Brazil Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2026-2034

Brazil Watch Market Summary:

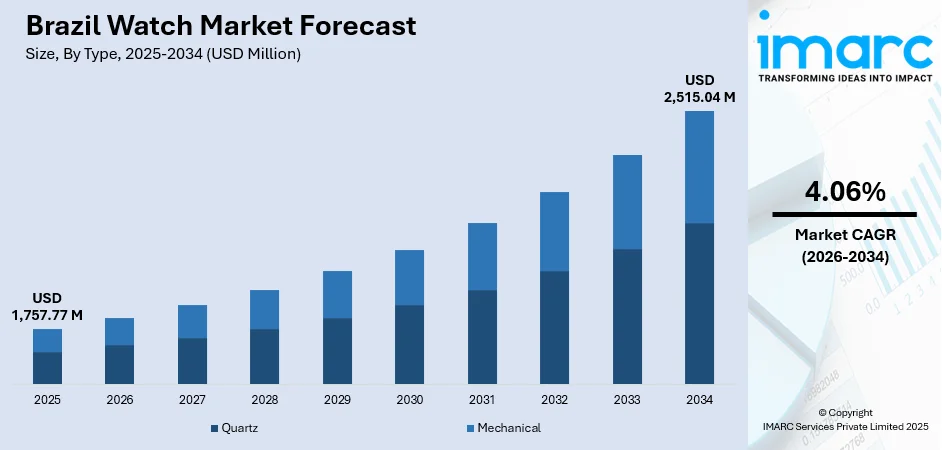

The Brazil watch market size was valued at USD 1,757.77 Million in 2025 and is projected to reach USD 2,515.04 Million by 2034, growing at a compound annual growth rate of 4.06% from 2026-2034.

The Brazil watch market is experiencing steady expansion, driven by rising disposable incomes among the growing middle class and evolving consumer preferences for timepieces as fashion accessories and status symbols. Increasing urbanization, particularly in major metropolitan areas, is strengthening demand across price segments. The market benefits from a diverse retail landscape combining traditional brick-and-mortar stores with expanding e-commerce channels, enhancing product accessibility.

Key Takeaways and Insights:

- By Type: Quartz dominates the market with a share of 60% in 2025, driven by its exceptional accuracy, affordability, and minimal maintenance requirements that appeal to budget-conscious Brazilian consumers seeking reliable timekeeping solutions.

- By Price Range: Mid-range leads the market with a share of 35% in 2025, reflecting the purchasing power of Brazil's expanding middle class seeking quality timepieces that balance affordability with style and durability.

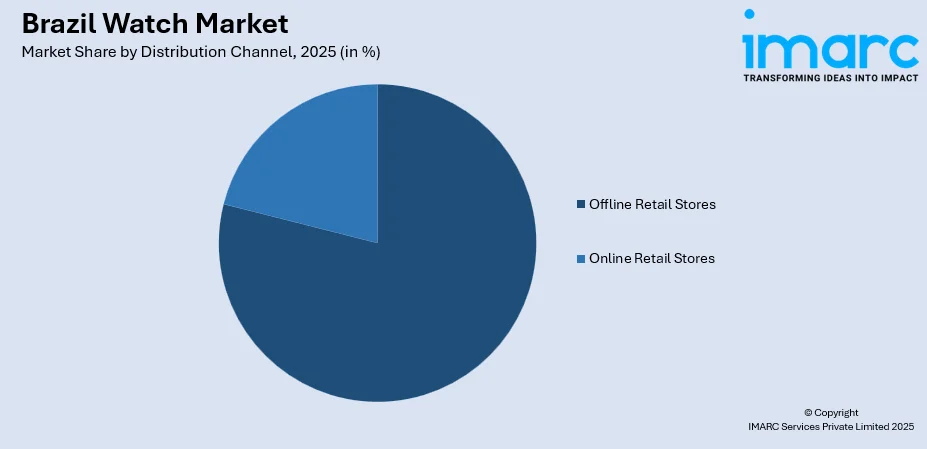

- By Distribution Channel: Offline retail stores represent the largest segment with a market share of 75% in 2025, as Brazilian consumers prefer tactile product evaluation, personalized service, and the trust associated with physical retail environments for watch purchases.

- By End User: Men prevail the market with a share of 55% in 2025, supported by traditional marketing strategies, emphasizing themes of achievement, success, and masculine sophistication that resonate strongly with Brazilian male consumers.

- Key Players: The Brazil watch market features a competitive landscape with international brands alongside domestic manufacturers, competing through product innovations, marketing strategies, and retail expansion initiatives.

To get more information on this market, Request Sample

The Brazil watch market continues to evolve, as consumer preferences are shifting between traditional timepieces and technology-integrated wearables. Economic stabilization and declining unemployment rates are bolstering consumer confidence and discretionary spending on accessories. Major metropolitan centers, including São Paulo and Rio de Janeiro, serve as primary demand hubs, where affluent consumers drive luxury segment growth while suburban and regional markets increasingly contribute to mid-range and entry-level sales. For instance, in January 2025, Tiffany & Co. opened its flagship store at Iguatemi São Paulo, featuring a dedicated space for watches. The retail environment is adapting to meet diverse consumer needs through omnichannel strategies that combine in-store experiences with digital convenience.

Brazil Watch Market Trends:

Growing Middle-Class and Rising Disposable Incomes

Brazil’s expanding middle class is a major growth driver for the watch market. As more individuals are experiencing improved income levels, spending on lifestyle and fashion accessories is increasing. As per the CEIC, households' disposable income figures were recorded at 735,327,000,000.000 BRL in February 2025. Watches are no longer viewed only as timekeeping devices but as statements of style and personal status. Consumers are becoming more comfortable investing in branded and premium products, especially in urban areas.

Increasing Fashion Awareness and Brand Consciousness

Brazilian consumers, particularly younger buyers, are becoming more style-conscious and brand-aware. Social media, celebrities, and global fashion trends influence purchase decisions, encouraging people to buy watches that match their outfits and personal identities. In January 2024, Brazil had 144.0 Million social media users, making up 66.3% of its entire population. Watches are increasingly seen as fashion accessories rather than just functional products. This shift is fueling the demand for trendy designs, limited editions, and global brands, helping watchmakers attract a younger and more fashion-driven customer base.

Expansion of E-Commerce and Digital Retail Channels

The rapid growth of e-commerce and digital retail channels has made watches more accessible across Brazil. As per IMARC Group, the Brazil e-commerce market size reached USD 513.3 Billion in 2025. Consumers can compare prices, read reviews, explore international brands, and shop conveniently from home. Online discounts and installment payment options also encourage higher spending on watches. Smaller brands can reach consumers nationwide without heavy investments in physical infrastructure.

Market Outlook 2026-2034:

The Brazil watch market is expected to show steady and balanced growth, driven by lifestyle upgrades and improving consumer sentiment. The market generated a revenue of USD 1,757.77 Million in 2025 and is projected to reach a revenue of USD 2,515.04 Million by 2034, growing at a compound annual growth rate of 4.06% from 2026-2034. Economic recovery, improving consumer confidence, and the continued expansion of retail infrastructure across major cities will support market advancement. The integration of digital technologies in traditional watch designs and the growing acceptance of wearable accessories among younger demographics represent key opportunities for market participants seeking to capture emerging consumer segments.

Brazil Watch Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Quartz | 60% |

| Price Range | Mid-Range | 35% |

| Distribution Channel | Offline Retail Stores | 75% |

| End User | Men | 55% |

Type Insights:

- Quartz

- Mechanical

Quartz dominates with a market share of 60% of the total Brazil watch market in 2025.

Quartz watches are affordable, accurate, and easy to maintain. They suit everyday users who want reliable performance without high servicing costs. With wide design variety and simple functionality, quartz models appeal to a broad range of consumers across age groups.

Brands produce quartz models in large volumes, which keeps prices competitive and encourages frequent upgrades. They are continuously launching stylish watch collections to attract youth and fashion-focused buyers. In November 2025, TAG Heuer launched ‘New Senna Formula 1 Series’ that captured Brazilian essence. The 44mm automatic utilized modern materials with its black DLC titanium case and forged carbon bezel, whereas the 43mm quartz version reintroduced the S/EL bracelet. Brazilian consumers also prefer lightweight, durable watches suitable for active lifestyles, which quartz designs support well.

Price Range Insights:

- Low-Range

- Mid-Range

- Luxury

Mid-range leads with a share of 35% of the total Brazil watch market in 2025.

The mid-range segment dominates the Brazil watch market because it offers the right mix of affordability, quality, and style. Consumers get better design and durability than budget models without paying high luxury prices, making mid-range watches the most practical choice for everyday use.

Moreover, mid-range watches appeal to a wide income group, including working professionals and young consumers seeking value for money. These watches usually provide trusted brand names, decent materials, and modern features at accessible prices. Installment payment options make them easier to buy, while online platforms increase their reach nationwide. As fashion awareness is growing, buyers prefer stylish yet reasonably priced watches, helping the mid-range category consistently outperform both low-end and luxury segments.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Online Retail Stores

- Offline Retail Stores

Offline retail stores exhibit a clear dominance with a 75% share of the total Brazil watch market in 2025.

Offline retail stores maintain commanding market presence, as Brazilian consumers demonstrate strong preferences for in-store shopping experiences when purchasing watches. Physical stores allow buyers to check design, size, comfort, and quality in person, giving them more confidence in their purchase decision than online shopping alone.

Additionally, offline stores offer immediate ownership, personalized assistance, and after-sales services, such as battery replacement and repairs. Many consumers trust authorized dealers for authenticity, especially when purchasing branded or premium watches. In-store promotions, installment payment options, and festive discounts further attract walk-in customers. Stores located in malls and busy streets also benefit from high footfall, making physical retail a convenient and familiar channel for watch purchases across different consumer groups.

End User Insights:

- Men

- Women

- Unisex

Men represent the leading segment with a 55% share of the total Brazil watch market in 2025.

Men dominate the market because watches are a widely preferred accessory for male consumers, often serving as both a functional item and a style statement. Many men view watches as a key part of their daily outfit, making them a consistent and loyal buyer group.

In addition, men tend to purchase watches for multiple purposes, including work, sports, special occasions, and status expression, driving higher overall demand. The availability of diverse designs, such as sporty, classic, and luxury models, further boosts male interest. Cultural preferences also play a role, as men are more likely to invest in premium or collectible watches. Gifting traditions, corporate culture, and rising fashion awareness are reinforcing this trend, making the men’s segment stronger than the women's in the market.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast holds prominence in the market due to higher income levels, dense urban population, and strong retail infrastructure. Fashion awareness is high, increasing the demand for branded and premium. Major cities drive trends, innovations, and faster adoption of new watch designs.

The South region shows stable growth, supported by organized retail networks and consistent purchasing power. Consumers prefer quality, durability, and trusted brands. Demand is spread across mid-range and premium segments, owing to increasing income levels.

The Northeast market is driven mainly by affordable and mid-range watches due to price sensitivity. Tourism supports sales of stylish and casual models. Urbanization and youth population growth are increasing the demand for trendy designs, helping fashion watches gain popularity across coastal cities and emerging urban centers.

In the North region, the market is shaped by climate and geography, increasing preference for durable and practical designs. Limited retail access makes offline channels important. The growth is supported by expanding mobile commerce and rising interest in stylish items.

The Central-West shows steady watch demand due to economic activity in agriculture, trade, and government services. Consumers favor reliable and mid-priced watches. Expanding cities and digital adoption are increasing interest in premium style, especially among professionals and younger buyers.

Market Dynamics:

Growth Drivers:

Why is the Brazil Watch Market Growing?

Youth Population and Trend-Driven Consumption

Brazil’s large youth population plays a powerful role in driving the market growth, as younger consumers are highly influenced by fashion trends, social media, and lifestyle branding. As per the UN WPP 2024 series, in 2025, individuals aged 15 to 24 were set to comprise 14.7% of Brazil's overall population. This group views watches not just as time-telling devices but as style accessories that express personality and identity. Trend-driven buying behavior encourages frequent upgrades as new designs, colors, and features are launched. Fashion watches are especially popular because they cater to evolving lifestyle preferences. Peer influence and digital promotions increase spending motivation, while limited editions create urgency. As this demographic matures financially, its long-term contribution to the market expansion becomes even more significant and sustainable.

Availability of Flexible Payment Options

The availability of flexible payment options, including mobile payments, has made watches more accessible to a wider consumer base across Brazil. As per IMARC Group, the Brazil mobile payment market size reached USD 67.0 Billion in 2025. Installment plans reduce the financial pressure associated with purchasing mid-range and premium watches, allowing consumers to spread costs over manageable periods. This increases confidence in buying higher-value products and encourages customers to select better models with advanced features or branded appeal. Retailers strategically promote no-cost or low-interest payment schemes to stimulate purchasing decisions. These financing arrangements also increase average transaction values and reduce price sensitivity. As both online platforms and physical stores offer customized payment solutions, overall market demand continues to strengthen steadily.

Growth of Tourism and Souvenir Purchases

Tourism significantly supports demand for watches, particularly in busy urban centers, coastal destinations, and popular travel hubs. As per the Brazilian government data, in 2024, more than 6.621 Million tourists selected Brazilian locations for their vacation or work travel, surpassing the previous record set in 2018, when 6.6 Million international visitors arrived. Travelers frequently purchase watches as souvenirs or gifts due to their portability and long-lasting value. Stylish designs and recognizable brands attract tourists seeking reminders of their trips. Tourist markets, retail outlets, and travel-oriented shopping zones enhance visibility. Seasonal tourism peaks drive higher footfall and impulse purchases, boosting sales volumes during holidays. In addition, duty-free shopping and promotional bundles further encourage spending. Tourism-driven demand helps stabilize revenue during peak travel periods and provides consistent growth opportunities for watch retailers operating in key tourist locations.

Market Restraints:

What Challenges the Brazil Watch Market is Facing?

Competition from Smartwatches and Digital Alternatives

The growing popularity of smartwatches and fitness wearables presents competitive pressure on traditional watch segments. Consumers, particularly younger demographics, increasingly evaluate timepiece purchases against feature-rich digital alternatives offering health tracking, connectivity, and multifunctional capabilities. This preference shift challenges manufacturers to innovate and differentiate traditional offerings.

Import Dependency and Supply Chain Considerations

The Brazil watch market relies significantly on imported products and components, exposing it to international supply chain dynamics and trade policy changes. Tariff structures and import regulations influence product availability and pricing, while global logistics challenges can affect inventory management and delivery timelines for retailers serving Brazilian consumers.

Presence of Counterfeit and Low-Quality Products

The availability of counterfeit and low-quality watches in informal markets affects brand trust and market value. Cheap imitation products attract price-conscious consumers, reducing demand for genuine brands. Counterfeits weaken brand identity and discourage premium purchases. Customers who experience poor quality may lose confidence in the entire category. This problem also pressures legitimate sellers to justify higher prices, making competition unfair and slowing the growth of organized and branded retail segments.

Competitive Landscape:

The Brazil watch market exhibits a moderately fragmented competitive structure with international brands competing alongside regional manufacturers across distinct price segments. Market participants differentiate through product design, brand heritage, retail presence, and after-sales service capabilities. Competition intensifies as companies expand distribution networks, introduce localized product offerings, and invest in marketing strategies targeting diverse consumer demographics. Strategic partnerships with retailers and omnichannel investments enable brands to enhance market penetration while building customer loyalty through personalized experiences and comprehensive service support.

Brazil Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Southeast, South, Northeast, North, Central-West, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil watch market size was valued at USD 1,757.77 Million in 2025.

The Brazil watch market is expected to grow at a compound annual growth rate of 4.06% from 2026-2034 to reach USD 2,515.04 Million by 2034.

Quartz, holding the largest revenue share of 60%, dominate the market due to its exceptional accuracy, affordability, low maintenance requirements, and wide accessibility across diverse consumer segments

Key factors driving the Brazil watch market include expanding middle-class purchasing power, cultural significance of watches as fashion accessories, retail infrastructure development, growing e-commerce penetration, and increasing consumer preference for quality timepieces.

Major challenges include economic volatility and inflationary pressures, competition from smartwatches and digital alternatives, import dependency affecting pricing, currency fluctuations impacting costs, and evolving consumer preferences towards technology-integrated wearables.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)