing environmental impact. The inherent carbon advantages of rail transportation compared to road freight increasingly influence shipper preferences, particularly among agricultural exporters facing pressure to demonstrate sustainable supply chain practices. This sustainability focus aligns railway modernization with broader national and international environmental commitments.

Market Outlook 2026-2034:

The Brazil rail freight transport market is projected to experience sustained revenue growth throughout the forecast period, supported by continued infrastructure investments and expanding commodity export volumes. Government initiatives promoting railway network expansion and modernization will attract significant private capital inflows. The completion of strategic rail corridors connecting agricultural production regions with export terminals positions the sector for enhanced market penetration. Rising demand for efficient bulk cargo transportation, coupled with sustainability-driven modal shifts from road freight, will contribute to accelerating revenue generation across the forecast timeline. The market generated a revenue of USD 34.64 Billion in 2025 and is projected to reach a revenue of USD 43.15 Billion by 2034, growing at a compound annual growth rate of 2.47% from 2026-2034.

Brazil Rail Freight Transport Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Cargo Type | Non-containerized | 73.7% |

| Service Type | Transportation | 86.5% |

| Region | Southeast | 46.5% |

Cargo Type Insights:

- Containerized (Intermodal)

- Non-containerized

- Liquid Bulk

The non-containerized dominates with a market share of 73.7% of the total Brazil rail freight transport market in 2025.

Non-containerized represents the foundational pillar of Brazil's rail freight transport operations, encompassing the movement of bulk commodities essential to the national economy. In July 2025, Rumo began operating 135-wagon freight trains across northern Brazilian corridors after a R$350 million upgrade, increasing useful tons per train by 9% and reducing diesel use by 1.8%. Further, this segment primarily handles iron ore, agricultural grains including soybeans and maize, and various mineral products requiring high-capacity transportation solutions. The physical characteristics of these commodities, featuring high tonnage and relatively low unit values, make rail transportation economically superior to alternative modes for long-distance movements.

The dominance of non-containerized cargo reflects Brazil's economic structure as a major global exporter of primary commodities. Railway infrastructure throughout the country has historically developed to serve bulk freight requirements, with specialized wagons and terminal facilities designed for efficient loading and unloading operations. Continued expansion of agricultural production in interior regions and sustained demand for mineral exports ensure this segment maintains its commanding market position throughout the forecast period.

Service Type Insights:

Access the comprehensive market breakdown Request Sample

- Transportation

- Services Allied to Transportation

The transportation leads with a share of 86.5% of the total Brazil rail freight transport market in 2025.

Transportation constitute the core operational function within Brazil's rail freight sector, encompassing the physical movement of goods across railway networks connecting production zones with consumption centers and export facilities. This segment includes freight haulage operations, train scheduling and dispatch services, and the essential locomotive and wagon utilization required for cargo movement. The fundamental importance of transportation services to overall market functionality explains its overwhelming share of sector revenues.

Railway operators continuously invest in transportation service enhancements through fleet modernization, track upgrades, and operational efficiency improvements. In March 2025, Brazil’s railways transported a record 150 million useful tonnes of general cargo in 2024, surpassing the previous 19‑year high, according to ANTF. Additionally, the adoption of precision scheduled railroading principles has enabled operators to achieve faster transit times and improved asset utilization rates. Growing demand for reliable bulk commodity transportation to meet export schedules drives ongoing investments in transportation capacity expansion. Service quality improvements, including enhanced tracking capabilities and schedule adherence, strengthen the competitive positioning of rail transportation within Brazil's broader logistics ecosystem.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast dominates with a market share of 46.5% of the total Brazil rail freight transport market in 2025.

The Southeast region commands market leadership through its combination of established railway infrastructure, major port facilities, and concentrated economic activity. São Paulo, Rio de Janeiro, Minas Gerais, and Espírito Santo states collectively generate substantial rail freight demand driven by industrial production, agricultural processing, and mineral extraction activities. The region's railway networks benefit from decades of investment and operational refinement, delivering reliable connectivity between interior production zones and coastal export terminals. According to sources, in December 2025, Brazil’s Ministry of Transport approved a R$3.8 billion investment in the Malha Sudeste (Southeast Rail Network), aiming to increase rail‑transported cargo to the Port of Santos by 45 million tonnes.

Strategic port infrastructure, particularly the Port of Santos as Latin America's largest port facility, anchors the Southeast's dominance in rail freight transportation. Railways serving this region handle diverse cargo flows including iron ore from Minas Gerais mining operations, agricultural products from interior farming regions, and manufactured goods destined for domestic and international markets. The concentration of Brazil's largest consumer and industrial markets within the Southeast ensures continued strong demand for rail freight services throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Brazil Rail Freight Transport Market Growing?

Strategic Infrastructure Investment Programs

The Brazil rail freight transport market benefits substantially from coordinated government and private sector investment programs targeting railway infrastructure expansion and modernization. National logistics planning prioritizes railway development as essential for enhancing commodity export competitiveness and reducing overall transportation costs. These investment programs encompass track construction and rehabilitation, terminal facility development, and signaling system upgrades that collectively improve network capacity and operational reliability. Public-private partnership frameworks enable substantial capital mobilization for major infrastructure projects while distributing risks appropriately between stakeholders. In November 2025, Brazil launched a new freight railway franchise policy with 140 billion investments, activating construction and upgrading of 9000 km of railway lines through public–private partnerships. Moreover, the completion of strategic railway corridors connecting interior production regions with coastal port facilities creates new transportation options for commodity exporters previously dependent on road freight.

Agricultural Export Volume Expansion

Brazil's position as a leading global exporter of agricultural commodities creates sustained demand growth for rail freight transportation services. Expanding production of soybeans, maize, cotton, and other agricultural products in interior farming regions generates increasing freight volumes requiring efficient long-distance transportation to export terminals. As per sources, in November 2025, Brazil’s soybean exports jumped 64% year-on-year to 4.2 million metric tons, highlighting rising agricultural export volumes driving demand for rail‑freight transportation. Furthermore, rail transportation offers significant cost advantages for moving high-volume agricultural commodities compared to road freight alternatives, particularly across the extensive distances characteristic of Brazilian agricultural supply chains. Growing international demand for Brazilian agricultural products, combined with expanding cultivation areas in the Central-West and Northeastern regions, ensures continued freight volume growth. Railway operators respond to this demand through capacity investments in agricultural commodity handling facilities and specialized wagon acquisitions.

Sustainability and Modal Shift Initiatives

Environmental sustainability considerations increasingly drive logistics decision-making toward rail freight solutions offering superior carbon efficiency compared to road transportation alternatives. In November 2025, Alstom highlighted rail transport’s role in decarbonising mobility at COP30 in Brazil, showcasing energy-efficient solutions and sustainable rail infrastructure to support low-carbon logistics. Moreover, corporate sustainability commitments among major commodity producers and exporters prioritize supply chain emissions reductions achievable through modal shifts to rail transportation. Government policies supporting sustainable transportation development provide additional incentives for rail freight utilization through preferential treatment in logistics planning and potential carbon pricing mechanisms. Railway operators leverage sustainability credentials in marketing efforts targeting environmentally conscious shippers seeking to demonstrate responsible supply chain practices. The inherent energy efficiency advantages of rail transportation for bulk commodity movements position the sector favorably as sustainability requirements intensify across global supply chains.

Market Restraints:

What Challenges the Brazil Rail Freight Transport Market is Facing?

Infrastructure Capacity Limitations

Brazil's railway network faces capacity constraints resulting from historical underinvestment and fragmented development patterns. Many rail corridors operate near capacity limits during peak agricultural harvest seasons, creating bottlenecks that affect service reliability and transit times. Single-track sections and insufficient passing sidings limit operational flexibility, while varying track gauges across different network segments complicate interoperability.

Geographic and Topographical Challenges

Brazil's continental dimensions and diverse topography present significant obstacles for railway infrastructure development and operations. Mountainous terrain in coastal regions requires complex engineering solutions increasing construction and maintenance costs. The vast distances between interior production zones and coastal export facilities demand substantial capital investments in track construction and ongoing operational expenditures for extended freight movements.

Regulatory and Concession Complexity

The regulatory framework governing railway concessions creates operational complexities affecting investment decisions and network development. Concession contract terms, renewal procedures, and regulatory oversight requirements introduce uncertainties that may delay infrastructure investments. Coordination challenges between different railway operators and government agencies complicate integrated network planning and multimodal transportation development efforts.

Competitive Landscape:

The Brazil rail freight transport market operates under a concession-based structure where private operators maintain exclusive rights to specific railway corridors within defined geographic regions. This framework has resulted in a moderately concentrated competitive environment characterized by regional specialization and differentiated service offerings. Market participants compete primarily through infrastructure quality, operational efficiency, service reliability, and integrated logistics capabilities connecting rail transportation with port facilities and inland distribution centers. Investment in rolling stock modernization and terminal facility enhancements represents a key competitive differentiator as operators seek to attract commodity shippers demanding consistent service performance. Strategic partnerships between railway operators and port terminal developers create competitive advantages through seamless multimodal connectivity. The market demonstrates ongoing consolidation tendencies as operators pursue scale economies and expanded geographic coverage.

Recent Developments:

- In October 2024, MRS Logística upgraded its Brazilian freight rail network with Iridium Certus 700 satellite connectivity, allowing real-time communication between trains and operations centers, improving cargo transport efficiency, enhancing safety through precise monitoring, and enabling seamless data, voice, and telemetry transmission across the railway system.

Brazil Rail Freight Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cargo Types Covered | Containerized (Intermodal), Non-containerized, Liquid Bulk |

| Service Types Covered | Transportation, Services Allied to Transportation |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil rail freight transport market size was valued at USD 34.64 Billion in 2025.

The Brazil rail freight transport market is expected to grow at a compound annual growth rate of 2.47% from 2026-2034 to reach USD 43.15 Billion by 2034.

Non-containerized held the largest market share of 73.7%, driven by the transportation of bulk commodities including iron ore, agricultural grains, and mineral products that require high-volume, cost-effective rail movement across long distances.

Key factors driving the Brazil rail freight transport market include expanding agricultural export volumes, government infrastructure investment programs, sustainability-driven modal shifts from road freight, port connectivity enhancements, and private sector participation in railway modernization initiatives.

Major challenges include infrastructure capacity constraints during peak seasons, geographic and topographical obstacles increasing development costs, regulatory complexities affecting investment certainty, track gauge incompatibilities limiting network interoperability, and coordination difficulties across multiple railway concessionaires.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)