Brazil Trade Finance Market Size, Share, Trends and Forecast by Finance Type, Offering, Service Provider, End User, and Region, 2026-2034

Brazil Trade Finance Market Summary:

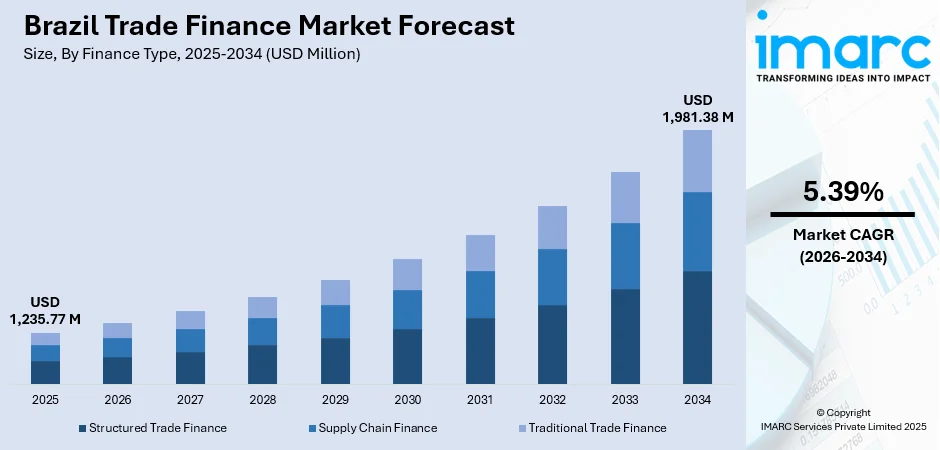

The Brazil trade finance market size was valued at USD 1,235.77 Million in 2025 and is projected to reach USD 1,981.38 Million by 2034, growing at a compound annual growth rate of 5.39% from 2026-2034.

Brazil's trade finance sector is experiencing sustained expansion driven by increasing cross-border commerce, government initiatives to simplify regulatory processes, and digital transformation initiatives that enhance accessibility for small and medium-sized enterprises. Regional banks are investing in advanced digital platforms to streamline documentation workflows and accelerate payment processing. The sector benefits from Brazil's position as a major global exporter of agricultural commodities, minerals, and energy products, creating consistent demand for letters of credit, guarantees, and supply chain financing solutions that mitigate payment risks and support working capital optimization across international value chains, expanding the Brazil trade finance market share.

Key Takeaways and Insights:

-

By Finance Type: Supply chain finance dominates the market with a share of 39% in 2025, driven by increasing adoption among corporates seeking to optimize working capital while providing early payment options to suppliers.

-

By Offering: Letters of credit lead the market with a share of 26% in 2025, reflecting the continued reliance on traditional trade instruments for mitigating counterparty and payment risks in cross-border transactions.

-

By Service Provider: Banks hold the largest segment with a market share of 69% in 2025, as major financial institutions maintain dominant positions through established correspondent banking networks and comprehensive product offerings.

-

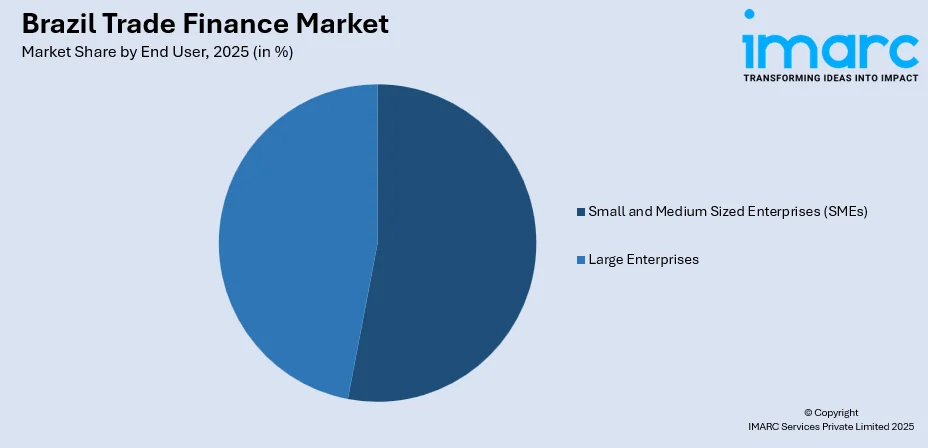

By End User: Small and medium sized enterprises (SMEs) represent the largest segment with a share of 53% in 2025, highlighting the critical importance of trade finance in enabling smaller businesses to participate in global value chains.

-

By Region: Southeast leads the market with a share of 33% in 2025, driven by the concentration of economic activity and financial infrastructure in São Paulo and Rio de Janeiro metropolitan areas.

-

Key Players: The Brazil trade finance market exhibits high concentration among established financial institutions, with major banks leveraging extensive branch networks, correspondent banking relationships, and digital transformation investments to maintain competitive advantages across corporate and SME segments.

To get more information on this market Request Sample

Brazil's trade finance ecosystem is evolving rapidly through digitalization initiatives and regulatory modernization aimed at reducing transaction costs and improving accessibility for businesses of all sizes. The Central Bank of Brazil launched a pilot program in November 2024 utilizing its Drex digital currency platform in partnership with Chainlink, Microsoft, Banco Inter, and 7COMm to automate settlement of cross-border agricultural commodity trades through tokenized bills of lading and blockchain-based smart contracts. This groundbreaking initiative demonstrates how distributed ledger technology can enhance transparency, reduce fraud risks, and streamline documentation processes that have historically created barriers for SME participation. The government's broader digital transformation strategy, targeting conversion of a quarter of industrial enterprises by 2026 and half by 2033, is creating infrastructure that supports real-time payment systems and data-driven financing models, enabling financial institutions to assess creditworthiness based on transaction histories rather than traditional collateral requirements, thereby expanding market reach and fostering more inclusive economic growth.

Brazil Trade Finance Market Trends:

Digital Transformation and Blockchain Adoption Accelerating

The Brazilian trade finance sector is undergoing rapid digitalization through blockchain-based platforms and central bank digital currency initiatives that promise to revolutionize cross-border transaction settlement. Financial institutions are implementing advanced technologies including artificial intelligence for credit assessment, application programming interfaces for system integration, and distributed ledger systems for real-time transaction tracking. The Central Bank's Drex pilot program, launched in November 2024 with partners including Chainlink, Microsoft, Banco Inter, and 7COMm, focuses on automating agricultural commodity trade settlements by tokenizing electronic bills of lading and incorporating supply chain data to trigger automated payments when contractual conditions are fulfilled, demonstrating practical applications of blockchain technology in reducing documentation burdens and accelerating payment cycles for exporters and importers.

Regional Trade Integration and Diversification Strategies Expanding

Brazil is strategically strengthening trade relationships within Latin America and with BRICS nations while diversifying beyond traditional Western partners to reduce dependence on single markets and currencies. The country signed thirty-seven collaboration acts with China during President Xi Jinping's November 2024 state visit, covering agriculture, trade, investment, infrastructure, and finance, with China now accounting for twenty-eight percent of Brazil's exports and twenty-four percent of imports. MERCOSUR's Partnership Agreement negotiations with the European Union reached conclusion in December 2024, promising expanded market access for Brazilian agricultural exports while opening protected South American markets to European industrial goods. These diversification efforts are creating demand for more sophisticated trade finance instruments that can accommodate multiple currencies, cross-border payment systems, and diverse regulatory frameworks across emerging and established trading partners.

Supply Chain Finance Solutions Proliferating for SME Access

Supply chain finance is gaining significant momentum as major corporations and financial institutions recognize its potential to strengthen entire value chains by providing liquidity to suppliers while optimizing working capital for buyers. Santander Brazil deployed a fifty million Brazilian real sustainability-linked supply chain finance program in 2024 for Vestas, marking the Danish manufacturer's first such program globally and demonstrating growing integration of environmental considerations into trade financing structures. These programs enable suppliers, particularly small and medium enterprises, to receive early payments on invoices at preferential rates tied to the creditworthiness of large corporate buyers rather than the suppliers' own credit profiles.

Market Outlook 2026-2034:

Brazil's trade finance sector is positioned for sustained growth through the forecast period as expanding export volumes, regulatory modernization, and digital infrastructure investments create favorable conditions for market expansion. The market generated a revenue of USD 1,235.77 Million in 2025 and is projected to reach a revenue of USD 1,981.38 Million by 2034, growing at a compound annual growth rate of 5.39% from 2026-2034. Regional integration through various agreements and deepening commercial relationships with BRICS nations are diversifying trade flows and creating demand for sophisticated financing instruments across multiple currencies and jurisdictions.

Brazil Trade Finance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Finance Type | Supply Chain Finance | 39% |

| Offering | Letters of Credit | 26% |

| Service Provider | Banks | 69% |

| End User | Small and Medium Sized Enterprises (SMEs) | 53% |

| Region | Southeast | 33% |

Finance Type Insights:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

Supply chain finance dominates with a market share of 39% of the total Brazil trade finance market in 2025.

Supply chain finance represents the largest segment within Brazil's trade finance ecosystem, driven by its dual benefits of optimizing working capital for buyers while providing liquidity to suppliers throughout complex international value chains. Major Brazilian corporations across agriculture, manufacturing, and energy sectors are increasingly implementing SCF programs that enable suppliers to receive early payment on invoices at rates reflecting the creditworthiness of large buyers rather than suppliers' own credit profiles, particularly benefiting small and medium enterprises that face challenges accessing traditional financing.

The segment's growth is further supported by technological advancements that enable real-time invoice verification, automated payment processing, and blockchain-based transparency across multiple tiers of supply networks. Regional banks including Banco do Brasil, Itaú Unibanco, and Bradesco are investing in digital platforms that connect buyers, suppliers, and financial institutions through secure application programming interfaces, reducing documentation requirements and accelerating funding cycles. Development finance institutions have increased commitments to supply chain finance programs specifically targeting SME participation in regional and global trade, recognizing that working capital constraints represent a primary barrier preventing smaller enterprises from scaling operations and accessing international markets effectively.

Offering Insights:

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

Letters of credit lead with a share of 26% of the total Brazil trade finance market in 2025.

Letters of Credit maintain their position as the most widely utilized trade finance instrument in Brazil, providing essential payment guarantees that mitigate counterparty risk in international transactions where buyers and sellers operate under different legal jurisdictions and regulatory frameworks. These documentary credits are particularly critical for Brazilian exporters of agricultural commodities, minerals, and manufactured goods who require assurance of payment upon fulfilling contractual obligations, while importers benefit from protection against non-delivery or non-conformance to specifications. Major Brazilian banks including Banco do Brasil, Itaú, Bradesco, and Santander maintain extensive correspondent banking networks across North America, Europe, Asia Pacific, and Latin America that enable efficient letter of credit processing and confirmation services.

Digital transformation initiatives are modernizing letter of credit operations through electronic document presentation, blockchain-based verification systems, and automated compliance checking that reduce processing times and costs associated with traditional paper-based workflows. Regional banks are implementing platforms that integrate with international standards while incorporating anti-money laundering checks and sanctions screening into seamless digital processes. The enduring relevance of letters of credit reflects their legal robustness under international banking law, their acceptance across virtually all trading jurisdictions, and their ability to facilitate transactions between parties with limited prior business relationships or varying levels of creditworthiness.

Service Provider Insights:

- Banks

- Trade Finance Houses

Banks exhibit a clear dominance with a 69% share of the total Brazil trade finance market in 2025.

Traditional banking institutions dominate Brazil's trade finance landscape through their established infrastructure including extensive correspondent banking networks, comprehensive product portfolios spanning letters of credit through supply chain finance, and deep relationships with corporate clients built over decades. Major banks including Banco do Brasil, Itaú Unibanco, Bradesco, Santander Brasil, and BTG Pactual control the vast majority of trade finance volumes, leveraging balance sheet strength that enables them to provide substantial credit lines and guarantees required for large-scale international transactions. Banco do Brasil reported a credit portfolio of 414 billion dollars in 2024 with 15.3 percent year-over-year growth driven by agribusiness and sustainable loans.

These institutions maintain strategic advantages through regulatory credentials that enable them to issue letters of credit accepted globally, correspondent banking relationships that facilitate cross-border settlements, and technology investments in digital platforms that streamline documentation and accelerate transaction processing. Regional banks are responding to fintech competition by modernizing legacy systems, implementing application programming interfaces that enable seamless integration with corporate treasury management systems, and developing specialized products for specific sectors including agriculture, energy, and manufacturing. Their ability to bundle multiple trade finance products including working capital facilities, foreign exchange hedging, and supply chain solutions creates comprehensive offerings that address diverse client needs across the entire trade lifecycle from pre-shipment financing through final settlement.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

Small and medium sized enterprises (SMEs) lead with a share of 53% of the total Brazil trade finance market in 2025.

Small and medium enterprises represent the primary users of trade finance services in Brazil, facing persistent challenges accessing affordable financing due to limited collateral, shorter credit histories, and higher perceived risk profiles. These businesses require trade finance instruments to manage working capital gaps inherent in international commerce where payment terms often extend thirty to ninety days beyond shipment, creating liquidity constraints that can prevent fulfillment of export orders or timely payment for imported inputs. Government initiatives that streamlines SME registration and the SIMPLES program that consolidates federal, state, and municipal taxes into single payments are reducing administrative burdens, while multilateral development banks committed to increase financial and advisory support specifically targeting SME access to supply chain finance.

Digital transformation is creating new pathways for SME participation through platforms that leverage transaction data and payment histories to assess creditworthiness rather than requiring traditional collateral or lengthy financial statements. Fintech companies are developing specialized solutions including invoice financing based on credit card receivables, automated trade loan applications that process documentation in hours rather than weeks, and supply chain finance programs that enable SME suppliers to access early payment at rates reflecting large corporate buyers' creditworthiness.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 33% share of the total Brazil trade finance market in 2025.

The Southeast region dominates Brazil's trade finance activity through its concentration of economic infrastructure, financial institutions, and export-oriented industries centered in São Paulo, Rio de Janeiro, Minas Gerais, and Espírito Santo states. São Paulo serves as the nation's financial capital, hosting headquarters of major banks that control the majority of trade finance volumes, while also maintaining the country's most developed transportation networks including Santos port, which handles substantial portions of Brazil's agricultural and manufactured exports. The region's diverse industrial base spanning manufacturing, agriculture, mining, and energy creates consistent demand for letters of credit, guarantees, supply chain financing, and trade credit insurance across domestic and international value chains.

Regional economic concentration is reinforced by higher disposable incomes, more educated workforce pools, and superior technological infrastructure that attracts both domestic and foreign investment in export-oriented activities. The metropolitan areas of São Paulo and Rio de Janeiro account for disproportionate shares of Brazil's gross domestic product while hosting the majority of multinational corporations that utilize sophisticated trade finance structures including cross-border supply chain programs and multi-currency hedging arrangements. Government investments in port modernization, logistics infrastructure, and digital connectivity are strengthening the region's competitive advantages in international trade, while initiatives including Brazil's semiconductor manufacturing ecosystem development are positioning São Paulo as a technology hub that will generate additional demand for trade finance supporting component imports and finished goods exports.

Market Dynamics:

Growth Drivers:

Why is the Brazil Trade Finance Market Growing?

Expanding Domestic Industrial Production and Neo-Industrialization Strategy

Brazil's government approved the Action Plan for Neo-Industrialization in January 2024 through the National Council for Industrial Development, focusing on sustainability, de-carbonization, technological innovation, and social inclusion across agro-industrial chains, health, urban welfare, digitalization, bioeconomy, energy transition, and defense sectors. This strategic pivot toward manufacturing renaissance is generating substantial demand for pre-shipment and post-shipment finance as domestic producers require working capital to procure raw materials, fund production cycles, and bridge payment gaps between manufacturing completion and customer payment receipt. The manufacturing expansion is particularly concentrated in value-added processing of agricultural commodities, renewable energy equipment production, and advanced manufacturing sectors where Brazilian companies are integrating into global supply chains as tier-one and tier-two suppliers requiring sophisticated trade finance instruments.

Rising Working Capital Optimization Needs Amid Interest Rate Volatility

Brazilian corporations and SMEs face persistent working capital pressures created by extended payment cycles in international trade combined with domestic interest rates that reached 14.75 percent in May 2025, making efficient cash flow management critical for business survival and growth. Trade finance instruments enable businesses to convert receivables into immediate liquidity, obtain advance payment against confirmed export orders, and extend payment terms to customers without straining balance sheets, effectively transferring financing costs to financial institutions with lower capital costs than corporate borrowing rates.

Strengthening Risk Mitigation Requirements in Global Trade Environment

Heightened geopolitical tensions, trade policy uncertainties, and currency volatility are compelling Brazilian businesses to adopt more sophisticated risk management approaches including trade credit insurance, bank guarantees, and structured finance solutions that protect against payment defaults, political instability, and sudden regulatory changes. The ongoing US-China trade tensions and resulting tariff adjustments have created both opportunities and risks for Brazilian exporters, with agricultural commodity exports benefiting from Chinese diversification away from US suppliers while manufactured goods face potential disruptions from shifting global supply chain configurations. Brazil's trade deficit with the United States stood at just 253 million dollars in 2024, the lowest since the 2008 Great Recession, reflecting vulnerability to potential US tariff actions that could necessitate rapid market pivots requiring flexible trade finance arrangements. Financial institutions are responding by expanding product offerings beyond traditional letters of credit to include performance bonds guaranteeing contract fulfillment, advance payment guarantees protecting buyers against non-delivery, and political risk insurance covering expropriation, currency inconvertibility, and contract frustration.

Market Restraints:

What Challenges the Brazil Trade Finance Market is Facing?

High Interest Rates and Elevated Financing Costs

Brazil's benchmark SELIC interest rate reached 14.75 percent in May 2025, significantly higher than developed economies, creating elevated financing costs that constrain demand for trade finance products among cost-sensitive small and medium enterprises. During periods when interest rates peaked at 14.25 percent between 2013 and 2016, small business loan rates climbed, effectively excluding most SMEs from accessing formal financing markets and forcing reliance on expensive informal alternatives. The elevated cost of capital makes Brazilian trade finance expensive compared to global competitors, limiting businesses' ability to optimize working capital through supply chain finance programs, reducing competitiveness of exporters who must factor higher financing costs into pricing structures, and constraining market expansion despite growing underlying demand for cross-border transaction support.

Complex Regulatory and Documentation Requirements Creating Operational Barriers

Brazilian businesses navigating international trade face highly complicated regulatory systems requiring compliance with federal, state, and local regulations affecting different aspects of cross-border transactions, with companies frequently required to re-test and re-certify products to meet Brazilian technical requirements even after successfully meeting standards in other jurisdictions. The World Bank Doing Business rankings have repeatedly classified Brazil's tax and regulatory environment among the less ideal globally, with complexity requiring companies to devote extraordinary resources to documentation preparation, customs clearance, and compliance verification. Outdated paper-based processes for letters of credit and trade documentation persist despite digitalization initiatives, adding layers of complexity and delays to international transactions that increase costs, extend settlement cycles, and create barriers preventing smaller businesses from competing effectively in global markets where speed and efficiency determine competitiveness.

Limited Access to Finance for Micro and Small Enterprises

Micro and small enterprises in Brazil face persistent challenges accessing trade finance due to limited collateral, shorter credit histories, fluctuating interest rates, and structural disparities in financial markets that favor larger corporations with established banking relationships. The global trade finance gap doubled between 2017 and 2025, with emerging market SMEs being most severely affected by rejection rates increasing in supply chain finance programs due to documentation challenges and limited credit access. Brazilian SMEs struggle with severe cash flow constraints, with a major percentage of merchants paying discount rates from 2 to 8 percent monthly to receive credit card sale values instantaneously rather than waiting the standard thirty-day settlement period, demonstrating how systemic financial architecture creates working capital problems that limit growth prospects and constrain participation in both local and global value chains.

Competitive Landscape:

The Brazil trade finance market exhibits high concentration among established financial institutions that leverage extensive correspondent banking networks, comprehensive product portfolios, and deep client relationships built over decades of operation. Major banks dominate market share through balance sheet strength enabling substantial credit lines and guarantees required for large-scale international transactions, while maintaining strategic advantages through regulatory credentials that ensure global acceptance of letters of credit and documentary instruments. These institutions are responding to fintech competition by modernizing legacy systems, implementing digital platforms with application programming interfaces for seamless integration with corporate treasury systems, and developing specialized products for key export sectors including agriculture, energy, and manufacturing. Non-bank financial institutions and fintech platforms are gaining traction in niche segments through innovative solutions targeting small and medium enterprises, including invoice financing based on transaction data, supply chain programs leveraging large corporate buyer creditworthiness, and automated loan processing that reduces documentation requirements and accelerates approval cycles.

Recent Developments:

-

In June 2025, Banco do Brasil and the Multilateral Investment Guarantee Agency (MIGA), part of the World Bank Guarantee Platform, have established a trade finance guarantee program of up to $700 million to support micro, small, and medium-sized exporting businesses (MSMEs) and sustainable initiatives in Brazil. The initiative offers MIGA's trade finance guarantees to mitigate default risk, allowing international financial institutions to lend to Banco do Brasil with minimized risk and decreased expenses.

Brazil Trade Finance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Finance Types Covered | Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance |

| Offerings Covered | Letters of Credit, Bill of Lading, Export Factoring, Insurance, Others |

| Service Providers Covered | Banks, Trade Finance Houses |

| End Users Covered | Small and Medium Sized Enterprises (SMEs), Large Enterprises |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil trade finance market size was valued at USD 1,235.77 Million in 2025.

The Brazil trade finance market is expected to grow at a compound annual growth rate of 5.39% from 2026-2034 to reach USD 1,981.38 Million by 2034.

Supply chain finance dominated with a market share of 39% in 2025, driven by increasing adoption among corporates seeking to optimize working capital while providing early payment options to suppliers. Major Brazilian corporations across agriculture, manufacturing, and energy sectors are implementing SCF programs that enable suppliers to receive early payment at rates reflecting large buyers' creditworthiness rather than suppliers' own credit profiles.

Key factors driving the Brazil trade finance market include growing cross-border trade activity driven by strong agricultural and commodity export sectors, government initiatives to modernize the regulatory environment and reduce bureaucratic complexity, and digital infrastructure development through blockchain platforms and central bank digital currency pilots that enhance transparency and accessibility for small and medium enterprises participating in global value chains.

Major challenges include high interest rates with the SELIC benchmark creating elevated financing costs, complex regulatory and documentation requirements that add operational barriers and compliance burdens, limited access to finance for micro and small enterprises facing rejection in supply chain finance programs, and structural disparities in financial markets that favor larger corporations with established banking relationships over smaller businesses seeking to participate in international trade.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)