Canada Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Canada Advertising Market Overview:

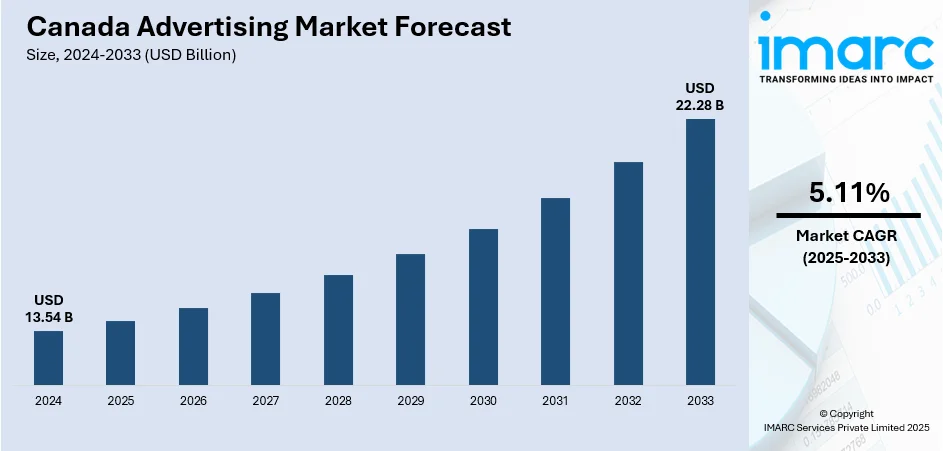

The Canada advertising market size reached USD 13.54 Billion in 2024. The market is projected to reach USD 22.28 Billion by 2033, exhibiting a growth rate (CAGR) of 5.11% during 2025-2033. The market is undergoing dynamic transformation, guided by a steady shift from traditional formats toward robust digital channels. Social media and search advertising have emerged as dominant platforms, fueled by mobile-first consumer behavior and advanced targeting capabilities. Programmatic and digital video formats enhance efficiency and reach, supported by AI-driven tools and contextual creativity. Regulatory frameworks, such as Canada’s Digital Services Tax, are reshaping revenue flows across domestic and foreign platforms. These forces collectively shape the evolving Canada advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.54 Billion |

| Market Forecast in 2033 | USD 22.28 Billion |

| Market Growth Rate 2025-2033 | 5.11% |

Canada Advertising Market Trends:

Rise of Programmatic Advertising and Data-Driven Strategies

As of January 2024, the programmatic approach has become the dominant method for digital display advertising in Canada, with automated buying accounting for most ad placements in that channel. This evolution reflects advertisers’ growing appetite for efficiency, precision, and scalability across multiple platforms, including mobile, connected TV and digital out‑of‑home. Programmatic technology enables real-time bidding, dynamic creative optimization, and better use of first-party data helping ads adapt in real time to match viewer context like location or time of day. Marketers are now building campaigns where visuals, copy, and calls to action adapt on the fly to meet audience behavior, turning once-static ads into fluid, personalized experiences. Contextual targeting is also rising, aligning ads with page content in place of third-party cookies, which adds privacy-friendly relevance. This shift is making programming not just a procurement method but the backbone of modern campaign strategy. With automation and data at its core, programmatic is redefining how advertising is bought, optimized, and measured. This strategic evolution is a key component of Canada advertising market growth.

To get more information on this market, Request Sample

Expanding Role of Influencer and Creator Marketing

In July 2024, a survey in Canada revealed that half of respondents had made purchases based on influencer recommendations, underlining the strong impact of creators on consumer behaviour. Influencer and creator marketing is increasingly taking a central role in brand strategy, especially across younger demographics drawn to authentic, relatable content. Content from trusted creators is outperforming traditional advertising formats significantly, with engagement and effectiveness substantially higher when influencer content is featured. Creators are now seen as vital storytellers who can capture attention and inspire action with formats like short-form video, reels and behind-the-scenes content tailored for platforms such as Instagram, TikTok and YouTube. Brands are focusing more on sustained partnerships with creators, working to align messaging with audiences in a seamless, narrative-driven manner rather than relying on one-off sponsorships. This shift is helping advertisers achieve stronger consumer connections and richer brand recall. As these creator-led approaches become firmly embedded in campaign planning, they are poised to shape both creative direction and media investment strategies in the Canada advertising market trends.

Emphasis on Sustainability and Purpose-Driven Advertising

As of May 2025, Canadian consumer surveys underline a clear demand for educational storytelling around sustainability in advertising, with nearly all respondents saying that advertising is a preferred way to learn about a brand’s eco‑friendly features. This desire reflects growing consumer skepticism toward vague or misleading sustainability claims, especially when contrasted with distrust in greenwashing, as highlighted by broader research into environmental messaging. Advertisers in Canada are responding by embedding authentic purpose into creative campaigns communicating supply chain transparency, ethical sourcing, and real environmental impact. Purpose-driven ads are shifting away from generic statements and toward storytelling that resonates emotionally: demonstrating meaningful action, backed by verifiable data, and delivered through clear visuals and narrative. Marketers are increasingly aligning messaging with values like community support, environmental responsibility, and long-term social impact. As regulations tighten and consumer expectations rise, sustainable marketing is becoming a strategic imperative rather than an optional add-on. This evolution prompts brands to ensure every campaign is rooted in credibility and genuine purpose.

Canada Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

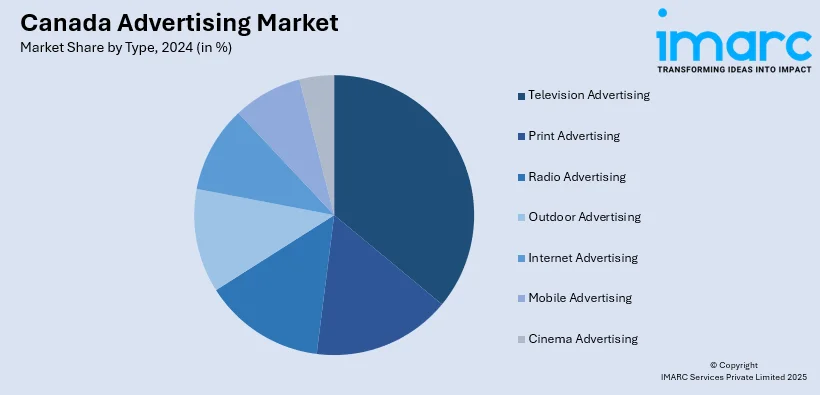

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Advertising Market News:

- July 2025: POV Film and Publicis Groupe Canada have launched a three-month Advertising Training Programme (ATP) in Toronto to foster BIPOC creative talent in Canada’s advertising, media, and communications industry. This initiative, a partnership between POV Film a charity focused on underrepresented talent and Publicis Groupe Canada, provides immersive training, job shadowing, and real-world project experience at their studio offices. Supported by industry experts and Canadian Tire via a pitch challenge and specialized course funding, the ATP aims to cultivate a vibrant, diverse creative workforce that more accurately mirrors Canadian society.

- May 2025: AdCellerant has officially launched its operations in Canada, offering award-winning digital advertising technology, automation, and local support to agencies and media companies across the country. Headquartered in Calgary, the move strategically taps into Canada’s thriving tech ecosystem and digital marketing demand. The company has appointed seasoned industry leaders, including George Leith, Anthony Gallace, and Todd Roberts, to drive partnerships and market adoption. This Canadian expansion marks a pivotal step in AdCellerant’s global growth strategy.

Canada Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada advertising market on the basis of type?

- What is the breakup of the Canada advertising market on the basis of region?

- What are the various stages in the value chain of the Canada advertising market?

- What are the key driving factors and challenges in the Canada advertising market?

- What is the structure of the Canada advertising market and who are the key players?

- What is the degree of competition in the Canada advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)