Building And Construction Tapes Market, Size, Share, Trends, and Forecast by Product, Material Type, Application, End User, and Region, 2025-2033

Building And Construction Tapes Market Size and Share:

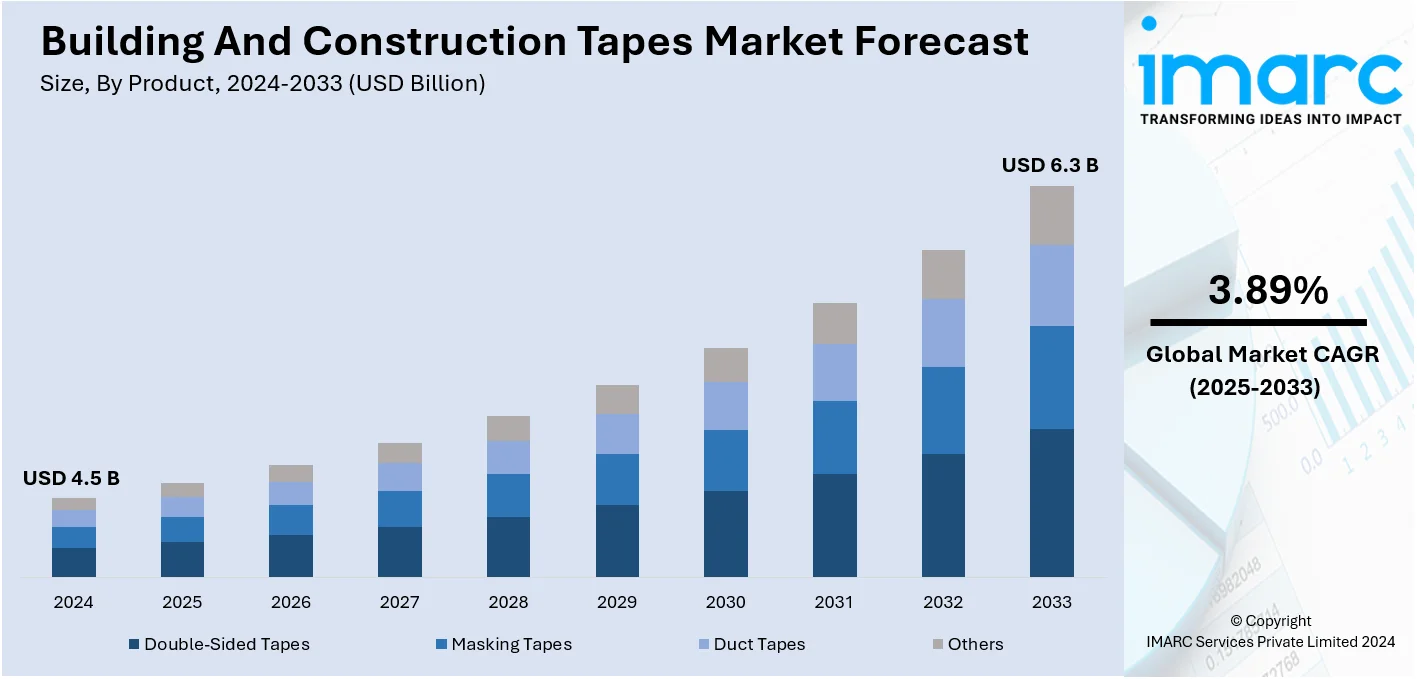

The global building and construction tapes market size was valued at USD 4.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.3 Billion by 2033, exhibiting a CAGR of 3.89% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 34.5% in 2024, driven by rapid industrialization, infrastructure development, and increasing construction activities across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Market Growth Rate 2025-2033 | 3.89% |

One of the major drivers of the building and construction tapes market is the increasing demand for high-performance adhesive solutions in construction projects. With the changes in construction practices, tapes with higher bonding strength, durability, and resistance to environmental factors like moisture and temperature variations are gaining demand. The product is useful for applications in surface protection, insulation, sealing, and joint reinforcement. Other market growth factors include innovation in tape technology, such as eco-friendly and multi-functional products, increased focus on more efficient and sustainable methods of construction fueling the demand for specialized adhesive tapes, and ongoing mergers and acquisitions. For instance, in 2024, Atlas Tapes SA completed the acquisition of 100% of PPM Industries Group, a global leader in high-performance masking, specialty, and duct tapes for the construction and automotive sectors, operating facilities in the USA.

The United States is a leading manufacturer and consumer of advanced adhesive technologies, making it a significant player in the market for building and construction tapes. With a steadily expanding construction sector and ongoing infrastructure development, the demand for specialty, durable, and high-performance tapes continues to grow. Prominent manufacturers maintain a strong presence within the U.S. market, investing substantially in research and development to innovate products tailored for construction applications. These advancements ensure that the tapes offer superior qualities, such as moisture resistance and weatherproofing, to meet the evolving requirements of the industry. For example, in 2024, Berry Global announced the sale of its Specialty Tapes division to Nautic Partners for $540 million, aligning with its strategy to prioritize higher-growth opportunities in consumer-focused markets and platforms. The U.S. market also enjoys a strong distribution network that ensures efficient supply chains and easy access to construction tape products across different sectors.

Building And Construction Tapes Market Trends

Significant Growth in the Construction Industry

The construction industry is growing at a rapid pace because of the tremendous urbanization and industrialization activities. This growth is increasing demand for building and construction tapes widely used in residential and commercial buildings, hospitals, retail stores, hotels, restaurants, warehouses, factories, industrial facilities, and manufacturing plants for sealing, bonding, reinforcing, repairing, marking, delineating, insulating, protecting, and masking applications. According to industry reports, the construction GVA in India is expected to grow by 8.5%-9% in FY2024e, in the backdrop of the Government’s thrust on infrastructure activity. It witnessed a YoY growth of 13.3% in Q2 FY2024 (compared to a 7.9% YoY growth in Q1 FY2024), driven by a healthy execution pace and moderation in raw material prices. Despite moderation in growth from the FY2023 level (+10% YoY), it remains higher than the long-term annualized growth of 5.3% during the FY2012-FY2023 period.

Extensive Research and Development (R&D) Activities

Smart pressure-sensitive adhesives used for building and construction tapes with high-temperature resistance, strong sealing performance, easy removability, and excellent adhesion on various surfaces like tiles, composites, vinyl, bitumen, latex, and non-woven fabric support the growth of the market. During the last few years, the building and construction tapes manufacturers have significantly invested in the latest tape technologies offering better adhesion, durability, performance, and weather resistance. For instance, in March 2023, IRPLAST implemented its green portfolio of products and solutions for a competitive edge. IRPLAST NOPP (Natural Oriented Polypropylene) TAPE is a new generation of high-performing and eco-friendly adhesive tapes, manufactured with 50% recycled materials.

Emerging Do-It-Yourself (DIY) Trends

Building and construction tapes are widely applied in DIYs because they bring convenience, flexibility, and practicality to any home improvement or renovation application-quick repair and fixes, sealing gaps, fixing broken items, fixing pipes, insulating surfaces, patching holes, or protecting areas before painting works. According to LIRA, homeowners spent USD 463 Billion on renovations in the first quarter of 2024. Americans spent a sizable chunk of change on home renovations in 2023, more so than a year prior. The median spending on home renovations totaled USD 24,000, a 60% increase from 2020, as per the Houzz study. However, homeowners in the top 90th percentile spent a median of USD 150,000, a 77% increase from 2022. Indeed, over half of homeowners spent USD 25,000 or more on renovations in 2023, up 14 percentage points from 2020. Kitchens remain the most renovated rooms (29%), with guest bathrooms (27%), primary bathrooms (25%), and living rooms following as the most preferred areas for renovation (21%).

Building And Construction Tapes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global building and construction tapes market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, material type, application, and end user.

Analysis by Product:

- Double-Sided Tapes

- Masking Tapes

- Duct Tapes

- Others

Double-sided tapes stand as the largest product segment in 2024. With adhesive on both sides, the tapes have formed a good, reliable bonding of surfaces; therefore, it can be applied to a broad variety of applications. The versatility and cost-effectiveness in providing clean aesthetics without extra fasteners make these tapes highly popular among industries in construction, automotive, and home improvement. In addition, there is an additional bonding strength in double-sided tapes, easy applicability, and damage-free removal, which results in its universal use. It's applied to objects and displays mountings, holding lightweight panels together, attaching artworks onto walls and windows, and binding materials such as glass, wood, metal, and plastics for strong durability and a long-lasting performance.

Analysis by Material Type:

- Polyvinyl Chloride

- Polyethylene Terephthalate

- Polypropylene

- Polyethylene

- Foil

- Paper

- Foam

Polyethylene leads the market in 2024. Due to its excellent flexibility, good conformity, low coefficient of friction, and good adhesive compatibility for providing reliable bonding with improvement in surface finish, polyethylene is a widely used raw material for building and construction tapes. Also, polyethylene is relatively cheaper. Its resistance to environmental factors such as moisture, UV exposure, and temperature fluctuations significantly enhances the tape's durability and longevity, ensuring a strong bond for extended periods. These qualities make polyethylene an ideal material for use in construction tapes, meeting the diverse needs of the industry.

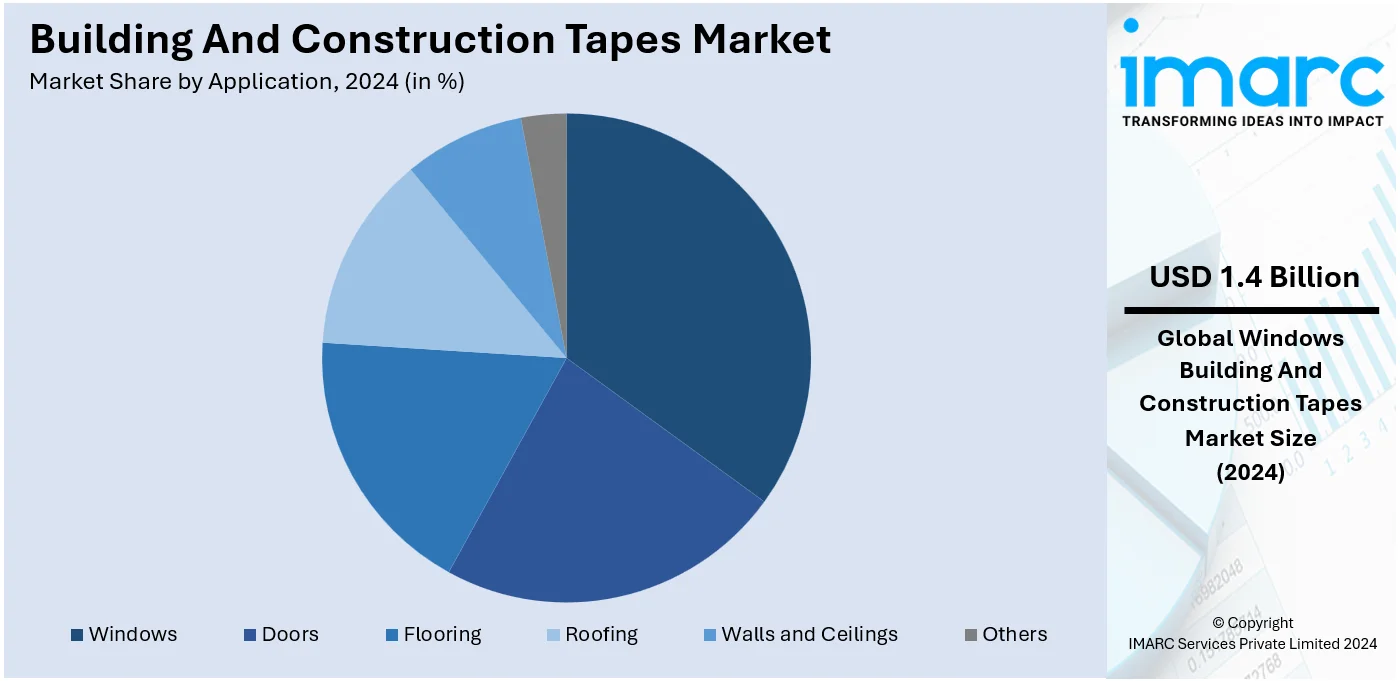

Analysis by Application:

- Doors

- Flooring

- Roofing

- Walls and Ceilings

- Windows

- Others

Windows leads the market with around 31.6% of the market share in 2024. Building and construction tapes come in a wide range of different materials, each suitable for attachment to various types of window frames, such as wood, vinyl, aluminum, and fiberglass. In addition, they are attached to the space and joints of the window frame and the other structure to prevent moisture intrusion through an airtight and watertight seal and minimize draft and water infiltration. In addition to this, building and construction tapes provide insulation properties that help in creating a thermal barrier. This reduces the transfer of heastructurest from window assembly. In addition to this, they help in noise insulation by reducing the transmission of outside sounds into the insides of the building. Slightly, applying building and construction tapes on windows aids in creating a hospitable environment, improves comfort, promotes energy efficiency, and contributes to lower heating and cooling costs.

Analysis by End User:

- Commercial

- Residential

- Industrial

Residential leads the market with around 49.7% of market share in 2024. The main driver for the growth is increasing demand for construction tapes in different residential applications, like sealing around windows and doors, installation of insulation materials, and roofing. Tapes work as efficient and cost-effective tools for the task, where dependable bonding and performance are ensured. The do-it-yourself movement among customers further enhances market growth. Homeowners are nowadays increasingly opting to carry out self-repairs and maintenance, often using construction tapes to seal or weatherproof walls, windows, or doors for minor repairs. The trend further boosts demand for construction tapes as it encourages consumers to use this tape as part of their general toolkit in completing home improvement jobs.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 34.5%. The Asia Pacific market is driven by rapid urbanization, increased infrastructure projects, and growing demand for residential and commercial spaces. The value of total construction work done rose 0.1% in the June quarter, according to the Australian Bureau of Statistics, in seasonally adjusted terms. Engineering work rose 0.5% in the June quarter and is 4.8% higher than the same time last year. An increase in the practice of green building and energy-efficient construction material will boost demand for high-performance tapes. This will also gain impetus through government initiatives, supporting infrastructure development, and further growth in the construction sector, particularly in developing economies such as China and India. Advancement in adhesive technology and increased need for more durable and weather-resistant tapes enhance the market.

Key Regional Takeaways:

United States Building and Construction Tapes Market Analysis

US accounts for 76.5% share of the market in North America. In the United States, the increasing demand for building and construction tapes is largely driven by robust infrastructure investments. For instance, with a growing emphasis on strengthening national infrastructure, the federal government allocated USD 36.6 trillion to infrastructure investments in 2022, of which USD 94.5 trillion was directly directed to the states. Large-scale projects in transportation, commercial, and residential sectors are creating a growing demand for materials that can ensure durability and efficiency during construction processes. Building and construction tapes play a crucial role in sealing, bonding, and providing reliable insulation for a variety of applications. These materials are becoming increasingly popular as they help streamline operations, improve safety standards, and enhance the quality of completed projects. The continuous development of highways, bridges, and other public infrastructures and expansion in urban areas always make for continued demand on sophisticated construction materials. Increased consciousness about sustainability and energy efficiency building also makes construction tapes necessary as an effective solution for insulation and weatherproofing complex designs.

North America Building and Construction Tapes Market Analysis

The North America building and construction tapes market is experiencing robust growth, driven by increasing construction activities and demand for advanced adhesive solutions. For instance, Shurtape Technologies launched the CR 400 Performance Grade Curbside Recyclable Paper Packaging Tape in April 2024, marking its first recyclable packaging solution. Made from FSC® certified paper and featuring a strong adhesive, this tape is designed for both manual and automated sealing applications while ensuring sustainability. The United States, as the largest market in the region, is witnessing significant demand for high-performance tapes used in applications such as insulation, sealing, surface protection, and joint reinforcement. The growth of residential, commercial, and infrastructure projects is further fueling this demand. The market also gains from innovations in tape formulations, such as products that are moisture-resistant, temperature-resistant, and environmentally friendly. Furthermore, robust distribution networks and the region's emphasis on sustainable construction practices are driving the market's growth. Companies are increasingly focusing on product innovation to cater to evolving industry needs and maintain a competitive edge in the region.

Asia Pacific Building and Construction Tapes Market Analysis

The adoption of building and construction tapes is gaining momentum in the Asia-Pacific region due to the rapid expansion of commercial facilities. As commercial infrastructure continues to grow, with shopping centres, office buildings, and hotels becoming more prevalent, the need for reliable and efficient construction materials increases. For instance, office space absorption across six major Indian cities surged by 30% year-on-year, reaching 55.1 Million square feet in the first nine months of 2024, highlighting robust growth in the commercial sector. Building and construction tapes are essential for ensuring that these large-scale structures are securely sealed, resisting environmental factors such as moisture and temperature changes. Additionally, the demand for cost-effective and quick solutions in construction projects drives the need for tapes that can simplify tasks like joint sealing, surface protection, and adhesion. The emphasis on enhancing the durability and longevity of commercial facilities has led to the increased adoption of these tapes in construction projects across the region.

Europe Building and Construction Tapes Market Analysis

In Europe, the adoption of building and construction tapes is being fuelled by the growth of the industrial sector. As manufacturing plants, warehouses, and logistics hubs expand, there is an increasing demand for materials that provide effective sealing and protection during construction. For instance,, in August 2024, the manufacturing industry saw a sharp output increase of +1.6%, while overall industry output grew by +1.4%, boosting demand in sectors like construction. This growth drives higher adoption of building and construction tapes, supporting industry expansion. Building and construction tapes are widely used in the industrial construction sector to improve the efficiency and quality of installations. These tapes help secure proper sealing, insulation, and protection of building components against environmental elements, minimizing the risk of damage and enhancing energy efficiency. With the rising trend of industrial automation and modernization, construction tapes offer a cost-effective solution for a range of applications, from sealing ducts and pipes to protecting surfaces from damage during construction. The growing demand for industrial expansion, coupled with the need for reliable, high-performance materials, continues to drive the adoption of construction tapes in Europe’s industrial sector.

Latin America Building and Construction Tapes Market Analysis

In Latin America, the adoption of building and construction tapes is experiencing growth due to the expansion of the residential sector. With ongoing urbanization, more individuals are moving into cities, spurring demand for residential buildings. For instance, Brazil's urban population grew by 0.73% in 2022, following a 0.81% increase in 2021, driving demand for residential construction. This urban growth boosts the adoption of building and construction tapes, vital for new housing projects. This shift in population dynamics has led to a rise in residential construction projects, with building and construction tapes becoming increasingly important in sealing, insulating, and protecting homes. These tapes help prevent leaks, moisture buildup, and air drafts, contributing to energy efficiency and enhanced living conditions. The growing need for affordable and sustainable housing solutions has driven the demand for cost-effective and efficient materials, and building tapes are a key component in ensuring the longevity and performance of residential buildings.

Middle East and Africa Building and Construction Tapes Market Analysis

The Middle East and Africa are witnessing an increase in the adoption of building and construction tapes, primarily due to the growing number of real estate construction projects. These areas have experienced significant growth in urbanization, marked by the initiation of various residential, commercial, and multi-purpose developments. According to reports, Saudi Arabia is currently overseeing over 5,200 construction projects valued at USD 819 Billion, representing 35% of the total active project value across the GCC. Building and construction tapes are essential in these developments, providing key functionalities like insulation, sealing, and weatherproofing. As the construction industry in these regions focuses on high-quality standards, the role of construction tapes in ensuring the structural integrity and energy efficiency of buildings has become more significant. These materials help optimize construction processes and contribute to the overall durability and safety of newly built structures.

Competitive Landscape:

The competitive scenario of the market for building and construction tapes encompasses various global as well as local players offering varied adhesive solutions. Leading manufacturers engage in product innovations with a keen focus on durability, moisture resistance, and ease of application among other performance properties. Companies have also been engaged in sustainable eco-friendly tape technology to meet a growing environmental necessity. Strategic partnerships, mergers, and acquisitions abound since companies aim to expand their product portfolios and regional reach. Competition is cutthroat because of factors including cost-effectiveness, quality standards, and diversity in construction sectors: residential, commercial, and industrial. For instance, in 2024, Bostik, part of Arkema, is expanding its UV acrylic hot melt pressure-sensitive adhesive (HMPSA) capabilities in North America, enhancing its high-performance portfolio with production starting in April 2024.

The report provides a comprehensive analysis of the competitive landscape in the building and construction tapes market with detailed profiles of all major companies, including:

- 3M Company

- Avery Dennison Corporation

- Berry Global Inc

- Bostik SA (Arkema)

- DuPont de Nemours Inc.

- Henkel AG & Co. KGaA

- Nitto Denko Corporation

- Saint-Gobain Corporation

- Scapa Group Plc.

- Shurtape Technologies LLC

- Tesa SE

Latest News and Developments:

- Novemeber 2024: Berry Global announced an agreement to sell its Specialty Tapes business to Nautic Partners, aligning with its strategy to focus on consumer-oriented markets. This move complements Berry's ongoing combination with Amcor, creating a global leader in consumer packaging with enhanced innovation capabilities.

- August 2024: H.B. Fuller Company acquired HS Butyl Limited, the UK's leading manufacturer of butyl tapes, enhancing its position in the $15 billion global waterproofing tape market. This acquisition builds on its existing butyl technology platform established through the 2022 acquisition of GSSI Sealants Inc.

- August 2024: DuPont has launched the DuraGard WD Self-Adhered Flashing Tape, designed to enhance the performance of its ArmorWall System in commercial construction. The tape provides superior air and water barrier continuity, protecting vulnerable areas around window and door rough openings. It features a primerless application, moisture-stable split-release liner, and is available in 9-, 10-, and 12-inch widths, ensuring optimal alignment with ArmorWall Plus panels. The product improves durability, energy efficiency, and streamlines installation on commercial buildings.

- July 2024: Coroplast Tape, a division of the Coroplast Group, has begun constructing a new factory in Schönebeck (Elbe) for special adhesive tapes, with an investment of approximately USD 27 Million for the first phase. This expansion follows a parallel investment in Wuppertal, totaling over USD 32 Million, to develop an IT center, adhesive tape processing competence center, and a logistics hub. The plants in Schönebeck and Wuppertal will be interconnected for efficient production and assembly.

- August 2023: Avery Dennison has launched its new Cold Tough™ adhesive portfolio, designed to meet the demanding needs of the building and construction industry. The portfolio enhances performance and saves application time in extreme temperatures. Cold Tough™ adhesive tapes are ideal for seaming and joining in metal building assemblies and other construction applications, including roofs, walls, ducts, and doors. This innovative solution ensures high performance even under challenging environmental conditions.

Building And Construction Tapes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Double-Sided Tapes, Masking Tapes, Duct Tapes, Others |

| Material Types Covered | Polyvinyl Chloride, Polyethylene Terephthalate, Polypropylene, Polyethylene, Foil, Paper, Foam |

| Applications Covered | Doors, Flooring, Roofing, Walls and Ceilings, Windows, Others |

| End Users Covered | Commercial, Residential, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Avery Dennison Corporation, Berry Global Inc, Bostik SA (Arkema), DuPont de Nemours Inc., Henkel AG & Co. KGaA, Nitto Denko Corporation, Saint-Gobain Corporation, Scapa Group Plc., Shurtape Technologies LLC, Tesa SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the building and construction tapes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global building and construction tapes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the building and construction tapes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The building and construction tapes market was valued at USD 4.5 Billion in 2024.

IMARC estimates the building and construction tapes market to exhibit a CAGR of 3.89% during 2025-2033.

Key factors driving the building and construction tapes market include increasing demand for high-performance adhesives, growth in construction activities, advancements in tape technology (such as eco-friendly options), rising DIY trends, and the need for efficient, cost-effective solutions in sealing, insulation, and surface protection across various construction applications.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global building and construction tapes market include 3M Company, Avery Dennison Corporation, Berry Global Inc, Bostik SA (Arkema), DuPont de Nemours Inc., Henkel AG & Co. KGaA, Nitto Denko Corporation, Saint-Gobain Corporation, Scapa Group Plc., Shurtape Technologies LLC, Tesa SE, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)