Brazil Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Brazil Steel Tubes Market Overview:

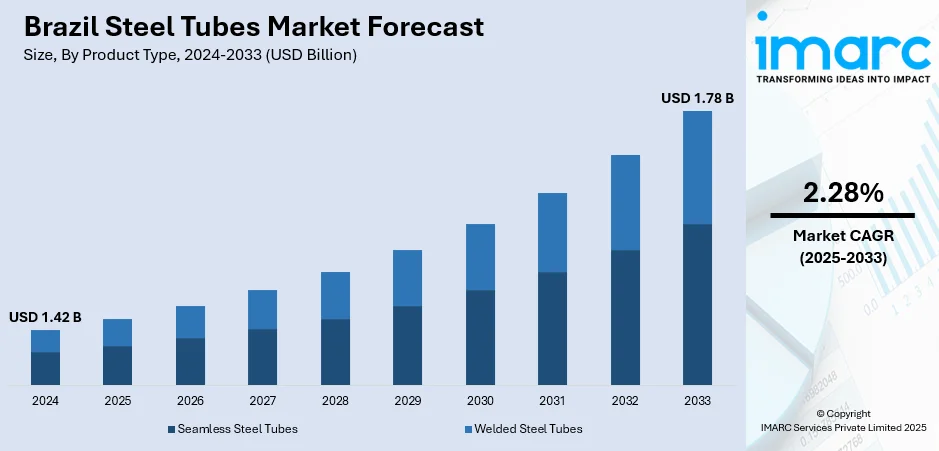

The Brazil steel tubes market size reached USD 1.42 Billion in 2024. The market is projected to reach USD 1.78 Billion by 2033, exhibiting a growth rate (CAGR) of 2.28% during 2025-2033. The market is experiencing dynamic transformation, driven by evolving demands across types and applications from infrastructure to energy and industrial construction. Advancements in manufacturing techniques and material innovations are shaping the sector’s diversification and resilience. Strong investments in domestic production capabilities, along with alignment to global supply dynamics, are reinforcing competitiveness in steel tube offerings. These developments are fostering deeper integration across value chains, bolstering national manufacturing strength and signaling promising prospects for Brazil steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.42 Billion |

| Market Forecast in 2033 | USD 1.78 Billion |

| Market Growth Rate 2025-2033 | 2.28% |

Brazil Steel Tubes Market Trends:

Rising Steel Imports Nudge Local Innovation

In January 2025, Brazil’s national steel body reported that steel imports reached record levels during 2024, signaling a pronounced shift in the industry’s raw material landscape. That change isn’t merely a statistic it’s a catalyst encouraging the steel tubes sector to elevate its game. As access to foreign steel expands, domestic manufacturers are sharpening their focus on agility, precision, and streamlined delivery. It’s about turning a rising tide of imports into an opportunity for value-driven differentiation by improving turnaround times, refining product adaptation, and reinforcing supply chain responsiveness. In the process, the industry is resetting its baseline, where local production is defined not just by cost, but by quality, reliability, and flexibility. This dynamic is fostering closer alignment between procurement strategies and emerging infrastructure needs, creating space for innovation in both production techniques and coordination. Through this evolution, Brazilian tube makers are positioning themselves to meet local and regional demand with sharper execution. It’s precisely this kind of proactive pivot rooted in opportunity, not obligation that reflects how Brazil steel tubes market trends are being shaped today.

To get more information on this market, Request Sample

Policy-Driven Investment Boosts Supply Chain Confidence

In May 2024, Brazil’s government announced a major policy and investment initiative aimed at revitalizing domestic steel production and strengthening national industry supply chains. While the announcement focused broadly on national steel capabilities, the impact on the tube segment is direct. With clear government backing for core steel infrastructure, tube manufacturers are seeing improved supply stability and growing confidence in sourcing locally. This shift supports stronger planning cycles, reduces import dependencies, and improves alignment with infrastructure timelines. For a market like Brazil experiencing rapid demand across transport, sanitation, and energy this foundation is essential. What’s particularly valuable is how these investments unlock further downstream innovation. Tube producers are no longer just reacting to supply limitations; they’re optimizing production, expanding specifications, and aligning with more technically demanding applications. As the industrial base strengthens, so too does the ability to meet project needs with consistency and quality. This emerging reliability and responsiveness are becoming defining features of Brazil steel tubes market growth.

Trade Protection Measures Shape Market Dynamics

In July 2025, Brazil's Foreign Trade Chamber renewed anti-dumping protections on China's stainless steel welded tubes for another five years. The action is intended to help the country's domestic steel tubes sector by addressing issues of unfairly priced imports. The renewal of these protections strengthens Brazil's focus on fair competition and its support of local producers. This regulatory climate pushes the local producers to enhance their capabilities and invest in innovation so that they can compete on both price and quality terms. The trade protection initiatives will also likely make procurement plans in end-use industries more flexible, leading buyers to look more earnestly at local and substitute sources. This can increase supply chain stability in the long run and drive the evolution of value-added products customized to meet Brazil's market requirements. The continued focus on safeguarding indigenous industry via trade measures is a crucial driving force of Brazil steel tubes market, as it harmonizes market growth and sustainable industry growth.

Brazil Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

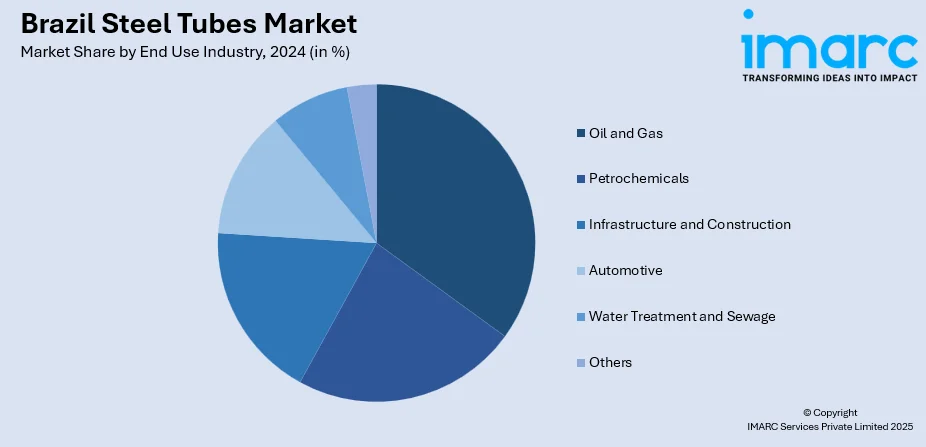

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include the Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Steel Tubes Market News:

- March 2025: Tuper, a leading Brazilian pipe producer, is set to become fully owned by ArcelorMittal, marking a significant step in their long-standing partnership. The agreement follows years of collaboration and reflects a strategic move to strengthen ArcelorMittal’s presence in Brazil’s industrial sector. Pending regulatory approval, the acquisition aims for a smooth operational transition. This development underscores continued investment in Brazil’s manufacturing base and reinforces confidence in the country’s industrial growth and strategic capabilities.

Brazil Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Others |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil steel tubes market on the basis of product type?

- What is the breakup of the Brazil steel tubes market on the basis of material type?

- What is the breakup of the Brazil steel tubes market on the basis of end use industry?

- What is the breakup of the Brazil steel tubes market on the basis of region?

- What are the various stages in the value chain of the Brazil steel tubes market?

- What are the key driving factors and challenges in the Brazil steel tubes market?

- What is the structure of the Brazil steel tubes market and who are the key players?

- What is the degree of competition in the Brazil steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)