Brazil Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

Brazil Running Gear Market Overview:

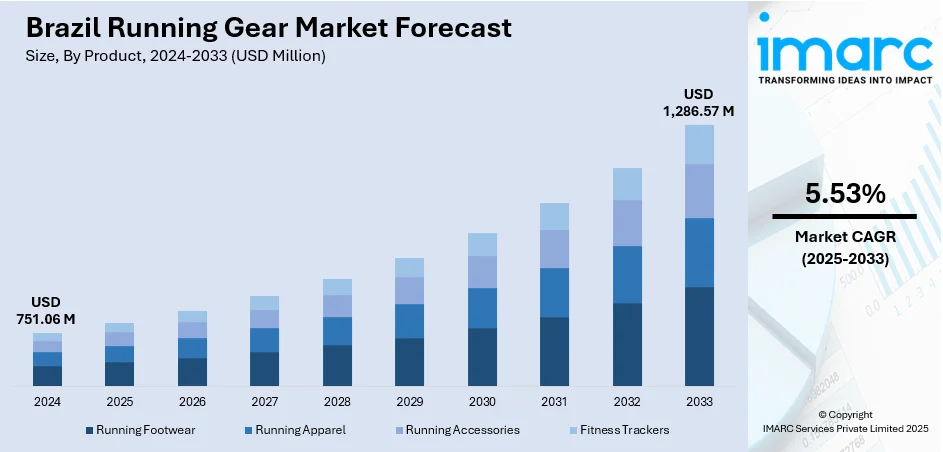

The Brazil running gear market size reached USD 751.06 Million in 2024. Looking forward, the market is projected to reach USD 1,286.57 Million by 2033, exhibiting a growth rate (CAGR) of 5.53% during 2025-2033. The market is driven by a blend of urban fashion and performance-oriented retail innovations that positions running gear as both lifestyle and athletic essential. Vibrant community events and cultural festival integration fuel demand for colorful, climate-suitable gear and frequent product updates. Advances in lightweight materials, eco-conscious design, and sustainability messaging enhance brand resonance and further augment the Brazil running gear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 751.06 Million |

| Market Forecast in 2033 | USD 1,286.57 Million |

| Market Growth Rate 2025-2033 | 5.53% |

Brazil Running Gear Market Trends:

Street Style Meets Athletic Performance in Urban Culture

Brazil’s running gear market is influenced by a fashion-smart, streetwear-inflected trend merging athletic performance with everyday style. In cities like São Paulo, Rio de Janeiro, and Brasília, sneakers are worn as fashion statements as often as training essentials. Retail outlets, including urban concept stores, offer limited-edition releases, designer-oriented collaborations, and customization services reflecting local fashion tastes. Influencer-led campaigns and live‑commerce launches showcase gear that combines vibrant Brazilian aesthetics with performance textiles. In Brazil, a +680% surge in searches for high-support sports bras signals booming demand for performance-oriented women’s gear, while community-driven running is on the rise through street races and apps like Strava. E‑commerce platforms feature personalized sizing tools, user reviews, and loyalty schemes tailored to style-conscious, active consumers. This fusion of street fashion and functional gear helps bridge sportswear into everyday wear. These retail innovations that align aesthetics with technical features are significant contributors to Brazil running gear market growth.

To get more information on this market, Request Sample

Innovation in Lightweight Materials and Sustainability Messaging

Brazilian consumers increasingly favor running gear that offers innovation in material technology, such as lightweight midsoles, breathable knit uppers, and thermoregulating fabrics. Brands like Olympikus, Adidas, Nike, and local manufacturers are introducing lines made partly from recycled plastic bottles, plant-based textiles, and biodegradable components. In May 2025, the Brazilian Olympic Committee (COB) and Adidas announced a new partnership to supply sports equipment for nine Olympic missions leading up to Los Angeles 2028. The collaboration marks Adidas' return as official outfitter for Team Brazil, with new uniforms debuting at the Milano Cortina 2026 Winter Olympics, and includes exclusive licensed product collections and fan-focused initiatives. Sustainability storytelling is prioritized in retail messaging and packaging design. Retailers highlight gear certified under environmental standards to support consumer trust. Seasonal product drops tied to ecological events, such as Earth Day runs or beach trail races, reinforce eco-conscious engagement. Local brands emulate global design trends while sourcing materials from sustainable regional supply chains to maintain affordability and performance standards. This focus on eco-friendly innovation paired with functional design aligns with emerging green consumer preferences, encouraging repeat purchases and brand loyalty.

Brazil Running Gear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

The report has provided a detailed breakup and analysis of the market based on the product. This includes running footwear, running apparel, running accessories, and fitness trackers.

Gender Insights:

- Male

- Female

- Unisex

The report has provided a detailed breakup and analysis of the market based on gender. This includes male, female, and unisex.

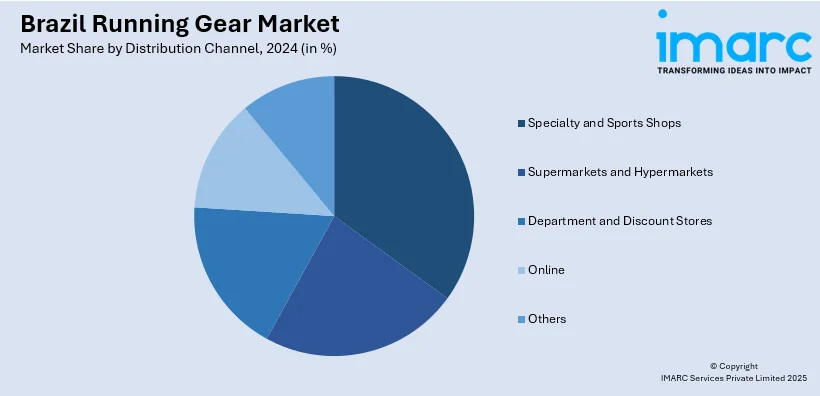

Distribution Channel Insights:

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialty and sports shops, supermarkets and hypermarkets, department and discount stores, online, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all major regional markets. This includes Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Running Gear Market News:

- In September 2024, Brazilian women-led startup RadarFit reached over 1 Million users with its AI-powered health and wellness app, offering gamified incentives like points redeemable for prizes to promote healthier habits. Backed by USD 456,000 in funding from Microsoft’s WE Ventures, RadarFit now supports 60+ corporate clients, aiming for 80 by year-end, and has already halved health complaints at companies like Cooabriel.

Brazil Running Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Trackers |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil running gear market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil running gear market on the basis of product?

- What is the breakup of the Brazil running gear market on the basis of gender?

- What is the breakup of the Brazil running gear market on the basis of distribution channel?

- What is the breakup of the Brazil running gear market on the basis of region?

- What are the various stages in the value chain of the Brazil running gear market?

- What are the key driving factors and challenges in the Brazil running gear market?

- What is the structure of the Brazil running gear market and who are the key players?

- What is the degree of competition in the Brazil running gear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil running gear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil running gear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil running gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)