Canada Access Control Market Size, Share, Trends and Forecast by Component, Type, End User, and Region, 2025-2033

Canada Access Control Market Overview:

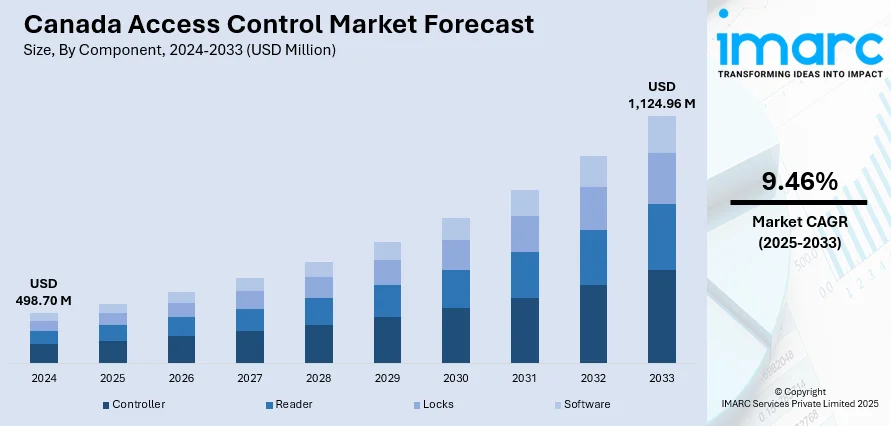

The Canada access control market size reached USD 498.70 Million in 2024. The market is projected to reach USD 1,124.96 Million by 2033, exhibiting a growth rate (CAGR) of 9.46% during 2025-2033. The rising security concerns, increased adoption of cloud-based and mobile-enabled solutions, and stricter regulatory compliance across industries is impelling the market demand. Moreover, the shift toward smart buildings and Internet of Things (IoT) integration fuels demand for advanced, scalable systems. Sectors like government, healthcare, and commercial real estate invest heavily in contactless and biometric technologies post-pandemic. Additionally, urbanization, infrastructure projects, and the need for data-driven security management further accelerate adoption, with vendors focusing on artificial intelligence (AI) analytics and seamless interoperability to enhance efficiency is surging the Canada access control market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 498.70 Million |

| Market Forecast in 2033 | USD 1,124.96 Million |

| Market Growth Rate 2025-2033 | 9.46% |

Canada Access Control Market Trends:

Rising Security Concerns and Regulatory Compliance

Canada’s access control market is driven by rising security needs across public and private sectors. Increasing theft, vandalism, and unauthorized entry are prompting organizations to implement advanced, tamper-resistant systems. Industries such as healthcare, banking, and government face strict privacy and security regulations like PIPEDA and the newly introduced CPPA, which imposes stricter requirements and penalties of up to $15 million or 5% of global revenue for non-compliance. These regulations encourage investment in audit-friendly, real-time monitoring solutions. Growing concerns over cyber-physical threats are leading organizations to integrate physical access control with cybersecurity measures. Layered security strategies—combining video surveillance, intrusion detection, and identity verification—are becoming standard, particularly in high-density urban areas and critical infrastructure facilities. Protecting people, assets, and sensitive data is now a non-negotiable business imperative, fueling Canada access control market growth and technological adoption.

To get more information on this market, Request Sample

Technological Advancements: Cloud, Mobile, and Biometrics

Technological innovation is a core growth driver for Canada’s access control market. The adoption of cloud-based platforms enables centralized management, scalability, and remote monitoring, reducing on-site infrastructure costs while improving flexibility. Mobile-enabled access control—using smartphones, wearables, or digital credentials—offers convenience and supports touchless entry, which gained momentum post-pandemic. Biometric technologies like fingerprint, facial recognition, and iris scanning add a high level of authentication, minimizing risks associated with lost or stolen credentials. These solutions are increasingly integrated with IoT devices and AI-powered analytics, enabling predictive security and operational insights. Interoperability between physical and digital systems allows organizations to unify identity management, enhancing both efficiency and user experience. The combination of enhanced security, cost savings, and user convenience is motivating Canadian enterprises and institutions to replace legacy systems with smart, connected, and adaptive access control technologies.

Urbanization, Infrastructure Growth, and Smart Building Trends

Another significant Canada access control market trend is the rapid urbanization and Canada’s investment in infrastructure are creating strong demand for modern access control systems. Large-scale projects in commercial real estate, transportation hubs, healthcare facilities, and educational campuses require robust, scalable, and integrated security solutions. Smart building initiatives—driven by energy efficiency goals, sustainability mandates, and tenant experience—are increasingly incorporating advanced access control as part of their core infrastructure. Integration with building management systems allows for seamless control of HVAC, lighting, and security through unified platforms. The proliferation of mixed-use developments in cities like Toronto, Vancouver, and Montreal further fuels demand for multi-tenant access management, visitor tracking, and contactless entry. Government-backed infrastructure programs and private sector investments are expected to sustain momentum, with developers prioritizing systems that enhance operational efficiency, occupant safety, and regulatory compliance while also supporting future-ready smart city ecosystems.

Canada Access Control Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, type, and end user.

Component Insights:

- Controller

- Reader

- Locks

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes controller, reader, locks, and software.

Type Insights:

- Card Based

- Contact

- Contactless

- Biometric Based

- Fingerprint

- Face Recognition

- Face Recognition and Fingerprint

- Iris Recognition

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes card based (contact, contactless), and biometric based (fingerprint, face recognition, face recognition and fingerprint, iris recognition, and others).

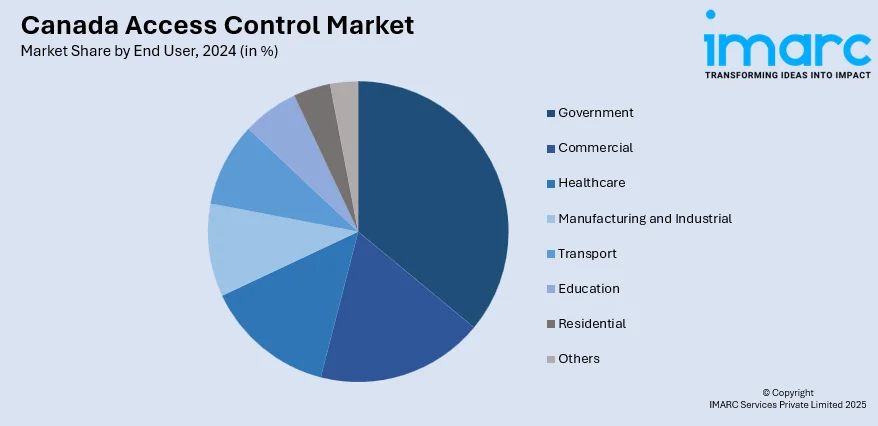

End User Insights:

- Government

- Commercial

- Healthcare

- Manufacturing and Industrial

- Transport

- Education

- Residential

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes government, commercial, healthcare, manufacturing and industrial, transport, education, residential, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Access Control Market News:

- In July 2025, TAC Security, Inc. a subsidiary of TAC InfoSec Limited, launched TAC Security, Inc. (Canada) to expand its North American footprint. Leveraging Canada’s skilled, cost-effective workforce and generous wage subsidies of up to 80%, the move aims to boost operations and client reach. With Canada’s cybersecurity market projected to grow from USD 14.05B in 2024 to USD 27.42B by 2030, TAC sees strong potential for innovation and partnerships.

- In March 2025, Bell launched its Security-as-a-Service (SECaaS) on its Canadian sovereign cloud, delivering advanced cybersecurity while ensuring data stays within Canada to meet strict privacy laws. Powered by AI-driven SIEM technology, the service offers real-time threat detection, response, and containment across on-prem, cloud, and hybrid systems. Supported 24/7 by Bell’s Canadian-based Cyber Intelligence Centre, SECaaS provides unified security visibility and compliance for public and private sector organizations.

Canada Access Control Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Controller, Reader, Locks, Software |

| Types Covered |

|

| End Users Covered | Government, Commercial, Healthcare, Manufacturing and Industrial, Transport, Education, Residential, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada access control market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada access control market on the basis of component?

- What is the breakup of the Canada access control market on the basis of type?

- What is the breakup of the Canada access control market on the basis of end user?

- What is the breakup of the Canada access control market on the basis of region?

- What are the various stages in the value chain of the Canada access control market?

- What are the key driving factors and challenges in the Canada access control market?

- What is the structure of the Canada access control market and who are the key players?

- What is the degree of competition in the Canada access control market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada access control market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada access control market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada access control industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)