Brazil Wound Care Management Devices Market Size, Share, Trends and Forecast by Product, Wound Type, and Region 2026-2034

Brazil Wound Care Management Devices Market Summary:

The Brazil wound care management devices market size was valued at USD 69.28 Million in 2025 and is projected to reach USD 104.12 Million by 2034, growing at a compound annual growth rate of 4.63% from 2026-2034.

The market is primarily driven by Brazil's rapidly aging population and the growing prevalence of chronic diseases, particularly diabetes mellitus, which significantly increases the incidence of diabetic foot ulcers and pressure wounds requiring specialized wound care management. The convergence of expanding healthcare infrastructure, rising adoption of advanced wound care technologies, and increasing awareness about proper wound management protocols among healthcare professionals is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants across the value chain.

Key Takeaways and Insights:

- By Product: Wound care dominates the market with a share of 58% in 2025, driven by the extensive adoption of advanced wound dressings, bandages, and topical agents across hospitals and home care settings, coupled with increasing healthcare professional preference for comprehensive wound management solutions.

- By Wound Type: Chronic wound leads the market with a share of 55% in 2025, owing to the rising prevalence of diabetes-related foot ulcers and pressure ulcers among Brazil's expanding elderly population, necessitating prolonged wound management protocols.

- Key Players: The Brazil wound care management devices market exhibits moderate competitive intensity, with multinational medical technology corporations competing alongside regional manufacturers across diverse product segments and distribution channels. Market participants differentiate through product innovation, pricing strategies, clinical effectiveness, and partnerships with hospitals and distributors to strengthen market presence.

The Brazil wound care management devices market is shaped by demographic, clinical, and structural transformations across the healthcare system. Rising prevalence of chronic diseases, particularly diabetes, continues to increase the incidence of complex and slow healing wounds that require prolonged clinical management. A rapidly aging population is expanding the pool of patients susceptible to pressure ulcers, surgical wounds, and mobility related injuries. Demand is further reinforced by growth in surgical volumes, trauma cases, and occupational accidents that require structured acute wound treatment. These drivers are supported by ongoing healthcare modernization efforts. In 2025, Brazil unveiled its first smart hospital project within the public Unified Health System and presented the initiative to the BRICS New Development Bank, signaling increased investment in advanced care delivery. Expansion of healthcare infrastructure, emphasis on infection control and patient safety, and growth of home and outpatient care models continue to strengthen the demand for specialized wound care management devices nationwide.

Brazil Wound Care Management Devices Market Trends:

Increasing Prevalence of Diabetes and Associated Chronic Wound Complications

Rising prevalence of diabetes in Brazil is creating sustained long-term demand for wound care management devices, as chronic high blood glucose levels slow healing and increase infection risk. Diabetes related complications, particularly diabetic foot ulcers, place ongoing pressure on hospitals and long-term care facilities to adopt specialized wound treatment solutions. This burden is evident in the scale of the affected population. According to the International Diabetes Federation, Brazil’s adult population reached 155,426,300 in 2024, with diabetes prevalence estimated at 10.6%. As ulcer incidence and recurrence rise, healthcare providers increasingly depend on advanced wound care devices to manage extended treatment durations, reduce complications, and improve patient outcomes.

Growing Geriatric Population

Brazil is experiencing a rapid demographic transition that is reshaping healthcare demand and significantly influencing the wound care management devices market. An expanding elderly population faces higher risks of chronic wounds due to reduced skin resilience, impaired circulation, and increased incidence of comorbid conditions. This aging trend is clearly reflected in national population data. According to IBGE population projections, Brazil’s average population age was 35.5 years in 2023 and is expected to rise to 48.4 years by 2070, highlighting a steadily growing geriatric cohort. As older patients require prolonged and hygienic wound treatment, healthcare providers are increasing reliance on specialized wound care devices to manage chronic conditions across hospital, long term care, and home healthcare settings.

Rise of Healthcare Infrastructure

Expansion of healthcare infrastructure in Brazil is catalyzing the demand for wound care management devices across hospitals, clinics, and outpatient facilities. Growth in both public and private healthcare capacity is improving access to advanced treatment and increasing procedure volumes that require structured wound management. This expansion is reflected in system scale. According to data published by ITA in 2025, Brazil has 7,309 hospitals, of which 63% are privately operated, supported by 500,253 hospital beds as of 2024. As infrastructure density increases, healthcare providers invest more consistently in wound care devices to support quality outcomes and operational efficiency.

Market Outlook 2026-2034:

The Brazil wound care management devices market shows steady growth potential across the forecast period, supported by long-term demographic shifts, rising life expectancy, and increasing incidence of chronic conditions. An expanding elderly population, higher diabetes prevalence, and greater awareness about advanced wound treatment options are strengthening the demand across hospitals and homecare settings. The market generated a revenue of USD 69.28 Million in 2025 and is projected to reach a revenue of USD 104.12 Million by 2034, growing at a compound annual growth rate of 4.63% from 2026-2034. Improvements in healthcare access and gradual adoption of modern wound therapies further support the market growth.

Brazil Wound Care Management Devices Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Wound Care |

58% |

|

Wound Type |

Chronic Wound |

55% |

Product Insights:

To get detailed segment analysis of this market, Request Sample

- Wound Care

- Dressings

- Bandages

- Hydrogel Dressings

- Topical Agents

- Wound Care Devices

- Wound Closure

- Suture and Staplers

- Tissue Adhesive, Sealant, and Glue

Wound care dominates with a market share of 58% of the total Brazil wound care management devices market in 2025.

Wound care holds the biggest market share due to its central role in treatment protocols and routine clinical practice settings. This solution is required across multiple stages of wound management, including assessment, cleaning, protection, and healing support. Continuous usage requirements result in consistent demand for consumables and associated devices. Standardization of care practices and procedural dependence further reinforce adoption. High patient volumes and recurring care needs sustain strong utilization levels, positioning wound care as the dominant segment within the overall market structure nationwide over extended periods.

Another factor supporting this dominance is the operational focus on prevention of complications and maintenance of optimal healing conditions. Wound care solution enables regular monitoring and intervention, reducing escalation risks and supporting continuity of treatment. Healthcare providers rely on this segment for routine management across inpatient and outpatient environments. Procurement priorities favor categories with predictable utilization patterns and steady turnover. Integration into standard care pathways further increases usage frequency. These structural and operational drivers collectively sustain market leadership for wound care across Brazil’s wound management landscape over long planning horizons and institutional settings nationwide.

Wound Type Insights:

- Chronic Wound

- Diabetic Foot Ulcer

- Pressure Ulcer

- Others

- Acute Wound

- Surgical Wounds

- Burns

- Others

Chronic wound leads with a market share of 55% of the total Brazil wound care management devices market in 2025.

Chronic wound represents the largest segment owing to its prolonged healing timelines and sustained clinical management requirements. This segment necessitates repeated interventions, ongoing monitoring, and continuous use of advanced wound care devices over extended periods. Demand intensity remains high as treatment pathways focus on complication prevention, infection control, and tissue regeneration support. The need for long-term care increases device utilization frequency and replacement cycles. Healthcare systems prioritize effective management to reduce burden, which drives consistent procurement and adoption of specialized wound care technologies across care settings.

Another factor supporting dominance is the rising prevalence of conditions associated with delayed wound closure and recurrent tissue damage. These wounds require structured care protocols and dependable device performance to manage exudate, promote healing, and limit complications. Treatment durations tend to be longer, increasing cumulative device demand per patient. Care delivery often involves multidisciplinary oversight, reinforcing reliance on standardized wound management solutions. Budget allocation within healthcare facilities favors segments with predictable, recurring demand, strengthening the market position of chronic wound management devices over acute alternatives across public and private treatment environments nationwide consistently over time.

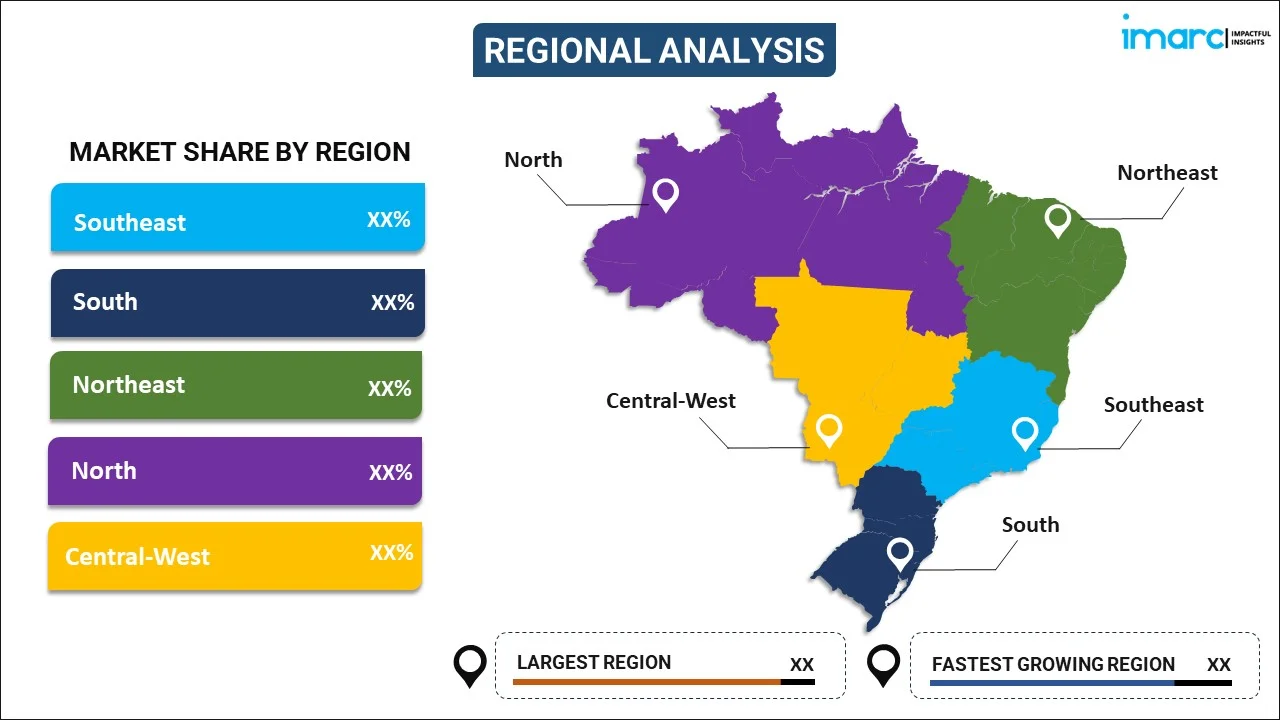

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast is a crucial segment in the market due to its advanced healthcare infrastructure, high concentration of medical facilities, and strong procurement capacity. Greater access to specialized care, higher healthcare spending, and consistent adoption of advanced medical technologies support sustained demand within this region.

South shows strong performance in the wound care management devices market driven by organized healthcare delivery systems and steady investment in medical technology. Efficient healthcare administration, high treatment adherence, and growing focus on quality care contribute positively to device utilization.

Northeast benefits from improving healthcare access and expanding public health initiatives, supporting growth in wound care management devices. Rising institutional capacity, increasing healthcare coverage, and gradual upgrades in treatment standards positively influence demand and adoption across urban and semi-urban healthcare settings.

North presents positive market conditions supported by increasing healthcare infrastructure development and targeted investments in medical access. Expansion of healthcare facilities and the growing focus on addressing treatment gaps contribute to rising utilization of wound care management devices across the region.

Central-West demonstrates steady growth in the market due to expanding healthcare networks and improving service delivery. Institutional development, increasing availability of medical professionals, and rising focus on standardized treatment practices support consistent market participation and positive demand trends.

Market Dynamics:

Growth Drivers:

Why is the Brazil Wound Care Management Devices Market Growing?

Increase in Trauma and Accident-Related Injuries

Rising incidence of trauma and accident-related injuries in Brazil is catalyzing the demand for wound care management devices, as acute wounds require prompt and structured clinical intervention. Road accidents, workplace injuries, and urban incidents continue to generate high treatment volumes across emergency and trauma care settings. This burden is reflected in national safety data. The Ministry of Labor and Employment reported 499,955 occupational accidents in 2023, resulting in 2,888 fatalities, while by June 2024 a further 268,788 accidents and 1,016 fatalities had already been recorded. As healthcare facilities prioritize infection prevention and recovery efficiency, consistent reliance on advanced wound care devices supports sustained utilization across emergency, inpatient, and follow up care environments.

Technological Advancements in Wound Care Solutions

Continuous technological progress is strengthening the wound care management devices market in Brazil. Innovations focused on improved healing efficiency, moisture balance, and wound monitoring are enhancing clinical effectiveness. Advanced materials and device designs allow better control of wound environments and support faster tissue repair. Healthcare providers are increasingly adopting technologically advanced devices to improve treatment outcomes and workflow efficiency. As awareness about these benefits grows, there is a rise in the demand for modern wound care solutions across hospitals, clinics, and home care settings. Technology driven differentiation is supporting higher adoption rates and long-term investment within the market.

Broad Public Healthcare Coverage Supporting Device Demand

Extensive public healthcare coverage in Brazil plays a significant role in driving the demand for wound care management devices by ensuring wide access to medical treatment across socioeconomic groups. The Unified Healthcare System supports large patient volumes that require consistent and standardized wound care solutions across hospitals and primary care facilities. This scale is evident as Brazil’s Unified Healthcare System serves approximately 72 percent of the population, or about 164 million people, according to IBGE, while an additional 51 million Brazilians also access private healthcare services, as stated by the ITA. The combined reach of public and private systems sustains high treatment volumes, encouraging continuous procurement of wound care devices to support chronic, surgical, and acute wound management needs nationwide.

Market Restraints:

What Challenges the Brazil Wound Care Management Devices Market is Facing?

High Cost of Advanced Wound Care Products Limiting Market Penetration

Cost barriers represent a fundamental challenge constraining broader adoption of advanced wound care devices among Brazilian healthcare providers and patients. Premium wound care technologies, including negative pressure wound therapy systems and specialized bioactive dressings, command significantly higher price points compared to traditional wound management products, creating affordability challenges particularly within the public healthcare system serving lower-income populations.

Reimbursement Challenges Within Public Healthcare System

The Brazilian Unified Health System faces ongoing challenges regarding reimbursement for advanced wound care products and devices. Complex procurement procedures, budget constraints, and limited coverage policies for newer therapeutic technologies create barriers to adoption within public healthcare facilities, slowing market penetration and limiting patient access to evidence-based wound management solutions despite clinical benefits.

Regional Healthcare Disparities and Distribution Infrastructure Gaps

Inadequate distribution networks and limited product availability in remote, rural, and economically disadvantaged areas create significant access barriers constraining market expansion. Geographic disparities in healthcare infrastructure leave vulnerable populations underserved, particularly in the North and Northeast regions where healthcare facilities and trained wound care specialists remain scarce compared to the more developed Southeast.

Competitive Landscape:

The Brazil wound care management devices market exhibits moderate competitive intensity characterized by the presence of multinational medical technology corporations alongside regional manufacturers competing across diverse product segments and distribution channels. Market dynamics reflect strategic positioning, ranging from premium innovation-driven offerings emphasizing advanced wound healing technologies to value-oriented products targeting cost-conscious healthcare providers. The competitive landscape is increasingly shaped by product innovation capabilities, regulatory approval timelines, distribution network breadth, and the ability to provide comprehensive wound care education and clinical support services. Leading market participants are expanding their presence through organic growth strategies, including product launches and clinical partnerships, as well as inorganic approaches involving strategic acquisitions to strengthen product portfolios and extend geographic reach.

Recent Developments:

- January 2026: StimLabs® announced the launch of Allacor P™, the first FDA 510(k)-cleared human umbilical cord particulate device for wound management. The product is designed to treat acute and chronic wounds, using extracellular matrix components rich in collagen and hyaluronic acid. The launch follows FDA clearance in February 2024 and expands access to regenerative wound care across additional clinical settings.

Brazil Wound Care Management Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Wound Types Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil wound care management devices market size was valued at USD 69.28 Million in 2025.

The Brazil wound care management devices market is expected to grow at a compound annual growth rate of 4.63% from 2026-2034 to reach USD 104.12 Million by 2034.

Wound care dominates the market with a share of 58% in 2025, driven by extensive adoption of advanced wound dressings and topical agents across hospitals and home care settings.

Key factors driving the Brazil wound care management devices market include the growing aging population, as older adults face higher risks of chronic wounds. This trend is reflected in IBGE projections showing average population age rising from 35.5 years in 2023 to 48.4 years by 2070, driving long term care needs.

Major challenges include high cost of advanced wound care products limiting broader adoption, reimbursement challenges within the public healthcare system, regional healthcare disparities restricting access in remote areas, and distribution infrastructure gaps in economically disadvantaged regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)