Brazil Team Collaboration Software Market Size, Share, Trends and Forecast by Components, Software Type, Deployment, Industry Vertical, and Region, 2026-2034

Brazil Team Collaboration Software Market Summary:

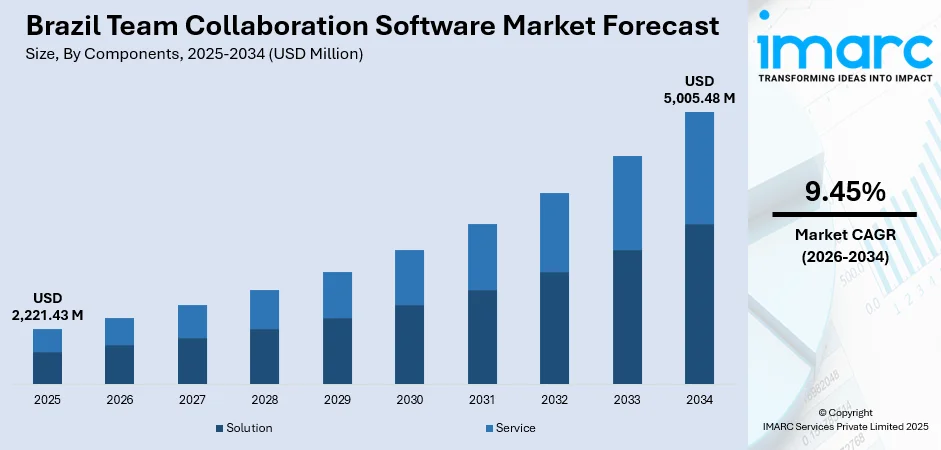

The Brazil team collaboration software market size was valued at USD 2,221.43 Million in 2025 and is projected to reach USD 5,005.48 Million by 2034, growing at a compound annual growth rate of 9.45% from 2026-2034.

The market experiences robust expansion driven by accelerating digital transformation initiatives across enterprises, widespread adoption of hybrid work models, and increasing demand for cloud-based productivity solutions. Organizations leverage collaboration platforms to enhance remote workforce connectivity, streamline communication workflows, and support distributed team operations. Government investments in digital infrastructure and AI development, coupled with rising cybersecurity awareness, are propelling sustained adoption across financial services, telecommunications, healthcare, and manufacturing sectors, expanding the Brazil team collaboration software market share.

Key Takeaways and Insights:

- By Components: Solution dominates the market with a share of 59% in 2025, driven by comprehensive feature sets including video conferencing, instant messaging, document management, and project tracking capabilities that address enterprise collaboration needs.

- By Software Type: Communication and co-ordination lead the market with a share of 55% in 2025, owing to critical demand for real-time messaging, file sharing, and unified communication tools that enable seamless workforce interaction.

- By Deployment: Cloud-based represents the largest segment with a market share of 68% in 2025, propelled by scalability advantages, reduced infrastructure costs, and accessibility benefits that support remote work environments.

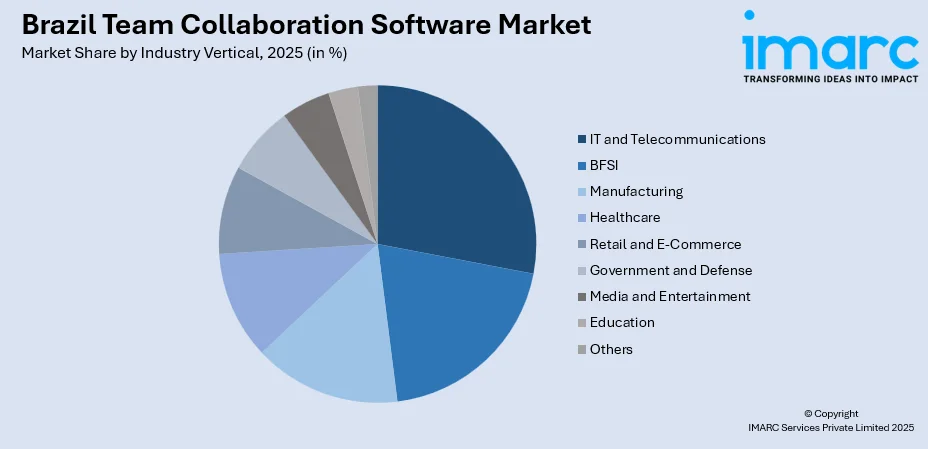

- By Industry Vertical: IT and telecommunications lead the market with a share of 20% in 2025, leveraging robust digital infrastructure and high technology adoption rates to implement advanced collaboration solutions.

- By Region: Southeast represents the largest segment with a market share of 34% in 2025, driven by concentration of major enterprises in São Paulo metropolitan area and strong digital ecosystem supporting technology adoption.

- Key Players: The market exhibits strong competitive intensity, with global technology leaders competing alongside regional providers across multiple segments. Major international vendors leverage comprehensive product portfolios and extensive enterprise relationships, while local integrators offer localized support and regulatory expertise tailored to Brazilian market requirements.

To get more information on this market Request Sample

Brazil's team collaboration software landscape reflects substantial momentum toward digital workplace transformation, driven by persistent hybrid work arrangements that emerged post-pandemic. Organizations increasingly recognize collaboration platforms as strategic infrastructure rather than discretionary tools, viewing them as essential enablers of productivity, innovation, and workforce retention. In September 2024, Microsoft announced BRL 14.7 billion investment in cloud and AI infrastructure expansion across São Paulo data center campuses over three years, demonstrating hyperscaler commitment to Brazilian digital economy development. This investment aligns with government priorities, as Brazilian authorities pledged BRL 186.6 billion toward industrial sector digital transformation in September 2024, with significant allocations directed toward telecommunications infrastructure, cloud computing deployment, and software development initiatives that create favorable conditions for collaboration platform adoption across enterprises of all sizes.

Brazil Team Collaboration Software Market Trends:

Integration of Artificial Intelligence (AI) and Automation Features

Collaboration platforms increasingly embed AI capabilities that transform user experiences through intelligent meeting transcription, automated translation, content summarization, and predictive task management. These AI-powered features enable organizations to extract greater value from collaboration interactions, reduce administrative overhead, and support multilingual workforce communication. Brazilian enterprises adopt AI-enhanced tools to improve decision-making velocity, enhance knowledge management, and optimize workflow automation. Platform vendors differentiate offerings through machine learning algorithms that analyze communication patterns, suggest productivity improvements, and automate routine collaboration tasks, driving preference for advanced solutions among digitally mature organizations seeking competitive advantages through technology-enabled efficiency gains. IMARC Group predicts that the Brazil artificial intelligence market is projected to attain USD 16,841.85 Million by 2033.

Heightened Emphasis on Data Security and Regulatory Compliance

Organizations prioritize collaboration platforms offering robust security architectures and comprehensive compliance frameworks aligned with Brazilian General Data Protection Law requirements. Following implementation of LGPD regulations and increasing cybersecurity threats, enterprises demand solutions incorporating end-to-end encryption, granular access controls, audit logging, and data residency options. In June 2024, Kyndryl established satellite Security Operations Center in Hortolândia, São Paulo, providing AI-powered cyber threat protection for Brazilian enterprises across industries. This heightened security focus drives vendors to enhance platform security features, obtain compliance certifications, and offer dedicated Brazilian data center deployments that address organizational concerns regarding sensitive information protection, regulatory adherence, and enterprise risk management requirements.

Proliferation of Industry-Specific Collaboration Solutions

Collaboration software providers develop vertical-specific offerings tailored to unique workflow requirements, compliance mandates, and operational needs across healthcare, financial services, manufacturing, and government sectors. These specialized solutions incorporate industry terminology, pre-configured templates, sector-specific integrations, and compliance-ready features that accelerate deployment and enhance user adoption. Organizations increasingly favor platforms offering purpose-built capabilities for their industry contexts over generic solutions requiring extensive customization. This trend reflects maturation of collaboration software market, where differentiation through vertical expertise and domain-specific functionality creates competitive advantages for vendors understanding sector nuances and delivering targeted value propositions aligned with specialized organizational requirements. In 2025, the Huawei Cloud Brazil Summit, its third annual event themed "Accelerating Intelligence, Pioneering a Smarter Brazil," took place on November 4 in Sao Paulo, Brazil. Huawei Cloud showcased its tech advancements for the intelligent era and introduced new cloud offerings, such as the AI Token Service, AI Agent Platform Versatile, and Huawei Cloud Stack 8.6.

Market Outlook 2026-2034:

Brazil's team collaboration software market trajectory reflects sustained momentum driven by irreversible workplace transformation toward hybrid models, accelerating cloud migration, and maturing digital infrastructure supporting distributed workforce operations. Organizations increasingly view collaboration platforms as foundational business systems warranting strategic investment rather than tactical expenditure, recognizing their central role in productivity, innovation, and competitive positioning. The market generated a revenue of USD 2,221.43 Million in 2025 and is projected to reach a revenue of USD 5,005.48 Million by 2034, growing at a compound annual growth rate of 9.45% from 2026-2034. This is further reflecting strong enterprise demand, expanding small and medium enterprise adoption, and continuous platform innovation addressing evolving workforce collaboration requirements.

Brazil Team Collaboration Software Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Components |

Solution |

59% |

|

Software Type |

Communication and Co-Ordination |

55% |

|

Deployment |

Cloud-based |

68% |

|

Industry Vertical |

IT and Telecommunications |

20% |

|

Region |

Southeast |

34% |

Components Insights:

- Solution

- Service

Solution dominates with a market share of 59% of the total Brazil team collaboration software market in 2025.

Solution segment commands majority market share through comprehensive feature portfolios addressing diverse organizational collaboration requirements. These platforms deliver integrated capabilities spanning video conferencing, instant messaging, document collaboration, project management, and workflow automation through unified interfaces that eliminate application switching and streamline user experiences. Enterprises prioritize solutions offering seamless integration with existing business systems, supporting multiple communication modalities, and enabling both synchronous and asynchronous collaboration patterns. In 2025, telecommunications provider TIM Brasil has finalized a new five-year agreement with Oracle aimed at speeding up the implementation of AI via Oracle Cloud Infrastructure (OCI). The agreement enhances the enduring partnership between the companies as part of the operator's digital advancement initiative, which began in 2021 when TIM commenced moving its data centers to OCI.

Solution providers compete through continuous innovation enhancing platform capabilities, expanding ecosystem partnerships, and improving user experience design. Organizations evaluate solutions based on feature breadth, scalability characteristics, integration flexibility, security architecture, and total cost of ownership considerations. Market leaders differentiate through AI-powered features, mobile-optimized experiences, and vertical-specific functionality addressing sector requirements. Solution segment growth reflects enterprise preference for comprehensive platforms consolidating multiple collaboration tools, reducing vendor management complexity, and providing unified administration interfaces supporting large-scale deployments across distributed workforce populations requiring reliable communication infrastructure.

Software Type Insights:

- Conferencing

- Communication and Co-Ordination

Communication and co-ordination lead with a share of 55% of the total Brazil team collaboration software market in 2025.

Communication and co-ordination segment dominates through critical importance of real-time messaging, file sharing, and unified communication capabilities enabling continuous workforce connectivity. These tools facilitate instant information exchange, support asynchronous collaboration patterns, and provide persistent communication channels maintaining organizational knowledge. Enterprises leverage communication platforms as primary interaction layers connecting distributed teams, supporting informal collaboration, and enabling rapid decision-making processes. Platform adoption accelerated following hybrid work transition, as organizations recognized messaging systems as essential infrastructure maintaining team cohesion and productivity across physical boundaries.

Communication platforms compete through feature richness including threaded conversations, searchable message archives, file repository integration, and notification management capabilities. Vendors differentiate through user experience design, mobile application quality, enterprise-grade security features, and extensive third-party integration ecosystems connecting communication layers with business applications. Segment growth reflects organizational dependence on continuous connectivity tools, expanding use cases beyond basic messaging toward comprehensive collaboration hubs, and increasing preference for platforms offering combined communication and coordination capabilities through unified experiences supporting diverse workflow patterns and collaboration styles.

Deployment Insights:

- On-Premises

- Cloud-based

Cloud-based exhibits a clear dominance with a 68% share of the total Brazil team collaboration software market in 2025.

Cloud-based deployment dominates market through superior scalability, reduced infrastructure investment requirements, and simplified administration supporting rapid deployment across distributed organizations. Cloud platforms eliminate on-premises hardware dependencies, enable consumption-based pricing models, and provide automatic software updates maintaining current functionality without internal IT intervention. Organizations favor cloud solutions for their ability to scale capacity dynamically, support remote workforce access requirements, and integrate seamlessly with other cloud-based business applications.

Cloud deployment advantages include faster time-to-value through streamlined implementation, lower total cost of ownership eliminating infrastructure maintenance burdens, and enhanced disaster recovery through provider-managed redundancy. Organizations appreciate cloud platforms' ability to support mobile workforce requirements, facilitate rapid capacity adjustments, and enable global team collaboration across geographic boundaries. Segment growth reflects declining resistance to cloud adoption as security capabilities mature, data sovereignty options expand, and organizations recognize cloud platforms' strategic advantages for supporting digital workplace transformation and enabling flexible work arrangements requiring reliable, accessible collaboration infrastructure independent of physical location constraints.

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Manufacturing

- Healthcare

- IT and Telecommunications

- Retail and E-Commerce

- Government and Defense

- Media and Entertainment

- Education

- Others

IT and telecommunications lead with a share of 20% of the total Brazil team collaboration software market in 2025.

IT and telecommunications sector lead adoption through inherent technology orientation, advanced digital infrastructure, and workforce characteristics favoring technology-enabled collaboration. Organizations in this vertical demonstrate highest willingness to implement cutting-edge collaboration tools, experiment with emerging platforms, and leverage advanced features optimizing distributed team productivity. Sector's technical workforce expects sophisticated collaboration capabilities, demands seamless integration with development tools, and requires platforms supporting complex technical workflows including code review, system architecture discussions, and project coordination across distributed engineering teams.

IT and Telecommunications organizations drive collaboration platform innovation through demanding use cases, extensive customization requirements, and willingness to adopt early-stage capabilities. These enterprises prioritize platforms offering developer-friendly APIs, extensive integration options, and advanced automation features supporting technical team workflows. Segment growth reflects continued technology sector expansion, increasing software development activity, and ongoing digital transformation initiatives requiring robust collaboration infrastructure supporting complex technical team operations across multiple locations.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 34% share of the total Brazil team collaboration software market in 2025.

Southeast region dominates market through concentration of major enterprises in São Paulo and Rio de Janeiro metropolitan areas, representing Brazil's economic heartland and technology adoption epicenter. Region hosts headquarters of multinational corporations, leading Brazilian enterprises, and thriving startup ecosystem driving collaboration platform demand. Dense concentration of technology vendors, system integrators, and consulting firms creates robust support infrastructure accelerating deployment and enabling sophisticated implementation approaches. Region benefits from superior digital infrastructure including fiber optic networks, data center facilities, and 5G deployment supporting advanced collaboration capabilities requiring high bandwidth and low latency connectivity.

Southeast region's market leadership reflects economic concentration, with São Paulo alone hosting over 340,000 technology companies supporting diverse enterprise requirements. Organizations in region demonstrate highest technology maturity, earliest adoption of emerging capabilities, and strongest willingness to invest in digital workplace transformation. In April 2025, Rio de Janeiro government launched "Rio AI City" initiative transforming city, demonstrating regional commitment to digital infrastructure development. Regional dominance continues through economic scale, talent concentration, and infrastructure advantages creating favorable conditions for collaboration platform adoption across enterprise, midmarket, and small business segments requiring technology solutions supporting competitive operations.

Market Dynamics:

Growth Drivers:

Why is the Brazil Team Collaboration Software Market Growing?

Accelerating Digital Transformation Across Enterprise Organizations

Brazilian enterprises accelerate digital transformation initiatives modernizing business processes, enhancing customer experiences, and improving operational efficiency through technology adoption. Organizations recognize collaboration platforms as foundational elements supporting digital workplace strategies, enabling data-driven decision making, and facilitating organizational agility. Government support for digital transformation, including BRL 186.6 billion pledge toward industrial sector digitalization announced in September 2024, creates favorable macroeconomic environment encouraging enterprise technology investment. Organizations leverage collaboration tools as enabling infrastructure for broader transformation programs encompassing cloud migration, process automation, and workforce modernization initiatives requiring effective communication and coordination capabilities across distributed teams and departments.

Expansion of Hybrid Work Models and Remote Workforce Operations

Hybrid work arrangements establish permanent fixture in Brazilian workplace landscape, with organizations recognizing productivity benefits, talent attraction advantages, and operational flexibility gained through location-independent work models. Collaboration platforms serve as essential infrastructure enabling effective hybrid team operations, maintaining organizational cohesion, and supporting asynchronous communication patterns accommodating varied work schedules and locations. Hybrid work adoption drives demand for feature-rich collaboration platforms supporting diverse communication modalities, enabling virtual meeting experiences approaching in-person quality, and providing persistent communication channels maintaining team relationships. Organizations prioritize solutions offering mobile optimization, reliable performance across varying network conditions, and intuitive user experiences encouraging adoption across diverse workforce populations. Research indicates Brazilian companies maintain hybrid models with 61 percent preferring two remote days weekly as of early 2025, representing sustained commitment to flexible work arrangements requiring technological support. This persistent hybrid work adoption creates continuous demand for collaboration infrastructure, drives platform feature innovation, and supports sustained market expansion as organizations optimize hybrid operations through technology investments.

Rapid Cloud Computing Adoption and Infrastructure Modernization

Brazilian organizations accelerate cloud computing adoption, recognizing scalability benefits, operational cost advantages, and innovation capabilities enabled through cloud infrastructure. Cloud-based collaboration platforms align with broader cloud migration strategies, eliminate on-premises infrastructure requirements, and provide consumption-based pricing models reducing capital expenditure barriers for small and medium enterprises. Government initiatives supporting cloud adoption, coupled with expanding data center infrastructure, create favorable conditions for cloud-based collaboration deployment. Brazil's cloud computing market is projected to reach to reach USD 86.6 Billion by 2034 as per IMARC Group’s predictions, reflecting strong momentum toward cloud infrastructure that benefits collaboration platform adoption.

Market Restraints:

What Challenges the Brazil Team Collaboration Software Market is Facing?

Data Privacy Concerns and Regulatory Compliance Requirements

Organizations face increasing complexity navigating Brazilian General Data Protection Law compliance requirements, managing cross-border data transfer restrictions, and implementing adequate security controls protecting sensitive business information. LGPD enforcement intensification, demonstrated through reported data breach increment, heightens organizational awareness regarding data protection obligations. Enterprises require collaboration platforms offering granular data controls, comprehensive audit capabilities, and compliance certifications addressing regulatory requirements, creating deployment barriers for solutions lacking robust privacy features or Brazilian data residency options.

Technical Skills Shortage and Implementation Complexity

Brazil faces significant technical talent shortages, with projected deficit of 530,000 technology professionals creating implementation challenges for sophisticated collaboration platforms requiring specialized expertise. Organizations struggle recruiting qualified personnel for platform administration, security configuration, and integration development necessary for successful deployments. Complex implementation requirements, including legacy system integration, customization needs, and user training programs, delay adoption and increase total cost of ownership. Skills shortage particularly affects small and medium enterprises lacking dedicated IT resources, creating barriers to advanced collaboration platform adoption and limiting market expansion beyond large enterprise segment with resources supporting complex technology initiatives.

Infrastructure Limitations and Connectivity Challenges

Uneven digital infrastructure distribution across Brazilian regions creates connectivity challenges affecting collaboration platform performance, particularly in secondary cities and rural areas lacking fiber optic networks and high-speed broadband access. Bandwidth limitations impede video conferencing quality, real-time collaboration effectiveness, and cloud application responsiveness, degradating user experiences and reducing platform value propositions. Organizations in underserved regions face higher connectivity costs, lower reliability, and reduced capacity constraining advanced collaboration feature utilization. Infrastructure disparities create market segmentation where sophisticated platform adoption concentrates in major metropolitan areas with robust digital infrastructure, while organizations in less-developed regions face barriers limiting collaboration software deployment and constraining overall market growth potential.

Competitive Landscape:

The Brazil team collaboration software market demonstrates moderate to high competitive intensity, characterized by presence of dominant global technology vendors, emerging regional players, and specialized niche providers competing across multiple dimensions including feature breadth, integration capabilities, pricing models, and vertical expertise. Market leaders leverage comprehensive product portfolios, extensive enterprise relationships, and substantial resources supporting continuous innovation and aggressive market expansion strategies. Competition intensifies through platform consolidation trends, as organizations prefer unified solutions over fragmented point products, favoring vendors offering integrated suites addressing multiple collaboration requirements through cohesive user experiences. Regional players differentiate through localized support, Portuguese language optimization, and regulatory expertise addressing Brazilian market nuances, while global vendors compete through feature sophistication, ecosystem breadth, and brand recognition attracting enterprise customers seeking proven solutions with long-term viability and extensive partner networks supporting implementation and ongoing operations.

Brazil Team Collaboration Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Software Types Covered | Conferencing, Communication and Co-Ordination |

| Deployment Modes Covered | On-premises, Cloud-based |

| Industry Verticals Covered | BFSI, Manufacturing, Healthcare, IT and Telecommunications, Retail and E-commerce, Government and Defense, Media and Entertainment, Education, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil team collaboration software market size was valued at USD 2,221.43 Million in 2025.

The Brazil team collaboration software market is expected to grow at a compound annual growth rate of 9.45% from 2026-2034 to reach USD 5,005.48 Million by 2034.

Solution segment dominates the market with 59% share, driven by comprehensive feature portfolios addressing diverse organizational collaboration requirements including video conferencing, instant messaging, document management, and project coordination capabilities through unified platforms eliminating application fragmentation.

Key factors driving the Brazil team collaboration software market include accelerating digital transformation initiatives across enterprises, expansion of hybrid work models requiring distributed team coordination infrastructure, rapid cloud computing adoption enabling scalable deployment, and increasing organizational focus on workforce productivity enhancement through technology-enabled collaboration supporting business objectives.

Major challenges include data privacy concerns and LGPD compliance complexity requiring robust security features, technical skills shortage creating implementation barriers particularly for small and medium enterprises, and infrastructure limitations in secondary markets constraining advanced collaboration feature utilization and limiting market expansion beyond major metropolitan areas with superior digital connectivity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)