Brazil Respiratory Devices Market Size, Share, Trends and Forecast by Diagnostic and Monitoring Devices, Therapeutic Devices, Disposables, and Region, 2026-2034

Brazil Respiratory Devices Market Size and Share:

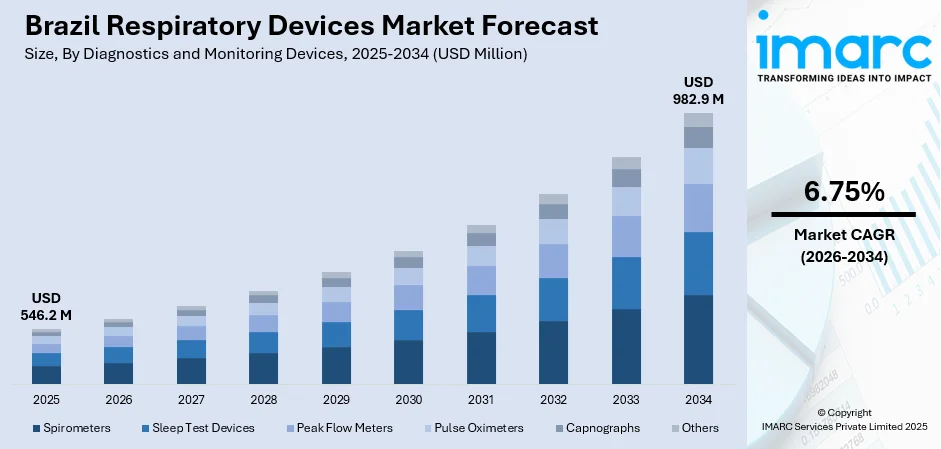

The Brazil respiratory devices market size was valued at USD 546.2 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 982.9 Million by 2034, exhibiting a CAGR of 6.75% from 2026-2034. The market is majorly driven by the rising prevalence of respiratory diseases such as COPD and asthma, increasing awareness of early diagnosis, government favourable initiatives to improve healthcare infrastructure, growing geriatric population, integration of IoT and AI in devices, demand for home healthcare solutions, expansion of telemedicine, and industry innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 546.2 Million |

|

Market Forecast in 2034

|

USD 982.9 Million |

| Market Growth Rate 2026-2034 | 6.75% |

The market in Brazil is majorly driven by the increasing prevalence of respiratory diseases, such as COPD and asthma, in the country. Moreover, the accelerating awareness regarding the necessity of early diagnosis and treatment of such diseases is augmenting demand for advanced respiratory devices. Also, government programs focusing on improving healthcare infrastructure and offering subsidies for medical equipment. For instance, as per a report by Emergo, Brazil's medical device regulator, ANVISA, approved its 2024-2025 "Regulatory Agenda" in December 2023, covering 172 topics across 66 themes. Key initiatives from Section 11 include electronic labeling for layperson devices, revising medical device reprocessing rules, updating SaMD guidelines (RDC nº 657/2022), reviewing safety and effectiveness requirements, and updating INMETRO certification standards. This has led to an increase in the availability of respiratory care solutions to the masses. Additionally, rise in old age population, which is more prone to respiratory disorders, drives the demand for portable and user-friendly devices.

To get more information on this market Request Sample

The integration of IoT and AI into respiratory devices for the purpose of real-time monitoring of patient health is significantly contributing to improving patient outcomes and expanding market reach. For instance, on September 26, 2024, it was reported that RadarFit, a Brazilian wellness app launched in 2020 by three female entrepreneurs, has surpassed one million users by leveraging AI-driven gamification to encourage healthy habits. The app offers personalized diet, exercise, and meditation plans, rewarding users with points redeemable for rewards or donations to social causes. Cooabriel, a corporate client, reported a 50% reduction in employee health complaints within six months of using the app. Powered by Microsoft Azure OpenAI Service, RadarFit aims to expand its user base to 10 million by the end of 2024. In addition to this, growing demand for home healthcare solutions that are convenient and more cost-effective, thereby making the adoption of compact and efficient respiratory devices easier. The advent of telemedicine services allows remote monitoring of respiratory health and thereby increasing the device's utilization. Also, collaboration among local manufacturers and global companies is sustaining innovation and fostering accessibility to respiratory devices, thus ensuring steady market growth.

Brazil Respiratory Devices Market Trends:

Increased Telemedicine and Remote Monitoring Integration

The market is driven by the ongoing advancements in the integration of telemedicine and remote monitoring. As a result of this, patients with chronic respiratory disorders such as COPD and asthma can receive constant care through connected devices and mobile platforms. For instance, a study conducted by Telemedicine and e-Health detailed the success of "TeleTrachea," a program for central airway disease patients in Brazil. The program conducted 1,153 telemedicine visits for 516 patients, with 56.2% using tracheal devices. Patients from 147 cities across 22 states participated, resulting in savings of over 1.2 million kilometers not traveled, reducing CO2 emissions by 250.14 tons, and saving BRL$ 1,272,283.78 in transportation costs for municipalities. Telemedicine's cost-efficiency and potential to expand specialized care solidify its role in modern healthcare. This escalating trend allows for real-time monitoring of respiratory conditions, decreasing the number of hospital visits, and ensuring timely interventions. This approach is aligning with Brazil's efforts to modernize its healthcare system and thereby improving patient outcomes through innovative digital health solutions.

Increasing Focus on Sustainable and Energy-Efficient Devices

The Brazilian market is witnessing a significant change towards more energy-efficient and environmentally friendly respiratory devices. Ongoing innovations by manufacturers catering to Brazil's 2030 Agenda for Sustainable Development, is focusing on environmental-friendly medical technology. It is very crucial for hospitals to achieve their operational cost-saving objectives while aligning with sustainability standards. For instance, as per an article published by the Royal Society of Chemistry, there are limitations of current energy storage devices in terms of performance, cost, and environmental impact, and it also proposes nature-inspired strategies, such as biomolecule-based electrodes and biodegradable materials, as an innovative solution for it. It highlights biomolecule-based electrodes with redox potentials from NADH (−0.32 V) to oxygen (+0.82 V) and yarn-based biobatteries achieving a maximum power density of 22.12 W m⁻³ and an open-circuit voltage of 444 mV in a 3-series assembly. The potential applications of green biobatteries in field such as environmental monitoring and healthcare. This trend supports environmental initiatives while addressing the increasing demand for efficient health care solutions.

Expansion of Portable and Home-Care Devices

Demand for portable and home-care respiratory devices is on the rise in Brazil due to the growing geriatric population with a higher susceptibility to chronic illnesses. This trend is leading to the adoption of compact, easy-to-use devices for home care, thereby reducing dependency on hospitals. As per an article published by Wiley, the integration of IoT technology in healthcare has led to remote health monitoring, which offers continuous real-time patient data analysis and personalized treatment plans. Portable IoT devices are instrumental in remote monitoring of chronic conditions and post-operative care, leading to early disease detection and reduced hospital readmissions. The concept of portable IoT smart devices in healthcare is revolutionizing healthcare delivery, and as per the data from latest research activities, it will improve patient outcomes on a global scale by enhancing patient engagement and clinical decision-making. In addition to this, portable oxygen concentrators and nebulizers are gaining much popularity as they ensure uninterrupted respiratory care with greater convenience for patients. This escalating trend is addressing the changing needs of a population with very limited access to healthcare facilities.

Brazil Respiratory Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Brazil respiratory devices market, along with forecasts at the region and country levels from 2026-2034. The market has been categorized based on diagnostic and monitoring devices, therapeutic devices, and disposables.

Analysis by Diagnostics and Monitoring Devices:

- Spirometers

- Sleep Test Devices

- Peak Flow Meters

- Pulse Oximeters

- Capnographs

- Others

Spirometers plays an important role in Brazil's market for respiratory devices as they facilitate the precise diagnosis and monitoring of chronic respiratory diseases such as COPD and asthma. The use of these devices is quite common in hospitals, clinics, and at home, with portable and advanced models available for the comfort of patients. As awareness of early detection increases, spirometers become a vital part of preventive care, better treatment results, and Brazil's health care modernization programs.

Sleep test devices plays a crucial role in Brazil’s market as they can diagnose and monitor sleep-related breathing disorders, such as sleep apnea. These devices help determine patterns that lead to complications in respiration, thereby helping in timely interventions. The increasing prevalence of sleep disorders, along with increased awareness about the impact of sleep disorders on general health, is driving the demand for advanced, user-friendly sleep test technologies in Brazil.

Peak flow meters play a crucial role in Brazil's respiratory devices market for managing asthma and other obstructive lung diseases. These portable devices help empower patients to monitor lung functions regularly, thereby allowing them to detect early onsets of worsening symptoms. Popularity of peak flow meters is increasing as it improves patient selfcare and reduces emergency hospital visitation, which in turn is improving care for respiratory diseases across wide demographics in Brazil.

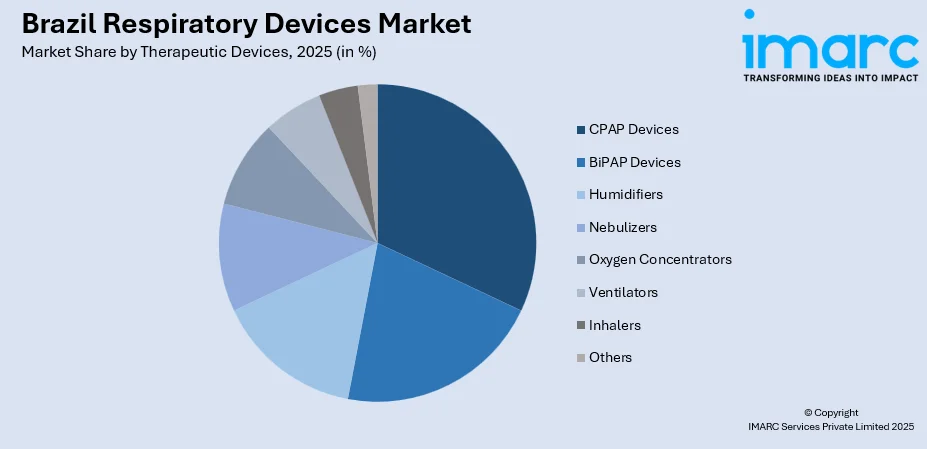

Analysis by Therapeutic Devices:

Access the comprehensive market breakdown Request Sample

- CPAP Devices

- BiPAP Devices

- Humidifiers

- Nebulizers

- Oxygen Concentrators

- Ventilators

- Inhalers

- Others

Continuous positive airway pressure (CPAP) devices are playing a vital role in Brazil's respiratory devices market by providing effective treatment for sleep apnea and other breathing-related disorders. Their increasing adoption is supported by the rising prevalence of sleep apnea among the aging population and advancements in portable and user-friendly designs. CPAP devices are becoming indispensable in improving patient outcomes, particularly in home-based care settings, enhancing both convenience and compliance.

Bilevel positive airway pressure (BiPAP) devices are playing a crucial role in the Brazil respiratory devices market, especially when it comes to patients diagnosed with chronic obstructive pulmonary disease or severe respiratory diseases. As these devices offer dual settings for pressure, they provide a perfect solution for a patient with complicated breathing problems. Their flexibility in application, both in the hospital setting and at home, enhances their significance, especially since Brazil is investing in telemedicine and distance respiratory care to upgrade its health services.

Humidifiers are significantly contributing to the Brazil respiratory devices market by addressing dryness and irritation in respiratory pathways, a common issue among patients using CPAP and BiPAP machines. These devices improve the comfort and efficiency of respiratory treatments, particularly in regions with dry climates. The integration of advanced humidification systems into respiratory therapies is improving patient adherence and outcomes, supporting the market's steady growth in Brazil.

Analysis by Disposables:

- Masks

- Breathing Circuit

- Others

Masks are a crucial component of the Brazil respiratory devices market as it is an essential tool in the form of oxygen and other therapeutic gas delivery tools to the patients who have some kind of respiratory disorders. Their applications range from hospitals, clinics, to homecare platforms for varied patient needs, such as in COPD or asthma patients. The rising incidence of respiratory diseases is propelling due to the increasing sensitivities to hygiene measures in healthcare settings and public places.

Breathing circuits are one of the key components of any respiratory therapy delivery process as they ensure efficient and controlled release of oxygen and anesthetic gases. With advancements in technology, their use is expanding to hospitals and surgical centers throughout Brazil. An increase in number of surgeries and ICU admissions due to the complications of the respiratory system is propelling the demand for durable yet innovative breathing circuits for higher patient outcomes and efficient management of healthcare facilities.

Regional Analysis:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region of Brazil is the primary market for respiratory devices in the country, with the highest population density and superior healthcare infrastructure. Cities such as Sao Paulo and Rio de Janeiro are the pioneers in adopting modern respiratory technologies due to the high incidence of chronic respiratory diseases. The established hospitals and research institutions are further promoting innovation and, thus, ensuring a continuous demand for respiratory devices in this region.

The Southern region plays a significant role in the market with its strong focus on preventive healthcare and advanced medical facilities. This region is characterized by its aging population, which is increasingly requiring respiratory support solutions. In addition, its integration of telemedicine and home care systems enhances access to respiratory devices, thereby driving regional growth and ensuring better healthcare outcomes for its residents.

The Northeast region is an emerging area for the respiratory devices market due to growing healthcare programs and government initiatives. Even though economic stress factors may prevail, increased awareness of the importance of breathing and high investments in public healthcare institutions are fostering the demand. Further, with improving access to rural healthcare, adoption of portable and low-cost respiratory devices in the region is increasing.

The North region is gaining significance in the market due to efforts in handling respiratory issues caused by environmental factors such as deforestation and pollution. The reliance of this region on government-backed healthcare programs and mobile clinics to reach the masses has created a growing demand for compact and user-friendly respiratory devices. In addition, initiatives in strengthening healthcare accessibility are positioning the North as a potential growth market.

The Central-West region is becoming significantly important to the market, being one of the areas where this region dominates agriculture. Increased exposure to allergies and pollution in this region continues to rise respiratory conditions which has led to an increase in the requirement for high-end devices. Apart from that, the strengthening health infrastructure in cities such as Brasília has been promoting the adoption of innovative technologies used in respiratory care devices in this region.

Competitive Landscape:

The competitive landscape of the Brazil respiratory devices market is marked by rapid technological advancements and innovation aimed at addressing rising respiratory health concerns. Market players are focusing on developing cost-effective and portable respiratory devices to cater to the increasing demand in urban and rural areas. Furthermore, the integration of telemedicine and remote monitoring technologies is driving competition, as companies strive to offer user-friendly and connected solutions. Government healthcare initiatives and collaborations with local distributors are further intensifying the market dynamics, enabling wider accessibility and enhancing service quality across the nation.

The report provides a comprehensive analysis of the competitive landscape in the Brazil respiratory devices market with detailed profiles of all major companies, including:

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare Limited

- Koninklijke Philips NV

- Medtronic plc

- ResMed Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

-

On July 5, 2024, GSK plc and Medicines for Malaria Venture (MMV) announced the launch of tafenoquine, a single-dose medicine co-administered with chloroquine, in Brazil and Thailand to prevent the relapse of Plasmodium vivax malaria, that can cause respiratory issues. This initiative supports malaria elimination efforts, as P. vivax is prevalent in regions outside sub-Saharan Africa and is known for causing recurrent infections if not adequately treated. The introduction of tafenoquine, which targets both the blood and the liver stage of the parasite, represents a significant advancement in the radical cure of P. vivax malaria.

Brazil Respiratory Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Diagnostic and Monitoring Devices Covered | Spirometers, Sleep Test Devices, Peak Flow Meters, Pulse Oximeters, Capnographs, Others |

| Therapeutic Devices Covered | CPAP Devices, BiPAP Devices, Humidifiers, Nebulizers, Oxygen Concentrators, Ventilators, Inhalers, Others |

| Disposables Covered | Masks, Breathing Circuit, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Companies Covered | Drägerwerk AG & Co. KGaA, Fisher & Paykel Healthcare Limited, Koninklijke Philips NV, Medtronic plc, ResMed Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil respiratory devices market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Brazil respiratory devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil respiratory devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Respiratory devices refer to medical equipment designed to diagnose, monitor, and treat respiratory conditions such as COPD, asthma, and sleep apnea. These devices include spirometers, nebulizers, CPAP machines, and oxygen concentrators, serving hospitals, clinics, and home healthcare for improved respiratory care and patient outcomes.

The Brazil respiratory devices market was valued at USD 546.2 Million in 2025.

IMARC estimates the Brazil respiratory devices market to exhibit a CAGR of 6.75% during 2026-2034.

The market is driven by the rising cases of respiratory diseases such as COPD and asthma, increasing awareness of early diagnosis, government healthcare initiatives, and the growing geriatric population. Additionally, technological advancements in devices, demand for home healthcare, and telemedicine adoption.

Some of the major players in the Brazil respiratory devices market include Drägerwerk AG & Co. KGaA, Fisher & Paykel Healthcare Limited, Koninklijke Philips NV, Medtronic plc, and ResMed Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)