Calcium Nitrate Market Size, Share, Trends and Forecast by Form, Application, and Region, 2025-2033

Calcium Nitrate Market Size and Share:

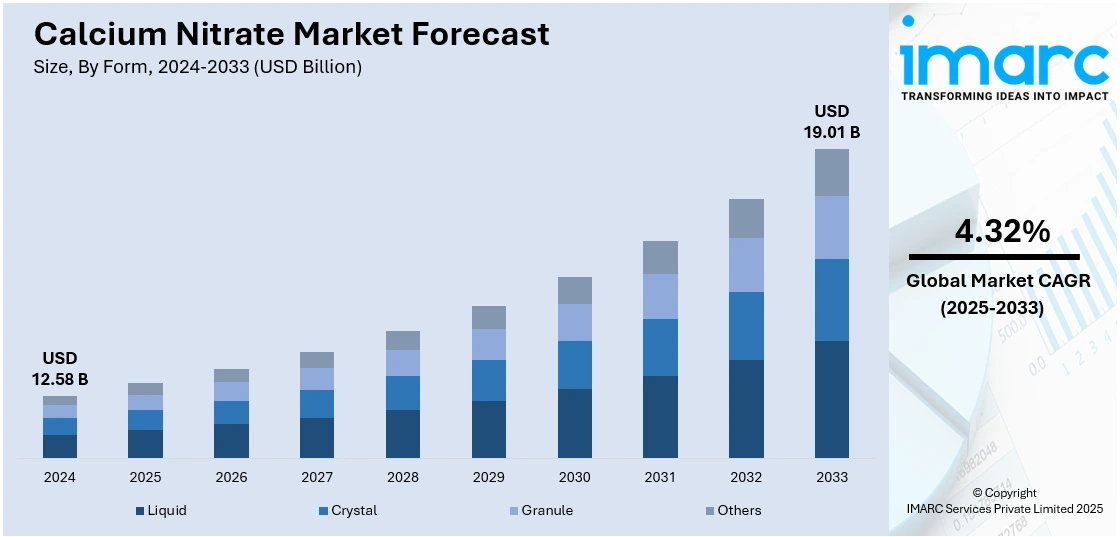

The global calcium nitrate market size was valued at USD 12.58 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.01 Billion by 2033, exhibiting a CAGR of 4.32% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 45.6% in 2024. This can be ascribed to its large agricultural base, growing demand for high-yield crops, and increasing adoption of advanced farming techniques. Government support for sustainable agriculture and expanding hydroponics systems further drive regional demand, making it a key contributor to global calcium nitrate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.58 Billion |

|

Market Forecast in 2033

|

USD 19.01 Billion |

| Market Growth Rate 2025-2033 | 4.32% |

The global calcium nitrate market is witnessing growth driven by advancements in controlled-release fertilizer technologies and their increased adoption in precision agriculture. Expanding applications in the wastewater treatment sector, especially in odor control and biological nutrient removal, are further enhancing market demand. The rise in greenhouse farming and demand for nutrient-rich soil supplements to optimize yield quality is promoting the usage of calcium nitrate as a soil amendment. Additionally, growth in construction activities across emerging markets is creating a steady demand for calcium nitrate-based concrete accelerators. The increasing global focus on sustainable farming and integrated nutrient management practices continues to position calcium nitrate as a key component in modern agricultural and environmental applications. For instance, in February 2025, Haifa North West Europe launched Haifa Soluble DUO, a new water-soluble fertilizer designed for sustainable fertigation. Introduced at HortiContact 2025 in the Netherlands, it enables growers to increase calcium without adding excess nitrogen, chlorides, or sulphates. Available in two formulas, it promotes efficient nutrient uptake, strengthens plant cells, and reduces nitrogen use, supporting eco-friendly cultivation.

In the United States, the calcium nitrate market growth is propelled by the country's emphasis on sustainable agricultural practices and the growing popularity of hydroponic and greenhouse farming systems. Government support for advanced irrigation and fertigation techniques further enhances its uptake. Additionally, rising investments in infrastructure development are boosting the demand for calcium nitrate in the construction sector, particularly for its use as a setting accelerator in cold-weather concrete applications. The product's efficiency in enhancing nitrogen availability and calcium content in high-value crops like berries and leafy greens contributes to its agricultural demand. Environmental regulations encouraging nutrient recycling and odor mitigation in wastewater systems also play a significant role in market growth.

Calcium Nitrate Market Trends

Rising Agricultural Dependency on Calcium Nitrate

The global calcium nitrate market is witnessing robust growth due to its critical role in modern agriculture. As a nitrogen-rich fertilizer, calcium nitrate enhances root growth, supports cell wall formation, and protects crops from stress-induced damage. Its non-acidifying nature makes it ideal for sensitive plants such as tomatoes, apples, and peppers. Moreover, calcium nitrate helps prevent common crop disorders like blossom end rot. The increasing need to boost agricultural productivity and soil health, especially in densely populated and food-insecure regions, is amplifying its demand. For instance, as per industry reports, global nitrogen fertilizer consumption is projected to reach 108 million metric tons (MMT) in 2024, marking a 5% increase compared to the previous year. Farmers are increasingly choosing calcium nitrate for its dual nutrient benefit, supplying both calcium and nitrate. As agricultural practices become more intensive and data-driven, calcium nitrate market outlook is anticipated to remain positive as a vital input in crop management.

Expansion of Hydroponic Farming Boosts Demand

The rise of controlled-environment agriculture is significantly boosting the demand for calcium nitrate, particularly in hydroponics. As a core nutrient source, it supplies calcium and nitrate, both essential for robust plant growth and high yields in soilless systems. It enhances photosynthesis, improves nutrient uptake, and supports disease resistance in leafy greens and fruiting crops. The IMARC Group reports the global hydroponics market will surge from USD 14.73 billion in 2024 to USD 33.12 billion by 2027, growing at a CAGR of 9.30%. This rapid growth reflects the global shift towards sustainable and resource-efficient agriculture, especially in urban settings. As hydroponics adoption increases, so will the integration of calcium nitrate, making it a foundational input in this expanding sector.

Growing Use in Wastewater Treatment Applications

Calcium nitrate is seeing increased demand in industrial and municipal wastewater treatment due to its role in odor control and improving system performance. It facilitates autotrophic denitrification, accelerating the oxidation of sulfides and preventing the formation of odorous compounds under anaerobic conditions. Governments, particularly in emerging economies, are driving market growth through environmental regulations and infrastructure initiatives. For example, India’s water and wastewater treatment market is expected to grow from USD 11 billion to over USD 18 billion by 2026, propelled by programs like the Jal Jeevan Mission and AMRUT. As urbanization and industrialization increase the demand for effective wastewater solutions, calcium nitrate is becoming an essential chemical in treatment protocols, reinforcing its importance beyond agriculture.

Calcium Nitrate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global calcium nitrate market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on form, and application.

Analysis by Form:

- Liquid

- Crystal

- Granule

- Others

Liquid leads the market in 2024 due to its ease of use, fast absorption, and compatibility with modern agricultural and industrial systems. Its high solubility allows for seamless integration into irrigation and fertigation systems, promoting efficient nutrient uptake in crops. This format is especially effective in intensive farming practices where precision and speed are essential. In industrial applications, liquid calcium nitrate offers convenient handling and consistent performance in processes such as wastewater treatment and concrete manufacturing. Its ability to be accurately dosed and uniformly applied ensures better results and less waste. Moreover, liquid formulations reduce the need for manual labor, streamline logistics, and improve storage efficiency, making them the preferred option for users seeking convenience and high performance.

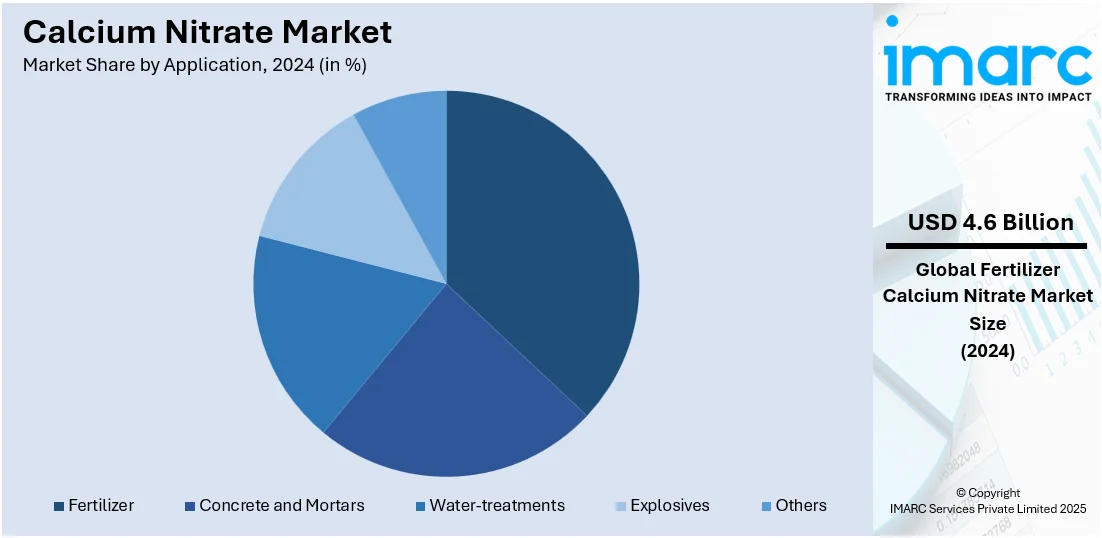

Analysis by Application:

- Fertilizer

- Concrete and Mortars

- Water-treatments

- Explosives

- Others

Fertilizer leads the market with around 36.78% of market share in 2024, driven by its vital role in enhancing plant growth and soil fertility. Calcium nitrate is a key nitrogen source that promotes healthy root development, improves nutrient uptake, and strengthens plant cell walls, making crops more resilient to disease and environmental stress. Its fast-acting nature and high solubility make it ideal for modern farming methods, including drip and foliar applications. Farmers prefer it for sensitive crops like tomatoes, peppers, and apples, as it prevents common disorders such as blossom end rot. As global food demand rises and agricultural practices shift toward high-efficiency solutions, calcium nitrate continues to be a critical component in sustainable and productive crop management.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 45.6%, primarily due to its large agricultural base and increasing demand for high-yield crop production. Countries like China and India are heavily investing in modern farming practices to meet the food demands of their growing populations. For instance, as per industry reports, in the financial year 2024, Madhya Pradesh recorded the largest area under organic agriculture in India, exceeding 1.14 million hectares. Maharashtra ranked second, with more than one million hectares dedicated to organic farming. The rising awareness among farmers regarding the benefits of calcium nitrate in improving crop quality, nutrient efficiency, and disease resistance has further accelerated its adoption. Additionally, regional governments are promoting balanced fertilizer usage and offering subsidies to encourage sustainable agriculture. Rapid urbanization, industrialization, and expansion of hydroponic farming systems have also contributed to the region’s leadership in the market, reinforcing Asia-Pacific’s role as a key consumer and producer of calcium nitrate-based agricultural inputs.

Key Regional Takeaways:

United States Calcium Nitrate Market Analysis

In 2024, the United States held a market share of around 87.80% in North America. The United States calcium nitrate market is primarily driven by increasing demand for high-efficiency fertilizers in precision agriculture, due to its quick solubility and fertigation compatibility. In line with this, growing awareness of soil health and nutrient balance is prompting the adoption of calcium-based fertilizers to address specific deficiencies. The expansion of greenhouse cultivation, requiring readily available nutrients for optimal plant growth, is further supporting market growth. USDA reported that from 2009 to 2019, controlled environment agriculture (CEA) operations, including greenhouses, vertical agriculture, hydroponics, aquaponics, and other methods, grew by over 100%, from 1,476 to 2,994. During this period, production volumes increased by 56%, reaching 7.86 million hundredweight. Furthermore, the rise in horticulture and specialty crop production, which relies on calcium to improve yield quality and shelf life, is reinforcing market demand. Additionally, the compound’s increasing role in wastewater treatment as a nitrogen supplement is broadening the industrial applications. The continual advancements in packaging and distribution, improving accessibility and usability for both large-scale and small-scale farmers, are impelling the market. Moreover, regional increases in calcium-deficient soil conditions, compelling more targeted fertilizer application, are creating lucrative market opportunities.

Europe Calcium Nitrate Market Analysis

The market in Europe is experiencing growth due to the region’s increasing emphasis on sustainable agriculture and compliance with strict EU regulations on nutrient runoff. EEA stated that the European Green Deal aims to have 25% of the EU’s agricultural area under organic farming by 2030. The share of organic farming land increased from 5.9% in 2012 to 9.9% in 2021, driven by rising demand for organic products and policy support. In accordance with this, rising demand for high-value and organic crops is driving the need for specialized nutrients to enhance yield quality and shelf life, propelling market growth. Similarly, expanding investments in drip irrigation systems, fostering the adoption of water-soluble fertilizers are strengthening the market demand. The growth of urban vertical farming and hydroponics is further driving calcium nitrate use due to its suitability for controlled environments. Additionally, rising soil calcium deficiencies in parts of Eastern Europe necessitate targeted nutrient application, which is impelling the market. Furthermore, calcium nitrate’s heightened industrial use in cement acceleration and explosives manufacturing is broadening its market base. Besides this, strategic collaborations in Europe’s agri-tech ecosystem are also enhancing innovation, accessibility, and market penetration across the region.

Asia Pacific Calcium Nitrate Market Analysis

The Asia Pacific calcium nitrate market is majorly driven by rapid urbanization and the increasing adoption of modern farming practices in emerging economies. In addition to this, the region’s heightened focus on enhancing agricultural productivity to ensure food security is fostering the use of nutrient-rich fertilizers like calcium nitrate. Similarly, the growth of the horticultural sector in countries like China and India is elevating the need for specialized fertilizers, which is stimulating market appeal. According to the Department of Agriculture, horticulture crop production in India is expected to reach approximately 362.09 million tons in 2024–25, as per the first advance estimates. This marks an increase of 7.34 million tons (2.07%) compared to the final estimates for 2023–24. Furthermore, calcium nitrate’s effectiveness in preventing blossom-end rot in fruits, fueling its popularity among growers, is supporting market expansion. Additionally, favorable government initiatives promoting efficient water usage in agriculture are encouraging the use of fertigation systems in the market. Moreover, the expansion of the chemical and construction industries in the region, accelerating demand in non-agricultural applications, is providing an impetus to the market.

Latin America Calcium Nitrate Market Analysis

In Latin America, the calcium nitrate market is expanding, driven by the region’s growing agricultural exports, particularly from Brazil, where efficient fertilizers are crucial for improving crop quality and yield. According to gov.br, from January to November 2024, Brazilian agribusiness exports totaled USD 152.63 Billion, representing 48.9% of the country’s total exports. Similarly, rising demand for sustainable farming practices is increasing the adoption of environmentally friendly fertilizers like calcium nitrate, fostering market expansion. The growth of greenhouse farming and controlled-environment agriculture is further supporting the market’s development. Furthermore, government incentives aimed at modernizing agricultural infrastructure and augmenting productivity are encouraging the use of effective fertilizers such as calcium nitrate across the region.

Middle East and Africa Calcium Nitrate Market Analysis

The market in the Middle East and Africa is significantly driven by the increasing agricultural diversification in countries like the UAE and Saudi Arabia. Additionally, the region’s growing focus on water-efficient farming techniques, such as fertigation, is strengthening the market demand. The rise of greenhouse agriculture in arid climates is also supporting market expansion. Furthermore, government-backed initiatives aimed at improving food security and promoting sustainable farming practices are accelerating the adoption of advanced fertilizers like calcium nitrate across the region. As such, Saudi Arabia allocated USD 533.33 Million to enhance agricultural projects, including red meat, poultry, greenhouse farming, aquaculture, and cold storage. In 2022, domestic agricultural production exceeded USD 26 Billion, supporting Vision 2030 goals for food security and import reduction.

Competitive Landscape:

The calcium nitrate market forecasts the presence of several global and regional players in the market offering a diverse range of product grades and formulations. Companies compete primarily on product quality, pricing strategies, distribution networks, and technological innovation. Strategic partnerships, mergers, and acquisitions are common tactics used to expand market reach and enhance product portfolios. Continuous investment in research and development helps improve application efficiency and environmental sustainability. The market also sees competition in targeting key sectors like agriculture, wastewater treatment, and construction. Furthermore, players focus on developing tailored solutions for specific crop and soil types or industrial needs, catering to growing demand across emerging and developed markets while maintaining regulatory compliance and supply chain efficiency. For instance, in April 2024, Nitricity launched a field trial of its climate-smart liquid calcium nitrate fertilizer on almond trees in California’s Central Valley, in partnership with Olam Food Ingredients and Elemental Excelerator. The product, made using air, water, and renewable electricity, offers a lower-emission alternative to conventional fertilizers. It will be tested on almond crops for performance and environmental impact.

The report provides a comprehensive analysis of the competitive landscape in the calcium nitrate market with detailed profiles of all major companies, including

- GFS Chemicals Inc

- Haifa Group

- Nutrien Ltd.

- ProChem Inc

- Rural Liquid Fertilisers

- Shanxi Jiaocheng Tianlong Chemical Industry Co. Ltd.

- Shanxi Leixin Chemical Co. Ltd

- Sterling Chemicals (Eastman Chemical Company)

- Van Iperen International

- Wego Chemical Group

- Yara International ASA

Latest News and Developments:

- March 2025: Russian mineral fertilizer producer Acron announced plans to launch its Talitsky potash mining complex in Russia's Perm Territory by H2 2026 and a second calcium nitrate unit in 2025. This development is crucial for Acron, which currently lacks its own raw materials for complex fertilizer production.

- January 2025: Bayer Crop Science launched Wojiarun, a new-generation water-soluble calcium fertilizer in China. The product, with enhanced calcium content (176 g/L) and added trace elements, is a significant upgrade from Bayer's first-generation calcium nitrate. It aims to improve crop health, stability, and mixability for Chinese farmers.

- July 2024: Yara and ATOME PLC signed Heads of Terms for the offtake of renewable Calcium Ammonium Nitrate (CAN) fertilizer from ATOME's Villeta project in Paraguay. The facility, set to produce 264,000 tons annually from 2027, will use renewable power, significantly reducing emissions in fertilizer production.

Calcium Nitrate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Liquid, Crystal, Granule, Others |

| Applications Covered | Fertilizer, Concrete and Mortars, Water-treatments, Explosives, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | GFS Chemicals Inc, Haifa Group, Nutrien Ltd., ProChem Inc, Rural Liquid Fertilisers, Shanxi Jiaocheng Tianlong Chemical Industry Co. Ltd., Shanxi Leixin Chemical Co. Ltd, Sterling Chemicals (Eastman Chemical Company), Van Iperen International, Wego Chemical Group and Yara International ASA |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the calcium nitrate market from 2019-2033.

- The calcium nitrate market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the calcium nitrate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The calcium nitrate market was valued at USD 12.58 Billion in 2024.

The calcium nitrate market is projected to exhibit a CAGR of 4.32% during 2025-2033, reaching a value of USD 19.01 Billion by 2033.

The calcium nitrate market is driven by rising demand in agriculture for high-efficiency fertilizers, growing use in wastewater treatment, and its role in concrete manufacturing. Increased global food production needs and infrastructure development further fuel growth. Environmental concerns also boost adoption in eco-friendly applications, enhancing calcium nitrate market expansion.

In 2024, Asia Pacific dominated the calcium nitrate market, holding a market share of over 45.6%. This dominance is driven by rapid industrialization, expanding agricultural activities, and growing demand for wastewater treatment across countries like China and India. Government support for sustainable farming and infrastructure projects further boosts consumption. The region’s large population and increasing food demand also contribute to Asia Pacific’s calcium nitrate market share.

Some of the major players in the calcium nitrate market include GFS Chemicals Inc, Haifa Group, Nutrien Ltd., ProChem Inc, Rural Liquid Fertilisers, Shanxi Jiaocheng Tianlong Chemical Industry Co. Ltd., Shanxi Leixin Chemical Co. Ltd, Sterling Chemicals (Eastman Chemical Company), Van Iperen International, Wego Chemical Group, Yara International ASA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)