Canada Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

Canada Agribusiness Market Overview:

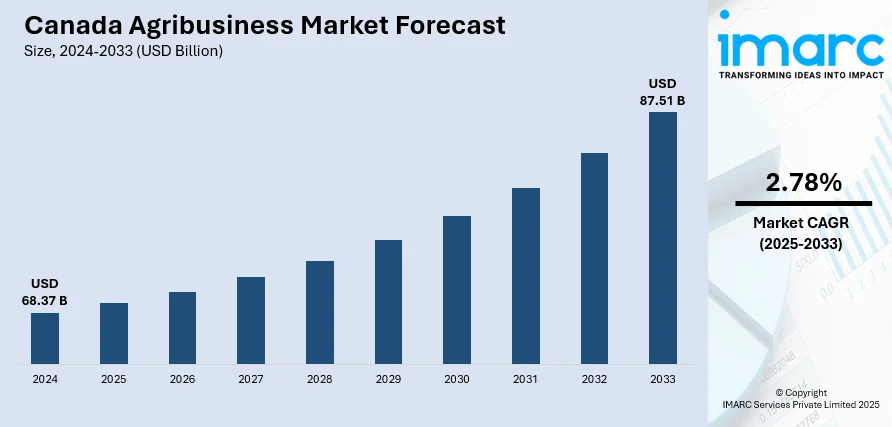

The Canada agribusiness market size reached USD 68.37 Billion in 2024. The market is projected to reach USD 87.51 Billion by 2033, exhibiting a growth rate (CAGR) of 2.78% during 2025-2033. Canada’s reputation for clean, safe, and sustainably grown items is enhancing its competitive edge in international trade, where buyers prioritize quality and traceability. Besides this, increasing investments in digital tracking systems and automated handling technologies, which aid in streamlining supply chains, are contributing to the expansion of the Canada agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 68.37 Billion |

| Market Forecast in 2033 | USD 87.51 Billion |

| Market Growth Rate 2025-2033 | 2.78% |

Canada Agribusiness Market Trends:

Rising demand for grains and pulses

Increasing demand for grains and pulses is fueling the market growth by boosting production, processing, and export opportunities for crops, such as wheat, barley, oats, lentils, peas, and chickpeas. As per the Statistics Canada, in 2024, wheat production rose by 6.1% compared to 2023, reaching 35.0 Million Tons. The growth was fueled by durum wheat (+43.6% to 5.9 Million Tons), due to a larger harvested area (+8.0% to 6.3 Million acres) and yield (+32.8% to 34.0 Bushels per acre). Canada’s beneficial climate, rich soil, and modern agricultural techniques position it as one of the largest and most dependable sources of premium grains and pulses globally. Within the country, pulses are becoming more popular because of their nutritional advantages, cost-effectiveness, and adaptability in food production, promoting the creation of value-added items like plant-based meat substitutes, protein supplements, and enriched flours. Additionally, Canada’s standing for clean, safe, and sustainably produced goods is boosting its competitive advantage in international trade, where purchasers emphasize quality and traceability. The grain and pulse industries are gaining from governmental assistance in research, innovation, and trade agreements, enhancing market access and lowering obstacles. Increasing demand is leading to investments in storage, transportation, and processing facilities, allowing agribusinesses to manage higher volumes effectively.

To get more information on this market, Request Sample

Advanced logistics infrastructure

Strong logistics infrastructure is impelling the Canada agribusiness market growth. As per the IMARC Group, the Canada logistics market size reached USD 113.61 Billion in 2024. Canada’s well-developed network of railways, highways, ports, and storage facilities enables the timely transportation of grains, oilseeds, livestock, and processed food products, reducing spoilage and maintaining quality. Modern grain elevators, cold storage units, and containerized shipping facilities help preserve freshness and meet stringent export standards. Major ports serve as critical gateways to Asia, Europe, and the US, supporting Canada’s position as a global agricultural exporter. Efficient rail connectivity links inland production hubs in the Prairies to coastal ports, while advanced trucking services ensure flexibility in distribution. Additionally, investments in digital tracking systems and automated handling technologies streamline supply chains and enhance traceability, which is increasingly important for meeting regulatory demands. This robust logistics framework is strengthening domestic supply chains by improving access to agricultural inputs and markets. As the demand for Canadian agricultural products is growing, the strength and reliability of its logistics infrastructure play an important role in sustaining agribusiness expansion and profitability.

Canada Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

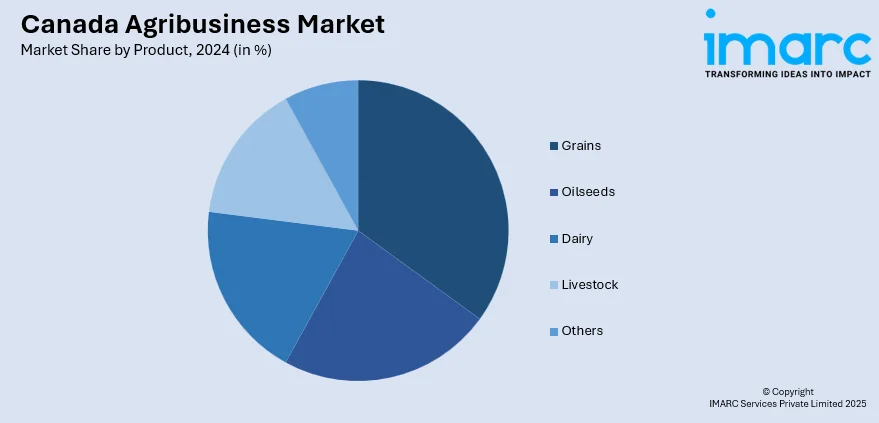

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Agribusiness Market News:

- In July 2025, the governments of Canada and Ontario committed as much as USD 4.4 Million through the Sustainable Canadian Agricultural Partnership (Sustainable CAP) to assist small enterprises in the agri-food sector in expanding their operations and improving their food safety and traceability systems. This funding would back 90 projects throughout the province via Ontario’s Food Safety and Growth Initiative, which aided in safeguarding workers and businesses by ensuring the sector could persist in flourishing, adapt to market and user needs, and maintain employment for workers.

- In March 2025, Terry Duguid, the Minister for PrairiesCan, revealed new federal financing of USD 3,265,583 for four agri-food initiatives throughout Saskatchewan, Canada. This funding was set to generate new opportunities for value-added agri-food by strategically investing in specific companies and enhancing the local food ingredient cluster's capacity. The agricultural manufacturing industry would gain advantages from the commercialization of innovative technology that enhanced the efficiency and safety of loading railcars.

Canada Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada agribusiness market on the basis of product?

- What is the breakup of the Canada agribusiness market on the basis of region?

- What are the various stages in the value chain of the Canada agribusiness market?

- What are the key driving factors and challenges in the Canada agribusiness market?

- What is the structure of the Canada agribusiness market and who are the key players?

- What is the degree of competition in the Canada agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)