Brazil Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Region, 2026-2034

Brazil Used Car Market Summary:

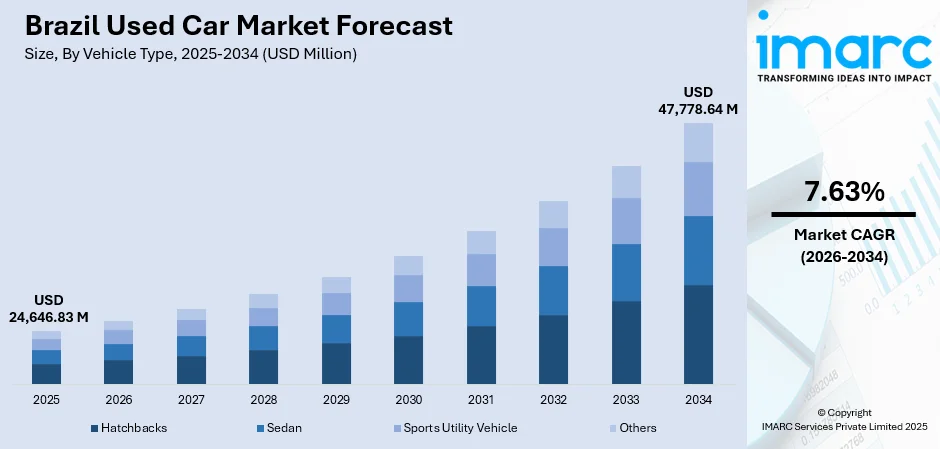

The Brazil used car market size was valued at USD 24,646.83 Million in 2025 and is projected to reach USD 47,778.64 Million by 2034, growing at a compound annual growth rate of 7.63% from 2026-2034.

The market is experiencing robust expansion driven by compelling economic value propositions as consumers increasingly seek affordable vehicle ownership alternatives amid elevated new car prices. Digital transformation initiatives are revolutionizing traditional transaction frameworks, with e-commerce platforms and advanced assessment technologies enhancing transparency and consumer confidence throughout the purchasing journey. Financial accessibility improvements through diversified credit solutions and competitive financing structures are enabling broader market participation across income segments, while evolving consumer preferences toward family-oriented and versatile vehicle configurations continue reshaping Brazil used car market share.

Key Takeaways and Insights:

-

By Vehicle Type: Sports utility vehicle dominates the market with a share of 36.02% in 2025, driven by their spacious interiors and flexible seating arrangements ideal for families.

-

By Vendor Type: Organized leads the market with a share of 58% in 2025, supported by the enhanced customer trust and structured quality assurance.

-

By Fuel Type: Gasoline represents the largest segment with a market share of 55% in 2025, leveraging widespread fuel infrastructure and established consumer preferences across regions.

-

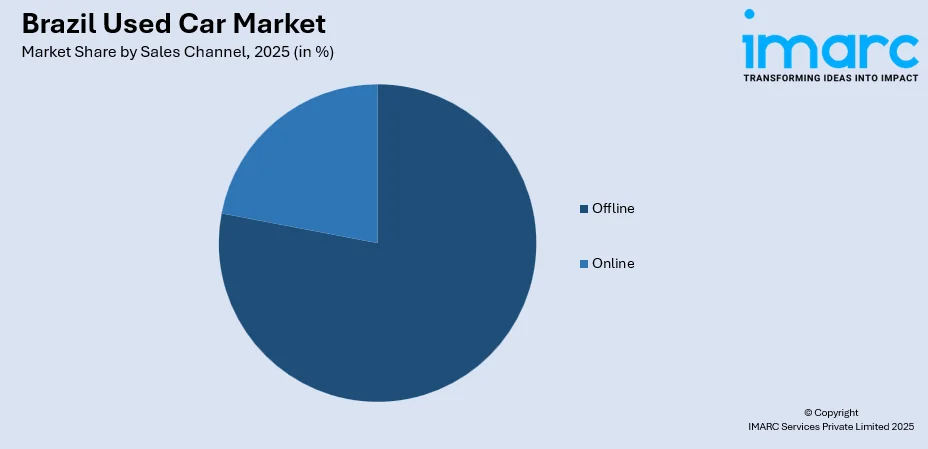

By Sales Channel: Offline dominates the market with a share of 78% in 2025, reflecting persistent consumer preferences for physical vehicle inspection before purchase.

-

By Region: Southeast leads the market with a share of 32% in 2025, concentrating market activity in the major cities, extensive dealership density, sophisticated financing infrastructure, and comprehensive automotive service ecosystems.

-

Key Players: The Brazil used car market exhibits moderate fragmentation, with digital platform operators competing alongside traditional dealership networks and rental company channels across price segments.

To get more information on this market Request Sample

Brazil's pre-owned vehicle sector stands as the third-largest globally, yet maintains substantial untapped potential within an evolving organized retail landscape. The market demonstrates remarkable resilience despite macroeconomic headwinds, with transaction volumes reaching extreme heightes, nearly quadruple new vehicle sales figures. Digital transformation represents a defining characteristic, exemplified by InstaCarro's automated auction system that facilitates vehicle sales spontaneously, connecting hundreds of retailers through real-time pricing algorithms. This technological sophistication extends across platform ecosystems, where companies like Kavak have invested over BRL 2.5 billion in infrastructure development, including one of Latin America's largest reconditioning facility with 240-point inspection protocols. The integration of real time payments and buy-now-pay-later financial solutions further accelerates market accessibility while traditional channels adapt hybrid operational models to maintain competitive positioning amid shifting consumer expectations toward seamless digital experiences. IMARC Group predicts that the Brazil real time payments market is projected to reach 18.50 Billion Payments by 2034.

Brazil Used Car Market Trends:

Digitalization Reshaping Traditional Distribution Models

Brazil's pre-owned vehicle sector is undergoing fundamental structural transformation as digital platforms disrupt conventional dealership-centric distribution networks. E-commerce penetration has accelerated dramatically, with 94M Brazilians expected to make online purchases, as per the ABCOMM - Associação Brasileira de Comércio Eletrônico. This digital migration extends beyond simple listing aggregation into comprehensive end-to-end transaction ecosystems featuring automated valuation algorithms, digital documentation processing, and home delivery services. Mexican unicorn Kavak exemplifies this evolution through its BRL 550 million investment in Rio de Janeiro operations in 2022, establishing integrated showrooms at Botafogo Praia Shopping and Nova América mall alongside its massive Barueri reconditioning complex. The platform's favorable return policy and thorough vehicle inspection standard demonstrate how digital operators leverage technology-enabled quality assurance to address longstanding consumer trust deficits that historically plagued informal market channels.

Expansion of Certified Pre-Owned Vehicle Programs

Organized retail segments are experiencing accelerated growth as standardized certification frameworks gain market traction, addressing persistent information asymmetries that have traditionally characterized Brazil's fragmented secondary vehicle landscape. The organized vendor segment is substantially outpacing unorganized channels, as people increasingly prioritize transparency and post-purchase support over pure price minimization. This shift manifests through expanding certified pre-owned initiatives that combine comprehensive mechanical inspections with extended warranty coverage and financing integration. Moreover, favorable government policies are supporting these programs. In 2024, Brazil launched the Green Mobility and Innovation (MOVER) Program, which took over the Rota 2030 Program. MOVER will establish mandatory standards for new vehicles sold, encompassing fuel efficiency and CO2 emission goals.

Financial Innovation Through Digital Lending Solutions

Brazil's used car financing landscape is experiencing disruption through fintech-enabled lending solutions that challenge traditional banking monopolies on automotive credit provision. Platform-integrated financing penetration approaches 50% of total sales, substantially exceeding the sub-30% penetration rates characteristic of conventional dealership channels, demonstrating how seamless digital integration reduces friction throughout credit application workflows. InstaCarro's launch of buy-now-pay-later functionality achieved BRL 4 million in initial sales, introducing flexible payment structures that particularly resonate with younger demographics and middle-income segments seeking alternatives to traditional amortization schedules. This financial innovation extends into alternative credit scoring methodologies leveraging non-traditional data sources, enabling lenders to assess creditworthiness across previously underserved consumer segments while simultaneously reducing approval timelines from days to minutes through automated decision algorithms. In 2025, Bettr, a prominent AI-powered lending company under Ant International, officially launched in Brazil today to enhance small and medium-sized enterprise (SME) lending, fostering local and regional economic growth through collaborations with local partners. Initially, it established a strategic alliance with AliExpress to introduce a new financing option, Bettr Working Capital, for local merchants using the platform.

Market Outlook 2026-2034:

Brazil's pre-owned vehicle sector is positioned for sustained expansion as structural drivers including urbanization acceleration, middle-class growth, and digital infrastructure maturation converge to unlock latent demand across income segments. The market generated a revenue of USD 24,646.83 Million in 2025 and is projected to reach a revenue of USD 47,778.64 Million by 2034, growing at a compound annual growth rate of 7.63% from 2026-2034. Technological integration will intensify across valuation, financing, and transaction execution workflows, with artificial intelligence (AI) applications enhancing credit assessment accuracy while blockchain solutions address documentation authenticity concerns that have historically constrained secondary market efficiency.

Brazil Used Car Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Vehicle Type | Sports Utility Vehicle | 36.02% |

| Vendor Type | Organized | 58% |

| Fuel Type | Gasoline | 55% |

| Sales Channel | Offline | 78% |

| Region | Southeast | 32% |

Vehicle Type Insights:

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

Sports utility vehicle dominates with a market share of 36.02% of the total Brazil used car market in 2025.

Sports utility vehicles command substantial preference within Brazil's secondary automotive landscape, reflecting consumer priorities encompassing elevated driving positions, versatile cargo configurations, and perceived safety advantages associated with larger vehicle footprints and higher ground clearance capabilities. The segment's dominance stems from practical utility combinations that resonate across diverse usage scenarios, with SUVs offering spacious cabin accommodations for families while maintaining capability for navigating Brazil's varied terrain conditions including unpaved rural roads and urban congestion environments where visibility advantages provide meaningful psychological comfort. Brazilian consumers particularly value SUV versatility as status symbols associated with aspirational lifestyles, with these vehicles bridging practical family transportation requirements alongside recreational activity support including weekend travel and outdoor adventure pursuits that drive sustained demand across suburban demographics.

Sports utility vehicles experienced particularly strong demand in Q1 2025 alongside compact cars, driven by their fuel efficiency improvements and versatility characteristics, while sedans and trucks faced headwinds from shifting consumer preference patterns toward more practical vehicle configurations. The SUV segment benefits from manufacturer investment in compact and mid-size model development that offer affordability advantages compared to full-size alternatives while maintaining core segment attributes including elevated seating positions and flexible cargo volumes. Entry-level SUV introductions including Volkswagen Tera are positioned to significantly influence market dynamics, creating accessible price points for middle-income households seeking SUV ownership experiences within constrained budgetary parameters, thereby expanding addressable market populations and sustaining segment growth momentum across forecast horizons.

Vendor Type Insights:

- Organized

- Unorganized

Organized leads with a share of 58% of the total Brazil used car market in 2025.

Organized retail channels maintain commanding positions through structured operational frameworks that translate into enhanced consumer confidence compared to informal transaction alternatives, particularly as buyers increasingly prioritize transparency, quality assurance certifications, and post-purchase support mechanisms over pure price minimization strategies characteristic of unorganized market segments. The organized vendor segment is projected to register a remarkable growth rate over the forecast period, substantially outpacing unorganized channels as market formalization accelerates through platform consolidation, standardized inspection protocols, and comprehensive warranty provision that address longstanding trust deficits plaguing Brazil's historically fragmented secondary vehicle landscape. Organized vendors leverage certified pre-owned program structures featuring multi-point mechanical inspections, vehicle history verification, and extended warranty coverage that reduce perceived acquisition risks while simultaneously supporting premium pricing strategies justified through quality certification and structured financing integration capabilities.

The organized retail advantage extends beyond certification into comprehensive service ecosystems integrating trade-in facilitation, financing arrangement through institutional partnerships, insurance coordination, and ongoing maintenance relationships that generate lifetime value substantially exceeding initial transaction margins. Companies demonstrating scale economics opportunities within multi-brand organized retail formats that leverage centralized procurement, standardized reconditioning processes, and brand portfolio diversification strategies. Organized vendors offer quality-assured vehicles with structured financing options, leading their dominance through superior operational efficiency, margin management discipline, and customer experience consistency that unorganized channels struggle to replicate given infrastructure investment requirements and working capital constraints inherent to certification-based business models.

Fuel Type Insights:

- Gasoline

- Diesel

- Others

Gasoline exhibits a clear dominance with a 55% share of the total Brazil used car market in 2025.

Gasoline-powered vehicles dominate the secondary market through widespread fuel infrastructure accessibility and established consumer familiarity patterns that have characterized Brazil's automotive landscape for decades, despite recent electrification initiatives and flex-fuel technology proliferation within new vehicle segments. The segment's substantial market share reflects installed base dynamics where gasoline vehicles constitute majority inventory within used car channels, providing diverse model selections across price points and age categories that appeal to budget-conscious consumers prioritizing immediate affordability over fuel economy optimization strategies. Brazilian fuel distribution networks maintain comprehensive gasoline availability across urban centers and rural regions, eliminating range anxiety concerns and refueling convenience barriers that constrain alternative fuel adoption, particularly in interior markets where charging infrastructure and ethanol availability remain unevenly developed compared to metropolitan concentrations.

Gasoline vehicles benefit from lower acquisition costs relative to hybrid and electric alternatives within secondary markets, as technology premiums associated with alternative powertrains during initial purchase translate into elevated used vehicle pricing that narrows affordability advantages compared to conventional gasoline options. New vehicle sales data demonstrates gasoline segment resilience with volumes increasing year-over-year across 2025 monthly reporting periods, indicating sustained production levels that ensure continuous inventory replenishment within used markets as vehicles age out of initial ownership cycles. While flex-fuel vehicles dominate Brazil's new car sales, the used market reflects historical composition patterns where gasoline-only powertrains represented majority production before flex-fuel technology standardization, creating supply dynamics that maintain gasoline dominance within pre-owned inventory despite shifting new vehicle powertrain preferences toward flexible fuel and electrification alternatives.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline leads with a share of 78% of the total Brazil used car market in 2025.

Traditional offline distribution channels maintain commanding positions despite accelerating digital adoption trends, reflecting persistent consumer preferences for physical vehicle inspection, test-driving experiences, and face-to-face negotiation processes before committing to significant purchase decisions. Brick-and-mortar dealerships, showroom environments, and physical reconditioning facilities provide tactile engagement that online channels struggle to replicate, enabling consumers to evaluate interior quality, mechanical sounds, driving dynamics, and cosmetic conditions through direct sensory assessment that photographs and video presentations cannot fully substitute.

Offline channels benefit from established trust relationships between local dealers and repeat customers, interpersonal negotiation flexibility that facilitates customized pricing accommodations, and immediate vehicle availability enabling same-day purchase completion without logistical coordination delays associated with home delivery scheduling. Traditional dealership networks encompassing diverse locations across Brazil provide geographic accessibility advantages in secondary cities and rural regions where digital platform logistics economics become prohibitive, forcing interior market consumers to rely on local physical retail channels lacking comprehensive online alternatives. Platform operators recognize offline channel importance through hybrid operational models combining digital browsing interfaces with physical showroom networks.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 32% share of the total Brazil used car market in 2025.

The Southeast region maintains commanding market concentration through economic advantages encompassing elevated income levels, extensive dealership density, sophisticated financing infrastructure, and comprehensive automotive service ecosystems that collectively position São Paulo, Rio de Janeiro, and Minas Gerais as the epicenter of Brazil's pre-owned vehicle sector. São Paulo, Rio de Janeiro, and Minas Gerais collectively account for a major portion of national used car sales, reflecting its dominant position even when subdividing these major metropolitan areas into separate analytical units. The region benefits from substantial population concentrations, creating density-driven demand volumes that support extensive retail competition, price discovery efficiency, and operational scale economies unavailable in less populated interior regions where market fragmentation constrains organized retail development.

Southeast automotive retail infrastructure superiority manifests through multi-brand dealership networks, specialized reconditioning facilities and comprehensive financing availability through major banking institutions and digital lending platforms that maintain headquarters and primary operations within São Paulo financial district. The region's economic dominance generates higher disposable income levels and vehicle ownership rates compared to national averages, translating into elevated replacement cycles and sustained secondary market transaction volumes as consumers upgrade vehicles more frequently within prosperous metropolitan environments. Geographic concentration advantages extend into logistics efficiency for platform operators and dealership chains distributing inventory across Southeast markets, with transportation cost optimization and rapid inventory turnover capabilities supporting competitive pricing strategies that attract buyers from surrounding regions, further reinforcing Southeast dominance through virtuous cycle dynamics where market concentration begets additional infrastructure investment and competitive intensity.

Market Dynamics:

Growth Drivers:

Why is the Brazil Used Car Market Growing?

New Vehicle Price Escalation and Total Ownership Cost Burden

Escalating new vehicle acquisition prices combined with substantial ongoing ownership expenses create powerful economic incentives favoring secondary market channels over primary market alternatives, as Brazilian consumers increasingly recognize that purchase price represents only initial component within comprehensive lifetime ownership cost equations. In October 2025, new car sales in Brazil increased by 7.2% from the previous month to reach 260.7 thousand units. Sales of passenger cars rose by 8% to 192.8 thousand units, light commercial vehicle sales increased by 4.5% to 55.3 thousand, while truck and bus sales climbed by 8.8% and 0.8% to 10.7 thousand and 1,970 units, respectively.

Corporate Fleet Disposal Pipeline and Rental Market Supply Dynamics

Systematic corporate fleet renewal programs generate consistent high-quality used vehicle inventory flowing into secondary markets through structured disposal channels that ensure reliable supply volumes supporting dealer acquisition strategies and consumer selection diversity unavailable through fragmented individual seller channels. Brazil's vehicle rental market reached 7.2 Billion in 2025 with projections indicating USD 12.9 Billion by 2034 according to the predictions of IMARC Group, driven by leisure tourism applications accelerating corporate mobility demand that increased as businesses optimize transportation cost structures by outsourcing fleet management rather than maintaining owned vehicle inventories.

Lower Recurring Cost Advantages from Insurance and Depreciation Mitigation

Used vehicle acquisition strategies deliver compelling ongoing ownership cost advantages beyond purchase price differentials through substantially reduced insurance premium obligations, lower property tax assessments calculated on depreciated vehicle valuations, and elimination of catastrophic first-year depreciation exposure that characterizes new vehicle ownership economics across Brazil's automotive landscape. Used vehicles deliver immediate depreciation mitigation benefits by avoiding severe first-year value erosion ranging 10-30% that new vehicles experience regardless of usage patterns or maintenance adherence. Various popular car models are bought as second-hand vehicles since their insurance is comparativel less. The Youse survey indicates that the average insurance expense for the Fiat Argo was R$2.941,02. Dominating the market, the Chevrolet Onix recorded an average insurance cost of R$ 2,657.87.

Market Restraints:

What Challenges the Brazil Used Car Market is Facing?

Certification Standards Inconsistency

Brazil's secondary vehicle sector continues grappling with fragmented quality assurance frameworks and inconsistent certification protocols that undermine consumer confidence and perpetuate information asymmetries across transaction channels. Despite high used vehicle sales in 2024, the market lacks standardized inspection parameters, vehicle history verification processes, or universally recognized certification seals that would enable buyers to make informed purchasing decisions with confidence comparable to new vehicle acquisitions. This certification deficit creates opportunities for fraudulent transactions, mechanical misrepresentation, and hidden damage concealment that erode consumer trust and constrain market expansion potential among risk-averse buyer segments preferring new vehicle alternatives despite premium pricing specifically to avoid secondary market uncertainty.

High Interest Rate Environment Constraining Credit

Brazil's monetary policy tightening cycle, with Selic rates reaching 14.25% and projected to approach 14.75% by year-end, creates substantial headwinds for financing-dependent vehicle purchases as elevated borrowing costs compress affordability and reduce loan approval rates across consumer segments. The financing environment particularly constrains used vehicle acquisitions for older models exceeding four years, where lenders increasingly implement stricter approval criteria and higher interest rate premiums to compensate for accelerated depreciation risks, creating credit access barriers for value-conscious people specifically seeking lower-priced vehicle alternatives that require financing but face rejection based on collateral concerns rather than borrower creditworthiness assessments, thereby limiting market accessibility across precisely those demographic segments most reliant on affordable pre-owned options.

Infrastructure Limitations in Secondary Markets

Geographic disparities in dealership density, digital connectivity infrastructure, and logistical capabilities create uneven market development patterns that constrain growth potential in interior regions and smaller municipalities lacking comprehensive automotive retail ecosystems. São Paulo, Rio de Janeiro, and Minas Gerais collectively account for over 50% of national used vehicle sales, reflecting concentration dynamics where major metropolitan areas benefit from competitive retail landscapes, extensive financing availability, and sophisticated service networks that remain underdeveloped in secondary markets despite potentially substantial latent demand. Transportation logistics present particular challenges for digital platform expansion into interior regions, where home delivery economics become prohibitive given extended distances and limited return-trip load opportunities, forcing consumers to travel significant distances for vehicle inspection and acquisition or rely on local informal channels lacking quality assurance and competitive pricing benefits characterizing organized urban retail environments, thereby perpetuating market fragmentation that limits operational scale efficiencies.

Competitive Landscape:

Brazil's used car market demonstrates moderate competitive intensity with diverse participant categories spanning digital platform operators, traditional multi-brand dealerships, OEM-affiliated certified pre-owned channels, and rental fleet disposal programs competing across differentiated value propositions and service delivery models. Market fragmentation reflects the sector's ongoing structural evolution from historically informal transaction patterns toward increasingly organized retail formats as technology-enabled platforms introduce standardization, transparency, and quality assurance protocols that reshape competitive dynamics and consumer expectations. Digital platform operators compete alongside established multi-brand networks footprint and specialized players. Traditional dealership networks maintain advantages through physical presence enabling vehicle inspection and established consumer relationships, yet face disruption from e-commerce platforms offering superior price discovery, streamlined transaction workflows, and integrated financing solutions that reduce purchase friction. Competitive differentiation increasingly centers on certification rigor, warranty comprehensiveness, financing accessibility, and digital experience quality rather than pure inventory scale, as consumers prioritize transaction transparency and post-purchase support assurances over traditional dealership proximity considerations that historically drove channel selection.

Brazil Used Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchbacks, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil used car market size was valued at USD 24,646.83 Million in 2025.

The Brazil used car market is expected to grow at a compound annual growth rate of 7.63% from 2026-2034 to reach USD 47,778.64 Million by 2034.

Sports utility vehicle dominates with a 36.02% market share, driven by consumer preferences for versatility, elevated driving positions, and rugged capability across Brazil's diverse terrain conditions. SUVs experienced particularly strong demand in Q1 2025 alongside compact cars, reflecting their fuel efficiency improvements and practical utility combinations that appeal to families, adventure enthusiasts, and status-conscious buyers seeking aspirational lifestyle associations.

Key factors driving the Brazil used car market include economic accessibility as affordable alternatives to new vehicles, digital infrastructure transformation enabling transparent e-commerce platforms and streamlined transactions, financial infrastructure development through diversified lending channels and competitive financing structures, and evolving consumer preferences toward family-oriented and versatile vehicle configurations within organized retail environments.

Major challenges include certification standards inconsistency limiting consumer confidence in vehicle quality assessments, high interest rate environment with Selic rates exceeding 14% constraining financing affordability and credit accessibility, infrastructure limitations in secondary markets creating geographic disparities in dealership density and service availability, and structural transition frictions as market evolves from informal transaction patterns toward organized retail formats requiring substantial investment in standardization protocols and digital infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)