Burkitt Lymphoma Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

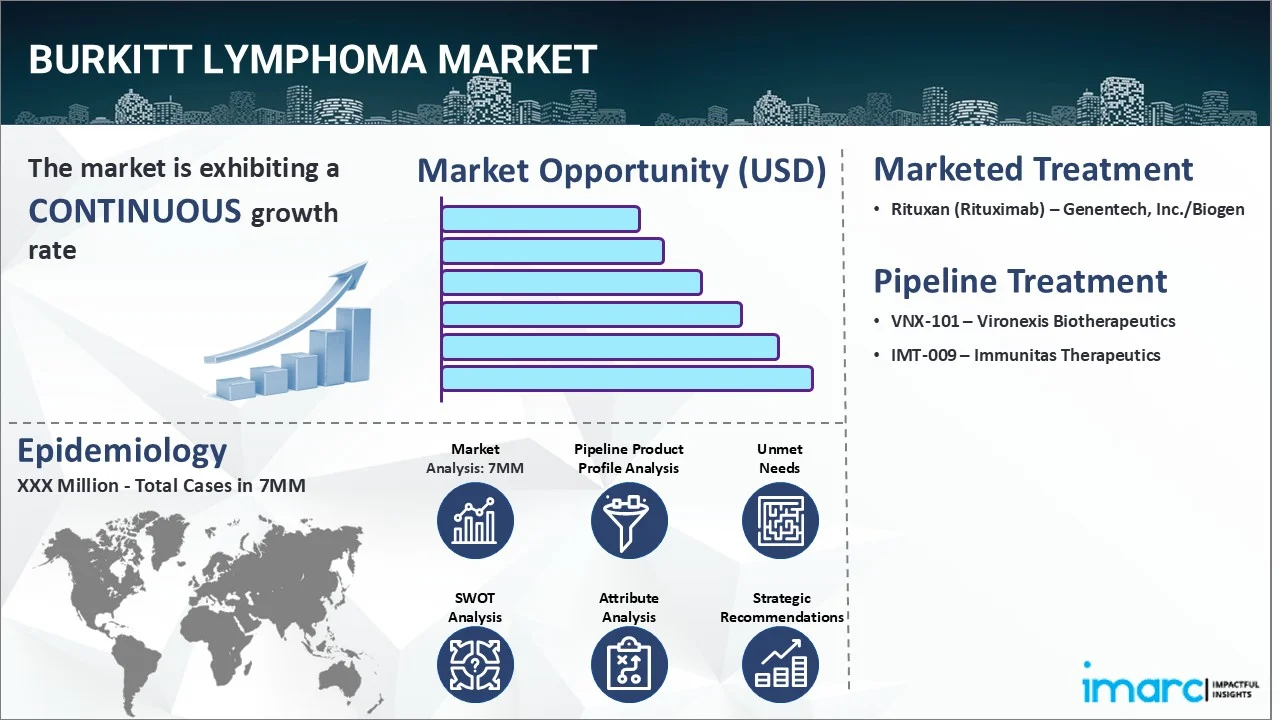

The burkitt lymphoma market reached a value of USD 1,088.3 Million across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 2,896.2 Million by 2035, exhibiting a growth rate (CAGR) of 9.31% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 1,088.3 Million |

|

Market Forecast in 2035

|

USD 2,896.2 Million |

|

Market Growth Rate (2025-2035)

|

9.31% |

The Burkitt lymphoma market has been comprehensively analyzed in IMARC's new report titled "Burkitt Lymphoma Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Burkitt lymphoma refers to a type of non-Hodgkin lymphoma that is characterized by rapidly growing cancerous cells in the lymphatic system. Some of the common symptoms include swollen lymph nodes in the neck, armpit, or groin; fever; night sweats; weight loss; fatigue; abdominal pain or swelling, etc. In many cases, the cancer can affect other organs like the central nervous system or gastrointestinal tract, leading to additional symptoms, such as anemia, neurological problems, digestive issues, etc. The diagnosis of Burkitt lymphoma typically involves a combination of imaging procedures, blood tests, and a biopsy of an affected lymph node or other tissue. Various imaging studies, including CT scans and MRIs, can help identify the location and extent of the cancer, while blood tests may reveal abnormalities like anemia or elevated levels of lactate dehydrogenase (LDH). Additional tests, such as a bone marrow biopsy or lumbar puncture to look for cancer cells in the central nervous system, may be done to determine the subtype of Burkitt lymphoma and assess the extent of the disease.

To get more information on this market, Request Sample

The increasing incidences of genetic translocation, in which the MYC gene becomes overactive, thereby leading to uncontrolled cell growth and development of cancer, are primarily driving the Burkitt lymphoma market. In addition to this, the escalating utilization of stem cell transplantation in high-risk cases to help restore the immune system and prevent cancer recurrence, is further bolstering the market growth. Moreover, the widespread adoption of prophylactic CNS therapy, such as intrathecal chemotherapy or radiation therapy to the brain and spinal cord, for preventing or delaying CNS involvement is also creating a positive outlook for the Burkitt lymphoma market. Additionally, numerous key players are making extensive investments in developing reduced-intensity regimens that can achieve favorable outcomes with fewer side effects. This, in turn, is acting as another significant growth-inducing factor. Furthermore, the emerging popularity of molecular imaging techniques, such as positron emission tomography (PET) scans, since they can identify areas of disease that are not visible on conventional imaging, is expected to drive the Burkitt lymphoma market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the Burkitt lymphoma market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for Burkitt lymphoma and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the Burkitt lymphoma market in any manner.

Key Highlights:

- Endemic (African) Burkitt lymphoma (eBL) primarily affects the jaw and facial bone (orbit) (> 50% of cases).

- The incidence of Burkitt lymphoma in Africa is almost 50 times higher than in the U.S.

- Burkitt lymphoma is responsible for 30 to 50 percent of all childhood cancer in equatorial Africa, with an estimated frequency of 3 to 6 cases per 100,000 children each year.

- The peak incidence is observed in children aged four to seven years.

- Burkitt lymphoma has a male-to-female ratio of roughly 2:1.

Drugs:

Rituximab, also known as Rituxan, is a monoclonal antibody used to treat autoimmune disorders and cancers. It is administered via gradual intravenous infusion (slow injection through an IV line). Rituximab targets the protein CD20, which is predominantly located on the surface of immune system B cells. When it connects with this protein, it causes cell death.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the Burkitt lymphoma market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the Burkitt lymphoma market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current Burkitt lymphoma marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Rituxan (Rituximab) | Genentech, Inc./Biogen |

| VNX-101 | Vironexis Biotherapeutics |

| IMT-009 | Immunitas Therapeutics |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the Burkitt Lymphoma market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the Burkitt Lymphoma across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the Burkitt Lymphoma across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of incident cases (2019-2035) of Burkitt Lymphoma across the seven major markets?

- What is the number of incident cases (2019-2035) of Burkitt Lymphoma by age across the seven major markets?

- What is the number of incident cases (2019-2035) of Burkitt Lymphoma by gender across the seven major markets?

- What is the number of incident cases (2019-2035) of Burkitt Lymphoma by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with Burkitt Lymphoma across the seven major markets?

- What is the size of the Burkitt Lymphoma’ patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend of Burkitt Lymphoma?

- What will be the growth rate of patients across the seven major markets?

Burkitt Lymphoma: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for Burkitt Lymphoma drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the Burkitt Lymphoma market?

- What are the key regulatory events related to the Burkitt Lymphoma market?

- What is the structure of clinical trial landscape by status related to the Burkitt Lymphoma market?

- What is the structure of clinical trial landscape by phase related to the Burkitt Lymphoma market?

- What is the structure of clinical trial landscape by route of administration related to the Burkitt Lymphoma market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)