Brazil Trade Credit Insurance Market Size, Share, Trends and Forecast by Component, Coverage, Enterprise Size, Application, Industry Vertical, and Region, 2026-2034

Brazil Trade Credit Insurance Market Summary:

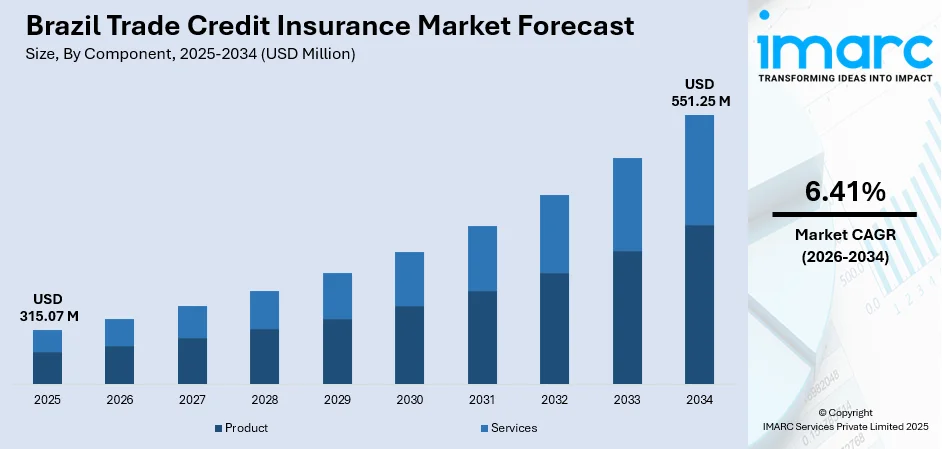

The Brazil trade credit insurance market size was valued at USD 315.07 Million in 2025 and is projected to reach USD 551.25 Million by 2034, growing at a compound annual growth rate of 6.41% from 2026-2034.

The market is driven by increasing trade activities among Brazilian businesses seeking financial protection against buyer defaults and insolvency risks. Growing awareness regarding receivables management and the need for securing commercial transactions has accelerated adoption across various industries. Exporters and domestic traders are increasingly leveraging credit insurance solutions to mitigate payment uncertainties and enhance their creditworthiness. These factors are contributing to the expansion of the Brazil trade credit insurance market share.

Key Takeaways and Insights:

- By Component: Product dominates the market with a share of 53% in 2025, driven by increasing demand for comprehensive policy packages offering customizable coverage options and integrated receivables protection solutions.

- By Coverage: Whole turnover coverage leads the market with a share of 62% in 2025, owing to its blanket protection across entire customer portfolios while reducing administrative burden.

- By Enterprise Size: Large enterprises represent the largest segment with a market share of 48% in 2025, driven by higher transaction volumes, complex supply chains, and greater financial capacity for comprehensive insurance.

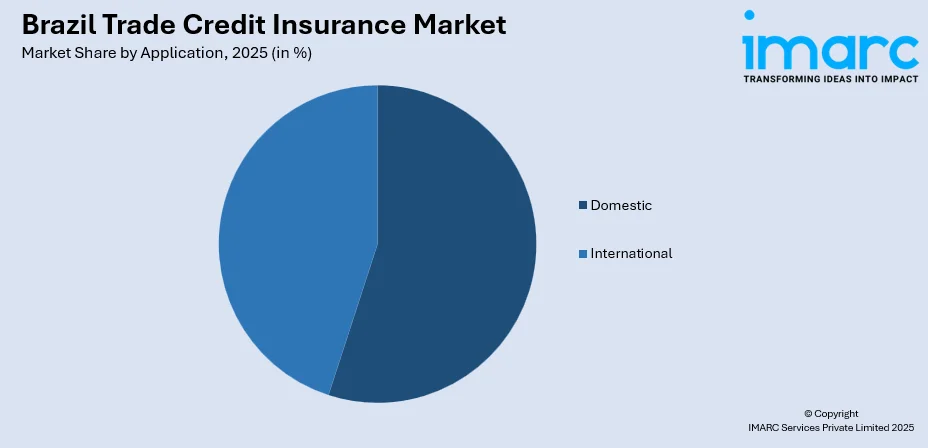

- By Application: Domestic dominates the market with a share of 55% in 2025, owing to extensive internal trade networks and increasing business-to-business transactions requiring receivables protection within national borders.

- By Industry Vertical: Food and beverages lead the market with a share of 20% in 2025, driven by high transaction volumes, perishable goods requiring quick payment cycles, and complex supply chains.

- By Region: Southeast represents the market with a share of 35% in 2025, owing to concentration of major industrial activities in São Paulo and Rio de Janeiro and higher business transaction volumes.

- Key Players: The Brazil trade credit insurance market exhibits a moderately consolidated competitive structure, with established international insurers competing alongside domestic providers. Market participants focus on developing customized solutions, expanding distribution networks, and leveraging digital platforms for enhanced efficiency.

To get more information on this market Request Sample

The Brazil trade credit insurance market is experiencing significant growth driven by multiple interconnected factors shaping the commercial landscape. Increasing business-to-business transactions and expanding trade relationships between companies have heightened the need for financial protection against buyer defaults and insolvency risks. As per sources, in July 2025, Brazil signed an export credit insurance MoU with UAE agencies ABGF and Etihad Credit Insurance, promoting technical cooperation, information exchange, best practices, and future risk-sharing initiatives globally. Moreover, the evolving economic environment has made businesses more conscious about managing credit risks and securing their receivables portfolios effectively. Growing awareness among enterprises regarding the benefits of credit insurance in facilitating access to better financing terms and improving cash flow management has accelerated adoption rates across various industry sectors. Additionally, the expansion of supply chain networks across domestic and international markets has created robust demand for comprehensive coverage solutions that protect against various payment-related uncertainties and commercial risks, thereby supporting sustainable business operations and growth.

Brazil Trade Credit Insurance Market Trends:

Digital Transformation in Policy Management

The trade credit insurance sector is witnessing accelerating digitalization across policy administration and claims processing functions. Insurance providers are implementing advanced technological platforms that enable real-time monitoring of buyer creditworthiness and automated risk assessments. According to reports, in December 2024, insurtech discovermarket launched operations in Brazil, introducing API-driven embedded insurance platforms that strengthen digital insurance delivery, automation, and real-time policy management capabilities. Furthermore, digital portals allow policyholders to manage coverage limits, submit claims, and access portfolio analytics through intuitive interfaces. These technological advancements are streamlining operational processes and reducing turnaround times for coverage decisions.

Expansion of Tailored Coverage Solutions

Market participants are increasingly developing customized insurance products designed to address specific industry requirements and business needs. Insurance providers are moving beyond standardized policies to offer flexible coverage options that can be adapted to particular trade patterns and customer segments. According to reports, in 2024, Brazilian insurer Icatu Seguros was ranked among the top five most innovative insurance companies for using AI and machine learning to tailor products and enhance customer-centric solutions. Moreover, this trend includes specialized solutions for different enterprise sizes, sector-specific risk profiles, and varying geographic exposures. The growing emphasis on personalization allows businesses to optimize their insurance investments while ensuring comprehensive protection against relevant commercial risks within their operational contexts.

Integration with Trade Finance Ecosystems

Trade credit insurance is becoming increasingly integrated within broader trade finance frameworks and banking relationships. Financial institutions are incorporating credit insurance requirements into their lending decisions and supply chain financing programs. In October 2024, the International Finance Corporation (IFC) partnered with Banco Safra under its Global Trade Finance Program, helping expand trade finance capacity in Brazil and boost credit availability for import-export transactions. Moreover, this integration enhances the overall credit ecosystem by providing additional security layers for financing transactions. Insurance coverage is increasingly viewed as a strategic tool that improves borrowing capacity and facilitates access to favorable financing terms.

Market Outlook 2026-2034:

The Brazil trade credit insurance market is positioned for sustained revenue expansion throughout the forecast period driven by increasing commercial transaction volumes and growing risk awareness among businesses. Market revenue is expected to benefit from expanding adoption across small and medium enterprises seeking receivables protection. The continued integration of digital technologies and development of innovative coverage solutions will support market advancement. Regional economic growth and increasing export activities are anticipated to create additional demand for comprehensive credit insurance solutions across multiple industry sectors. The market generated a revenue of USD 315.07 Million in 2025 and is projected to reach a revenue of USD 551.25 Million by 2034, growing at a compound annual growth rate of 6.41% from 2026-2034.

Brazil Trade Credit Insurance Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Product |

53% |

|

Coverage |

Whole Turnover Coverage |

62% |

|

Enterprise Size |

Large Enterprises |

48% |

|

Application |

Domestic |

55% |

|

Industry Vertical |

Food and Beverages |

20% |

|

Region |

Southeast |

35% |

Component Insights:

- Product

- Services

Product dominates with a market share of 53% of the total Brazil trade credit insurance market in 2025.

The product leads the Brazil trade credit insurance market, capturing the largest share of total revenues. This leadership position reflects the fundamental preference among businesses for comprehensive insurance policies that provide tangible coverage against commercial payment defaults and insolvency risks. As per sources, Brazil’s insurance segment Crédito e Garantia saw a 20,6% increase in premiums written, reflecting stronger uptake of credit risk protection solutions. Furthermore, organizations across various industries prioritize acquiring robust insurance products that offer protection throughout their receivables portfolios and trading relationships.

The dominance of the product is further reinforced by continuous innovation in policy structures and coverage terms offered by insurance providers operating in the Brazilian market. Companies seek sophisticated insurance products that can be customized to match their specific risk profiles and operational requirements effectively. The availability of diverse product options ranging from single buyer policies to comprehensive turnover coverage enables businesses to select appropriate protection levels aligned with their risk management strategies and financial objectives.

Coverage Insights:

- Whole Turnover Coverage

- Single Buyer Coverage

Whole turnover coverage leads with a share of 62% of the total Brazil trade credit insurance market in 2025.

Whole turnover coverage dominates the market by providing comprehensive protection across entire customer portfolios under single policy frameworks designed for operational simplicity. This coverage type is preferred by businesses seeking administrative efficiency combined with extensive receivables protection against buyer defaults. According to reports, Brazil’s Credit and Collateral insurance segment recorded R$639 Million in premiums, a 30.4% increase year-on-year, highlighting stronger adoption of comprehensive trade credit coverage. Moreover, the approach eliminates the need for individual buyer assessments while ensuring consistent coverage across all commercial relationships and transactions.

The popularity of whole turnover coverage stems from its operational efficiency and cost-effectiveness for businesses maintaining diverse customer bases across multiple industry sectors. Organizations benefit from streamlined policy management and predictable premium structures that facilitate accurate budgeting and financial planning processes. This coverage model is particularly attractive for companies engaged in high-volume trading activities where individual buyer coverage would create significant administrative complexity, resource requirements, and operational burdens that could detract from core business activities.

Enterprise Size Insights:

- Large Enterprises

- Medium Enterprises

- Small Enterprises

Large enterprises exhibit a clear dominance with a 48% share of the total Brazil trade credit insurance market in 2025.

Large enterprises account for the dominant share of the market, reflecting their substantial transaction volumes and sophisticated risk management requirements across complex operations. These organizations typically maintain extensive customer portfolios and intricate supply chain relationships that necessitate comprehensive credit insurance protection mechanisms. According to reports, in first three months of 2025, Brazilian insurers contracted R$ 7.1 Billion in reinsurance, a 13.8% increase compared to first quarter of last year, driven by Credit and Guarantee products, reflecting strong demand for corporate credit protection. Furthermore, their significant financial capacity enables investment in robust insurance solutions that provide thorough coverage across all business activities.

The leadership position of large enterprises is supported by their established relationships with major insurance providers and access to customized policy solutions tailored to specific needs. These organizations leverage credit insurance strategically to enhance their financial standing, improve access to trade financing, and support expansion into new markets domestically and internationally. Their procurement practices often include mandated insurance requirements within supplier contracts, further driving market demand and establishing credit insurance as standard business practice across their networks.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Domestic

- International

Domestic leads with a market share of 55% of the total Brazil trade credit insurance market in 2025.

The domestic commands the largest market share, driven by extensive internal trade activities within Brazilian commercial networks and business ecosystems. Businesses operating primarily within national borders require protection against payment defaults from local buyers across various regions and industry sectors. The domestic economy’s high transaction volumes demand robust receivables protection, as local trade relationships still pose significant credit risks requiring adequate insurance coverage. In September 2025, Brazilian insurtech 180° Insurance raised $9.2 Million in a pre-Series B round to scale AI-driven insurance, expanding adoption among domestic businesses across Brazil.

Domestic benefit from established legal frameworks and collection mechanisms that facilitate efficient claims resolution within national jurisdictions and court systems. Companies prefer domestic coverage for its alignment with local business practices, regulatory requirements, and familiar legal procedures governing commercial transactions. The segment continues to expand as increasing economic activity generates higher transaction volumes between businesses operating within the national market, creating sustained demand for protective insurance solutions that safeguard receivables portfolios.

Industry Vertical Insights:

- Food and Beverages

- IT and Telecom

- Metals and Mining

- Healthcare

- Energy and Utilities

- Automotive

- Others

Food and beverages dominate with a market share of 20% of the total Brazil trade credit insurance market in 2025.

The food and beverages lead the market due to its inherent characteristics that create elevated credit risk exposure requiring specialized protection. This sector involves high transaction volumes, tight payment schedules, and multiple intermediaries throughout complex supply chains connecting producers to consumers. Moreover, companies operating within this industry require robust protection against payment uncertainties that naturally arise from intricate distribution networks and competitive market conditions. The sector's operational dynamics make credit insurance essential for maintaining financial stability.

The leadership of food and beverages reflects the sector's critical role within the Brazilian economy and its extensive commercial relationships spanning producers, distributors, and retailers. Seasonal demand variations, perishable product characteristics, and intense competitive market conditions create environments where payment difficulties may emerge unexpectedly among trading partners. Insurance coverage provides essential financial security that enables continued operations and relationship maintenance even when individual buyers experience payment challenges, ensuring business continuity throughout supply chain networks.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast dominates with a market share of 35% of the total Brazil trade credit insurance market in 2025.

Southeast leads geographic segmentation, reflecting its position as the economic and commercial center of Brazilian business activity and industrial development. São Paulo and Rio de Janeiro host the highest concentration of industrial, commercial, and financial enterprises that require comprehensive credit insurance solutions for their operations. The region's economic significance generates substantial transaction volumes that drive insurance demand across multiple industry sectors. Businesses concentrated in this region maintain extensive trading relationships that necessitate robust receivables protection mechanisms.

The regions leadership is reinforced by the presence of major insurance providers, brokers, and financial institutions that facilitate convenient access to diverse credit insurance products. Businesses in this region benefit from sophisticated financial infrastructure and established insurance markets offering comprehensive coverage options tailored to various requirements. The concentration of multinational corporations and large domestic enterprises creates sustained demand for comprehensive risk management solutions including trade credit insurance, establishing the region as the primary market hub.

Market Dynamics:

Growth Drivers:

Why is the Brazil Trade Credit Insurance Market Growing?

Increasing Trade Transaction Volumes Across Industries

The expansion of commercial trading activities throughout Brazilian industries is generating substantial growth in demand for trade credit insurance solutions. As businesses engage in increasing numbers of transactions with diverse customer bases, the potential exposure to payment defaults rises correspondingly. According to sources, Coface Brazil reported a surge in credit insurance inquiries after major corporate defaults, highlighting growing demand for portfolio monitoring and protection against unexpected business and economic risks. Moreover, organizations recognize that protecting their receivables portfolios is essential for maintaining financial stability and supporting continued business operations.

Enhanced Awareness of Credit Risk Management Benefits

Growing understanding among business leaders regarding the strategic advantages of credit insurance is driving market expansion. Companies increasingly recognize that trade credit insurance provides benefits beyond simple default protection, including improved access to financing and enhanced creditworthiness. This awareness has been fostered through educational initiatives by insurance providers and industry associations highlighting successful risk management implementations. Business decision-makers appreciate how insurance coverage can strengthen negotiating positions with financial institutions and enable more favorable credit terms. The broadening recognition of these comprehensive benefits encourages adoption across enterprises of all sizes and industries.

Regulatory Environment Supporting Financial Protection

The evolving regulatory landscape in Brazil has created conditions that encourage businesses to implement formal credit risk management practices. Regulatory frameworks emphasizing financial responsibility and risk transparency have motivated companies to adopt structured approaches to protecting their receivables. Compliance requirements and corporate governance standards increasingly reference the importance of managing commercial credit exposure through appropriate mechanisms. This regulatory environment reinforces the business case for credit insurance adoption and legitimizes the investment in comprehensive coverage solutions. The alignment of regulatory expectations with prudent risk management practices supports continued market growth.

Market Restraints:

What Challenges the Brazil Trade Credit Insurance Market is Facing?

Premium Cost Considerations Among Small Enterprises

Small businesses often perceive trade credit insurance premiums as significant expenses relative to their operational budgets and transaction volumes. The cost-benefit analysis for smaller enterprises may not immediately favor insurance adoption, particularly when cash flow constraints limit available resources for protective measures. These organizations may prioritize other operational expenditures over insurance coverage, despite the potential risks associated with unprotected receivables.

Limited Understanding of Policy Terms and Conditions

Many potential purchasers lack comprehensive understanding of trade credit insurance mechanics, coverage exclusions, and claims processes. This knowledge gap creates hesitation among businesses considering insurance adoption and may result in inappropriate coverage selections that fail to meet actual protection needs. The complexity of policy documentation and technical terminology can discourage engagement with insurance solutions.

Preference for Traditional Credit Management Approaches

Some organizations maintain preference for established credit management practices such as letters of credit, advance payments, or internal collection procedures rather than insurance-based solutions. This attachment to familiar approaches may delay adoption of more comprehensive risk transfer mechanisms. Businesses with long-standing customer relationships may believe their personal knowledge of buyers provides sufficient protection against default risks.

Competitive Landscape:

The Brazil trade credit insurance market operates within a structured competitive environment characterized by established international participants and domestic providers serving diverse customer segments. Market participants differentiate through coverage innovation, customer service quality, and distribution network effectiveness. Competition centers on developing comprehensive solutions that address evolving business requirements while maintaining competitive premium structures. Providers invest in digital capabilities to enhance customer experience and operational efficiency throughout policy lifecycles. Partnerships with banks, brokers, and trade associations expand market access and facilitate customer acquisition. The competitive landscape continues evolving as participants respond to changing commercial conditions and emerging business needs through product development and service enhancement initiatives.

Recent Developments:

- In April 2025, Brazil’s Ministry of Development, Industry, Foreign Trade and Services (MDIC) resumed post-shipment export credit insurance (SCE) for micro, small, and medium-sized companies. The program protects exporters against non-payment risks, facilitates financing, and complements the pre-shipment SCE, strengthening Brazilian exporters’ capacity to expand international trade.

Brazil Trade Credit Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Product, Services |

| Coverages Covered | Whole Turnover Coverage, Single Buyer Coverage |

| Enterprise Sizes Covered | Large Enterprises, Medium Enterprises, Small Enterprises |

| Applications Covered | Domestic, International |

| Industry Verticals Covered | Food and Beverages, IT and Telecom, Metals and Mining, Healthcare, Energy and Utilities, Automotive, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil trade credit insurance market size was valued at USD 315.07 Million in 2025.

The Brazil trade credit insurance market is expected to grow at a compound annual growth rate of 6.41% from 2026-2034 to reach USD 551.25 Million by 2034.

Product held the largest market share, driven by increasing demand for comprehensive insurance policies offering customizable coverage options, risk assessment services, and integrated receivables protection solutions catering to diverse business requirements across various industry sectors.

Key factors driving the Brazil trade credit insurance market include commercial transaction volumes, growing awareness of credit risk management benefits, expanding domestic and international trade activities, evolving regulatory environments supporting financial protection mechanisms, and rising demand for receivables security solutions.

Major challenges include premium cost considerations affecting adoption among smaller enterprises, limited understanding of policy terms and coverage conditions, preference for traditional credit management approaches, complexity in claims documentation, and varying awareness levels across different industry sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)