Brazil Tourism Market Size, Share, Trends and Forecast by Travel Purpose, Travel Type, Tourism Type, Mode of Booking, Age Group, and Region, 2026-2034

Brazil Tourism Market Summary:

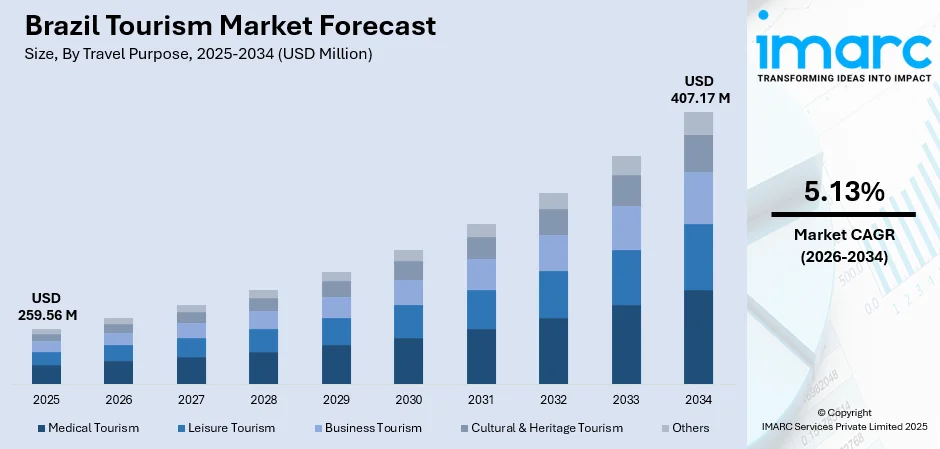

The Brazil tourism market size was valued at USD 259.56 Million in 2025 and is projected to reach USD 407.17 Million by 2034, growing at a compound annual growth rate of 5.13% from 2026-2034.

The Brazil tourism market is experiencing unprecedented momentum as the nation strengthens its global positioning through strategic government initiatives and infrastructure investments. Record-breaking international arrivals, expanded air connectivity, and diversified destination offerings are reshaping the travel landscape. Growing consumer preference for digital booking platforms, experiential travel, and nature-based tourism continues to drive demand. The convergence of robust promotional campaigns, enhanced accessibility, and Brazil's unique cultural heritage is accelerating visitor growth, positioning the country as South America's premier tourism destination and contributing to the Brazil tourism market share.

Key Takeaways and Insights:

-

By Travel Purpose: Leisure tourism dominates the market with a share of 55% in 2025, driven by Brazil's diverse natural attractions, iconic beaches, and vibrant cultural festivals. Growing interest in adventure tourism, eco-destinations, and authentic local experiences continues to fuel leisure-driven visitation across domestic and international segments.

-

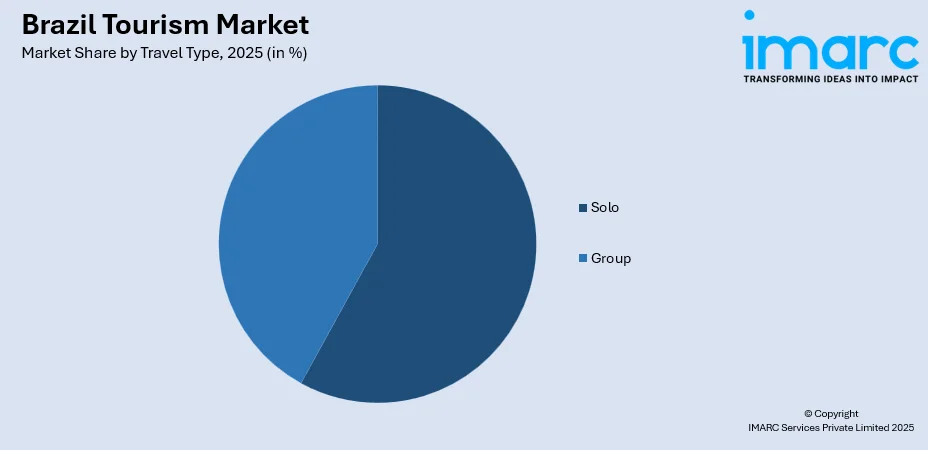

By Travel Type: Solo leads the market with a share of 58% in 2025, reflecting shifting consumer preferences toward independent, flexible travel experiences. Younger demographics, particularly Gen Z and millennials, increasingly seek personalized itineraries and self-planned journeys that allow greater exploration autonomy.

-

By Tourism Type: Domestic tourism exhibits a clear dominance with 68% share in 2025, supported by government incentive programs and currency dynamics encouraging Brazilians to explore their own country. Enhanced regional connectivity and promotional campaigns targeting local travelers strengthen this segment.

-

By Mode of Booking: OTA platform represents the leading segment with a share of 56% in 2025, reflecting consumers' preference for convenient, real-time booking solutions with transparent pricing. Mobile-first platforms, loyalty programs, and AI-driven personalization continue to enhance user engagement and conversion rates.

-

By Age Group: Below 30 years holds the largest share at 32% in 2025, driven by digital-native behaviors, preference for experiential travel, and higher propensity for adventure and cultural exploration. This demographic actively seeks authentic, shareable experiences through online platforms.

-

By Region: Southeast is the largest region with 45% share in 2025, anchored by São Paulo and Rio de Janeiro as primary international gateways. Concentrated infrastructure, business travel demand, and iconic tourist attractions sustain this region's market leadership.

-

Key Players: Market participants are intensifying efforts to enhance service quality, expand destination portfolios, and leverage digital transformation. Strategic investments in sustainable tourism practices, technology integration, and partnerships with government agencies are driving competitive differentiation across accommodation, transportation, and travel services sectors.

To get more information on this market Request Sample

The Brazil tourism market is undergoing transformative growth, supported by strategic government interventions and private sector collaboration. The travel and tourism sector contributed nearly USD 167 Billion to Brazil's GDP in 2024, demonstrating the industry's significance to the national economy. Domestic tourism remains the cornerstone of visitor spending, accounting for approximately ninety-four percent of total expenditure, while international arrivals continue setting new records. The expansion of digital booking channels, particularly online travel agencies, is revolutionizing how consumers plan and purchase travel experiences. Nature-based tourism and adventure activities are experiencing accelerated demand, reflecting evolving consumer preferences toward experiential and sustainable travel. Enhanced air connectivity, with expanded international flight routes and seat capacity, is improving accessibility to previously underserved destinations. Government initiatives promoting regional tourism development and infrastructure modernization continue creating new opportunities for market participants across all segments.

Brazil Tourism Market Trends:

Digital Transformation Reshaping Travel Booking Behaviors

The proliferation of online travel agencies and mobile booking platforms is fundamentally changing how Brazilian consumers plan and purchase travel experiences. Digital channels now dominate the booking landscape, with travelers increasingly expecting seamless, personalized experiences from search through checkout. In March 2024, Despegar.com launched SOFIA, Latin America's first Generative AI Travel Assistant, enhancing customer value propositions through intelligent travel recommendations. This digital shift is enabling real-time price comparisons, transparent reviews, and flexible cancellation policies that align with evolving consumer expectations, contributing to Brazil tourism market growth.

Rise of Nature-Based and Experiential Tourism

Brazilian travelers are increasingly prioritizing authentic, immersive experiences over traditional package tourism, driving demand for eco-tourism, adventure activities, and cultural exploration. The Amazon, Pantanal wetlands, and Atlantic rainforest destinations are attracting growing interest from both domestic and international visitors seeking meaningful environmental encounters. Nature-based tourism has experienced significant growth among international travelers, with demand continuing to accelerate as Embratur promotes Brazil's diverse ecosystems and biodiversity offerings. This shift reflects broader global trends toward transformational travel that emphasizes connection, learning, and personal growth through unique destination experiences.

Expansion of Solo and Independent Travel

Solo travel is reshaping tourism dynamics as younger demographics seek flexibility, autonomy, and personalized itineraries. Gen Z and millennial travelers increasingly prefer self-planned journeys that enable deeper cultural immersion and spontaneous exploration. United Airlines reported a five percent increase in solo bookings in 2024 compared to the previous year, reflecting growing independence in travel decisions. Brazil's diverse destinations, improved safety perceptions, and enhanced digital infrastructure supporting independent travelers are accelerating this trend, with long-haul destinations including Brazil becoming particularly popular among global solo tourists seeking adventure and cultural experiences.

Market Outlook 2026-2034:

The Brazil tourism market demonstrates robust growth potential as strategic investments in infrastructure, air connectivity, and destination development continue strengthening the sector's foundations. Government commitment through the National Tourism Plan and international promotion initiatives positions Brazil for sustained expansion. The market generated a revenue of USD 259.56 Million in 2025 and is projected to reach a revenue of USD 407.17 Million by 2034, growing at a compound annual growth rate of 5.13% from 2026-2034. Digital transformation, experiential tourism preferences, and enhanced accessibility to diverse destinations will continue driving market momentum across all segments.

Brazil Tourism Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Travel Purpose | Leisure Tourism | 55% |

| Travel Type | Solo | 58% |

| Tourism Type | Domestic Tourism | 68% |

| Mode of Booking | OTA Platform | 56% |

| Age Group | Below 30 Years | 32% |

| Region | Southeast | 45% |

Travel Purpose Insights:

- Medical Tourism

- Leisure Tourism

- Business Tourism

- Cultural & Heritage Tourism

- Others

Leisure tourism dominates with a market share of 55% of the total Brazil tourism market in 2025.

Leisure tourism maintains commanding market leadership, driven by Brazil's extraordinary diversity of natural attractions and cultural experiences that appeal to both domestic and international visitors. The country's iconic beaches, including Copacabana and Ipanema in Rio de Janeiro, continue attracting millions of sun-seekers, while the Amazon rainforest and Pantanal wetlands draw eco-conscious travelers seeking authentic environmental encounters. According to the World Travel and Tourism Council, leisure travel accounted for nearly 90% of total travel spending in Brazil in 2024, underscoring the segment's critical importance to market dynamics.

The leisure segment benefits from Brazil's year-round favorable climate and diverse geography that accommodates varied travel preferences from beach relaxation to adventure activities. Growing interest in experiential tourism, festival attendance including the world-famous Carnival, and gastronomic exploration continues expanding the leisure travel proposition. Enhanced domestic connectivity through expanded flight networks and improved road infrastructure enables greater exploration of previously underserved destinations, distributing tourism benefits more broadly across regions while sustaining leisure tourism's dominant market position.

Travel Type Insights:

Access the comprehensive market breakdown Request Sample

- Group

- Solo

Solo leads the market with a share of 58% of the total Brazil tourism market in 2025.

Solo travel has emerged as the predominant travel type, reflecting fundamental shifts in consumer preferences toward flexibility, independence, and personalized experiences. Younger travelers, particularly millennials and Gen Z, increasingly value the autonomy to craft individual itineraries that align with personal interests rather than predetermined group schedules. The rise of digital nomadism, extended workation trends, and improved safety perceptions in major Brazilian cities contribute to solo travel's accelerating popularity among both domestic and international visitors seeking authentic cultural immersion.

Digital infrastructure development, including enhanced mobile connectivity and proliferation of travel applications, empowers solo travelers with real-time information, navigation assistance, and instant booking capabilities. Brazilian travelers planning trips on their own more than ever value flexibility and control over traditional pre-arranged packages, according to recent consumer surveys. Solo travel is particularly pronounced among urban dwellers and young professionals who prioritize experiential value over structured tourism products, driving demand for flexible accommodation options, activity-based experiences, and authentic local encounters.

Tourism Type Insights:

- International Tourism

- Domestic Tourism

Domestic tourism exhibits a clear dominance with a 68% share of the total Brazil tourism market in 2025.

Domestic tourism forms the cornerstone of Brazil's visitor economy, with Brazilian nationals generating most of the travel spending across destinations nationwide. Currency dynamics, particularly the depreciation of the Brazilian real, encourage local residents to explore their own country rather than incur higher costs of international travel. The Ministry of Tourism's summer trends survey indicated that fifty-nine million Brazilians planned domestic leisure travel during the 2024-2025 summer season, with average spending increasing up to 34% compared to the previous year to approximately BRL 2,514 per traveler.

Government initiatives actively promoting internal travel through incentive programs and regional destination development reinforce domestic tourism's strength. Enhanced regional connectivity, particularly through expanded domestic flight networks and improved road infrastructure, enables greater accessibility to diverse destinations from northeast beaches to southern highlands. The familiarity of language, customs, and payment systems removes barriers that might otherwise deter travel, while growing appreciation for local cultural heritage and natural attractions sustains domestic travelers' enthusiasm for exploring Brazil's vast geographic diversity.

Mode of Booking Insights:

- Direct Booking

- OTA Platform

OTA platform represents the leading segment with a 56% share of the total Brazil tourism market in 2025.

Due to Brazilian consumers' growing preference for digital channels for travel planning and booking, online travel companies have achieved dominating market leadership. The ease of using unified platforms for pricing comparison, review reading, and transaction completion is in line with modern consumer expectations for smooth digital experiences. Travelers who are tech-savvy and anticipate rapid access to real-time availability and pricing information across the country are increasingly using mobile applications. Continuous innovation in user experience, customization algorithms, and loyalty programs that improve customer retention and promote repeat bookings is fueled by the competitive dynamics among major OTA platforms.

The value proposition of OTA platforms is strengthened by the incorporation of AI-powered suggestions, flexible payment alternatives, such as installment plans that are popular with Brazilian customers, and extensive service offerings that include flights, lodging, and activities. The addressable market for digital booking solutions in Brazil is continuing to grow due to rising middle-class travel demand and strong smartphone penetration rates. While improved internet connectivity in previously underserved areas expands platform accessibility and user engagement across a variety of consumer sectors, government-backed digitalization programs further encourage the adoption of online booking.

Age Group Insights:

- Below 30 Years

- 30 to 41 Years

- 42 to 49 Years

- 50 Years & Above

Below 30 years holds the largest share at 32% of the total Brazil tourism market in 2025.

Compared to older populations, young travelers under thirty have the highest propensity to participate in tourism due to their demand for experiencing value, digital-native habits, and more flexible schedules. This group prioritizes unusual locations and activities that produce interesting content for their online networks, actively searching for genuine, shareable experiences that connect with social media culture. The most likely demographic groups to travel independently in search of adventure and cultural discovery in far-off places like Brazil are Gen Z and millennials.

The under-thirty group has unique booking habits, such as preferences for mobile-first platforms, price sensitivity weighed against expectations for experience quality, and receptivity to other lodging options like hostels and peer-to-peer rentals. The need for adventurous travel, music festivals, nightlife, and immersive cultural activities that fit their social identities and lifestyle preferences is driven by this age group. Through social media amplification, which modifies impressions of destinations, generates viral travel trends, and influences travel decisions across larger peer networks and followers, their influence goes beyond direct expenditure.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast comprises the largest region with 45% share of the total Brazil tourism market in 2025.

The Southeast region maintains unrivaled market dominance, anchored by São Paulo and Rio de Janeiro as Brazil's primary international gateways and domestic tourism hubs. São Paulo consolidated its position as the country's main entry point, receiving nearly 2.5 Million international visitors between January and November 2025, representing a significant increase compared to the previous year. Rio de Janeiro followed closely, welcoming approximately 1.97 Million international tourists during the same period, driven by its iconic attractions including Copacabana Beach, Christ the Redeemer, and Sugarloaf Mountain.

The region's concentration of business activities, particularly in São Paulo's financial district, generates substantial corporate travel demand that complements leisure tourism flows. Superior infrastructure including major international airports, extensive hotel inventory across all segments, and well-developed transportation networks facilitate seamless visitor experiences. Cultural institutions, world-class restaurants, and vibrant entertainment options provide diverse activities that extend visitor stays and spending, while proximity to beach destinations and mountain retreats enables combined urban-nature itineraries that maximize regional tourism revenue.

Market Dynamics:

Growth Drivers:

Why is the Brazil Tourism Market Growing?

Strategic Government Investment in Tourism Infrastructure

The Brazilian government has demonstrated unprecedented commitment to tourism sector development through strategic infrastructure investments and promotional initiatives. The federal government announced a historic USD 10.6 Million investment in the International Tourism Acceleration Program for 2025, expected to generate at least 500,000 new international flight seats. This comprehensive program strengthens public-private partnerships with airlines and airports while expanding Brazil's international flight network to previously underserved regions, particularly in the Northeast. The initiative will be rolled out in phases throughout the year, beginning with regular international flights followed by charter operations and sub-regional domestic routes, demonstrating coordinated efforts to improve destination accessibility and enhance visitor experiences nationwide.

Expanded Air Connectivity and Enhanced Accessibility

Brazil's tourist accessibility and competitiveness are undergoing a major transformation due to the dramatic expansion of both domestic and international aviation networks. In the Northeast, where beach locations outside of Rio and São Paulo are gaining worldwide attention, airlines are expanding their flights and raising frequencies to both established gateways and new destinations. In order to overcome previous connectivity constraints that restricted Brazil's potential for international tourism, Galeão International Airport has expanded its operations and added new direct connections from Europe and North America, which shorten travel times and increase convenience for long-haul travelers.

Effective International Marketing and Brand Positioning

Brazil's tourism agency, Embratur, has executed transformative marketing strategies that successfully reposition Brazil's global image and drive record visitor arrivals. Brazil achieved nine Million international visitors in 2025, surpassing the National Tourism Plan target of 6.9 Million visitors. Strategic campaigns targeting priority markets, particularly neighboring Argentina which delivered 3.1 Million visitors representing an 82.1% increase, demonstrate the effectiveness of focused promotional investments. Marketing initiatives emphasizing Brazil's diverse offerings beyond traditional sun-and-beach imagery, including Afro-Brazilian heritage travel, community-based tourism, and indigenous territory experiences, expand the country's appeal across varied traveler segments and preferences.

Market Restraints:

What Challenges the Brazil Tourism Market is Facing?

Infrastructure Limitations in Regional Destinations

In rural and emerging tourist areas, infrastructural deficiencies continue to limit visitor access and experience quality despite large investments. The distribution and growth potential of tourism are limited by a lack of transportation choices, a poor supply of lodging, and underdeveloped supporting services in regions outside of large urban centers. underdeveloped tourism infrastructure in underdeveloped regions and enhancing air connection to northeastern destinations are still urgent issues that call for consistent investment commitment.

Persistent Safety Perception Challenges

Even while conditions in popular tourist destinations are improving, international travelers' decisions are still influenced by safety worries. Travel advisories issued by governments in the US, Canada, France, and the UK advise visitors to exercise caution when visiting crowded public spaces and specific districts. Strong visitor increase indicates changing attitudes, but maintaining the momentum of tourism requires addressing safety issues through improved enforcement and destination management.

High Tourism Costs and Value Perception

Price-conscious foreign tourists have difficulties due to Brazil's relative cost positioning in comparison to rival destinations. Brazil does not have the affordable prices found in certain alternative tourism markets in Southeast Asia or other Latin American nations, even if it is not one of the most costly travel destinations in the world. Language hurdles and a lack of tourism services specifically catered to foreign visitor preferences can reduce perceived value propositions for prospective travelers.

Competitive Landscape:

The competition between domestic and foreign service providers in the travel, lodging, and transportation sectors of the Brazilian tourist market is become more intense. In order to meet changing customer tastes, market players are giving priority to digital transformation, sustainable tourism practices, and experience diversification. While domestic operators prioritize local market expertise and cultural authenticity, hotel chains like Accor, Marriott, and Hilton continue to grow their Brazilian footprint through franchise expansion and strategic acquisitions. To meet the increasing demand from travelers, airlines are competing on route expansion, service quality, and pricing tactics. For improving client engagement and retention throughout increasingly digital booking journeys, travel technology platforms are investing in AI-powered personalization, mobile optimization, and loyalty programs.

Brazil Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Travel Purposes Covered | Medical Tourism, Leisure Tourism, Business Tourism, Culture & Heritage Tourism, Others |

| Travel Types Covered | Group, Solo |

| Tourism Types Covered | International Tourism, Domestic Tourism |

| Mode of Bookings Covered | Direct Booking, OTA Platform |

| Age Groups Covered | Below 30 Years, 30 to 41 Years, 42 to 49 years, 50 years & Above |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil tourism market size was valued at USD 259.56 Million in 2025.

The Brazil tourism market is expected to grow at a compound annual growth rate of 5.13% from 2026-2034 to reach USD 407.17 Million by 2034.

Leisure tourism dominated the market with a share of 55%, driven by Brazil's diverse natural attractions, iconic beaches, and vibrant cultural experiences that appeal to both domestic and international visitors throughout the year.

Key factors driving the Brazil tourism market include strategic government infrastructure investments, expanded international air connectivity, effective marketing by Embratur, growing digital booking adoption, and increasing demand for experiential and nature-based tourism.

Major challenges include infrastructure limitations in regional destinations, persistent safety perception concerns in certain areas, high tourism costs compared to competing markets, language barriers, and uneven distribution of tourism benefits across regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)