Brazil Sportswear Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2025-2033

Brazil Sportswear Market Overview:

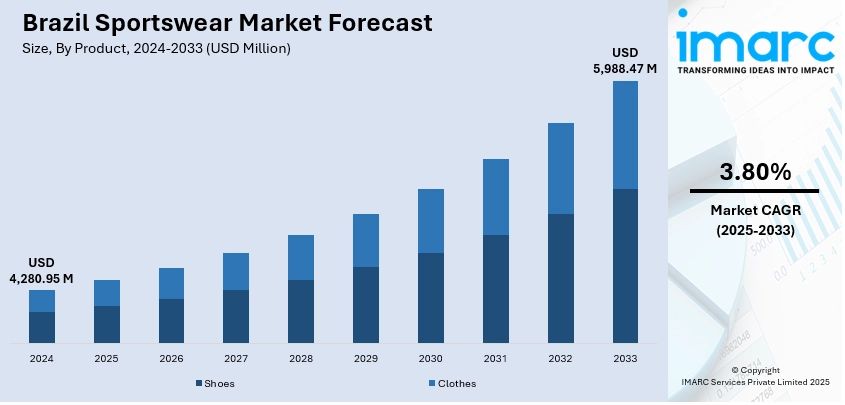

The Brazil sportswear market size reached USD 4,280.95 Million in 2024. Looking forward, the market is expected to reach USD 5,988.47 Million by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is expanding steadily, fueled by increasing health consciousness, growing gym and sports participation, and rising demand for athleisure wear. Urbanization, influencer-driven trends, and the popularity of football also boost apparel and footwear sales. E-commerce growth further enhances accessibility, contributing to a positive outlook for the Brazil sportswear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,280.95 Million |

| Market Forecast in 2033 | USD 5,988.47 Million |

| Market Growth Rate 2025-2033 | 3.80% |

Brazil Sportswear Market Trends:

Growth of Athleisure and Fashion-Conscious Consumers

The fusion of sport and casual clothing, or athleisure, has become the leading trend in the Brazilian fashion scene. Spurred by fashion-driven consumers who want comfort without sacrificing fashion, athleisure has expanded well beyond the gym and into the workplace, school, and social circles. Brazilian consumers are increasingly donning leggings, joggers, and sportswear tops as regular fashion pieces, mirroring a world-wide tendency toward comfortable yet fashion-forward clothing. Influencer advertising, fashion joint ventures, and celebrity endorsement have also played a part in the popularization of sportswear in everyday life. Domestic and foreign brands are reacting with adaptive, fashion-inspired collections that are both functional and stylish. This blending of style and fitness continues to broaden the reach of the sportswear market, drawing in consumers who value versatility, self-expression, and trend-relatedness.

To get more information on this market, Request Sample

Expanding E-Commerce and Digital Engagement

E-commerce growth has transformed how Brazilian consumers shop for sportswear, making it easier than ever to access a wide range of brands and products. Improved internet connectivity, mobile apps, and online payment options have boosted consumer confidence in digital purchases. Many sportswear companies are investing heavily in online platforms, offering personalized shopping experiences, virtual fitting tools, and fast delivery services. Digital engagement through social media, influencer partnerships, and targeted advertising helps brands connect directly with consumers, particularly younger demographics. Online exclusives and discount campaigns further attract price-sensitive buyers. This digital transformation not only enhances convenience and product discovery but also drives sales volumes across urban and regional markets. As online retail continues to scale, it becomes a key growth engine for Brazil’s sportswear market.

Increasing Health and Fitness Awareness

The rising health consciousness across Brazil is a significant factor boosting the Brazil sportswear market growth. An increasing number of consumers are adopting active lifestyles that include gym workouts, running, cycling, and group fitness classes. Public health campaigns, urban fitness events, and the growing presence of wellness influencers on social media have further reinforced this trend. People are investing more in performance-oriented apparel that provides comfort, breathability, and durability during workouts. Women’s participation in fitness is also on the rise, creating demand for gender-specific designs and apparel lines. This heightened focus on physical well-being, combined with broader societal shifts toward preventive healthcare, continues to make sportswear an essential part of everyday wardrobes, driving market growth across various income and age segments in Brazil.

Brazil Sportswear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, distribution channel, and end user.

Product Insights:

- Shoes

- Clothes

The report has provided a detailed breakup and analysis of the market based on the product. This includes shoes and clothes.

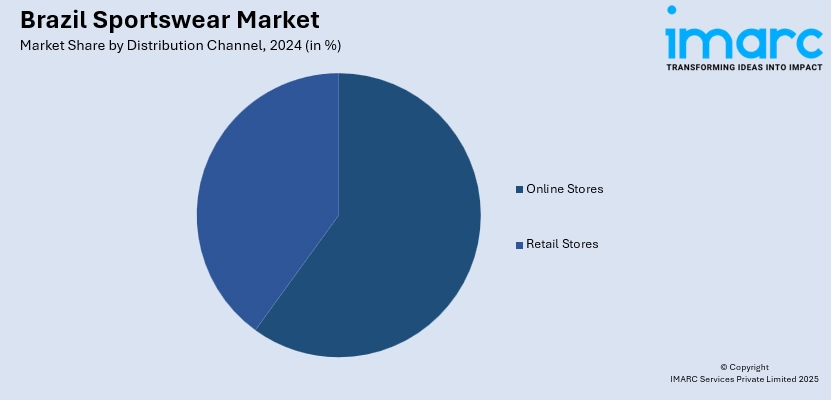

Distribution Channel Insights:

- Online Stores

- Retail Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online stores and retail stores.

End User Insights:

- Men

- Women

- Kids

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and kids.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Sportswear Market News:

- In December 2024, The Brazilian Football Federation (CBF) renewed its exclusive kit supply agreement with Nike, extending the partnership for another 12 years. As part of the deal, Nike will provide its cutting-edge football technologies to support the performance of Brazil’s national players. Among Nike’s global ambassadors is Real Madrid star Vinicius Jr, who secured the second spot on SportsPro’s 2024 list of the 50 Most Marketable Athletes.

Brazil Sportswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Shoes, Clothes |

| Distribution Channels Covered | Online Stores, Retail Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil sportswear market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil sportswear market on the basis of product?

- What is the breakup of the Brazil sportswear market on the basis of distribution channel?

- What is the breakup of the Brazil sportswear market on the basis of end user?

- What is the breakup of the Brazil sportswear market on the basis of region?

- What are the various stages in the value chain of the Brazil sportswear market?

- What are the key driving factors and challenges in the Brazil sportswear market?

- What is the structure of the Brazil sportswear market and who are the key players?

- What is the degree of competition in the Brazil sportswear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil sportswear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil sportswear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil sportswear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)