Brazil Solar Energy Market Size, Share, Trends and Forecast by Technology and Region2026-2034

Brazil Solar Energy Market Summary:

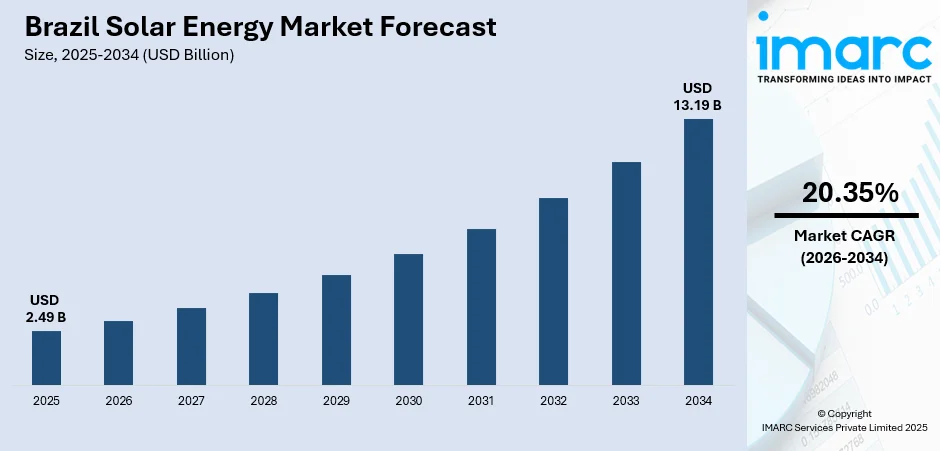

The Brazil solar energy market size was valued at USD 2.49 Billion in 2025 and is projected to reach USD 13.19 Billion by 2034, growing at a compound annual growth rate of 20.35% from 2026-2034.

The market expansion is primarily driven by Brazil's strategic commitment to energy diversification, favorable government policies supporting distributed generation, and declining photovoltaic technology costs. The country's abundant solar irradiation resources, combined with supportive net metering regulations and the growing corporate sustainability initiatives, continue to attract substantial domestic and international investments. Rising electricity prices and increasing environmental awareness among residential and commercial users further drives the demand and contributes to the Brazil solar energy market share.

Key Takeaways and Insights:

-

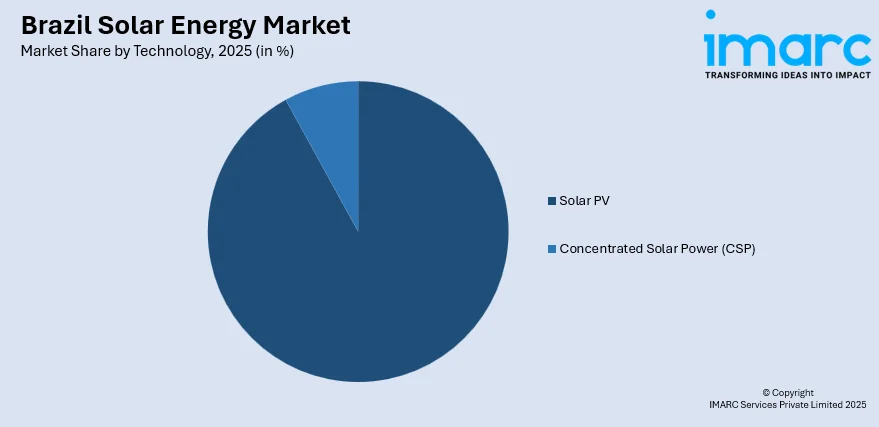

By Technology: Solar PV dominates the market with a share of 92% in 2025, driven by its proven cost-effectiveness, scalability across distributed and utility-scale applications, and mature supply chain ecosystem supporting rapid deployment.

-

By Region: Southeast leads the market with a share of 48.7% in 2025, supported by concentrated economic activity in São Paulo and Minas Gerais, higher disposable incomes enabling premium installations, and advanced grid infrastructure.

-

Key Players: The Brazil solar energy market exhibits competitive intensity characterized by multinational energy corporations, regional developers, and emerging distributed generation specialists competing across residential, commercial, and utility-scale segments.

To get more information on this market Request Sample

The Brazil solar energy market is experiencing significant growth, driven by a combination of favorable factors such as ideal climate conditions for solar generation, declining technology costs, and strong government support for renewable energy. In 2025, Brazil introduced a reform to its electricity sector, which includes opening the energy market to all users by 2028, along with changes to self-production rules and energy tariffs. This reform is expected to create a more competitive energy market and foster wider adoption of solar energy. Environmental awareness and sustainability goals are encouraging both individuals and businesses to invest in solar solutions. Coupled with rising electricity tariffs and the desire for energy independence, these drivers enhance the appeal of solar energy. Furthermore, improved financing options make solar systems more accessible across residential, commercial, and industrial sectors. Together, these factors create a conducive environment for continued growth in Brazil solar energy sector.

Brazil Solar Energy Market Trends:

Advancements in Solar Technology

Continuous improvements in the efficiency, durability, and cost-effectiveness of solar modules make solar energy more attractive to both residential and commercial sectors. Innovations like higher efficiency modules enable greater energy production even in regions with less optimal sunlight, increasing the overall viability of solar projects. As technological breakthroughs continue, they not only reduce costs but also enhance the long-term sustainability and performance of solar energy systems in Brazil. In line with this trend, in 2025, TCL Solar launched its advanced solar solutions in Brazil, focusing on high-performance BC and TOPCon modules. These products, benefiting from SunPower's legacy, offer 24.8%+ efficiency, enhanced durability, and are tailored to Latin America's energy needs. The company aims to drive the region’s green energy transformation with cutting-edge technology and sustainable solutions.

Increased Investment in Large-Scale Solar Projects

The growing investment in large-scale solar projects by government and private sector is a crucial factor positively influencing the market. Major players are expanding their portfolios with large solar farms, contributing significantly to the nation’s renewable energy capacity. These projects are supported by favorable financing options and long-term power purchase agreements, ensuring financial stability. As more investors and companies commit to large-scale solar installations, the market benefits from economies of scale, reduced costs, and enhanced energy production, accelerating Brazil's transition to renewable energy. In 2025, Scatec ASA began construction of a 142 MW solar project in Minas Gerais, Brazil. The project, valued at $85 million, is supported by a €25 million loan from IFU and includes a power purchase agreement with Statkraft for 75% of its output. Commercial activities are projected to start in the first half of 2026.

Strategic Collaborations

Strategic collaborations between financial institutions and renewable energy sectors are crucial for improving access to financing for small-scale solar systems, enabling wider adoption of solar technologies across businesses and households. By reducing financial barriers and promoting innovation, such collaborations play a vital role in advancing the transition to cleaner and more sustainable energy sources, helping Brazil achieve its renewable energy goals more effectively. For instance, in 2025, the International Finance Corporation (IFC) announced a $150 million investment in BV Bank to expand financing for small-scale solar systems in Brazil. This partnership aims to increase access to solar energy and support the country's transition to cleaner, more sustainable energy. The initiative aligns with Brazil's climate goals and IFC's strategy to boost climate finance in emerging markets.

Market Outlook 2026-2034:

The Brazil solar energy market is positioned for strong growth supported by stable policy incentives and improving economic conditions that encourage widespread adoption of photovoltaic systems. The market generated a revenue of USD 2.49 Billion in 2025 and is projected to reach a revenue of USD 13.19 Billion by 2034, growing at a compound annual growth rate of 20.35% from 2026-2034. The growing investment activity competitive project costs and steady demand from residential commercial and utility scale users contribute to this sustained upward outlook.

Brazil Solar Energy Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | Solar PV | 92% |

| Region | SoouthEast | 48.7% |

Technology Insights:

Access the comprehensive market breakdown Request Sample

- Solar PV

- Concentrated Solar Power (CSP)

Solar PV dominates with a market share of 92% of the total Brazil solar energy market in 2025.

Solar PV represents the largest segment due to its cost-effectiveness and scalability. With decreasing installation costs and technological advancements, solar PV is becoming accessible to both residential and commercial sectors.

The dominance of solar PV is also attributed to Brazil's abundant sunlight, which is being leveraged through technological advancements and targeted projects, as evidenced by the 2025 launch of Brazil's first photovoltaic power plant with sodium battery storage in the Amazon, featuring 7.5 kWp solar capacity and 38.4 kWh of storage for the remote community of Tumbira.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast leads with a market share of 48.7% of the total Brazil solar energy market in 2025.

Southeast dominates the market owing to its high population density and robust industrial base. The significant adoption of solar energy in major cities like São Paulo and Rio de Janeiro, driven by commercial and residential demand, is quantified by the Brazilian Association of Photovoltaic Solar Energy (Absolar) in 2025, which reports that São Paulo's installed capacity has reached 5.8 gigawatts (GW), reflecting a 38% growth compared to the last 12 months.

Moreover, the Southeast benefits from favorable weather conditions and ample sunlight, making it an ideal location for solar installations. The region’s well-developed infrastructure, government incentives, and the growing commitment to renewable energy further accelerate the adoption of solar power in both urban and rural areas.

Market Dynamics:

Growth Drivers:

Why is the Brazil Solar Energy Market Growing?

Innovation in Floating Solar Technology

The adoption of innovative solar technologies, such as floating solar systems, is contributing to the growth of Brazil solar energy market. By utilizing unique platforms and advanced technologies like bifacial solar modules, these systems optimize energy production in unconventional locations, such as reservoirs and water bodies. This approach enhances Brazil’s solar capacity and offers a sustainable solution to land use challenges, making solar energy more accessible and efficient while supporting the country's clean energy transition. In 2024, Tigo Energy announced that Apollo Flutuantes will deploy 97,200 Tigo TS4-X-O optimizers for Brazil’s largest floating solar plant at the Lajeado Hydroelectric Power Plant reservoir in Tocantins. The plant, set for completion by December 2025, will feature innovative platforms and optimize energy production using bifacial solar modules. This project highlighted Brazil's growing solar capacity and demonstrates the potential of floating solar technology.

Government Support for Renewable Energy

The increasing initiatives by the governing body are a crucial factor impelling market growth by creating favorable policies, attracting investments, and promoting the adoption of renewable energy technologies like solar power. By setting ambitious investment targets and prioritizing renewable energy, including solar power, the policy fosters an environment conducive to sustainable development. These efforts create significant opportunities for both domestic and international investments, encourage technological innovation, and integrate solar energy into the broader green economy, positioning Brazil as a leader in the renewable energy sector. In 2024, President Lula launched Brazil's National Energy Transition Policy (PNTE), aiming to attract BRL 2 trillion in investments over ten years. The policy focused on advancing the green economy by promoting renewable energy sources like wind, solar, and green hydrogen. It also aimed to create synergies with existing government policies to support sustainable and inclusive economic growth.

Growing Investment in Solar Assets

The increasing investment in solar energy assets is influencing the market by expanding capacity, ensuring stable returns, and attracting further capital to renewable energy projects. Strategic acquisitions, such as the purchase of solar facilities by energy companies, provide a stable cash flow and attractive returns, attracting more investors. These investments not only expand Brazil's solar capacity but also leverage favorable conditions like high solar irradiation and long-term contracts, ensuring the financial viability of projects and contributing to the country’s renewable energy transition. For instance, in 2025, Energea acquired the 1.3 MW Pains Solar Facility in Minas Gerais, Brazil, for $1.3 million. This acquisition enhances their Community Solar Portfolio, offering immediate cash flow with a projected 15% internal rate of return (IRR). The project also benefits from long-term rental contracts and strong solar irradiation.

Market Restraints:

What Challenges the Brazil Solar Energy Market is Facing?

Regulatory and Policy Uncertainty

The Brazil solar energy market faces persistent challenges due to inconsistent and frequently changing regulatory policies. Shifts in government incentives, tax structures, and compliance requirements create an unpredictable environment for investors and developers. This regulatory instability complicates long-term planning and investment, as stakeholders are unsure of the future landscape. As a result, the lack of a clear and stable policy framework slows down the market's growth potential, particularly for large-scale solar projects that require significant upfront commitment.

Grid Integration Issues

The integration of solar energy into Brazil’s national grid remains a complex challenge due to its variable nature. Solar generation is highly dependent on weather conditions, leading to fluctuations in supply that can disrupt grid stability. Moreover, Brazil's existing grid infrastructure is not fully equipped to handle the increasing volume of decentralized solar generation. This necessitates substantial upgrades to transmission and distribution systems, which involves both time and investment, slowing the overall efficiency of energy distribution.

Financing Barriers

One of the primary barriers to expanding solar energy in Brazil is the difficulty in securing affordable financing. The high upfront costs associated with solar installations, including panels, equipment, and labor, are often prohibitive for smaller businesses and households. While there is rise in the interest in renewable energy, many potential adopters, especially small and medium firms, face challenges in accessing the necessary credit or financing options. This restricts the widespread adoption of solar energy systems, particularly in less affluent regions.

Competitive Landscape:

The Brazil solar energy market exhibits dynamic competitive intensity characterized by multinational energy corporations, regional project developers, and specialized distributed generation companies competing across market segments. Market participants differentiate through technological capabilities, project development expertise, financing partnerships, and geographic coverage. The competitive landscape is evolving as international renewable energy companies expand Brazilian portfolios while domestic developers leverage local market knowledge and established distribution networks. Strategic positioning increasingly emphasizes integrated solutions combining generation, storage, and energy management services to capture emerging opportunities across residential, commercial, industrial, and utility-scale applications.

Recent Developments:

-

In November 2025, Iberdrola launched the "Noronha Verde" project in Brazil to decarbonize the Fernando de Noronha archipelago, a UNESCO World Heritage Site. The initiative integrates solar energy with battery storage, aiming to make the island the first Latin American inhabited oceanic island with a sustainable energy model. The €50 million project is part of Iberdrola’s broader commitment to invest over €7 billion in Brazil over the next five years.

-

In November 2025, Enel Group's Arinos Solar Park in Minas Gerais, Brazil, became a key player in the country's renewable energy transition. The 611 MW plant, utilizing over 1 million solar modules, generates 1.4 TWh annually, powering 680,000 homes and reducing CO₂ emissions by 790,000 tons. Beyond energy production, the project also boosts the local economy with over 3,500 jobs and a range of community-focused initiatives.

Brazil Solar Energy Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Solar PV, Concentrated Solar Power (CSP) |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Companies Covered | Canadian Solar Inc., Enel SpA, Engie SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil solar energy market size was valued at USD 2.49 Billion in 2025.

The Brazil solar energy market is expected to grow at a compound annual growth rate of 20.35% from 2026-2034 to reach USD 13.19 Billion by 2034.

Solar PV leads the market with 92% in 2025, driven by its proven cost-effectiveness, deployment flexibility across residential and utility-scale applications, and mature supply chain infrastructure.

Key factors driving the Brazil solar energy market include the growing investment in large-scale solar projects by both government and private sectors. With projects like Scatec ASA's 142 MW solar farm in Minas Gerais, supported by favorable financing and power purchase agreements, the market benefits from economies of scale, lower costs, and increased energy production.

The Brazil solar energy market faces challenges including regulatory instability, grid integration issues, and financing barriers. Inconsistent policies create uncertainty for investors, while grid infrastructure struggles to accommodate solar generation. High upfront costs and limited access to financing hinder broader adoption, especially for smaller businesses.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)