Brazil Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Brazil Vegan Cosmetics Market Overview:

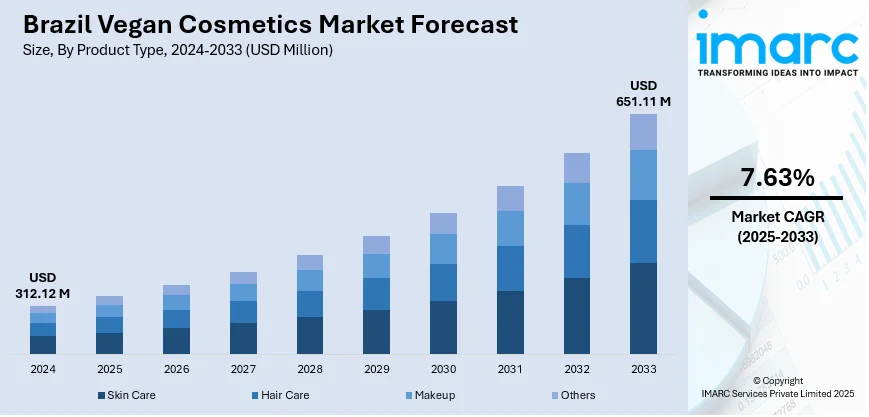

The Brazil vegan cosmetics market size reached USD 312.12 Million in 2024. Looking forward, the market is expected to reach USD 651.11 Million by 2033, exhibiting a growth rate (CAGR) of 7.63% during 2025-2033. The market is fueled by cultural appreciation for biodiversity, growing customer interest in cruelty-free products, and high environmental consciousness. Leading brands are aligning with sustainable sourcing practices and indigenous community partnerships to ensure ethical, traceable botanical supply chains. Along with this, Brazil’s regulatory encouragement of eco-conscious and clean-label beauty also boosts adoption, further strengthening the Brazil vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 312.12 Million |

| Market Forecast in 2033 | USD 651.11 Million |

| Market Growth Rate 2025-2033 | 7.63% |

Brazil Vegan Cosmetics Market Trends:

Amazonian Biodiversity and Ethnobotanical Ingredient Innovation

One of the defining tendencies in Brazil's vegan beauty industry is the promotion of Amazonian biodiversity and ethnobotanical actives to the fore, on the lookout for plant-based actives that connect with Brazil's natural heritage. The brands feature native botanicals such as cupuaçu butter, maracujá passion fruit extract, açaí pulp, buriti oil, and bacuri, which are actives naturally vegan and frequently celebrated in local Indigenous cultures. These ingredients are incorporated into clean-label products like body butters, facial oils, and hair masks, that highlight indigenous origin stories and ecological authenticity. Manufacturers frequently work with cooperatives and Indigenous peoples of Amazonas and Pará so that they can guarantee regenerative sourcing practices and fair-trade relationships. Consequently, vegan beauty brands are no longer only cruelty-free but also regionally based in environmental and cultural stewardship. The visual identity tends to incorporate Amazonian design elements and natural color palettes into the packaging, adding to the authenticity. The trend combines Brazil's ecological abundance with ethical vegan values and green sourcing storytelling, creating a unique regional template for the Brazil vegan cosmetics market growth.

To get more information on this market, Request Sample

Sustainability Storytelling and Circular Packaging Movement

A second key focus shaping Brazil's vegan cosmetics market is the intersection of sustainability storytelling with circular packaging innovation. Vegan brands in urban centers such as São Paulo and Rio de Janeiro increasingly highlight plastic-free, biodegradable, or refillable packaging modes, supporting cruelty-free vegan ingredients with larger ecological accountability. Refillable jars of balms, compostable sachets, and recycled plastic containers, often designed from upcycled Amazon pulp materials, support the vegan philosophy with end-to-end sustainability. This packaging-driven narrative is strongly shaped by Brazilian national debates on plastic pollution and rainforest protection. Brands that involve consumers explain packaging life cycles, traceability of ingredients, and community footprint in their online branding. Return-and-refill programs are being set up by most firms, inviting consumers to return containers to be reused. Vegan certification coupled with circular packaging resonates well with environment-sensitive urban consumers, particularly those active with sustainability campaigns and Indigenous rights. As Brazil's zero-waste culture expands, vegan beauty brands with open, environmentally conscious packaging and local biodiversity sourcing, are gaining consumer confidence and telling the larger clean-beauty story.

Digital Advocacy, Social Awareness, and Veganization

Brazil's digitally savvy youth and socially aware consumer are driving the vegan cosmetics movement through influencer advocacy and ingredient labeling. Social media sites like Instagram, TikTok, and beauty forums feature content creators who post critiques of cruelty-free vegan products, compare 'before and after' results using Amazonian oil serums, and highlight vegan certifications and responsible sourcing. Especially in urban centers like São Paulo, Belo Horizonte, and Recife, consumers respond to brands that provide rich narratives of plant origins, village-level harvesting practices, and fair-trade collaborations with local harvesters. This trend is amplified by Brazil's highly developed social movements around environmental and Indigenous causes, so vegan beauty brands are incorporating purpose messaging into product design. Clean beauty bloggers not only assess product effectiveness but also highlight environmental impacts and cruelty-free standards. Consequently, vegan ranges that have clearly traceable ingredient processes, social responsibility commitments, and accessible branding are preferred. The intersection of ecological pride, national Brazilian heritage, and digital consumerism is driving the growth of vegan cosmetics that are imbued with ethical goodness as well as Brazilian botanical heritage.

Brazil Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

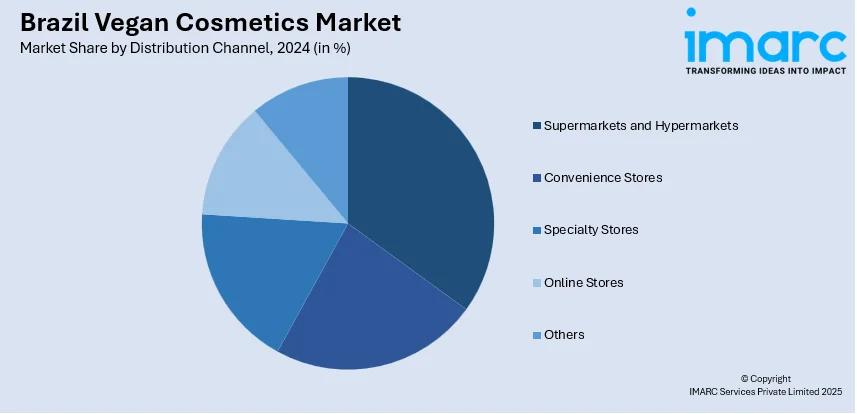

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Vegan Cosmetics Market News:

- In June 2025, Skala and Lola from Rio, two leading and creative brands in Brazil’s beauty industry, revealed a merger that will form one of the biggest groups in the nation's beauty market. With total revenues nearing R$2 Billion, a reach of 54% of Brazilian homes, and sales across more than 80 countries, the newly formed group is initiated with a notable presence and established growth path both locally and globally. Skala, recognized for its inclusivity and providing a product range that ensures quality at a reasonable cost, is the top player in hair treatment creams, available in 76% of the nation’s retail outlets. Lola From Rio, in contrast, is recognized for her creativity, humor, and vibrant personality. Established in 2011, it was among Brazil’s earliest vegan beauty brands and a trailblazer for various trends in the industry.

Brazil Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil vegan cosmetics market on the basis of product type?

- What is the breakup of the Brazil vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Brazil vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Brazil vegan cosmetics market?

- What are the key driving factors and challenges in the Brazil vegan cosmetics market?

- What is the structure of the Brazil vegan cosmetics market and who are the key players?

- What is the degree of competition in the Brazil vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)