Butyl Acetate Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Butyl Acetate Price Trend, Index and Forecast

Track real-time and historical butyl acetate prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Butyl Acetate Prices February 2026

| Region | Price (USD/KG) | Latest Movement |

|---|---|---|

| Northeast Asia | 0.97 | 1.0% ↑ Up |

| Europe | 1.35 | -7.5% ↓ Down |

| North America | 1.38 | -14.3% ↓ Down |

Butyl Acetate Price Index (USD/KG):

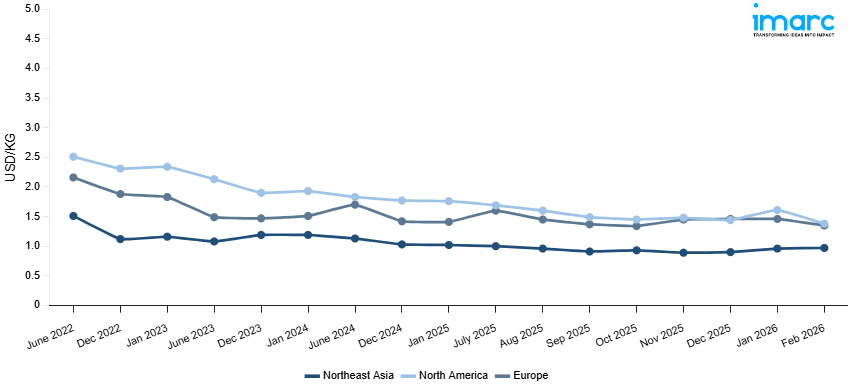

The chart below highlights monthly butyl acetate prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q4 Ending December 2025

Northeast Asia: The butyl acetate prices in Northeast Asia reached 0.90 USD/KG in December 2025. The downward pricing movement registered between September and December 2025 was 1.6%. The marginal price decline was primarily driven by softened demand from the coatings, paints, and adhesives manufacturing sectors, which moderated procurement volumes amid subdued construction and automotive refinishing activity across the region. Declining upstream n-butanol and acetic acid feedstock costs further eroded support for regional producers' production costs. Elevated inventory levels among major manufacturers prompted competitive pricing strategies to facilitate stock rotation, while tepid export enquiries from traditional trading partners provided limited support for offtake. Additionally, adequate domestic production capacity maintained comfortable supply availability, sustaining mildly bearish pricing conditions throughout the quarterly period.

Europe: The butyl acetate prices in Europe reached 1.46 USD/KG in December 2025. The upward pricing movement registered between September and December 2025 was 6.4%. The notable price appreciation was underpinned by firm upstream n-butanol and acetic acid feedstock costs, which elevated production expenses for regional manufacturers throughout the quarter. Sustained demand from the industrial coatings, automotive paints, and printing inks sectors maintained robust procurement activity amid stable end-market consumption patterns. Tightened supply conditions, driven by capacity constraints at key production facilities, further limited regional availability. Additionally, escalating energy costs associated with esterification processes reinforced upward cost pressures across the supply chain, while limited import alternatives due to elevated international pricing and freight expenses restricted buyers' sourcing flexibility, maintaining bullish pricing momentum throughout the quarter.

North America: The butyl acetate prices in North America reached 1.44 USD/KG in December 2025. The downward pricing movement registered between September and December 2025 was 3.4%. Weakening demand from the industrial paints, adhesive formulation, and architectural coatings industries amid a slowdown in building and cautious consumer spending throughout the region was blamed for the price drop. Lower production cost benchmarks for domestic manufacturers were enabled by reducing the costs of upstream n-butanol and acetic acid feedstocks, thereby enabling price reductions. While rising import competition from lower-priced cargoes put further downward pressure on current market rates, adequate local production capacity maintained acceptable supply availability. Bearish pricing dynamics persisted throughout the quarter due to cautious procurement by downstream consumers, implemented in anticipation of further price softening.

Market Overview Q3 Ending September 2025

Northeast Asia: Weakness in downstream coatings and paints demand, particularly from China’s construction and automotive sectors, contributed to reduced consumption. Supply-side conditions were stable, with producers maintaining steady operating rates in China and South Korea. However, regional oversupply exerted downward price pressure. Additional cost elements, including shipping delays and modest fluctuations in currency exchange rates against the US dollar, further shaped import-export dynamics. Feedstock costs for n-butanol, derived from propylene, were relatively soft due to lower crude oil benchmarks, adding to the bearish sentiment. Compliance with evolving environmental standards, particularly in China’s solvent sector, increased domestic logistics and handling costs but did not offset the broad market downtrend.

Europe: A slump in industrial demand, particularly from the paints, coatings, and adhesives segments, weighed heavily on the market. On the supply side, European producers faced rising energy costs linked to natural gas volatility, which elevated production expenses. However, these higher costs failed to translate into stronger prices due to sluggish demand. Imports from Asia, offered at competitive rates, further pressured domestic sellers. International shipping charges eased slightly due to declining freight rates on the Asia–Europe corridor, although port congestion and customs clearance procedures added marginal handling expenses. Currency fluctuations, with the euro softening against the dollar, made imports more expensive but did not significantly alter overall pricing trends.

North America: The decline was primarily attributed to seasonally reduced demand from the construction and automotive coatings industries, particularly in the United States. Meanwhile, supply remained steady, with domestic producers operating at near-normal rates. Feedstock butanol costs were contained due to stable propylene availability, while crude oil price fluctuations provided only limited upward support. International logistics costs eased as trans-Pacific freight rates declined, lowering import expenses for buyers sourcing from Asia. Domestic logistics, including trucking and rail freight, remained stable, minimizing distribution bottlenecks. Regulatory compliance costs associated with solvent handling, particularly under US EPA guidelines, continued to add to the baseline cost structure but were not sufficient to offset downward market pressure.

Butyl Acetate Price Trend, Market Analysis, and News

IMARC's latest publication, “Butyl Acetate Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the butyl acetate market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of butyl acetate at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed butyl acetate prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting butyl acetate pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

.webp)

Butyl Acetate Industry Analysis

The global butyl acetate industry size reached USD 1.38 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 1.77 Billion, at a projected CAGR of 2.82% during 2026-2034. The market is driven by the rising demand for coatings in construction and automotive, expansion of packaging and adhesives applications, strong consumption in Asia’s industrial sector, and substitution potential in eco-friendly solvents.

Latest developments in the Butyl Acetate Industry:

- July 2025: Laxmi Organic Industries Ltd. announced an upward revision in the domestic pricing of butyl acetate (N-Butyl Acetate) in India. The adjustment was implemented to reflect the rising cost of key feedstocks, particularly n-butanol and acetic acid, alongside higher operational and logistics expenses.

- December 2023: Brenntag announced the agreement to acquire Solventis Group, a glycols and solvents distribution company operating from Antwerp, Belgium, and the UK.

- September 2023: Japan’s Mitsubishi Chemical Group plans to build a new domestic plant for semiconductor materials, aiming it to be operational by 2025. The project expects significant investments from Taiwan Semiconductor Manufacturing Co. and other players.

Product Description

Butyl acetate is an organic ester solvent derived from the esterification of acetic acid and n-butanol. It is a clear, flammable liquid with a fruity odor and belongs to the family of acetate esters. Widely consumed in the global solvents market, it plays a crucial role in industrial applications due to its excellent solvency, fast evaporation rate, and compatibility with a range of resins. The compound is extensively used in the production of paints, coatings, adhesives, inks, and cosmetics, where it enhances product performance by improving flow, leveling, and drying characteristics. Its versatility and favorable balance of solvency and volatility make it one of the most commercially important solvents worldwide.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Butyl Acetate |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Butyl Acetate Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of butyl acetate pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting butyl acetate price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The butyl acetate price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The butyl acetate prices in February 2026 were 0.97 USD/Kg in Northeast Asia, 1.35 USD/Kg in Europe, and 1.38 USD/Kg in North America.

The butyl acetate pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for butyl acetate prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)