Brazil Used Cooking Oil Market Size, Share, Trends and Forecast by Source, Application, and Region, 2025-2033

Brazil Used Cooking Oil Market Overview:

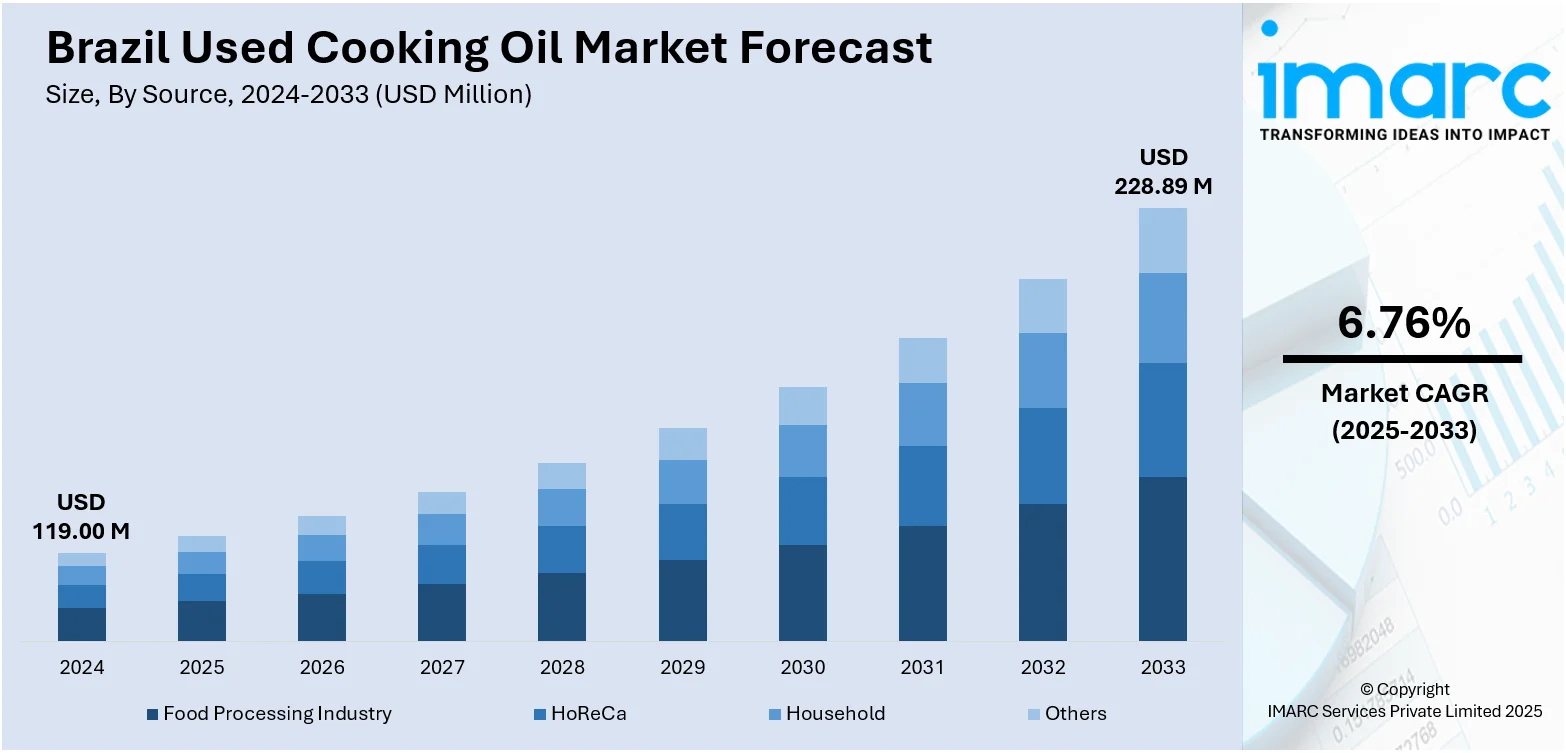

The Brazil used cooking oil market size reached USD 119.00 Million in 2024. The market is projected to reach USD 228.89 Million by 2033, exhibiting a growth rate (CAGR) of 6.76% during 2025-2033. The aviation sector is under increasing pressure to decrease greenhouse gas emissions, and sustainable aviation fuel (SAF) has become an essential solution to achieve decarbonization objectives. This is catalyzing the demand for used cooking oil, which is recognized as a valuable and sustainable feedstock for producing low-carbon aviation fuels. Besides this, increasing tourism activities are contributing to the expansion of the Brazil used cooking oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 119.00 Million |

| Market Forecast in 2033 | USD 228.89 Million |

| Market Growth Rate 2025-2033 | 6.76% |

Brazil Used Cooking Oil Market Trends:

Growing demand for SAF

Rising demand for SAF is offering a favorable market outlook in Brazil. Used cooking oil is increasingly recognized as a valuable and sustainable feedstock for producing low-carbon aviation fuels. The aviation industry is facing mounting pressure to reduce greenhouse gas emissions, and SAF has emerged as a critical solution to meet global decarbonization goals. Brazil, with its strong biofuel expertise and increasing renewable energy adoption, is well-positioned to convert used cooking oil into SAF, aligning with both environmental objectives and circular economy principles. As per the IMARC Group, the Brazil renewable energy market was valued at USD 16.3 Billion in 2024. Transforming waste oil into aviation fuel is not only reducing reliance on fossil fuels but also minimizing waste disposal issues, offering dual environmental benefits. International aviation regulations and commitments to carbon neutrality are driving higher blending mandates for SAF, creating new demand channels for used cooking oil beyond traditional biodiesel applications. Technological advancements in refining processes ensure that SAF derived from used cooking oil meets the stringent quality and safety standards required by the aviation sector.

To get more information on this market, Request Sample

Increasing tourism activities

Rising tourism activities are propelling the Brazil used cooking oil market growth. Brazil welcomed 6.65 Million international tourists in 2024, marking a 12.6% increase compared to 2023, as reported by Embratur. Popular tourist destinations, especially coastal cities and cultural hubs, experience high food consumption, particularly fried and prepared dishes, leading to greater used cooking oil availability. As tourism is growing in the country, seasonal peaks in visitor numbers are creating surges in cooking oil usage, providing a steady and predictable supply for collection and recycling. Many hospitality businesses, encouraged by environmental regulations and sustainability initiatives, are partnering with certified collectors to ensure proper disposal and recycling of used cooking oil. This collected oil is then converted into biodiesel, soaps, and other industrial products, supporting Brazil’s renewable energy and circular economy goals. Additionally, tourism-driven economic growth is encouraging investments in better waste management infrastructure, improving used cooking oil collection efficiency in high-traffic areas. With Brazil’s tourism industry continuing to expand due to cultural events, natural attractions, and international interest, the consistent generation of used cooking oil from foodservice outlets linked to tourism ensures a dependable feedstock for biodiesel production and other recycling applications, strengthening the overall market.

Brazil Used Cooking Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source and application.

Source Insights:

- Food Processing Industry

- HoReCa

- Household

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes food processing industry, HoReCa, household, and others.

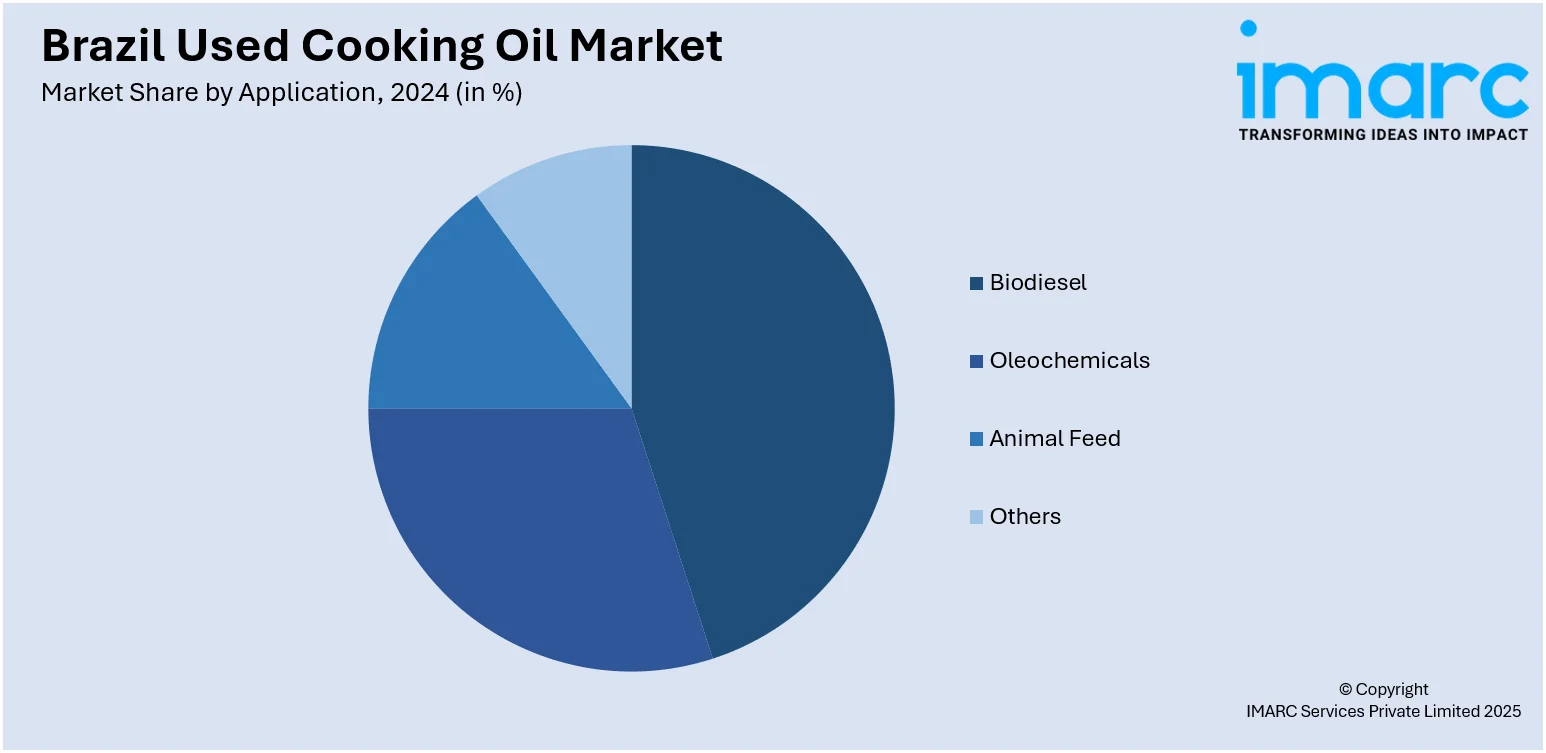

Application Insights:

- Biodiesel

- Oleochemicals

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes biodiesel, oleochemicals, animal feed, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Used Cooking Oil Market News:

- In May 2025, Fuel distributor Vibra commenced the supply of sustainable aviation fuel (SAF) at its facility located at Tom Jobim International Airport (GIG) in Rio de Janeiro, Brazil, thus becoming the first company in the nation to offer SAF. The SAF provided by Vibra was made from used cooking oil, which is among the most sustainable feedstocks because of its minimal carbon intensity.

Brazil Used Cooking Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Food Processing Industry, HoReCa, Household, Others |

| Applications Covered | Biodiesel, Oleochemicals, Animal feed, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil used cooking oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil used cooking oil market on the basis of source?

- What is the breakup of the Brazil used cooking oil market on the basis of application?

- What is the breakup of the Brazil used cooking oil market on the basis of region?

- What are the various stages in the value chain of the Brazil used cooking oil market?

- What are the key driving factors and challenges in the Brazil used cooking oil market?

- What is the structure of the Brazil used cooking oil market and who are the key players?

- What is the degree of competition in the Brazil used cooking oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil used cooking oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil used cooking oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil used cooking oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)