Brazil Seeds Market Size, Share, Trends and Forecast by Type, Seed Type, Traits, Availability, Seed Treatment, and Region, 2025-2033

Brazil Seeds Market Overview:

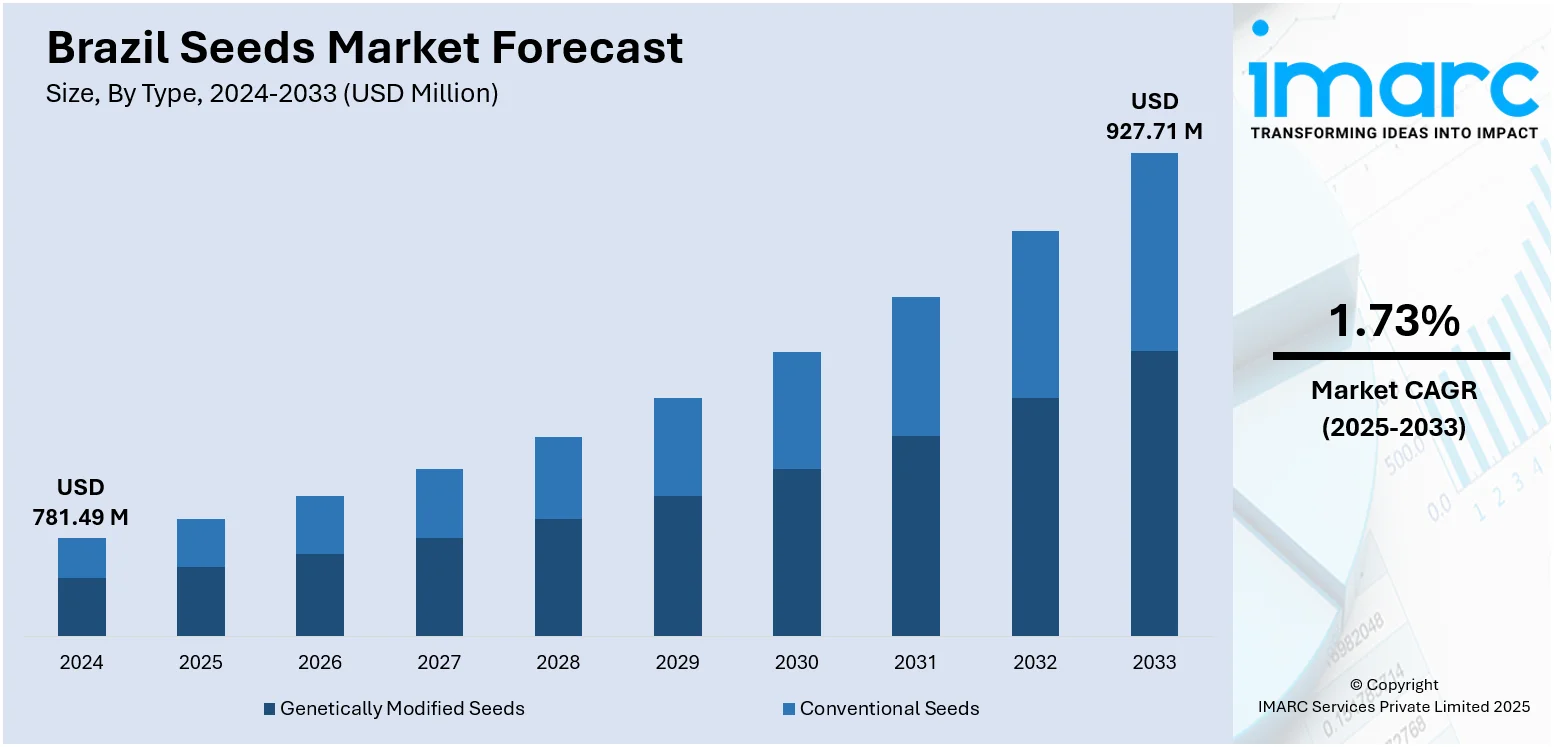

The Brazil seeds market size reached USD 781.49 Million in 2024. The market is projected to reach USD 927.71 Million by 2033, exhibiting a growth rate (CAGR) of 1.73% during 2025-2033. The seeds market is driven by rising adoption of high-yield and genetically modified seeds, expanding commercial agriculture, and increasing demand for sustainable farming practices. Government initiatives supporting crop innovation, coupled with growing export opportunities, are further boosting industry growth, enhancing productivity and profitability. Strong R&D investments by seed companies are improving crop resilience and quality, contributing to competitive advantages. These factors collectively strengthen the Brazil seeds market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 781.49 Million |

| Market Forecast in 2033 | USD 927.71 Million |

| Market Growth Rate 2025-2033 | 1.73% |

Brazil Seeds Market Trends:

Enhancing Seed Health and Regulatory Standards

In February 2025, Brazil conducted its largest-ever seizure of pirated soybean seeds, recovering over one ton of illicit product during a coordinated federal inspection in Rio Grande do Sul. This operation reflects growing national attention to seed quality enforcement and the formalization of certified seed supply chains. At the same time, nearly 190 laboratories across Brazil are now accredited to perform phytopathological diagnostics, improving early detection of seed-borne diseases and ensuring healthier planting material. Led by COPASEM, a renewed focus on harmonizing diagnostic methods and expanding technical training is raising the national baseline for seed testing and safety. These improvements are helping reduce counterfeit seed circulation, while simultaneously boosting farmer confidence in certified varieties. With better traceability, reliable germination data, and improved lab oversight, Brazil is elevating its seed health standards to global benchmarks. These regulatory upgrades are laying the groundwork for stronger supply chain transparency and are a key foundation driving Brazil seeds market growth in both domestic and export-oriented segments.

To get more information on this market, Request Sample

Strategic Export Expansion into New Markets

In April 2024, Brazil received formal approval to export vegetable seeds such as tomato, cucumber, eggplant, and sweet pepper to the Saudi Arabian market. This milestone reflects increasing international recognition of Brazilian seed quality, particularly in crops suited for greenhouse and semi-arid growing conditions. Brazil’s seed exports are expanding steadily, with growing demand from Central America, Africa, and parts of the Middle East. These regions value Brazilian seed lines for their genetic resilience and adaptability to water-scarce environments. Ongoing efforts to strengthen phytosanitary compliance, improve packaging standards, and align with international testing protocols are reinforcing Brazil’s position as a reliable seed supplier. These changes not only help Brazilian seed producers reach new markets but also encourage domestic alignment with global expectations for traceability and varietal documentation. As logistical and regulatory systems improve, Brazil is well-positioned to deepen its role in global seed distribution networks. These shifting dynamics driven by new trade partnerships and evolving seed standards represent a defining moment in Brazil seeds market trends, with global integration and quality assurance at the forefront.

Strengthening Domestic Seed Innovation Ecosystem

In early 2025, Brazilian authorities anticipated a rebound to record-level grain output following a dip in harvest results in the previous year. This projected recovery is coupled with growing demand for certified and particularly non‑GMO seed varieties amid global traceability requirements. Brazil’s status as top soy producer relies on locally bred and certified non‑GMO seed strains, though recent reporting indicates that non‑GMO seed supply remains constrained, particularly for European export contracts. Seed innovation centers are therefore accelerating development of traceable, compliant seed lines that meet both domestic and export market needs. Technical improvements in genetic quality, disease resistance and seed processing are supported by lab expansions and upgraded quality assurance protocols. These coordinated innovation efforts help Brazil retain full value capture in seed production and adapt to rising international standards. Stronger research-to-field integration is creating deeper seed variety selection and supply reliability. Together, these initiatives underline a vibrant domestic innovation ecosystem that supports sustainable production and strategic seed sector development.

Brazil Seeds Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, seed type, traits, availability, and seed treatment.

Type Insights:

- Genetically Modified Seeds

- Conventional Seeds

The report has provided a detailed breakup and analysis of the market based on the type. This includes genetically modified seeds and conventional seeds.

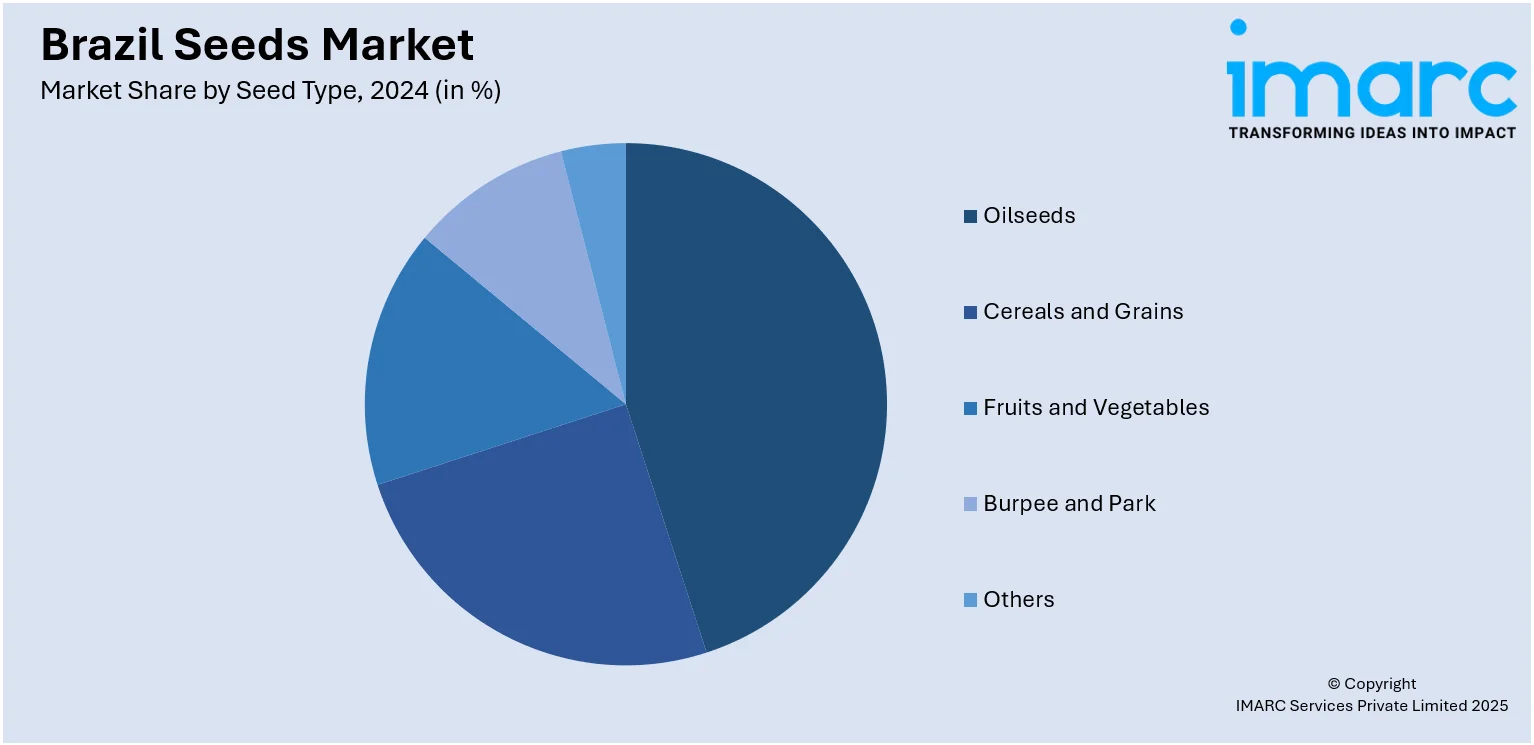

Seed Type Insights:

- Oilseeds

- Soybean

- Sunflower

- Cotton

- Canola/Rapeseed

- Cereals and Grains

- Corn

- Wheat

- Rice

- Sorghum

- Fruits and Vegetables

- Tomatoes

- Lemons

- Brassica

- Pepper

- Lettuce

- Onion

- Carrot

- Burpee and Park

- Others

A detailed breakup and analysis of the market based on the seed type have also been provided in the report. This includes oilseeds (soybean, sunflower, cotton, and canola/rapeseed), cereals and grains (corn, wheat, rice, and sorghum), fruits and vegetables (tomatoes, lemons, brassica, pepper, lettuce, onion, and carrot), burpee and park, and others.

Traits Insights:

- Herbicide-Tolerant (HT)

- Insecticide-Resistant (IR)

- Others

The report has provided a detailed breakup and analysis of the market based on the traits. This includes herbicide-tolerant (HT), insecticide-resistant (IR), and others.

Availability Insights:

- Commercial Seeds

- Saved Seeds

A detailed breakup and analysis of the market based on the availability have also been provided in the report. This includes commercial seeds and saved seeds.

Seed Treatment Insights:

- Treated

- Untreated

The report has provided a detailed breakup and analysis of the market based on the seed treatment. This includes treated and untreated.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include the Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Seeds Market News:

- February 2025: GDM Group officially launched its new corn seed brand, Supra Seeds, at Show Rural Coopavel in Brazil. This brand emerged from GDM’s acquisition of KWS Seeds’ corn and sorghum business in South America. Supra Seeds focuses on delivering high-quality genetics and reliable seed production to Brazilian farmers. With this launch, GDM aims to strengthen its position as a leading corn genetics provider in South America, supporting agricultural innovation and farmer productivity in the region.

- June 2025: Advanta Comércio de Sementes Ltda., part of UPL Group in Brazil, is selling all assets of its associate company Serra Bonita Sementes S.A. Advanta holds a one-third stake in Serra Bonita, which will remain an associate until the sale and legal processes are complete. This strategic move is part of UPL’s plan to optimize its asset portfolio and unlock value. Advanta focuses on developing high-performance, climate-smart seeds to support sustainable agriculture and address climate challenges.

Brazil Seeds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Genetically Modified Seeds, Conventional Seeds |

| Seed Types Covered |

|

| Traits Covered | Herbicide-Tolerant (HT), Insecticide-Resistant (IR), Others |

| Availabilities Covered | Commercial Seeds, Saved Seeds |

| Seed Treatments Covered | Treated, Untreated |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil seeds market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil seeds market on the basis of type?

- What is the breakup of the Brazil seeds market on the basis of seed type?

- What is the breakup of the Brazil seeds market on the basis of traits?

- What is the breakup of the Brazil seeds market on the basis of availability?

- What is the breakup of the Brazil seeds market on the basis of seed treatment?

- What is the breakup of the Brazil seeds market on the basis of region?

- What are the various stages in the value chain of the Brazil seeds market?

- What are the key driving factors and challenges in the Brazil seeds market?

- What is the structure of the Brazil seeds market and who are the key players?

- What is the degree of competition in the Brazil seeds market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil seeds market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil seeds market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil seeds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)