Brazil Rum Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Brazil Rum Market Summary:

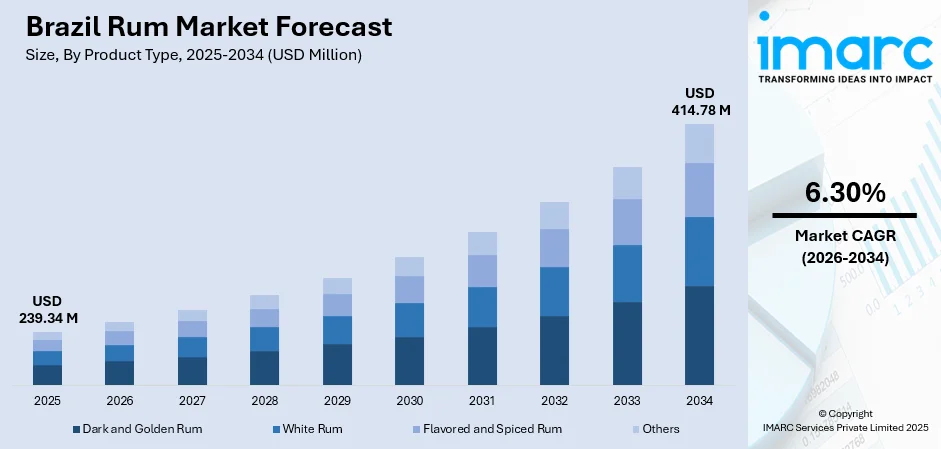

The Brazil rum market size was valued at USD 239.34 Million in 2025 and is projected to reach USD 414.78 Million by 2034, growing at a compound annual growth rate of 6.30% from 2026-2034.

The market is driven by rising domestic consumption, increasing tourism, and a significant shift toward premium and craft rum varieties. Favorable government policies supporting alcohol production, evolving consumer preferences for unique and authentic flavors, and growing interest in traditional Brazilian spirits continue to strengthen market expansion. The expanding export potential of Brazilian rum into international markets and the cultural heritage associated with cachaça are generating favorable conditions for sustained growth and solidifying the Brazil rum market share.

Key Takeaways and Insights:

- By Product Type: Dark and golden rum dominates the market in 2025, driven by consumer preference for rich, aged spirits with complex flavor profiles and the growing appreciation for premium sipping rum among Brazilian consumers seeking sophisticated drinking experiences.

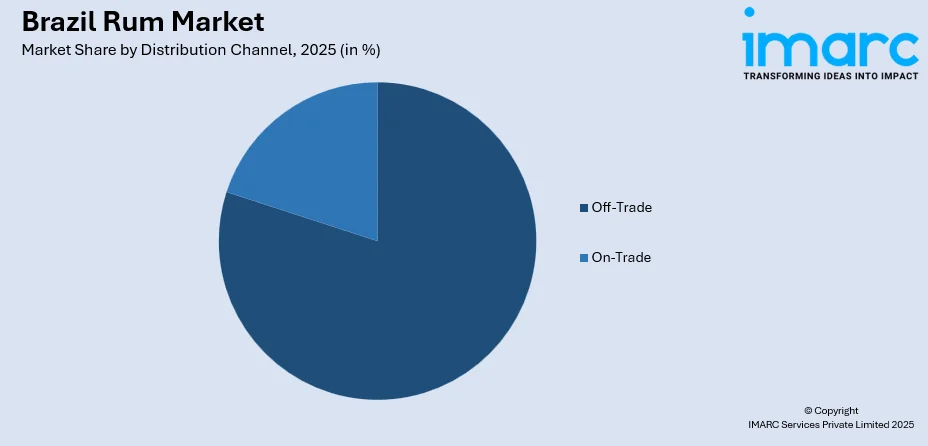

- By Distribution Channel: Off-trade leads the market with a share of 79.2% in 2025, owing to widespread availability of rum products in supermarkets, liquor stores, and hypermarkets, enabling convenient home consumption and bulk purchasing options.

- By Region: Southeast dominates the market with a share of 48.7% in 2025, driven by high population concentration in São Paulo and Rio de Janeiro metropolitan areas, higher disposable incomes, vibrant nightlife culture, and significant tourism activities.

- Key Players: The Brazil rum market exhibits a moderately fragmented competitive landscape, with established multinational spirits corporations competing alongside traditional domestic producers and emerging artisanal distilleries across various price segments and product categories.

To get more information on this market Request Sample

The Brazil rum market is experiencing robust growth, propelled by multiple converging factors that are reshaping the domestic spirits landscape. Rising disposable incomes and an expanding middle class are enabling consumers to explore premium alcohol options beyond traditional offerings. The country's rich cultural heritage in sugarcane cultivation and distillation provides a strong foundation for authentic rum production, particularly cachaça, which enjoys deep-rooted consumer affinity. Tourism growth, especially in coastal regions, is amplifying demand for traditional Brazilian cocktails like caipirinha. Additionally, shifting consumer demographics, with younger populations seeking diverse and innovative drinking experiences, are driving experimentation with various rum varieties. The increasing sophistication of domestic bartending culture and the rise of craft cocktail establishments are further contributing to market expansion, while export opportunities continue to unlock new revenue streams for Brazilian producers. In February 2025, Ron Botrán was launched in Brazil through a partnership with Importadora del Maipo, marking a strategic expansion into one of Latin America’s most dynamic premium rum markets.

Brazil Rum Market Trends:

Rising Premiumization and Craft Distillery Movement

The Brazil rum market is witnessing a pronounced shift toward premiumization, with consumers increasingly favoring artisanal, small-batch offerings over mass-produced alternatives. Boutique distilleries are gaining prominence by emphasizing traditional production methods, terroir-specific characteristics, and authentic heritage storytelling. In November 2025, Brazilian ultra-premium spirit BRABO debuted in the U.S. at Miami’s Moxy South Beach, showcasing mixology demos, tastings, and highlighting its small-batch Amburana wood craftsmanship. Moreover, this trend reflects broader consumer desires for quality over quantity, with discerning buyers willing to pay premium prices for unique flavor profiles and craftsmanship. The movement extends beyond cachaça to include aged golden and dark rum varieties that compete with international premium spirits. Distillers are investing in extended aging programs and experimenting with different wood cask types to create distinctive products.

Cocktail Culture Renaissance and Mixology Innovation

Brazil's cocktail culture is undergoing a significant renaissance, driving substantial demand for quality rum products suited for mixology applications. Professional bartenders and home enthusiasts are increasingly experimenting with rum-based variations of classic cocktails, moving beyond traditional caipirinha to create innovative mixed drinks. This trend is supported by the proliferation of specialty cocktail bars and the growing influence of international mixology competitions on domestic drinking preferences. In July 2024, BCB São Paulo showcased Brazil’s beverage industry, highlighting premium cachaça and rum, attracting 3,200 visitors and 120 brands, boosting cocktail innovation and craft spirits visibility. Moreover, educational initiatives and bartending academies are raising awareness about proper spirit selection and cocktail crafting techniques. The emergence of ready-to-drink cocktail products is further expanding consumption occasions beyond traditional bar settings.

Sustainability and Organic Production Practices

Environmental consciousness is increasingly influencing production practices and consumer purchasing decisions in the Brazil rum market. Distilleries are adopting sustainable sugarcane farming methods, including organic cultivation and reduced pesticide usage, to appeal to environmentally aware consumers. In July 2024, Spinagro’s SôZé cachaça, produced near Ribeirão Preto, São Paulo, implemented sustainable sugarcane farming, organic methods, and solar energy, establishing a benchmark for environmentally responsible rum production. Further, producers are implementing eco-friendly packaging solutions, including recycled materials and lightweight glass bottles to reduce carbon footprints. Water conservation and waste management programs are becoming standard operational practices among leading manufacturers. This sustainability focus extends to supply chain transparency, with consumers demanding traceability from field to bottle, creating opportunities for producers who can demonstrate authentic commitment to environmental stewardship.

Market Outlook 2026-2034:

The Brazil rum market revenue is poised for substantial expansion throughout the forecast period, underpinned by favorable demographic trends and evolving consumption patterns. Continued premiumization, expanding export opportunities, and growing international recognition of Brazilian spirits are expected to drive sustained revenue growth. The market will benefit from increasing tourism inflows, rising disposable incomes among younger consumers, and the ongoing sophistication of domestic drinking culture. Innovation in product offerings, including flavored variants and aged expressions, will create new revenue streams while strengthening brand differentiation in an increasingly competitive landscape. The market generated a revenue of USD 239.34 Million in 2025 and is projected to reach a revenue of USD 414.78 Million by 2034, growing at a compound annual growth rate of 6.30% from 2026-2034.

Brazil Rum Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Distribution Channel | Off-Trade | 79.2% |

| Region | Southeast | 48.7% |

Product Type Insights:

- Dark and Golden Rum

- White Rum

- Flavored and Spiced Rum

- Others

The dark and golden rum dominates Brazil rum market in 2025.

Dark and golden rum varieties have emerged as the leading product segment in the Brazil rum market, reflecting evolving consumer preferences toward more complex and flavorful spirits. According to sources, in August 2025, Docca Distillery from Camboriú won double gold and the title of “The Best of Show – Rum” at the Brazil Spirits Cup, becoming the most awarded distillery in the competition. Further, these aged variants appeal to discerning consumers seeking sophisticated sipping experiences comparable to premium whiskey and brandy alternatives. The extended aging process in wooden casks imparts distinctive caramel, vanilla, and oak notes that resonate with Brazilian palates accustomed to rich flavor profiles. Premium dark rum products are increasingly featured in upscale bars and restaurants catering to affluent clientele.

The segment benefits from strong associations with quality and craftsmanship, commanding premium pricing that enhances profitability for producers. Marketing strategies emphasizing heritage, tradition, and artisanal production methods effectively target consumers willing to trade up from standard white rum offerings. Gift-giving occasions and celebratory moment drive significant sales volumes in this category, particularly during festive seasons. Continued innovation in aging techniques and cask selection is enabling producers to create unique expressions that differentiate their offerings in an increasingly crowded marketplace while capturing the premiumization trend.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Off-Trade

- On-Trade

The off-trade leads with a share of 79.2% of the total Brazil rum market in 2025.

The off-trade in Brazil’s rum market serves as the primary channel for consumer purchases, offering convenience and accessibility that cater to everyday consumption. Supermarkets, hypermarkets, and convenience stores provide a wide array of rum varieties, from classic aged rums to flavored and premium options, allowing consumers to make selections suited to personal taste and occasion. Retailers often focus on attractive shelf displays, promotional pricing, and bundled offers, making rum more appealing to a broad consumer base. The segment’s strength lies in its ability to combine affordability with variety, enabling consumers to explore different brands and styles without the constraints of bar or restaurant settings.

In addition, the off-trade environment supports a more sustained and consistent demand throughout the year. It allows brands to build strong visibility and brand loyalty through repeated in-store interactions. Packaging innovations, such as ready-to-drink rum cocktails and smaller bottle sizes, are also commonly targeted at the off-trade, enhancing impulse purchases and providing convenient options for home consumption, celebrations, and social gatherings. This makes off-trade a critical driver of overall rum market growth in Brazil.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast dominates with a market share of 48.7% of the total Brazil rum market in 2025.

The Southeast region maintains dominant market position, driven by its substantial population base and concentration of major metropolitan areas including São Paulo and Rio de Janeiro. These urban centers feature vibrant nightlife ecosystems, sophisticated dining establishments, and cosmopolitan consumer bases receptive to premium alcohol offerings. Higher average disposable incomes in the region enable greater spending on quality spirits and support premiumization trends. The region's well-developed retail infrastructure ensures comprehensive product availability across diverse channel formats.

Tourism activities, particularly in Rio de Janeiro's beach districts and São Paulo's culinary destinations, generate significant rum consumption through hospitality establishments serving international visitors. According to sources, in March 2025, Rio Carnival hotel occupancy reached 95.51%, attracting an estimated 8 million visitors, generating R$5.7 billion in local revenue, and boosting demand for premium spirits nationwide. Further, the concentration of corporate headquarters and business travelers creates additional demand for premium spirits in hotels and airport retail outlets. Cultural events, music festivals, and sporting occasions drive periodic consumption spikes throughout the year. The region's trendsetting influence shapes consumption patterns nationwide, with new product introductions typically launching in Southeast markets before broader national rollouts.

Market Dynamics:

Growth Drivers:

Why is the Brazil Rum Market Growing?

Expanding Middle Class and Rising Disposable Incomes

Brazil's expanding middle class represents a fundamental driver of rum market growth, creating a larger consumer base with financial capacity to explore premium alcohol offerings. In January 2025, a study by Tendências Consultoria reported that 50.1% of Brazilian households earned over R$3,400 monthly in 2024, marking the first time the middle class became the majority since 2015. Moreover, as household incomes rise, discretionary spending on quality spirits increases, enabling consumers to trade up from basic alternatives to more sophisticated rum varieties. This demographic shift is particularly pronounced among younger urban professionals who demonstrate willingness to experiment with different brands and products. Growing financial security encourages more frequent social entertaining at home, driving off-trade purchases and brand exploration. The aspiration for premium lifestyle experiences extends to beverage choices, with consumers increasingly viewing quality spirits as affordable luxury indulgences.

Strong Cultural Heritage and Authentic Production Traditions

Brazil's centuries-old tradition in sugarcane cultivation and spirit distillation provides an unparalleled foundation for authentic rum production that resonates with domestic and international consumers alike. The cultural significance of cachaça, Brazil's national spirit, creates deep emotional connections that sustain consumer loyalty across generations. According to sources, In May 2025, Brazil’s national cachaça production reached 292.459 Million Liters in 2024, marking a 29.58% increase over 2023, highlighting growth in industrial rum-based spirits. Moreover, this heritage advantage positions Brazilian rum favorably against imported alternatives, particularly among consumers seeking authentic, locally-rooted drinking experiences. Traditional production methods passed down through generations add compelling storytelling elements that support premium positioning and brand differentiation. The connection between rum and Brazilian national identity, reinforced through cultural celebrations and traditional recipes, ensures sustained baseline demand.

Growing Tourism Sector and International Recognition

Brazil's growing tourism sector significantly contributes to rum market expansion by introducing international visitors to local spirits and creating export ambassadors who continue purchasing Brazilian rum upon returning home. According to sources, in 2024, Brazil welcomed a record 6,657,377 international tourists, marking a 12.6% increase from 2023, with key entry points including São Paulo, Rio de Janeiro, Paraná, and Rio Grande do Sul. Moreover, tourist destinations, particularly beach resorts and cultural centers, serve as showcases for traditional cocktails and premium rum offerings. International recognition through spirits competitions and critical acclaim enhances the global reputation of Brazilian rum, opening export opportunities in sophisticated markets worldwide. Tourism-related consumption drives on-trade channel growth while generating positive word-of-mouth marketing. The increasing presence of Brazilian rum in international duty-free retail further amplifies brand awareness among global travelers.

Market Restraints:

What Challenges the Brazil Rum Market is Facing?

Intense Competition from Alternative Spirits Categories

The Brazil rum market faces sustained competitive pressure from alternative spirits categories, particularly whiskey, vodka, and gin, which continue gaining consumer attention and market share. International premium brands invest heavily in marketing campaigns targeting younger demographics, potentially diverting consumers away from traditional rum consumption. The proliferation of craft spirits across multiple categories creates additional competition for consumer attention and retail shelf space, challenging rum producers to maintain visibility and relevance.

Regulatory Complexity and Taxation Burden

Complex regulatory frameworks governing alcohol production, distribution, and marketing create operational challenges for market participants, particularly smaller producers lacking resources for compliance management. High taxation rates on alcoholic beverages increase consumer prices, potentially constraining demand growth and encouraging informal market activities. Evolving regulations regarding advertising restrictions and labeling requirements add compliance costs that disproportionately affect emerging brands seeking market entry.

Economic Volatility and Currency Fluctuations

Brazil's periodic economic instability creates uncertainty affecting consumer spending patterns and business planning for market participants. Currency fluctuations impact import costs for production inputs and export competitiveness in international markets. Inflation pressures may compress consumer purchasing power, potentially driving trade-down behavior toward lower-priced alternatives. Economic uncertainty discourages long-term capital investments in production capacity expansion and brand building initiatives.

Competitive Landscape:

The Brazil rum market features a diverse competitive landscape characterized by the coexistence of established multinational spirits corporations, traditional domestic producers, and emerging craft distilleries. Market participants compete across multiple dimensions including product quality, brand heritage, distribution reach, pricing strategies, and marketing effectiveness. Larger players leverage extensive distribution networks and substantial marketing budgets to maintain visibility, while smaller artisanal producers differentiate through authenticity narratives and limited-edition offerings. Strategic acquisitions and partnerships are reshaping competitive dynamics as international players seek to establish footholds in this attractive market. Innovation in product development, packaging design, and consumer engagement strategies serves as key competitive differentiators. The emergence of e-commerce channels is democratizing market access, enabling smaller brands to compete more effectively against established competitors.

Recent Developments:

- In May 2025, Serra de Martins Rum, produced in Rio Grande do Norte’s Alto Oeste region, secured the highest score at the News Spirits/Expocachaça competition in Minas Gerais. Evaluated blindly among more than 600 labels, the rum and its honey brandy received top honors, reinforcing the region’s growing excellence in premium spirits.

Brazil Rum Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dark and Golden Rum, White Rum, Flavored and Spiced Rum, Others |

| Distribution Channels Covered | Off-Trade, On-Trade |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil rum market size was valued at USD 239.34 Million in 2025.

The Brazil rum market is expected to grow at a compound annual growth rate of 6.30% from 2026-2034 to reach USD 414.78 Million by 2034.

Dark and golden rum lead the Brazil market, favored for their distinctive flavors, smoothness, and versatility in cocktails, while also reflecting Brazil’s cultural heritage, making them a popular choice among both everyday consumers and premium spirits enthusiasts.

Key factors driving the Brazil rum market include rising domestic consumption, increasing tourism inflows, shift toward premium and craft rum varieties, favorable government policies supporting alcohol production, evolving consumer preferences for authentic flavors, and expanding export potential.

Major challenges include intense competition from alternative spirits categories, complex regulatory frameworks and high taxation burdens, economic volatility and currency fluctuations, limited international brand recognition, and infrastructure constraints affecting distribution in remote regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)